Upstox Originals

Why 22 nations are banking on the rupee

9 min read | Updated on December 26, 2025, 16:59 IST

SUMMARY

India’s rupee is quietly finding new strength, not through appreciation, but through credibility. Almost 22 countries have now agreed to an INR settlement. As more countries settle trade in rupees, what began as a workaround during sanctions is evolving into a subtle form of financial diplomacy. The rupee’s edge lies in reliability, not dominance.

22 nations have agreed to participate in INR-based transactions

The rupee has weakened against the dollar, and that’s the story most people know. But that’s only part of the picture. Beneath the noise, the rupee has been earning credibility, not through appreciation, but through how it behaves when the world gets uncertain.

Vostro accounts

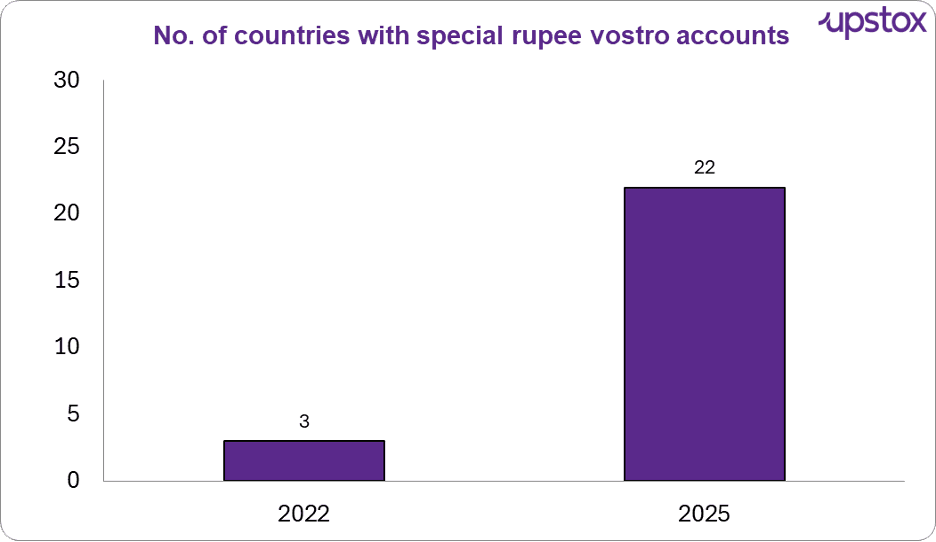

A Vostro account simply lets a foreign bank keep rupee balances in India, which can then be used for trade or investment. After the RBI opened the door to rupee settlements in 2022, progress was slow. For nearly a year, only three countries had operational Vostro accounts. Then, between late 2023 and mid-2025, activity began to pick up sharply as more banks and partner nations joined in.

The number of countries using rupee settlement has now climbed to 22, reflecting how the idea is quietly gaining traction across regions. The rise is small in scale, but significant in signal, it shows that trade partners are beginning to treat the rupee as a working currency, not a diplomatic experiment.

Source: News articles & Govt notices.

The push: what’s happening

When the RBI quietly launched its rupee settlement framework in July 2022, it looked like a niche experiment. Two years later, it has become a small but growing network that allows India’s trade partners to settle deals without touching the dollar.

What began as a workaround for Russia has since evolved into a test of trust. By early FY25, Indian banks such as SBI, UCO Bank and HDFC Bank were collectively handling dozens of Special Vostro Accounts on behalf of partner nations. Each account allows foreign banks to hold rupee balances in India, which can then be used to pay Indian exporters, invest locally, or finance new imports.

The system now covers a diverse mix of countries. Some, like Russia and Sri Lanka, turned to rupee trade out of necessity during currency shortages or sanctions. Others, like the UAE and Mauritius, joined by choice, seeing practical advantages, faster settlements, lower costs, and deeper financial links with India.

