Upstox Originals

Will Budget 2026 address India’s real estate’s structural issues?

7 min read | Updated on January 27, 2026, 18:47 IST

SUMMARY

India’s real estate story looks impressive from a distance. Up close, buying a home is getting harder for millions. On paper, the market is booming… on the ground, affordable homes are vanishing, loans crawl, rentals stay tight, and buyers carry the risk. As the sector marches toward a trillion-dollar future, can Budget 2026 finally fix the cracks beneath the boom?

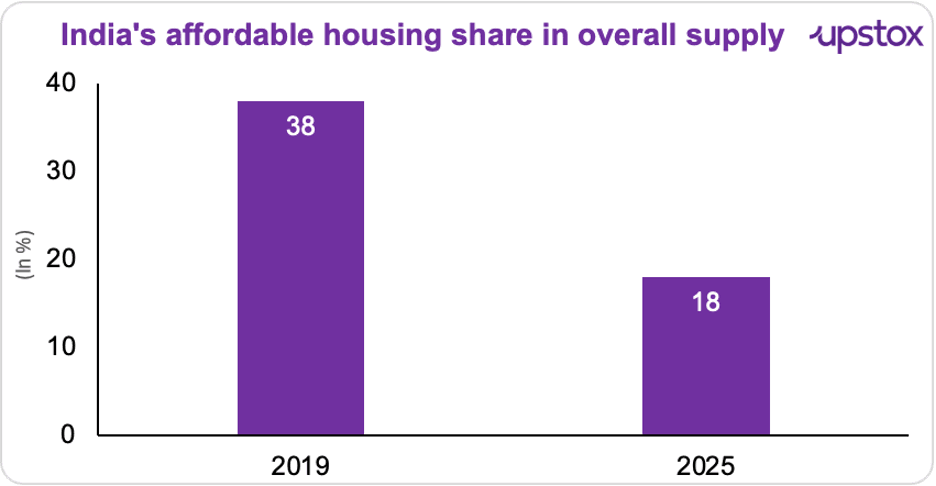

According to ANAROCK Research, affordable housing’s share has fallen from 38% in 2019 to 18% in 2025.

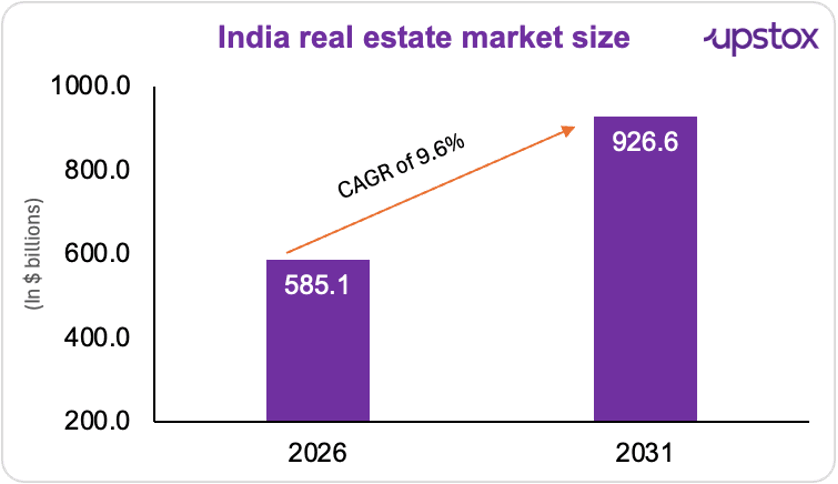

Nearly one out of every 14 rupees in India’s economy is linked to real estate, which employs about 70 million Indians. The market is expected to jump from ~$585 billion in 2026 to nearly $927 billion by 2031, clocking a ~9.6% CAGR.

Source: Mordor Intelligence

But, well, growth alone doesn’t tell the full story.

For buyers, developers, and lenders, things still feel far less smooth on the ground; affordable homes are getting harder to find, loans move slowly, rentals remain tight, and projects often run late.

