Upstox Originals

Why is India’s steel industry facing a pricing pressure?

9 min read | Updated on September 02, 2025, 15:47 IST

SUMMARY

India’s steel production has been on an uptrend. The domestic steelmaking capacity is expanding and reached an all-time high in FY25. Despite these growth indicators, the industry is grappling with downward pricing pressure. Let’s find out why.

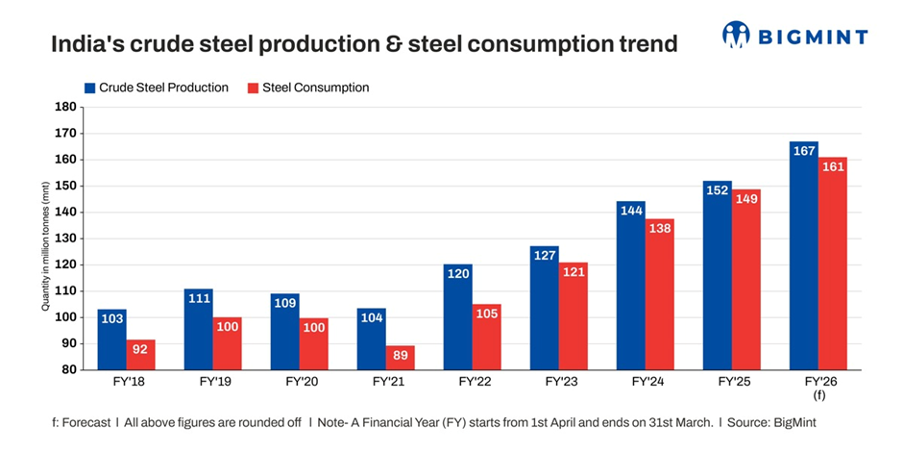

India produced nearly 152 million tonnes of crude steel in FY25

India is the world’s second-largest steel producer, after China. Interestingly, in the first six months of 2025, India’s crude steel production was nearly equal to the combined production of the US and Japan.

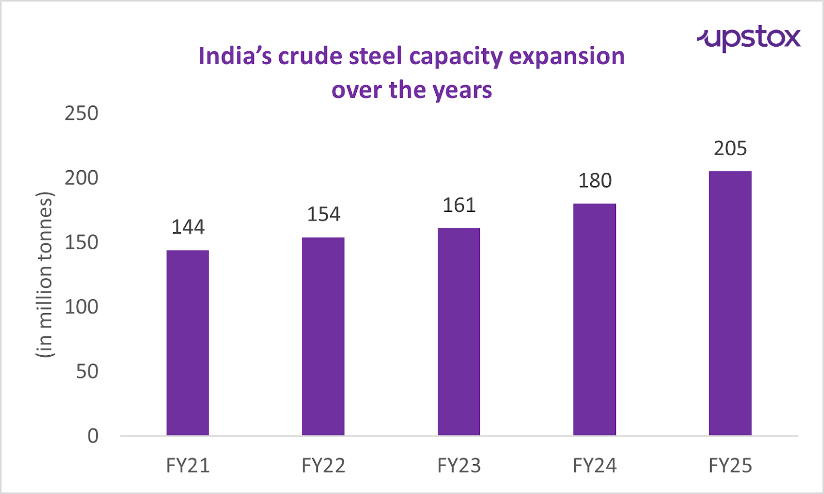

India produced nearly 152 million tonnes of crude steel in FY25. Further, in the same year, the country’s total steelmaking capacity reached 205 million tonnes. That’s a 14% jump from FY24!

Source: BigMint

Source: Ministry of Steel

Now here’s where it gets even more interesting!

