Upstox Originals

Why India loves a good ₹99 deal

8 min read | Updated on September 30, 2025, 18:12 IST

SUMMARY

India loves a bargain, and price tags ending in ₹99, ₹199, ₹299 make shoppers feel like they’re getting one. It’s not just a number, it’s a nudge. Retailers from Market99 to Vishal Mega Mart use these price points to draw in value-hungry customers, especially in Tier-2 and Tier-3 cities. In this article, we explore how the ₹99 price psychology is shaping India’s value retail market, from consumer behaviour to store strategies.

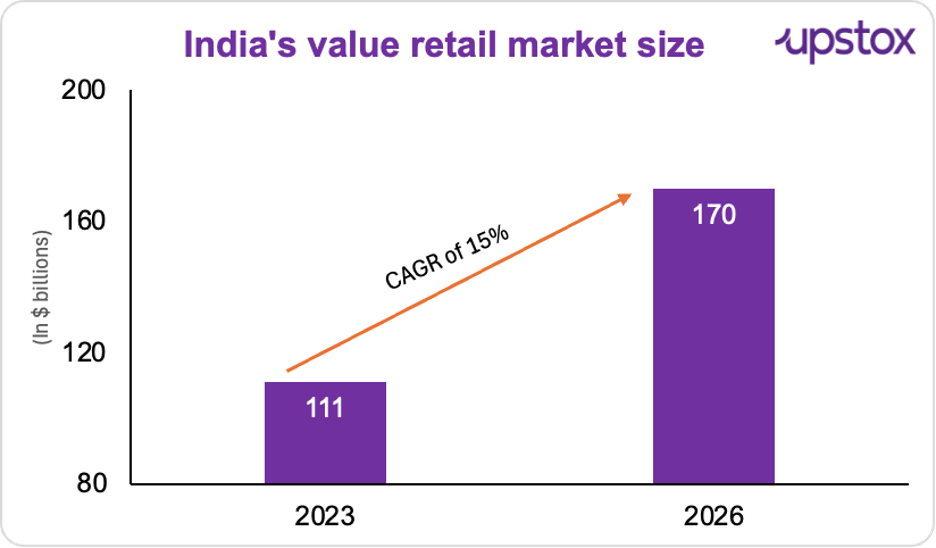

India's value retail market has grown by almost 15% in the past few years

If there’s one thing Indians can agree on, it’s that ₹99 just feels better than ₹100.

Whether it’s a kurta, or a kitchen container, that tiny price tag triggers a little dopamine rush. And retailers know it, they’ve built billion-dollar businesses around this very habit.

But ₹99 isn’t the only lever they pull, it’s just one among many promotional strategies. The real game is turning that irresistible price tag into footfall, and then converting that footfall into a basket filled with apparel, home goods, FMCG, and even higher-ticket items.

According to Wazir Advisors, India’s value retail market (excluding food and grocery) is set to leap from $111 billion in FY23 to nearly $170 billion by FY26. That’s a solid 15% compound annual growth rate (CAGR), much faster than the overall retail sector’s 10%, which itself is projected to hit $1.2 trillion by FY26.

And what’s filling these shopping carts? Apparel takes the crown, followed by furniture, beauty & personal care, and footwear. The real action though? It’s happening in Tier-2 and Tier-3 towns, where new stores are mushrooming to serve millions of price-conscious shoppers who want branded quality without the premium tag.

Source: Live Mint

The psychology of ₹99

Okay, but why do we love ₹99 so much?

Turns out, it’s not just a habit — it’s science. Behavioral economists call it the “left-digit bias.” Basically, our brains focus on the first number we see and anchor our perception there. So ₹999 feels closer to ₹900 than ₹1,000 — even though it’s just a rupee shy.

A 2025 study on Mumbai’s retail shoppers backs this up. Nearly 70% of people in the survey said that prices ending in ₹99 seemed more attractive than round numbers like ₹100. And here’s the kicker — the study found that this “99 love” wasn’t just talk. People who preferred such prices actually shopped more often.

