Upstox Originals

Why global diversification could give your portfolio an edge

8 min read | Updated on September 10, 2025, 13:54 IST

SUMMARY

This article explores how Indian investors can broaden their horizons by investing in sectors like technology, healthcare, consumer staples, and electric vehicles, areas that are still underrepresented at home. As an example, a decade-long S&P 500 versus Nifty comparison it highlights why global diversification could give your portfolio that extra edge.

The Nasdaq-100 technology sector index comprises of some of the biggest tech companies like Apple, Microsoft, Nvidia, Alphabet

Ever thought about owning a piece of the brands you interact with every day—Google, Instagram, WhatsApp, or even McDonald’s? These aren't just global icons, they're investment opportunities sitting halfway across the world. Thanks to easier access to global markets, Indian investors can now go beyond local listings and tap into sectors that simply don’t exist at scale in India.

We take the US markets as an example, given the size and ease of access. Let’s explore the US sectors that offer Indian investors something fresh, exciting, and unavailable back home.

Technology

The US tech sector is home to some of the world’s most valuable and influential companies, many of which are investor favourites. Some of them are Apple, Nvidia, Microsoft, Alphabet(Google), Meta and the list keeps going on.

To help make sense of the breadth of the US tech sector, here’s how it breaks down across key segments:

- Hardware and equipment - Apple, HP,etc

- Software and Services - Microsoft, Adobe, Alphabet

- Semiconductors - Nvidia, Intel

- E-commerce & internet services - Amazon, Meta platforms

- Cloud computing - Providers like Amazon web services(AWS), Microsoft azure

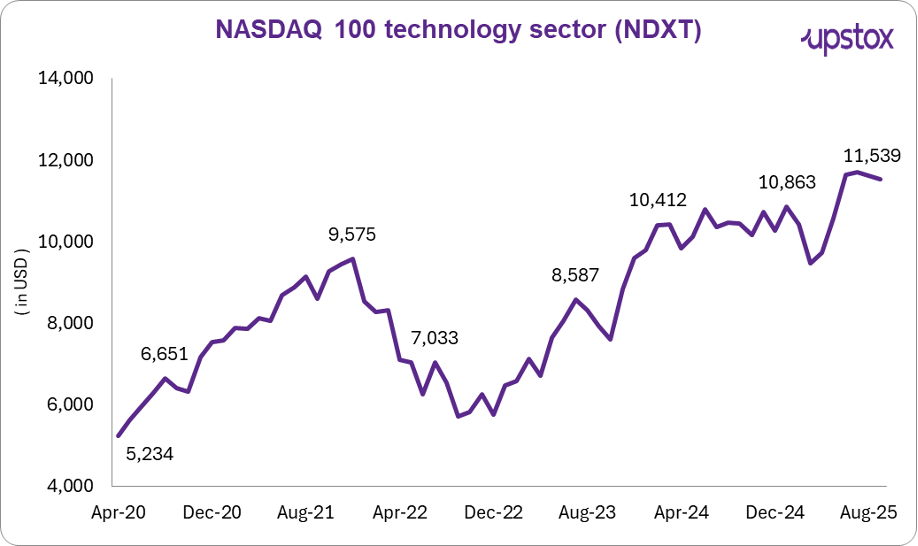

Investing.com; data as of 04-09-25

The Nasdaq-100 technology sector index comprises few of the biggest tech companies of the world like Apple, Microsoft, Nvidia, Alphabet and many more.

This index has grown in the last 5 years and 10 years at around 14% (cumulative annualised) and 18% (cumulative annualised) respectively.

The US tech sector is the largest in the world by market capitalisation, making up roughly two-fifths of S&P 500's weight. (US Bank). The US tech spending is forecast to grow by 6.1% in 2025 to reach $2.7 trillion, according to Forrester. This presents a lucrative opportunity to diversify the portfolios into tech stocks.

Lets have a look at some of the top NDXT stock :-

Average annual returns

| Company | 5yr CAGR | 10yr CAGR |

|---|---|---|

| Analog Devices, Inc. (ADI) | 17% | 18% |

| ON Semiconductor Corporation (ON) | 16% | 17% |

| CDW Corporation (CDW) | 8% | 16% |

| Microsoft Corporation (MSFT) | 18% | 29% |

| Intuit Inc. (INTU) | 15% | 24% |

Source: financecharts.com

Healthcare

From COVID vaccine makers like Pfizer and Moderna to robotic surgery pioneers like Intuitive Surgical, the US healthcare sector spans innovation, data, and delivery.

