Upstox Originals

Will capex finally help drive India’s economic growth?

4 min read | Updated on February 02, 2026, 15:24 IST

SUMMARY

India’s investment engine is shifting gears. Strong government spending, rising private investments, healthy order books, and wider sector participation signal a broad, deep, and structural investment upcycle powering India’s next growth phase.

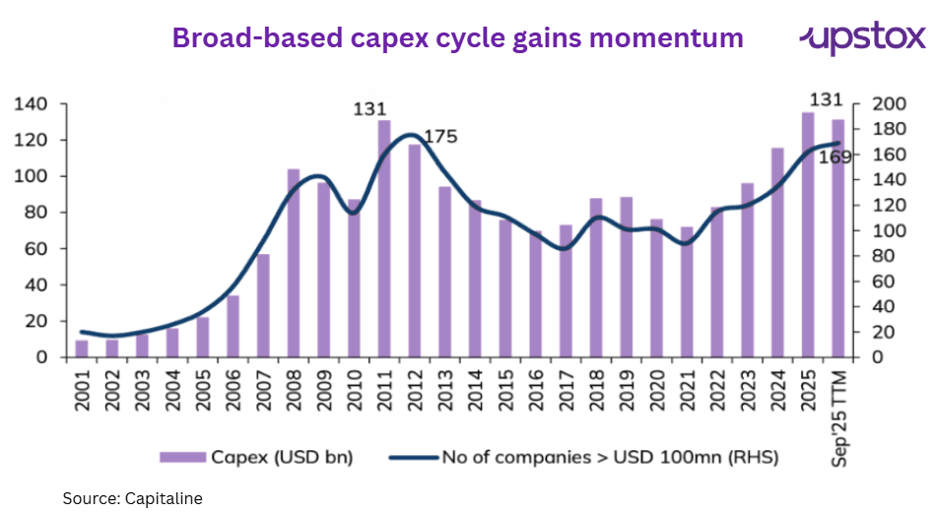

Number of companies spending more than $100 million annually on capex has risen sharply to 169 in FY25 from 135 in FY24.

Investment is one of the strongest engines behind any growing economy.

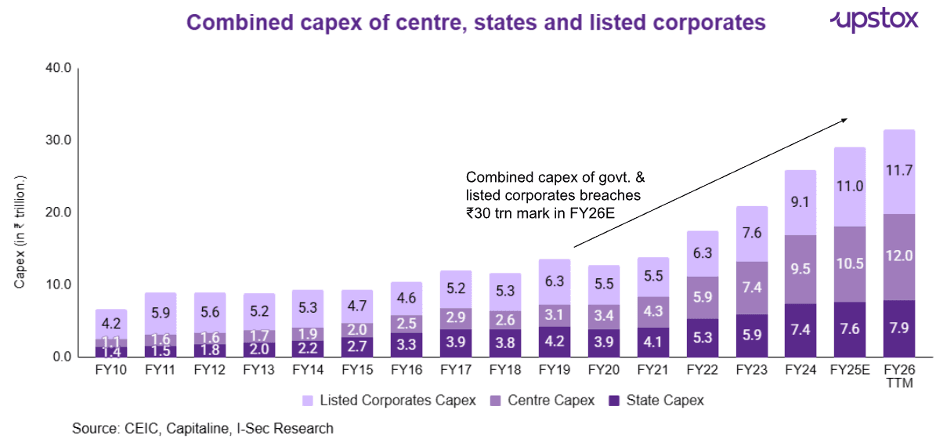

India’s investment-to-GDP ratio averaged 30.3% in the past four years, up from 28.6% pre-Covid (FY16–19). While it dipped slightly to 29.9% in FY25-mainly due to an election-related slowdown in H1-early data from FY26 signals a revival is underway.

Here’s what’s driving optimism:

- Government capex is going strong, with both the Centre and 19 major states clocking double-digit growth in H1 FY26.

- Private sector capex is picking up, with growing capex by 19% in FY25, reaching ₹11 trillion as per CMIE, which is inline with annualized growth seen in private capex post covid period.

Order books of capital goods companies look healthy, hinting at a broader investment upcycle owing to increased focus towards defence and renewables.