Younger shoppers (18–25) turned out to be the most sensitive to this charm pricing. And lower-to-middle income groups were the ones most likely to let that single rupee difference sway their decision.

Another study goes even further — charm pricing can bump up sales anywhere from 24% to 60% depending on the category. No wonder brands from Big Bazaar to Flipkart use it religiously. It’s not just a pricing trick, it’s a nudge that builds trust, creates a feeling of “getting a deal,” and sparks impulse buys.

Meet the value retail giants...

Alright, we’ve seen why ₹99 works like a charm. But who’s actually making money off this psychology? Let’s meet the big players.

Market99

Market99’s entire business model is charm pricing on steroids. Prices start as low as ₹9 and aim to serve every pocket size. With 60+ stores nationwide, the focus is simple: low prices, decent quality, smooth shopping experience.

This is the no-frills, no-pretence cousin of modern retail — just aisles of “oh this is cheap, might as well buy it.”

Vishal Mega Mart – The Tier-2 Titan

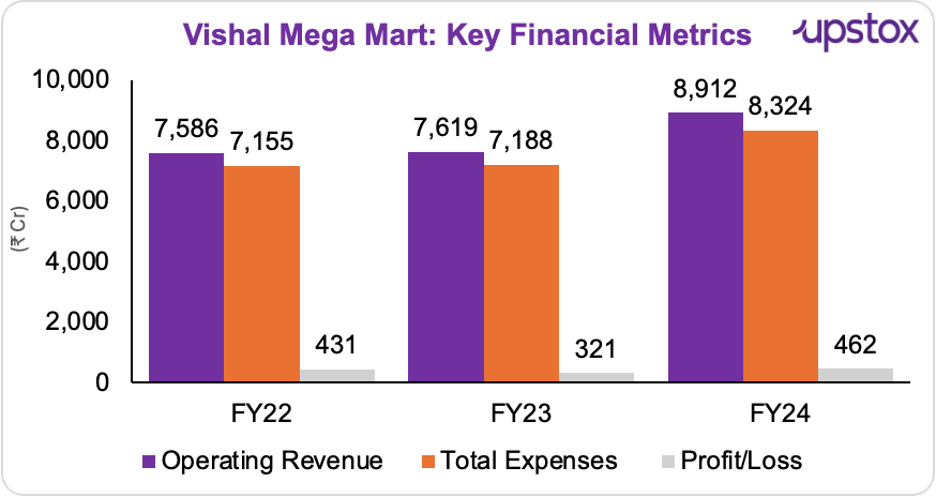

Vishal isn’t a pure “₹99 store,” but its shelves are filled with ₹99 and ₹199 price tags. With 400+ stores across India, Vishal Mega Mart is everywhere your bus stops. And they know their customers well, 70% of their stores are in Tier-2 and Tier-3 cities, where the middle class loves a good bargain. Their numbers?

Source: BS

Vishal’s big bet is on apparel, which makes up 50% of sales. General merchandise and FMCG split the rest 50:50. And investors clearly love the story, when Vishal listed in December 2024, its shares debuted at ₹110 on BSE, a cool 41% above issue price.

The loyalty program is another standout feature, with 13.6 crore customers registered, making it one of the largest in the country. Then there’s a rapid expansion strategy, they’ve been consistently opening 60 to 80 new stores every year, and are now looking to accelerate this further, aiming for 90 to 100 new stores annually.

V-Mart

V-Mart focuses on affordable apparel and everyday essentials. ₹99 tags are common in categories like kids’ wear, small home items, and accessories, acting as hooks to draw customers in. V-Mart had a rough patch last year but bounced back with style, literally.

Q4 FY25: Revenue up 17% YoY to ₹780 crore, profit at ₹19 crore (vs. ₹39 crore loss last year).

Full FY25: Revenue ₹3,254 crore, net profit ₹46 crore, same-store sales up 11%.

The retailer added 62 stores in FY25 and closed 9, ending the year with 497 stores. That’s a pretty solid expansion considering the competition.

Wait, there’re more…

And then there are the disruptors.

Take Zudio, for instance.

