Upstox Originals

Why are banks still struggling to hold on to CASA?

6 min read | Updated on December 12, 2025, 16:27 IST

SUMMARY

The banking system’s cheapest source of funding has been under pressure for the past 8-10 quarters. Slowly, yes, but enough to shake margins. And here’s the thing: this isn’t a one-off blip. It’s a steady shift in how savers behave. People are moving their money to places that earn more; and banks are struggling to keep up. So what does it mean for banks today? Let’s unpack it.

Across banks, average CASA fell from 38.89% in Q2 FY24 to 36.38% in Q2 FY26

You’ve probably noticed this already (its been in news everywhere)… Bank CASA ratios haven’t been looking too cheerful lately.

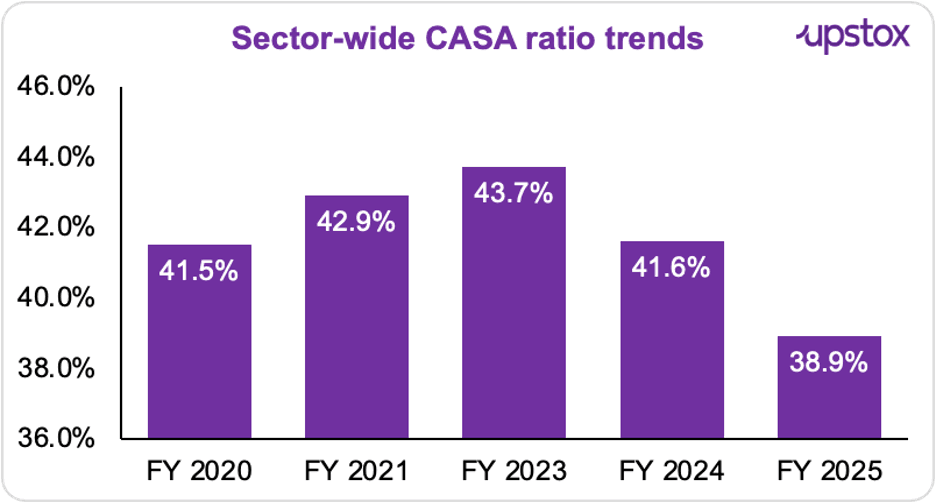

They had a good run; rising from 41.5% in FY20 to 42.9% in FY21, and touching a high of 43.7% in FY23. But then the trend flipped. By FY24, CASA slipped to 41.6%, and in FY25, it dropped further to 38.9%.

The quarterly data isn’t any kinder. Across PSU and private banks, average CASA stood at 38.89% in Q2 FY24. It fell to 37.53% in Q2 FY25, and then to 36.38% in Q2 FY26; nearly 8–10 quarters of steady compression. There was a tiny bump from 36.15% in Q1 FY26, but it didn’t change much.

Source: ETBFSI

Alright, but what is CASA?

CASA is simply the money sitting in a bank’s Current Accounts and Savings Accounts. For the account holder, savings accounts earn a tiny bit of interest, and current accounts earn nothing at all.

But here’s why banks love CASA.

It’s cheap money. They barely pay anything on these deposits but can lend them out at much higher rates. So a higher CASA means lower funding costs and healthier margins. And when CASA begins to fall… well, the math stops working in a bank’s favour.

What’s pushing CASA down?

When banks dangled 8%, savers stopped settling for 3%

During the up-rate phase, banks were offering over 8% on term deposits while savings accounts sat at 2.5–3%. That gap was too big to ignore. Households and corporates shifted balances into FDs, and any extra liquidity moved into equity markets and mutual funds instead.

A senior private-sector banker said the high-cost deposits raised in FY23 and FY24 during the liquidity crunch are still rolling off, keeping the funding mix tilted toward term deposits. And as Suresh Shukla of SBI Securities puts it, “Retail and affluent customers are no longer leaving lazy money in savings accounts, they’re actively chasing higher-yielding alternatives.”

