Upstox Originals

When markets panic, does gold shine?

.png)

7 min read | Updated on May 26, 2025, 13:32 IST

SUMMARY

Gold as a hedge for market volatility is a tale as old as time. In a volatile market, gold often plays the hero, but does it always deliver? This article dives into how gold has fared during some of the biggest crashes. We break down when gold shines, when it stumbles, and what are some key factors that drive its performance.

Is gold always a good investment during times of market volatility?

“May you always live in interesting times” - Old English proverb!

Sometimes considered a blessing, sometimes a curse, this proverb has never been more relevant than now and is extremely applicable to the current investment climate. Just when we have overcome a conflict with the neighbouring country, America’s president has once again reignited tariff talks over the weekend.

This time around, President Trump has suggested straight 50% tariffs on the EU and also a 25% tariff on the phones Apple imports into the USA. While the former has been paused till July, and the latter has not been enforced, it has once again riled up markets. 2025 has been a chaotic year - market correction, trade war, skirmishes - and the year is not even halfway through.

When markets turn chaotic, investors naturally go looking for safety. And for centuries, gold has been seen as a steady anchor in the raging storm of uncertainties. But does it really live up to that reputation in today’s markets?

To answer that, let’s walk through three major market crashes of the past two decades—two where gold did well (the Global Financial Crisis (GFC) and COVID-19), and one where it stumbled (the Taper Tantrum).

Here’s how gold stacked up against the Nifty over different time frames during each crisis (average rolling returns):

| Crises | Gold versus Nifty - 1st year | Gold versus Nifty - 1st year | Gold versus Nifty returns (3 years) | Gold versus Nifty returns (3 years) |

|---|---|---|---|---|

| Gold | Nifty | Gold | Nifty | |

| GFC | 31% | 0% | 25% | 14% |

| Taper tantrum | -3% | 10% | -3% | 14% |

| COVID-19 | 35% | -2% | 15% | 15% |

Source: Investing.com, Internal research. Note: To derive the above figures, we calculated the average rolling returns from the Nifty 50's market peak at the onset of each crisis year. Numbers are rounded up

Here are some key observations

-

In the short term, gold is a safer bet than equity markets, sometimes outperforming the markets by a wide margin

-

Over the midterm (3 years), gold provides a good alternative to the markets, providing good returns and reducing overall risk in the portfolio.

-

However, gold is not infallible. The taper tantrum is proof of that. Times when the interest rate rises or the USD becomes more robust, gold can falter as well. Investors should simply ask themselves, what is the cost of holding gold? Meaning, in a rising interest rate environment, holding gold tends to come with a higher opportunity cost, which hampers its performance.

Before we analyse each of these crises in more detail, a quick note on why we used rolling returns. This approach smoothens volatility and offers deeper insights into performance patterns.

2008–09: The global financial crisis

Why gold soared during the 2008 crisis?

-

Easy money boost: The US Fed slashed interest rates from 5.25% to nearly 0.0% and kicked off a massive quantitative easing. Other central banks followed suit, flooding the global economy with liquidity. That extra cash had to go somewhere, and gold was one of the clear favourites.

-

Low real rates: With inflation still hanging around and nominal rates close to zero, real interest rates turned negative. That made gold more appealing than cash or bonds.

-

Flight to safety: When panic hit, investors rushed towards safer bets. Gold bars, coins, and ETFs saw record demand globally. In India alone, gold investment demand shot up by 47% in 2008.

-

Systemic risk hedge: As big banks started to fall, fears of a full-blown financial meltdown grew. Gold, which doesn’t carry default risk, became the go-to safe haven for many.

-

Rupee depreciation: To top it off, a weaker rupee made imported gold even pricier, boosting returns for Indian investors.

Fast forward a decade: 2020’s COVID crash

The 2008 crash was a financial meltdown. But 2020? That brought something completely different: a global health crisis. As lockdowns froze supply chains and brought daily life to a standstill, Indian markets nosedived nearly 40% in March. Once again, gold stepped up. Prices jumped almost 40%, hitting ₹55,000 by August 2020, as fear swept through investors.