That’s where Budget 2026 comes in.

Policymakers, developers, and investors are all watching closely, hoping the Budget can ease some of these long-standing frictions.

So here’s what we’ll do:

- What’s holding Indian real estate back today

- What the sector is hoping Budget 2026 will deliver

Alright, let’s get to it!

The bottlenecks we think are worth a closer look

Affordable housing is no longer affordable

According to ANAROCK Research, affordable housing’s share has fallen from 38% in 2019 to 18% in 2025. In the top seven cities, homes under ₹50 lakh made up over half of launches in 2018. By 2025, that share was just 17%.

Source: Anarock Research

Why the pullback?

The government defines “affordable housing” using a ₹45 lakh price limit. That limit, set in 2017, hasn’t kept up with today’s cities like Mumbai, Pune, Bengaluru, and Delhi-NCR, cutting off tax benefits and making projects unviable, says Avneesh Sood, Director, Eros Group.

Land is expensive. Steel, cement, and labour cost more. Approvals move slowly. Affordable housing margins sit at 10–12%, versus 25–30%+ for premium projects.

Urban housing shortage

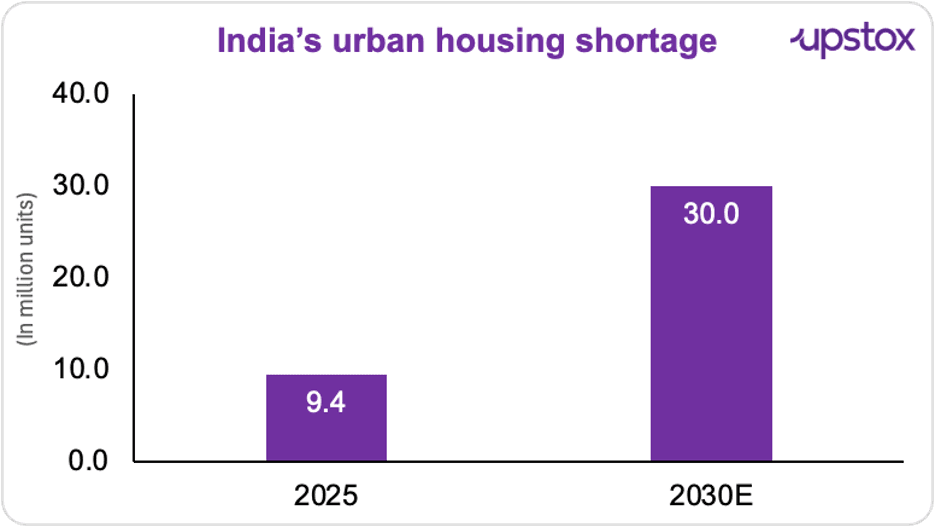

India faces an urban housing shortage of ~9.4 million homes, which could balloon to 30 million by 2030. In Bengaluru, 42% of buyers looking for homes under ₹1 crore are now priced out, even though budget housing demand grew 13% YoY, says Anuj Puri, Chairman, ANAROCK Group.

Source: BS

Housing finance: Digital, but stuck

Home loans look digital. They don’t feel that way.

Over 80–85% of underwriting data is already digital, yet approvals still take 15–25 days. Why? Repetitive checks, not lack of credit appetite.

Banks pull credit scores, verify income, check employment, and still do physical verifications. Most lenders validate the same data separately, slowing everything down, especially for first-time and middle-income buyers.

The core problem is structural. This hits hardest because 35–40% of borrowers are self-employed or semi-formal earners, who don’t fit clean templates.

Where rental housing falls short

Knight Frank says India needs a much stronger rental housing market. While schemes like ARHC (Affordable Rental Housing Complexes, aimed at providing rental housing for migrant and urban poor workers) help migrant workers, low-income renters are still largely ignored.

At the same time, there’s a strange mismatch. Many homes priced below ₹50 lakh, bought as investments, remain empty. Why? Because rents are too low, so owners don’t find it worthwhile to rent them out.

