Upstox Originals

Why global investors want a seat at India’s retail buffet

8 min read | Updated on October 03, 2025, 15:31 IST

SUMMARY

India’s retail sector is stealing the spotlight, with foreign investors doubling down as the market grows bigger, faster, and smarter. From rural demand booms to e-commerce surges and GST reforms, the piece tracks how capital is flowing in, and why the next decade looks even brighter for retail FDI.

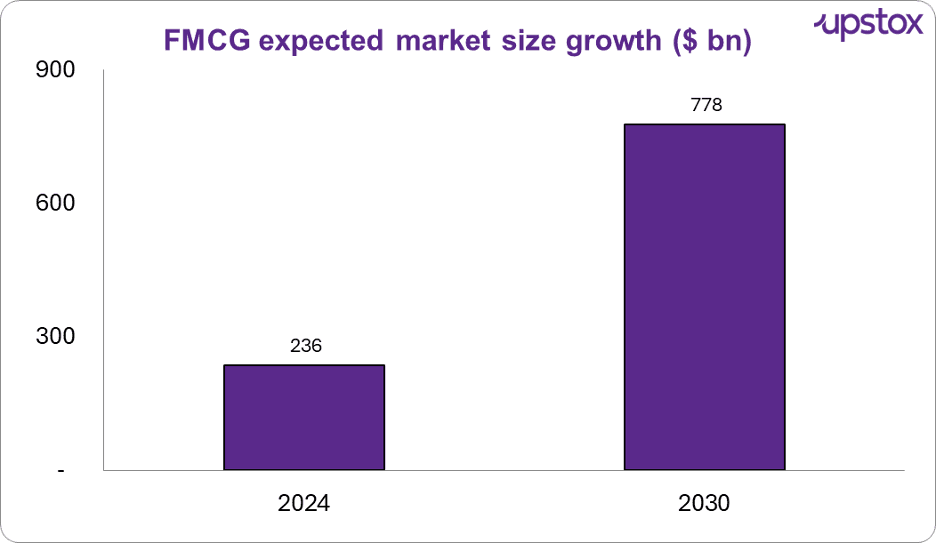

As of 2024, India’s FMCG market is pegged at $236 bn, projected to hit $778 bn by 2030, a 22% CAGR runway.

Think of India’s FMCG market like a well-stocked buffet at a Big Fat Indian Wedding: food counters (obviously), beauty kiosks, retail carts, even premium dessert corners. Footfall is rising, queues are getting longer, and global investors are quietly reserving tables in advance.

But behind the consumption boom lies another story, one about where foreign capital is flowing, how fast it’s moving, and why retail is emerging as the next big FDI frontier.

The size of the buffet (and why it matters)

Source: Rubix data science estimate

As of 2024, India’s FMCG market is pegged at $236 bn, projected to hit $778 bn by 2030. That’s a 22% CAGR runway. What makes this even more striking? The comparison with other emerging markets.

While economies like China and Brazil are seeing their consumer growth taper off to 2-5% a year, India remains one of the last large-scale consumption stories still posting double-digit expansion.

For foreign investors, this isn’t just about size, it’s about speed and resilience. A market growing this fast, at this scale, gives them one of the few big opportunities left in the global consumer space.

Retail FDI is picking up speed

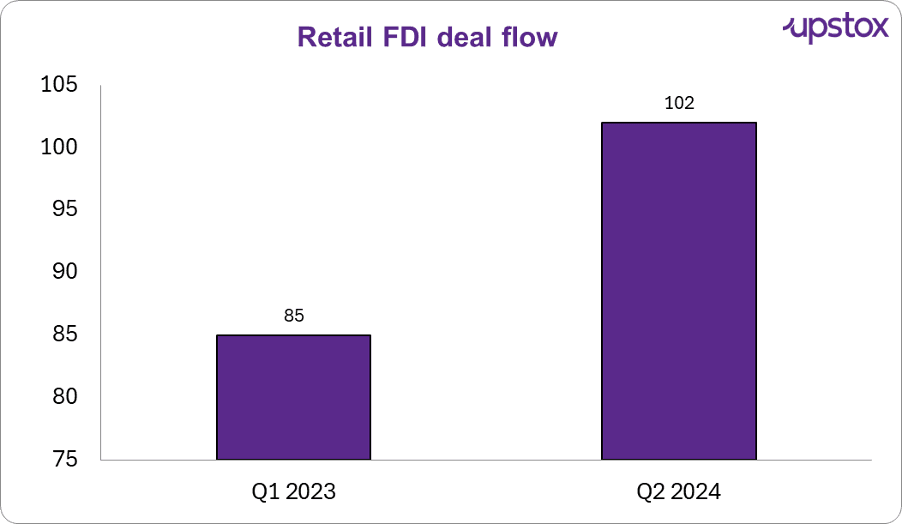

Source: Grant Thornton

The latest data shows retail FDI deal flow climbing sharply, from 85 deals in FYQ1 2023 to 102 deals in FYQ1 2024. It’s not just more transactions, it shows foreign investors are writing bigger cheques with growing confidence in India’s retail story.