Together, these early adopters show how the rupee is finding different reasons to be useful, from emergency workaround to deliberate policy tool. Here’s how the participation looks so far:

| Partner country | When joined | Trade areas using rupee settlement | Why it matters |

|---|---|---|---|

| Russia | 2022 | Crude oil, defence, fertilisers | Helped maintain trade flow amid Western sanctions. Established the first large-scale rupee settlement. |

| UAE | 2023 | Oil, gems and jewellery, re-exports | First OPEC country to agree to rupee-dirham trade. Signalled mainstream acceptance. |

| Sri Lanka | 2023 | Essential goods, fuel | Helped Colombo stabilise imports during its forex crisis. |

| Mauritius | 2022 | Services, investments | Supports offshore financial links between India and Africa. |

| Tanzania, Kenya, Bangladesh (exploratory) | 2024–25 | Agricultural trade, machinery | Expands the rupee’s footprint across Africa and South Asia. |

Source: News articles

While the total value of trade settled in rupees remains small, under 2% of India’s total trade, it’s rising faster than expected. What matters more is intent. Each new Vostro account signals that the rupee is being treated as a usable currency abroad, not just a domestic token.

Global context: the new local currency wave

India’s rupee trade framework is part of a broader shift taking shape across Asia, one that’s slowly challenging the dollar’s near-total dominance of global payments.

China has been at the forefront of this push. Through its Cross-Border Interbank Payment System (CIPS), launched in 2015, Beijing has encouraged trading partners to settle deals directly in yuan (RMB). The results are visible: the yuan now accounts for about 4.5% of global payments (as of late 2024, SWIFT data), up from less than one per cent a decade ago. The currency has gained particular traction in energy trade, with countries like Russia and Saudi Arabia accepting yuan payments for oil, something that would have been unthinkable a few years ago.

Closer to home, ASEAN countries have built a Local Currency Settlement (LCS) network that lets members use their domestic currencies for cross-border trade instead of converting everything into US dollars. The system, now adopted by Indonesia, Thailand, Malaysia, the Philippines and Singapore, covers a modest share of total trade but is growing steadily, especially in regional goods and services.

Each of these experiments has taken a different shape, from Beijing’s centralised push to ASEAN’s regional coordination to India’s bilateral trust-building. Here’s how the three models compare:

| Initiative | Scope | Who is driving it ? | How it works? | Why it matters? |

|---|---|---|---|---|

| China’s CIPS | 100+ countries | State-led | Centralised system for cross-border yuan payments | Expands China’s financial influence; links to Belt & Road partners. |

| ASEAN LCS | 5 core members | Bloc-coordinated | Uses existing banking networks for intra-ASEAN trade in local currencies | Reduces transaction costs and dollar exposure within the region. |

| India’s rupee settlement | 22+ partners | Bilateral & organic | Vostro-account framework allowing direct rupee trade | Builds trust-based financial links without political overtones. |

Source: Amro, Bank of China, CIPS.

Three very different routes to the same goal: less dependence on the dollar, more control over regional trade finance.

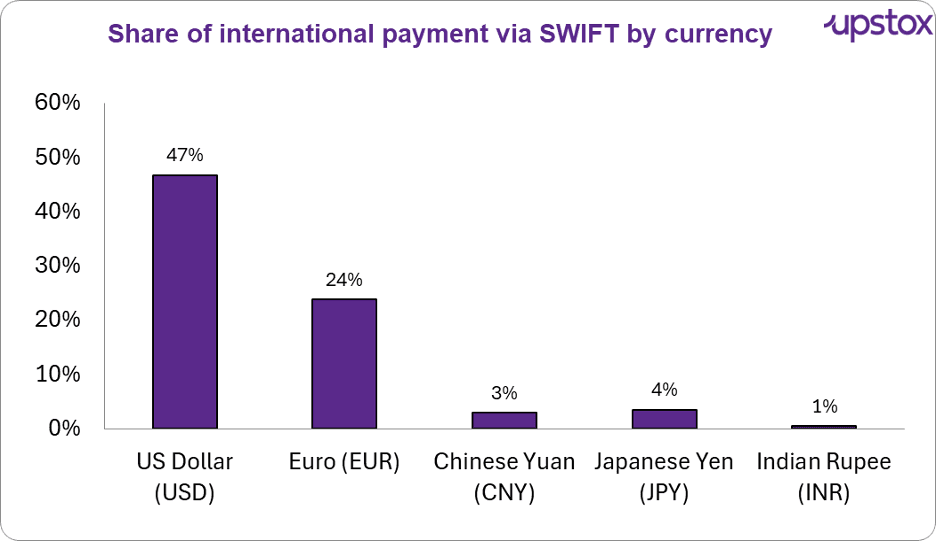

Even with these efforts, the dollar still dominates global trade flows, a reminder of just how concentrated the financial system remains.