But unlike in 2008, the bounce-back this time was lightning-fast. Governments rolled out massive stimulus packages, central banks slashed rates, and money poured into the markets. Additionally, retail investors piled in — especially through digital platforms and low-cost brokers. India saw record Demat account openings, and equity inflows surged. By the end of the year, the NIFTY had clawed its way back.

2013: Taper Tantrum, when gold stumbled

After the 2008 crisis, 2013 brought a new kind of stress, the “Taper Tantrum.” When the US Fed signalled plans to wind down its QE program, global investors pulled capital from emerging markets. The rupee plunged, inflation flared, and macro fears spiked.

Gold should’ve rallied—but it didn’t. Instead, gold prices in India fell from ~₹31,000 in late 2012 to ~₹26,000 by mid-2014. Why?

-

Rising US bond yields: As the Fed talked about tightening, US 10-year yields jumped from ~1.6% (mid-2012) to over 3% (end-2013). Higher yields raised the opportunity cost of holding gold, dampening demand.

-

India’s import curbs hit domestic demand: To stem the CAD and rupee fall, the government hiked import duties (from 4% to 10%) and introduced the 80:20 rule (requiring 20% of gold imports to be re-exported). This choked official gold imports and reduced availability.

-

Shift in investor preference: With no systemic financial crisis and rising US yields, investors rotated to equities, not gold.

Equities held up — and then took off

-

2013: Despite macro headwinds, the Nifty 50 gained 6.7%, buoyed by ~$20 billion in FII inflows—the second-highest in Asia after Japan. The rupee stabilized after RBI stepped in, and defensive sectors like IT cushioned the downside.

-

2014: Equities surged over 30% as inflation cooled, crude prices dropped, and investor sentiment jumped after the national election. FII inflows topped ₹97,000 crore (~$16B), with financials, autos, and capital goods leading the charge.

Not all crises are equal. Gold performs best during systemic risk events. When the fear is about tightening liquidity or rising interest rates, gold may actually struggle.

Putting it all together, what should Indian investors learn?

For Indian investors, gold isn’t about growth—it’s about protection. It acts as portfolio insurance, stepping in during crises like 2008 and 2020. Once recovery begins, equities tend to outpace gold in returns.

Gold’s returns often amplify in INR terms due to rupee depreciation, a key factor during past crises. However, gold thrives only in specific crises, such as when trust in money, banks, or markets collapses, not when fears around policy tightening or risk appetite return.

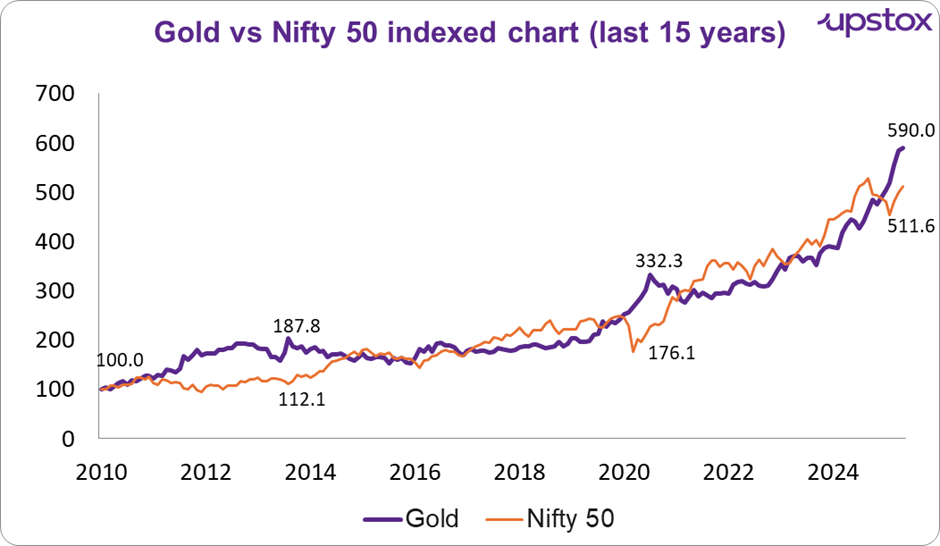

Source: Investing.com; *Data up to May 26, 2025

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story