In FY 2024–25, the trading sector (including retail) made up 8% of India’s total FDI inflows, or roughly $6.5–7 bn out of ~$81 bn. Cumulatively, retail has now attracted $4.8 bn since 2000, with most of it coming in the last five years as modern retail and e-commerce expanded.

Where the money’s flowing: FDI hotspots

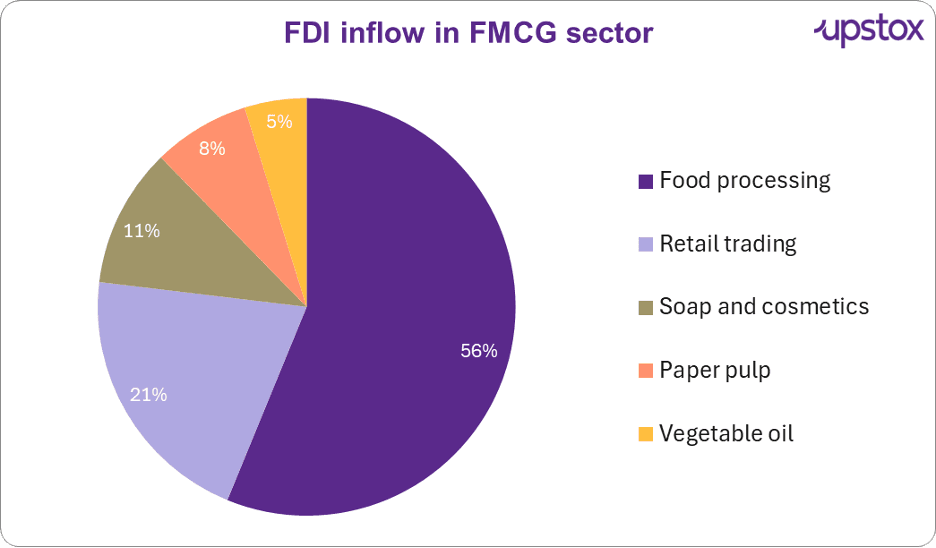

Source: IBEF

FDI inflows reveal where international investors believe there is long-term opportunity. Food processing continues to dominate with 56% of FMCG FDI since 2000, assisted by export opportunities as well as government schemes such as PLI schemes and mega food parks.

But the larger story today is retail trading, at 21% and accelerating rapidly. With e-commerce, modern trade and quick commerce reshaping shopping habits, investors want a slice of both physical retail and India’s fast-growing digital commerce universe.

Soaps and cosmetics at 11% are riding the premiumisation tide, with increasing incomes driving demand for skin and beauty brands across cities and smaller towns.

Why retail FDI is gathering momentum

Rural appetite is on a roll

Rural FMCG volumes increased by 8.4% in March 2025, four times the 2.6% of urban India. Consumers outside metros are upgrading from starter packs to branded and mid-premium products, with firms such as Dabur and HUL now taking 35–50% of revenues from rural India. For overseas investors, that translates into much bigger, higher-growth consumer bases to be exploited.

Digital rails are remolding consumer retailing

Indian fast-commerce businesses such as Blinkit, Zepto and Instamart now generate 35% of FMCG e-commerce revenues, slashing delivery times and driving impulse purchases. For FDI, it implies that technology-enabled retailing can scale fast in India's decentralized market.

GST reforms bring new energy

Reductions across FMCG essentials, from 12–18% down to 5%, could shave up to 10% off retail prices. For investors, cheaper products plus easier compliance mean faster volume growth and smoother operations.

Where the smart money is flowing inside FMCG

Food processing still anchors the story

With inflows worth over $13.4 bn between April 2000 and June 2025, food processing has consistently drawn the lion’s share of FMCG FDI, more than half of the sector’s total. The market itself was valued at $307 bn in 2022 and is projected to cross $547 bn by 2028, growing at nearly 10% CAGR.

For investors, it’s the scale and export potential, plus steady government incentives like the PLI scheme and Mega food parks, that keep food processing as the anchor bet inside FMCG.