The US Healthcare sector is also one of the largest sectors in the S&P 500, representing roughly 10% of the market capitalization of the index. With healthcare spending in the US projected to reach $7.7 trillion by 2032 (CMS.gov), the industry accounts for nearly 18% of US’ GDP.

An ageing population and rising chronic diseases are driving demand across pharmaceuticals, medical devices, health services, and technology.

Indian markets are strong in generics and hospital chains but lack scale exposure to high-growth biotech, weight-loss drugs, robotic surgery, and healthcare analytics, all of which are common in US-listed firms.

The US pharma and healthcare sectors can be classified in the below categories

- Pharmaceutical giants - Eli Lilly, Johnson & Johnson

- Biotech Innovators - Vertex Pharmaceuticals, Moderna, Pfizer

- Medical Devices & Equipment - Boston Scientific, Medtronic, Stryker

- Healthcare Providers & Insurers - UnitedHealth Group, HCA Healthcare, McKesson

- Healthcare Technology & Services - Teladoc Health, Tempus AI, IQVIA

Lets have a look at some of the top performing stocks in the US healthcare sectors.

Average annual returns

| Company | 5yr CAGR | 10yr CAGR |

|---|---|---|

| Eli Lilly and Co (LLY) | 38% | 27% |

| AbbVie (ABBV) | 20% | 15% |

| Amgen (AMGN) | 7% | 9% |

| Vertex Pharmaceuticals (VRTX) | 11% | 14% |

| Alnylam Pharmaceuticals (ALNY) | 23% | 12% |

Source: financecharts.com

Beyond just pharma and biotech, there are several high-growth themes that are reshaping the future of healthcare investing.

Areas like weight loss, data analytics, diagnostics, robotics, medical devices and insurance are proving especially attractive to investors right now.

Weight loss is a worldwide challenge. Eli Lilly is favorably positioned to solve the burdening weight problem with its GLP-1 drugs Mounjaro (for diabetes) and Zepbound (weight loss)

The sheer volume of health data in the US opens up vast opportunities for analytics, AI, and digital health firms. Veeva, NVIDIA, Meta Platforms, Alphabet, Oracle, Amazon, Microsoft, and Palo Alto Networks are among technology-related companies with products or groups that extend into healthcare.

Robotics and medical devices are among companies positioned to offer solutions for improved patient outcomes, workforce shortages, and physician efficiencies. Companies that operate in these areas include Intuitive Surgical, Medtronic, Stryker, Insulet and GE Healthcare.

Consumer staples

Ever had a Coke, a packet of Lay’s, or used Colgate toothpaste? So why are we talking about snacks and toothpaste? These aren’t just pantry items, they’re global businesses you can invest in.

The US market gives the opportunity to invest in some of the biggest consumer goods companies of not just the United States but the entire world. We can invest in companies like PepsiCo, Coco Cola, P&G, Walmart and many more.

Consumer staples stocks typically sell consumer goods that people use every day. These include everything from groceries, paper products, and cleaning products to over-the-counter health products, tobacco, and cosmetics.

These stocks are non-cyclical, they offer investors safety even in recessionary times. Since these companies sell goods such as food and cleaning products that consumers rely on regardless of the state of the economy, they tend to generate solid profits even in weak economies.

While India has home-grown FMCG giants like HUL or ITC, US markets give access to global consumer powerhouses with unmatched scale and dividend track records.

Here’s how some of these well-known global names have performed.

Average annual returns

| Company | 5yr CAGR | 10yr CAGR |

|---|---|---|

| Coca-Cola (KO) | 11% | 9% |

| PepsiCo (PEP) | 3% | 7% |

| Walmart (WMT) | 20% | 17% |

| Procter & Gamble (PG) | 6% | 9% |

| Hershey (HSY) | 8% | 10% |

| Philip Morris International (PM) | 22% | 12% |

| Costco Wholesale (COST) | 27% | 24% |

Source: financecharts.com

Consumer staples stocks offer economic resiliency and steady dividends, ideal for low-risk portfolios.