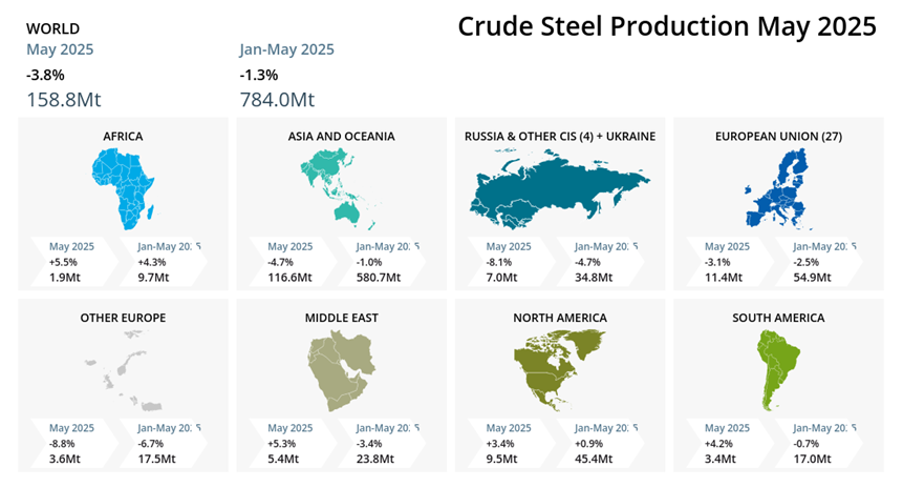

On one hand, where global crude steel output dipped by 3.8% YoY in May 2025, India's steel production outpaced the rest of the world with a sharp 9.7% rise.

Global steel output

| Country | Steel output in May 2025 (million tonnes) | YoY % change in steel production in May 2025 |

|---|---|---|

| World | 158.8 | -3.8 |

| China | 86.6 | -6.9 |

| India | 13.5 | +9.7 |

| Japan | 6.8 | -4.7 |

| US | 7.0 | +1.7 |

| Russia | 5.8 | -6.9 |

Source: World Steel

That’s not all.

India is among the very few countries to achieve consistent volume growth. Between FY19 and FY25, India’s steel production grew by a robust 37% in absolute terms. On the contrary, during the same period, the global steel production declined by 1%.

This makes India a standout performer in the steel market globally.

But it's not all rosy beneath the surface!

But why? Blame the dumping of cheap steel in India by countries like China, South Korea, Indonesia and Japan.

For context, India has been a net exporter of finished steel for almost a decade. But for the first time in FY24 and FY25, India became a net importer of finished steel. This is despite the fact that India’s consumption is lower than its production in both years.

India’s finished steel imports from China rose 9.2% YoY to 10.5 million tonnes in FY25, while exports dropped sharply by 27% YoY to 6.3 million tonnes.

Why is China dumping cheap steel in India?

There is a combination of factors here.

- Significant overcapacity in China’s steel industry

- Weak domestic steel demand in China

- China’s real estate market has been facing a slump for the past three years, leading to weak demand for steel

China is getting rid of its surplus steel by exporting it to international markets, including India, at a cheaper price. By doing this, China is not just clearing its excess inventory; it is also disrupting the domestic market in India.

As a result, Indian steel manufacturers are having a tough time competing with Chinese steel prices. In April 2025, Indian steel prices were ₹52,000 per tonne, but Chinese steel prices were ₹46,000 per tonne.

So, is the Indian government doing anything to tackle this problem? We’ll come to that in a while.

But for now, there is another important question.

Why are steel prices falling globally?

Well, it’s pretty straightforward.

China produces more than half of the steel produced globally. In May 2025, China produced 86.6 million tonnes out of the world’s 158.8 million tonnes of steel. Clearly, China dominates the global steel market, and an oversupply of steel, coupled with weak demand in China, is causing steel prices to fall worldwide. Not just the finished steel, but even the prices of raw materials like iron ore and coal have declined.

Source: Trading Economics

Source: Trading Economics

Another reason is a slowdown in manufacturing activity in several regions, especially the developed countries. Infrastructure growth in developed countries has largely reached a mature stage, leading to fewer new construction projects and, consequently, a reduced demand for steel.

This is evident from the fact that the steel output in May 2025 in developed regions has declined by:

- 4.7% in Asia and Oceania region

- 8.1% in Russia and CIS region

- 3.1% in European Union (EU) region

- 8.8% in non-EU Europe

- 10.8% in Germany

At the same time, developing regions saw a rise in steel output in May 2025.

- 5.5% in Africa

- 5.3% in the Middle East

- 9.7% in India

Source: World Steel

Impact of global slowdown on the Indian steel industry

Like every coin, there are two sides to this story as well.