The great migration of money: from banks to markets

Savers today don’t rely only on deposits. As Priyashis Das explains, households are steadily directing more money into equity, mutual funds, and bonds. This is financialisation in action, a long-term behavioural shift, not a short-term reaction, and it naturally reduces the amount of stable, low-cost savings that flow into CASA accounts. The numbers back this up. As of FY2025, the share of bank deposits in household financial assets has fallen to 35.2%, down from roughly 40% in FY2024, even as mutual funds assets surge to nearly ₹65.7 trillion by March 2025.

Digital banking killed the ‘lazy balance’

With sweep-in/sweep-out features, instant transfers, and automated money movement tools, customers now keep only transactional balances in their savings accounts. The rest moves to wherever the yield is better. In short, technology has made it effortless to optimise every rupee, and the age of leaving money idle in a CASA account is over.

What is the impact?

Margins are getting crushed

Over the past 8–10 quarters (FY23 to Q2 FY26), customers have steadily moved money out of CASA accounts that pay 0–3% into term deposits offering 6.5–8%. This shift really accelerated during the FY23–FY24 rate-hike cycle, when many banks were paying over 8% on FDs while keeping savings rates unchanged.

And this has hit NIM (Net Interest Margin - the profit a bank makes on every rupee it lends).

The damage is visible in FY25 and FY26 numbers. System-wide NIMs (i.e., across all banks) have dropped from around 3.7% in FY24 to roughly 3.3–3.5% by Q2 FY26. And several banks have seen an even sharper squeeze; take RBL Bank, whose NIM fell from 5.7% in FY24 to 4.5% in Q2 FY26, or IndusInd Bank, which saw its NIM slide from 4.3% to 3.5% over the same period.

Of course individual lending patterns do play a role in this, but a move away from CASA has also played an important role here.

The credit–deposit gap is widening

Banks are giving out loans faster than they are receiving deposits. That’s why the 3-month incremental Credit–Deposit Ratio has jumped to 119%; meaning banks lent ₹119 for every ₹100 of new deposits in that period.

Even the year-to-date CDR is close to 80%, higher than the more comfortable 70–73% seen a couple of years ago. This is happening because loan growth (11.4% YoY) is still outpacing deposit growth.

When deposits don’t keep up, a liquidity gap opens up. Banks sometimes end up parking whatever small surplus they have with the RBI instead of deploying fresh loans; a trend visible since early FY25.

Lower CASA only adds to this pressure, especially for MSME and retail lending.

Is this uniform?

No. Some banks are holding up better than others. Public-sector banks still maintain slightly higher CASA ratios than private peers, though both groups have felt the squeeze. And a few players have actually strengthened their position despite the downtrend. Bank of Maharashtra continues to top the charts with a CASA ratio of 50.35%. IDFC First Bank isn’t far behind; it climbed to 50%, up from 48% last quarter, helped by a stronger retail push and higher savings rates.

Looking ahead

Banks know CASA isn’t bouncing back just because they hope it will. After 8–10 quarters of slipping from 38.9% in Q2 FY24 to 36.4% in Q2 FY26; with only a tiny Q1-to-Q2 bump; it’s clear that low-cost deposits need a push, not patience. So they’re getting creative.

Take Indian Bank. CEO Binod Kumar has tied salary accounts to the bank’s lending deals. If Indian Bank leads a loan consortium, it asks the borrower to route 20% of employee salary accounts through the bank. And the strategy’s working; of the 4 lakh salary accounts it wants to open in FY26, 1.7 lakh are already done. It’s also rolling out ING Shakti for women and tapping places like the Raipur steel belt to scoop up more accounts.

Suryoday SFB is playing a different game; going all-in on digital onboarding and relationship deepening across Western and Central India, while using SIDBI refinance to strengthen its deposit engine.

PSU banks are casting wider nets with MSME products, FASTag-driven onboarding, and partnerships with temples and universities. Private banks are doubling down on their strength; slick digital journeys and hybrid onboarding; because customers now move money with UPI and sweep tools the moment a better yield pops up.

So the next phase of CASA won’t be about waiting for deposits to return. It’ll be about who adapts fastest in a world where customers move money at the tap of a button; and banks have to work harder than ever to earn it.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story