This Sector is likely to remain attractive as investors hedge against the upcoming market swings.

Electric Vehicles

With EV sales projected to surpass 20 million units in 2025, according to The International Energy Agency (IEA), the sector offers strong long-term potential.

According to Cox Automotive Inc., about 1.3 million electric vehicles (EVs) were sold in the U.S. in 2024 — up from the 1.2 million sold the previous year.

EV Stocks comprises of companies in the electric vehicle ecosystem and includes automakers, battery manufacturers, charging infrastructure providers, and firms supplying essential components like software and semiconductors

With pureplay EV brands like Tesla and Rivian, the US market offers investors a unique way to ride the EV wave.

Tata Motors and Mahindra are entering EVs, but they’re still legacy automakers. India has no listed pureplay EV players like Tesla or Rivian, and its EV ecosystem, battery makers, charging infra, semiconductors, is still in early stages.

The sector can be broken down into several key categories:

- EV manufacturers(Pure-play and traditional) - Tesla,Rivian

- EV battery stocks - QuantumScape, Solid Power

- Charging infrastructure companies - Chargepoint, EVgo

- Component and technology providers - NVIDIA, ON Semiconductor

Lets see how some of the EV stocks have delivered in the past.

Average annual returns

| Company | 5yr CAGR | 10yr CAGR |

|---|---|---|

| Tesla (TSLA) | 25.5% | 33.1% |

| Li Auto (LI) | 9.3% | - |

| NIO (NIO) | -18.0% | - |

| Xpeng (XPEV) | -4.0% | - |

| Quantumscape (QS) | -3.0% | - |

Source: financecharts.com

The long-term potential of EVs goes beyond personal vehicles. Commercial adoption is also on the rise, a recent Cox Automotive report estimates that 14% of US fleets use EVs today, with over half expected to make the switch in the next five years.

Internal combustion engines aren’t disappearing, but experts agree the shift to electrification will continue, even if it falls short of sky-high expectations. To capitalize on this long term trend, investors may want to consider positions in some of the best EV stocks.

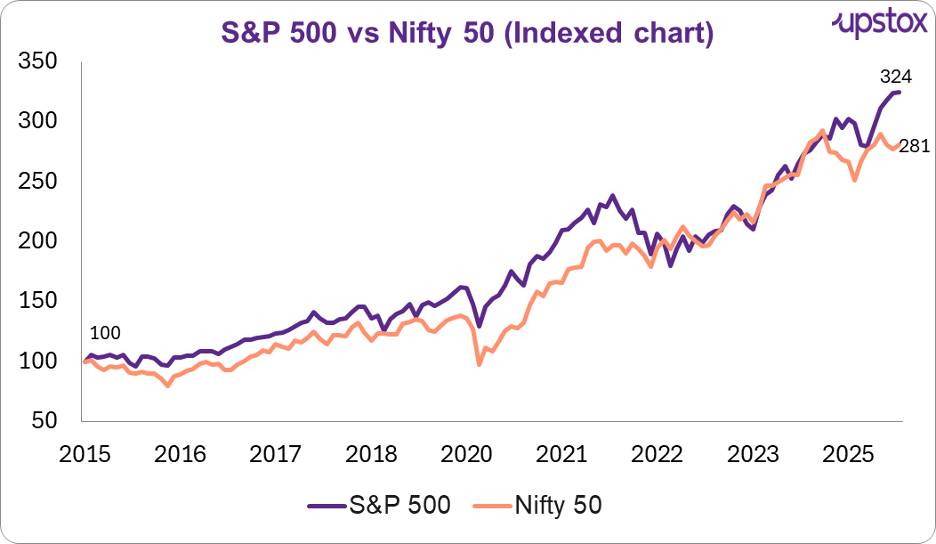

Before we wrap up, let’s see how the US and Indian markets have stacked up over the years.

S&P 500 vs NSE: A decade of growth at a glance

Source: investing.com

The S&P 500 has surged from 100 to 324, over a threefold rise, while the Nifty has delivered strong gains too. The chart tells a clear story: global diversification pays off.

Outlook

Looking ahead, global diversification will only become more relevant as sectors like AI, clean energy, and healthcare innovation reshape global markets. Indian investors who expand their horizons beyond domestic equities could benefit from exposure to these high-growth themes, while also hedging against local market volatility.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story