Upstox Originals

Why has cheque clearing suddenly slowed down?

5 min read | Updated on November 27, 2025, 16:42 IST

SUMMARY

We swipe, tap and UPI everything today. So why are cheques even in the picture? Because they move some of the country’s biggest, most time-sensitive payments. That’s why the RBI rolled out Continuous Same-Day Clearing, a system meant to give cheques a much-needed speed boost. But is it actually making things faster? Why are some users still seeing delays? And who continues to rely on cheques in a digital-first world?

Under CTS, cheques can now be cleared within hours, with banks needing to notify their honour or dishonour by 7:00 pm the same day

A delayed UPI payment is annoying. A delayed cheque can break a business. Well, because this tiny sliver still handles some of the most important payments in the country; SME vendor dues, property settlements, government disbursements, corporate transactions, and even legally enforceable commitments.

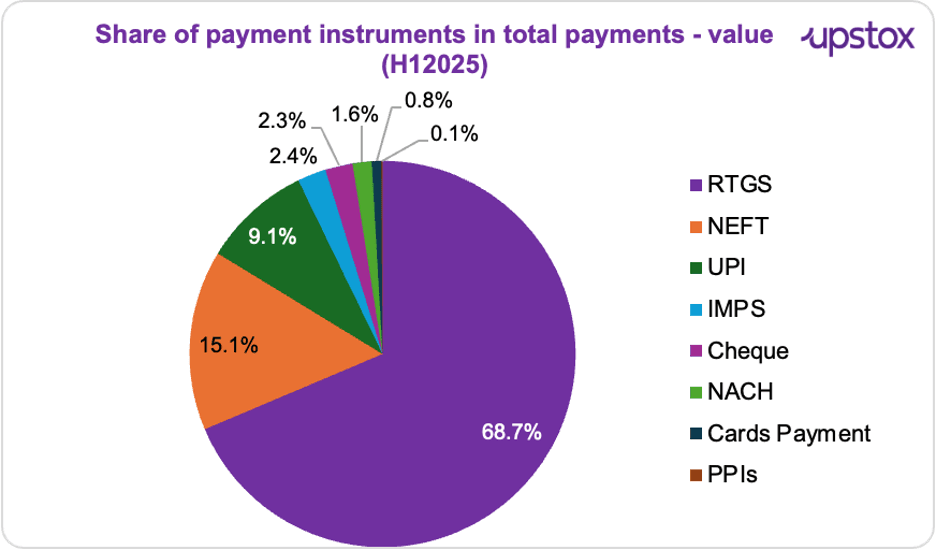

Today, cheques account for less than 3% of total transactions. And that naturally raises the question; why talk about them at all?

Because the value they move is concentrated in high-stakes payments. When these get held up, the impact shows up instantly in cashflows, payrolls and business cycles. Cheques also haven’t always been this small; they had their glory days.

Back in 2006, a study by the Indian School of Business found that cheques accounted for 82% of all retail payments by volume and a staggering 98.7% by value.

Fast-forward to 2012, and cheques still made up 74.6% of payment value in the country. With that backdrop, here’s how India’s payment mix looks today.

Source: RBI

To get a sense of the scale of things, let’s look at how India’s payment activity has been moving. Almost all the growth you see today is driven by digital modes; UPI, NEFT, RTGS and cards.

Here’s a quick snapshot of how the numbers have changed over the past three halves.

India’s Payment Metrics (H1 2024 → H1 2025)

| Metric | H1 2024 | H2 2024 | H1 2025 | Daily Average (H1 2025) |

|---|---|---|---|---|

| Total Payments – Volume | 9,688 Cr | 11,161 Cr | 12,549 Cr | 69 Cr |

| Total Payments – Value | 1,364 lakh crore | 1,466 lakh crore | 1,572 lakh crore | 9 lakh crore |

Source: RBI

In October 2025, RBI rolled out something called Continuous Same-Day Clearing under CTS. Think of it as an upgrade to make cheque settlements quicker and smoother. Faster funds for people, lower processing costs for banks, better liquidity all around, and a uniform system working the same way across the country; that was the idea.

But the rollout hasn’t been as smooth as hoped. And that’s where our story really begins. What Is CTS continuous clearing and how has cheque clearance evolved?

The Reserve Bank of India (RBI) launched the Continuous same day cheque Clearing System on October 4, 2025 to modernise cheque processing. This technology replaces the conventional batch-based technique, which might take up to two business days to clear cheques.

Under this structure, cheques can now be cleared within hours, with banks needing to notify their honour or dishonour by 7:00 PM the same day. Further upgrades are anticipated beginning in January 2026, with the goal of processing cheques in three hours.

| Year/Period | System/Method | Clearance time |

|---|---|---|

| Pre-1980s | Manual | ~1 week |

| 1980s | MICR sorting | 1-3 days |

| 2008 | Cheque Truncation System | 1 day |

| 2021 | Nationwide grid | T+1 (next day) |

| 2025 | Continuous clearing under CTS | A few hours |

Source: ETBFSI

The new clearing system was meant to bring cheque processing up to speed with India’s digital payments. But the transition hasn’t been as smooth as expected.

Banks and the central clearing system (NPCI) are still ironing out software issues. When their systems don’t sync perfectly, cheque data ends up stuck in the pipeline. And since cheques are cleared using scanned images, even small problems; a blurry signature, a smudged account number, or a faint MICR code; can lead to rejection. Those rejected cheques then need manual checks. And many bank branches simply aren’t trained to handle that volume quickly.

So wasn’t this a problem earlier too? What’s different now?

Earlier delays came from physical handling; courier holdups, branch backlogs or misplaced cheques. Under CCS, the bottleneck has moved to the central image-clearing system. Even minor scanning or data-sync errors can stall transactions across multiple banks, making delays broader and more visible during the transition, even though the goal is faster settlement.

So the delays are real. Cheques that once cleared within a day are now taking over a week.

For SMEs that depend on quick settlements to manage payroll, vendor payments or stock, CTS was supposed to make life easier. For now, though, it’s doing the opposit

The way forward for India

Continuous Clearing Systems (CCS) under the Cheque Truncation System (CTS) are reshaping cheque processing with faster, near-real-time clearing and fewer traditional delays.

And even in 2025, cheques remain relevant. Elderly users, small traders and semi-urban clients still rely on them. SMEs and B2B firms continue using cheques; even post-dated ones; as a risk-management tool and a sign of commitment. Legal protections for cheque bounce add another security layer. Even when not delivered, cheques act as backup for repayments or credit terms, showing their value beyond the payment itself.

But the downsides remain. Cheque-bounce cases still overwhelm courts; around 4.3 million are pending, making up more than half of cases in some regions. Payments can fail due to inadequate funds or tech issues. The Supreme Court is pushing UPI-based connectivity in courts to speed up dispute resolution, but the transition is still messy.

So what’s the solution? Modernise. CCS can make cheques faster, safer and more reliable, even as India pushes digital payments. Cheques will shrink in usage, but they’ll survive in segments where digital adoption is still uneven. Faster clearance plus gradual digital uptake is the balance India needs.

About The Author

Next Story