Quick commerce is becoming the poster child for retail innovation

Blinkit, Zepto and Instamart now handle over 70% of India’s e-grocery orders, up from ~35% in 2022. FMCG majors say sales through these channels doubled in FY25.

Personal care and beauty are punching above their weight

D2C players like Nykaa and Mamaearth are attracting foreign capital on the back of premiumisation and a younger, aspirational consumer base. When P&G India crossed $2 bn in sales in FY24, it shows why beauty and grooming are no longer niche, they’re central to the consumption upgrade story.

New adjacencies are opening up

Dairy is on track for 13–14% growth this year, and even pet food has gone from a $10.5 bn market in FY24 to a projected $16.2 bn by FY32. These are small categories today, but they highlight how FMCG FDI is broadening into new lifestyle-driven consumption.

The takeaway? Retail FDI may look like a small slice in the official pie, but zooming in shows a far more dynamic picture: foreign capital is following where Indian consumers are changing fastest, not just where the biggest market already exists.

Examples of the momentum in action

-

Walmart–Flipkart:- India’s biggest retail FDI deal so far at $16 bn in 2018. Flipkart has since expanded into quick commerce, payments and logistics, proving how global capital can build full-stack ecosystems.

-

IKEA:- Has invested over ₹10,500 crore in India, with large-format stores in Hyderabad, Navi Mumbai and Bengaluru, plus smaller city-centre outlets for urban convenience.

-

Apple:- Opened its first two flagship stores in Mumbai and Delhi in 2023, a milestone for India’s premium retail space under the single-brand route.

-

H&M and Zara:- Now have 80+ stores across India, alongside growing online sales via platforms like Myntra.

These examples show foreign investors are betting across physical retail, e-commerce and hybrid formats, not just one channel.

But to really understand the scale of retail FDI, it helps to zoom out and see how it stacks up against other sectors in India’s overall FDI story.

How FMCG stacks up against other sectors

India’s top FDI sectors (and where FMCG fits in) (from April 2000 to June 2025)

| Rank | Sector | FDI inflow ($ mn) | % of total inflows |

|---|---|---|---|

| 1 | Services sector* | 122,124 | 16.3% |

| 2 | Computer software & hardware | 116,158 | 15.5% |

| 3 | Trading (includes retail)* | 52,947 | 7.0% |

| 4 | Telecommunications | 40,096 | 5.4% |

| 5 | Automobile industry | 39,148 | 5.2% |

| 6 | Construction (infrastructure) | 36,850 | 4.9% |

| 7 | Construction development (townships, housing, built-up infra) | 27,214 | 3.6% |

| 8 | Drugs & pharmaceuticals | 24,617 | 3.3% |

| 9 | Retail* | 24,089 | 3.2% |

| 10 | Chemicals (other than fertilisers) | 23,399 | 3.1% |

Source: DPIIT FDI Fact Sheet, June 2025. Note: *Services sector includes financial, banking, insurance, outsourcing, R&D, courier, testing and related activities. *Trading (includes retail) Retail trading is only 0.65%. *Food processing attracted ~$13.5 billion, given that is 56% of retail flows, we have calcualted implied retail flows (13.5/0.56)

The picture is clear, services and IT still dominate the FDI landscape, but that's precisely what makes the rise of retail so striking. Even with a smaller share today, retail and FMCG inflows are punching above their weight class because they represent fresh and long term bets when it comes to India’s consumption story.

In other words, global capital isn’t just chasing India’s traditional strengths in tech and services anymore, it’s reserving a seat at the retail table.

Outlook: the road ahead for retail FDI

India’s retail sector is moving into a new phase. The market size is exploding, rural demand is outpacing urban growth, and e-commerce plus quick commerce are opening up channels that didn’t exist five years ago. Add to that GST reforms, digital payments, and better infrastructure, and you get a market that’s bigger, faster and easier to operate in.

For foreign investors, the next wave of retail FDI will likely focus on:

-

Omnichannel retail:- Blending physical stores with digital platforms for scale and reach.

-

Premiumisation: Capturing the rising demand for beauty, personal care and lifestyle products.

-

Tier-2 and Tier-3 cities:- Moving beyond metros into India’s next 500 million consumers.

-

Supply chain investments:- Warehousing, cold chains and last-mile delivery to support growth.

With all these shifts converging, India’s retail sector looks set to remain one of the most compelling FDI stories in global consumer markets over the next decade.

Disclaimer: Views and opinions expressed in the article are the author's own and do not reflect those of Upstox.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story