It uses ₹99 as a gateway price point, their pricing typically starts from ₹99 and goes up to ₹999. It’s planning to open one store every three days in 2025.

Its numbers are just as crazy, ₹8,537 crore in revenue in FY25, a 1200% jump in just four years. From a modest 7 stores in 2018 to a massive 760 stores in 2025, Zudio is rewriting the playbook for Indian fashion retail.

While every brand was racing online, Zudio went the other way. It bet everything on offline stores. Analysts thought it was suicidal. But Trent’s stock price, up 1200% in four years, proves they were visionaries.

The reason is simple. In smaller Indian cities, e-commerce is a money pit. Fashion return rates hit 40%, which kills profits. And in these markets, “touch and feel” isn’t optional — it’s a must.

And Zudio’s runaway success has inspired others, Reliance Retail’s Yousta, Aditya Birla Fashion & Retail’s Style-Up, and Shoppers Stop’s InTune are all jumping in.

What’s fuelling the ₹99 rush?

The Indian consumer has evolved. They’re no longer just bargain hunters; they’re mood-driven shoppers. Sometimes they splurge on a ₹3,999 Lacoste polo, other times they’re happy with a ₹399 local brand.

As Rajesh Jain, MD & CEO of Lacoste India, puts it - “Value can’t be defined as just money.”

Private labels are doing the heavy lifting. Take Vishal Mega Mart — over 70% of its products come directly from manufacturers. That means lower costs, better control over quality, and fatter margins.

The Tier-2 and Tier-3 boom. Value retailers, in general, have 50% of their presence concentrated in these smaller cities and towns on average, which are now driving the bulk of growth.

Let’s talk about Zudio. It has 85% of its stores in non-metro cities and avoids posh areas in South Delhi or South Mumbai altogether. Why? Because its core audience, students and first-jobbers, doesn’t live there.

Global context

India isn’t alone in loving budget retail - many countries have thriving “dollar store” or “value retail” formats. But the way they operate is slightly different.

| Country | Leading Players | Price Point Model | Key Insight / Difference vs India |

|---|---|---|---|

| US | Dollar General, Dollar Tree, Family Dollar | Mostly $1.25 (Dollar Tree recently moved from $1) | Focused on rural America; heavy reliance on private labels and essentials (household cleaning, packaged food) |

| China | Miniso, Mumuso | ¥10–¥30 pricing bands | More aspirational value play, trendy, design-focused products attract young urban shoppers |

| Japan | Daiso | ¥100 (≈₹55) | Highly standardised product quality and a mix of quirky, innovative items, known for creativity rather than just cheapness |

| UK | Poundland, B&M | £1 pricing core (but multi-price strategy growing) | Expanded beyond “pound” items; sells general merchandise, apparel, and frozen foods |

| India | Vishal Mega Mart, Market99, Zudio (fashion) | ₹49–₹99 psychological price points | Targeting Tier-2 & Tier-3 cities, mix of FMCG + apparel + general merchandise, and increasingly building private labels |

Source: News articles

What’s next for India’s value stores?

-

Price Anchoring: Global giants often start with a single-price model and later move to multiple price points as costs rise — think Dollar Tree shifting to $1.25. Indian players could follow suit as inflation bites.

-

Product Strategy: While Japan’s Daiso and China’s Miniso sell novelty and design, India’s 99-stores stick to basics, affordable, useful, and everyday essentials.

-

Growth Opportunity: India’s value retail scene is still fragmented. Dollar General has 19,000+ stores in the US; in India, no player has crossed even 1,000 yet. That’s a lot of headroom.

-

The silver lining: Despite pandemic challenges, retailers like Vishal Megamart, Style Bazaar, and V Bazaar posted a healthy CAGR of 15%+ between 2018 and 2022.

Rising consumption in smaller cities, changing price dynamics, and evolving product strategies suggest that the ₹99 segment will continue to evolve. Price tweaks, product experiments, and new players could shake things up. The market is still fragmented, the rules are evolving, and in the world of ₹99, the next big move could come from anywhere.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story