Central government capex-favorable government finances

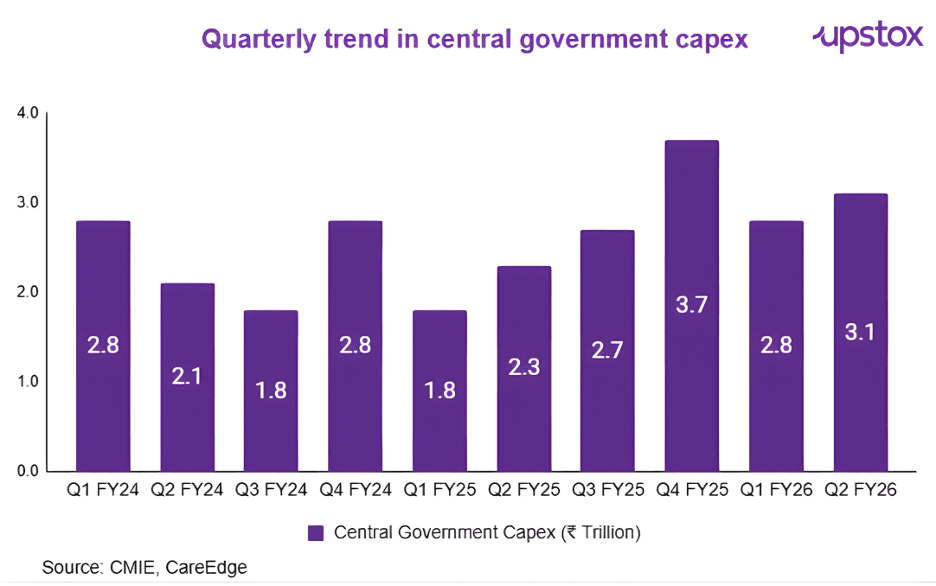

India’s capital expenditure momentum is back in focus. In the first half of FY26, the Centre’s capex surged by an impressive 40% yoy. This strong growth comes on the back of subdued spending in the previous year, when elections led to delayed disbursals. With front-loading of expenditure now underway, key infrastructure sectors like highways, railways, and defence have emerged as the biggest beneficiaries.

But what about private capex?

One economic metric most experts want to see a strong revival in is - India’s corporate capex. Encouragingly, there are some early revival signs:

Post covid (2020-25), revenue of Nifty500 companies increased by ~ 11% CAGR, will capex outpaced that growth at a ~14% clip. This is also evident from rising capex as % of sales. We do however note that, while this is definitely a recovery from the 6.1% lows of, it remains far below the 15%–17% intensity seen during the FY10–11 boom.

| Financial Year | Net Sales of Nifty 500 (₹ Trillion) | Capex (₹ Trillion) | Capex as % of Net Sales of Nifty 500 |

|---|---|---|---|

| FY20 | 80.5 | 5.5 | 6.8 |

| FY21 | 79.5 | 5.5 | 6.9 |

| FY22 | 102.5 | 6.3 | 6.1 |

| FY23 | 125.6 | 7.6 | 6.1 |

| FY24 | 133.4 | 9.1 | 6.8 |

| FY25 | 136.1 | 11.0 | 8.1 |

Source: MOSL, CMIE

As of the trailing twelve months (TTM) ending September 2025, listed corporates have invested a total of ₹11.7 trillion in capex.