Source: Macromicro.me

The dollar remains the world’s default trade language, but regional currencies are slowly finding their accents.

By comparison, India’s progress looks modest, but it’s also more organic. Unlike China’s state-led play or ASEAN’s institutional design, the rupee’s spread has come through bilateral trust. India doesn’t demand adoption; it invites it. And in a world where financial systems are increasingly weaponised, that softer approach gives it credibility.

The difference isn’t just in method, it’s in mindset. Where China’s model projects control and ASEAN’s builds coordination, India’s relies on credibility, it is trust, not muscle, that’s doing the work.

Strategic Implications

At first glance, the rupee’s global push looks like a banking story, some new accounts, a few bilateral deals, and a bunch of paperwork. But under the surface, it’s doing something far more strategic. It’s giving India a bit of breathing space in a world where the dollar decides almost everything.

Shielding against dollar risk

The dollar still runs the global show. Around 47% of world trade is settled in it. So when the US sneezes, whether it’s sanctions, rate hikes or a banking wobble, everyone else catches a cold. By creating its own payment routes, India is building a small safety valve. When Western sanctions on Russia blocked dollar payments in 2022, the rupee trade mechanism quietly kept some oil and defence deals moving. It wasn’t a rebellion, just a workaround that kept things steady when global finance turned messy.

Supporting energy security

Here’s where it gets practical. Energy imports make up nearly a quarter of India’s total imports, and crude oil alone cost over $180 billion in FY24. Every dollar saved on those transactions helps protect foreign exchange reserves, which have held near $650 billion through FY25.

Paying for even part of that oil in rupees, especially with countries like Russia or the UAE, means fewer dollars leaving the system. It’s not a game-changer yet, but it does take pressure off the rupee when oil prices spike. In a world that moves on headlines, that kind of quiet stability matters.

Building financial diplomacy

And then there’s the influence angle, the softer kind that doesn’t make headlines but lasts longer. When another country holds rupees in Indian banks, that money doesn’t just sit idle. It can be used to invest in Indian bonds, buy goods or fund projects. Each new trade relationship builds a small financial bridge back to India.

For smaller economies, it’s a way to plug into a stable system without dealing with the volatility of the dollar. For India, it’s a smart way to turn trade into trust, finance as foreign policy, one Vostro account at a time.

Put simply, this isn’t just about payments. It’s about options, about India slowly giving itself room to manoeuvre in a world where the dollar still calls most of the shots.

Expert voices and policy signals

For the Reserve Bank of India, the push to internationalise the rupee isn’t a headline project. It’s the outcome of a policy direction that began quietly in 2022. During his tenure, then–RBI Governor Shaktikanta Das often described rupee settlement as a “natural progression” of India’s growing economic strength and external confidence.

The RBI’s 2023–24 annual report echoed that sentiment, noting that wider rupee use in trade would “reduce exchange risk and strengthen India’s position in global value chains.” The Ministry of Commerce has also signalled intent. Officials have confirmed that discussions are under way with several countries in Africa and the Gulf to expand the rupee settlement framework.

The focus is not just on trade flows but on creating a parallel investment channel, where surplus rupee balances can be used for projects or Indian debt instruments. That, policy analysts say, could turn India’s trade relationships into longer financial partnerships.

Where the rupee could go next

The next phase of India’s rupee trade experiment is likely to move beyond its neighbourhood. Policymakers are already exploring settlements with Africa, the Gulf and BRICS partners, where India’s trade footprint is expanding and dollar liquidity can be patchy. The digital rupee, still in pilot mode, could eventually plug into this system, allowing cross-border payments that are faster and cheaper for smaller banks and exporters.

What began as a workaround in 2022 is now shaping into a quiet alternative. The goal isn’t to challenge the dollar but to build resilience, giving India and its partners more options when global finance turns unpredictable. If the rupee can stand for dependability in a volatile world, that may be its real power. Not dominance, but durability.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story