Construction delays hurt buyers

Banks give out home loans before a house is fully built. EMIs start immediately. If construction is delayed, buyers still have to pay these EMIs, even though they cannot move into the house. At the same time, they continue paying rent for the home they live in.

This happens because banks do not link loan payments to how much of the house is actually completed. So when construction slows or stops, buyers keep paying, but the house does not get finished.

As Anurag Goel points out, “loans are disbursed upfront despite uncertain timelines, weakening buyer confidence and making homeownership unnecessarily stressful.” Budget 2026 to the rescue?

Reviving affordable housing

“The most direct and immediate tool the government has is to bring back the 100% tax holiday under Section 80-IBA of the Income Tax Act, 1961. It was very effective in driving affordable housing supply.” as put by ANAROCK Chairman Anuj Puri in January 2026.

When it was in place, the incentive helped bridge thin margins, pulling more developers into affordable housing. Its removal has since choked new launches. A time-bound revival, limited to projects approved within a 24–36 month window, could deliver quick impact without long-term fiscal strain.

Manish Jain, President, CREDAI Pune, is more specific: “Raising the affordable housing threshold to ₹90 lakh, along with tax incentives and GST rationalisation, can revive supply and improve affordability.”

Some experts suggest a city-wise cap, ₹85 lakh for Mumbai and ₹75 lakh for other metros, while keeping strict carpet-area norms to ensure benefits reach genuine first-time and middle-class buyers.

Homebuyer tax relief is stuck in the past.

Under Section 24(b), buyers can deduct up to ₹2 lakh on home loan interest. That limit hasn’t changed in nearly 10 years, even as home prices and loan sizes have surged. In big cities, a typical middle-income borrower now pays over ₹7.5 lakh a year in interest. The current cap barely scratches the surface, leaving much of the real housing cost without tax relief.

And this will matter even more over time. About 36% of India already lives in cities. By 2050, that could be close to 50%.

A housing credit passport

What if home loans came with faster approvals and less paperwork?

That’s where experts say a housing credit passport can help.

As Adhil Shetty, CEO of BankBazaar, explains, “A housing credit passport is a consent-based digital snapshot of a borrower’s financial profile, covering income, credit history, and existing loans, which lenders can access during a home loan application.”

The impact could be meaningful. Experts estimate 30–40% fewer document checks and 40–50% faster turnaround times, especially for salaried buyers.

Making rentals worth it

Knight Frank proposes a 100% tax exemption on rental income up to ₹3 lakh for homes priced up to ₹50 lakh to unlock vacant supply. It also suggests using surplus government urban land (railways, defence) for high-density, long-term rental housing with regulated yields, no resale, and government ownership.

To support this, it recommends a 5-year tax holiday for rental projects and central viability gap funding for ARHCs in Tier-II and Tier-III cities.

But here’s the context. Most of these fixes aren’t new, as they have surfaced in Budget discussions for years. Progress has been uneven so far! So, one hopes that Budget 2026 can make meaningful changes.

A quick reality check

That said, not every demand automatically makes sense just because it’s popular. Budgets aren’t wish lists, they’re trade-offs.

Some proposals carry real risks. Bigger tax breaks can strain public finances without guaranteeing lower prices. Expanding affordable housing thresholds too aggressively could blur the line between genuine affordability and mid-premium housing.

Rental incentives, if poorly targeted, may benefit investors more than tenants. And faster credit, without tighter safeguards, could recreate the very buyer risks policymakers are trying to fix.

In short, intent matters, but design matters more. For Budget 2026, the real challenge is to shape reforms carefully, so they fix structural problems while avoiding unintended consequences.

Before you go

Real estate doesn’t need louder growth targets. It needs better plumbing. If Budget 2026 gets the basics right; aligning incentives with costs, credit with construction, and policy with long-term certainty, the sector’s next phase can be broader, safer, and more durable. The opportunity isn’t just to grow faster, but to grow fairer.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story