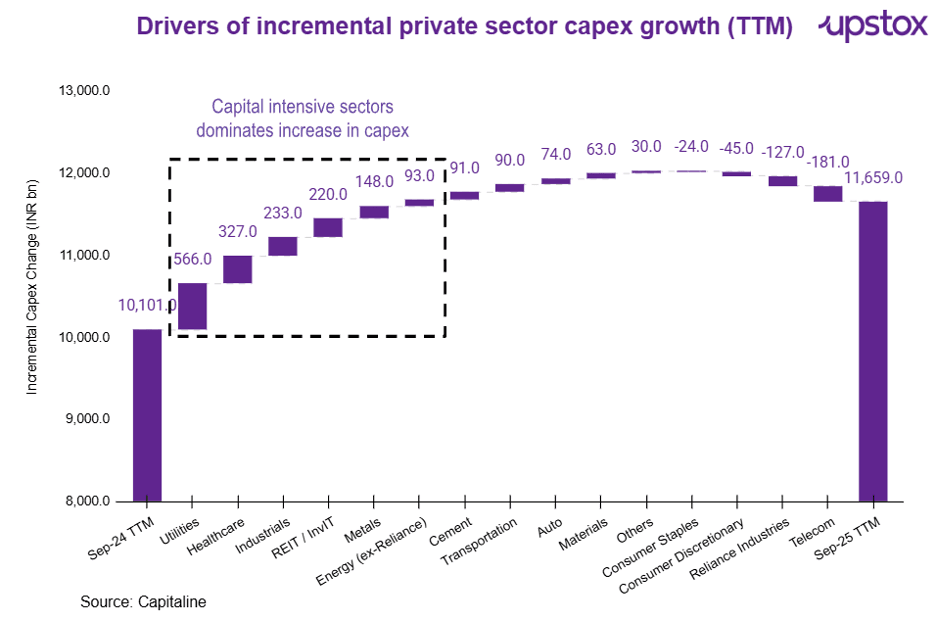

Where is the Capex happening?

Among the listed companies, the top contributors-each with over ₹1 trillion in capex-include the utilities and energy sectors, Reliance Industries, metals, industrials, and automobiles.

New Age Capex

This broad-based revival suggests that even relatively less capital-intensive sectors-like autos, consumer goods, and healthcare, are stepping up their investment activity; suggest capex intensity in new age sectors are also increasing.

Depth of Capex

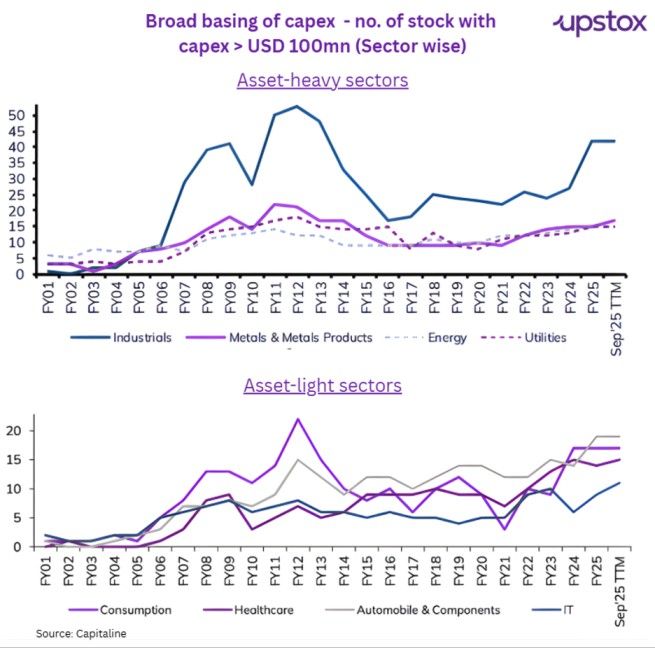

What stands out this year is the depth of the capex recovery. The number of companies spending more than $100 million annually on capex has risen sharply to 169 in FY25 (up from 135 in FY24). This expansion spans across a diverse set of sectors:

- Industrials lead the pack with 42 companies,

- Followed by automobiles (19), metals (17), and consumption (17),

- Sectors like energy, utilities, and healthcare also show strong participation, each with 15 companies crossing the $100 million capex mark.

Conclusion: India’s Capex Cycle Is No Longer Just a Hope-It’s a Structural Shift

India’s capital expenditure story is unfolding not as a short-term rebound, but as a structural transformation. With the public sector front-loading infrastructure investments and the private sector increasingly joining in with growing equity-funded expansion, India seems poised to enter a multi-year investment cycle.

What sets this phase apart is the breadth and depth of participation, from traditional heavyweights like energy and metals to newer sectors like consumer goods, electronics, and healthcare. High-frequency indicators, improving macro stability, and proactive policy support are reinforcing the momentum.

While global risks remain, the combination of policy clarity, rising consumption, healthy corporate balance sheets, and increased investor confidence paints a promising picture. As India builds the physical and digital foundations for its $5 trillion economy ambition, capex will likely remain the engine powering long-term growth, productivity, and employment.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story