Because of the global steel industry slowdown, the Indian steel market is also facing headwinds. The domestic industry is facing downward pricing pressure and increasing competition from the influx of cheaper Chinese steel.

The result? Shrinking profit margins of Indian steel manufacturers. Even steel giants like Tata Steel and JSW Steel experienced flat operating profit margins in FY25.

Quarter-on-quarter operating profit margins

| Period | Tata Steel | JSW Steel |

|---|---|---|

| Q2 FY24 | 8% | 20% |

| Q3 FY24 | 11% | 17% |

| Q4 FY24 | 11% | 13% |

| Q1 FY25 | 12% | 13% |

| Q2 FY25 | 11% | 15% |

| Q3 FY25 | 11% | 14% |

| Q4 FY25 | 12% | 16% |

| Q1 FY26 | 14% | 18% |

Source: Screener

Not just that, it has forced several smaller mills (which represent a substantial portion of India’s steel production) to reduce production, lay off workers, and even shut down operations entirely. Moreover, this situation has created investment uncertainty among Indian steel manufacturers, who are now hesitant to invest in expanding production capacity or modernising their operations.

This looks like a minor issue, but it’s not. The investment hesitation can become a huge barrier in India’s long-term ambition of becoming a global leader in steel production.

On one hand, falling steel prices are putting pressure on Indian steel manufacturers. At the same time, declining prices of raw materials of steel (iron ore and coal) are bringing some relief in the form of lower input costs. But this is only true for companies that source raw materials from the merchant market. Companies with captive iron ore mines may not benefit from a drop in raw material prices.

Moreover, companies that use steel as a raw material, like construction, automotive, shipbuilding and transportation industries, are likely to benefit from lower input costs. So, we can say that a reduction in raw material prices can protect the profit margins of companies.

Indian government’s response to China’s steel dumping

To protect Indian steel producers from aggressive steel dumping by China and other countries, the Indian government has set minimum import prices and introduced anti-dumping duties. In April 2025, the government imposed a 12% safeguard duty on steel imports. For the unversed, safeguard duty is a temporary import tax that protects domestic industries from cheap imports and unfair competition.

And it has been instrumental in boosting domestic profitability.

Since the imposition of a safeguard duty, there has been a reduction in steel imports in India. It also gave rise to the domestic demand for steel, thus boosting domestic steel production.

Following the imposition of the duty, domestic steel prices have rebounded by 14% in the current calendar year-to-date, reaching ₹53,500 per tonne as of June 2025. This price is now about 5% higher than the cost of imported steel.

But it’s never this easy, right?

There are still two major problems.

First, as per the industry players, a 12% safeguard duty is still not enough to compete with cheaper Chinese steel and falling international steel prices. Indian steel companies are pushing for a 24% duty. For now, the 12% duty is in effect for 200 days, and after this period, the government will assess if it is sufficient or needs a further scale-up.

Second, the imposition of a 12% safeguard duty on steel imports has become a problem for companies that need specialised high-grade steel as a raw material, which India doesn’t produce.

These companies now have no choice but to import large quantities of high-grade steel from foreign markets and pay high duties on it.

Future outlook of the steel industry in India

While the major economies are grappling with supply constraints and falling demand, India has managed to maintain a consistent volume growth and strong domestic demand to support the output.

Looking ahead, global brokerage firm Jefferies expects India's steel companies to maintain strong performance, projecting an 8-10% CAGR in steel volumes between FY25 and FY27. This growth will be fuelled by several factors such as:

-

Expanding construction and infrastructure under programmes like National Infrastructure Pipeline, PM Gati Shakti and Make in India

-

Government support in the form of protective measures against cheaper steel imports, easing regulatory frameworks for setting up steel plants and Production Linked Incentive (PLI) schemes for specialty steel

-

Growth in the automobile and consumer durables industries that rely heavily on steel

-

Growing urbanisation and housing (under the PM Awas Yojana affordable housing scheme), further boosting steel demand

The bottom line

The changing dynamics of global steel demand are creating both opportunities and challenges for India. The good news, however, is that the rising domestic steel demand is building a strong home market for domestic manufacturers. At the same time, it is also positioning India as an attractive market for international steel exporters, especially during weak international demand phases. Will India seize the opportunity and overcome the challenges? Only time will tell.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story