Upstox Originals

What’s catching investor eyes in 2026?

9 min read | Updated on January 21, 2026, 15:14 IST

SUMMARY

What do rare-earth-free motors, water, and copper have in common? Well, on the face of it, nothing at all. But from an investor’s lens, these are intriguing themes investors can take a deeper look at in 2026. Let’s dive in.

Exploring rare earth free motors, water, and copper as investment themes in 2026

Investment themes are always evolving and investors are consistently seeking fresh opportunities. In this article, we highlight several emerging and ongoing themes that investors could consider exploring. This is intended to serve as a starting point for identifying potential investment ideas for further research and evaluation.

Theme 1: Rare-earth free motors

One of the most challenging times of 2025 was when China, which controls over 90% of the critical rare-earth metals, decided to ‘control’ its supply.

Major domestic industries including automotives were all put at significant risk. At one point, there was a risk, their production would come to a grinding halt. This risk did not fructify in its totality. But, the limited availability of these metals and one country’s significant control remain a major challenge.

These electric motors generate rotational force without rare-earth magnets. Besides some industrial applications, they have significant applications in mass-market EVs. And this technology now already has some proven applications.

- Ola Electric has developed these magnets for its 2Ws.

- Tesla has used rare-earth-free motors in several of its models for ruggedness and cost-effective advantage.

How does this compare against the existing technology?

| Characteristics | Rare-earth motors | Ferrite-magnet Motors* |

|---|---|---|

| Size and weight | Compact and lightweight | Bulkier and heavier |

| Cost | High | Low (30-60% cheaper) |

| Supply-chain risk | High | Low |

| Torque | Very high | Moderate |

| Efficiency | High | Moderate |

Source: JMK Research; * A type of rare earth free motor used in the auto industry

Clearly, the ability to source the raw materials for these magnets is the biggest green flag for this technology. On the other hand, the technology is still nascent and mass-scale use cases are yet to become a reality.

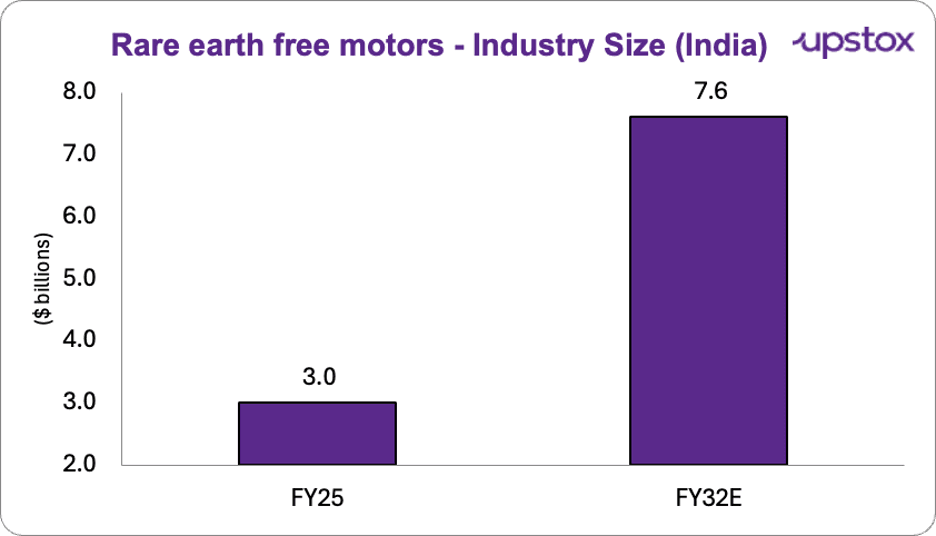

Where does India stand?

The Indian market is still relatively small, but is expected to grow at a rate of about 13% over the next few years.

Source: Mordor Intelligence

Management commentary around this technology is also encouraging.

So, what are some potential areas one can look at to explore this theme?

| Theme | Explanation |

|---|---|

| EV Powertrain Ancillaries | Focus on manufacturers of motors and engines for vehicles |

| Energy-Efficient Consumer Durables | Opportunity in premium consumer care products (5-star rated inverter air conditioners) |

| Robotics | Providers of precision motion-control systems and factory automation hardware. |

| Urban Mining | High-margin niche for companies recovering rare-earth materials from end-of-life electronics |

| Company | Market cap (₹ crore) | ROE | 5Y EPS CAGR | FY25 FCF |

|---|---|---|---|---|

| Sona BLW | 27,545 | 14.4% | 31% | Positive |

| ABB India | 99,067 | 28.8% | 40% | Positive |

| TVS Motor Company | 1,70,649 | 28.4% | 27% | Positive |

| Ola Electric | 14,640 | NA | NA | NA |

| Ather Energy | 23,310 | NA | NA | NA |

Source: Screener; * As on Jan 20, 2026

Theme 2: Water

Did you know?

-

Since 2010-11 India has been a ‘water-stressed’ country.

-

Despite accounting for only 2% of the Earth’s landmass and 4% of its freshwater resources, India supports 18% of the global human population and 15% of the world’s livestock.

-

Multiple reports suggest that India could face serious water scarcity by 2030. As much as 40% (extreme worst case) of the population could have drinking water challenges.

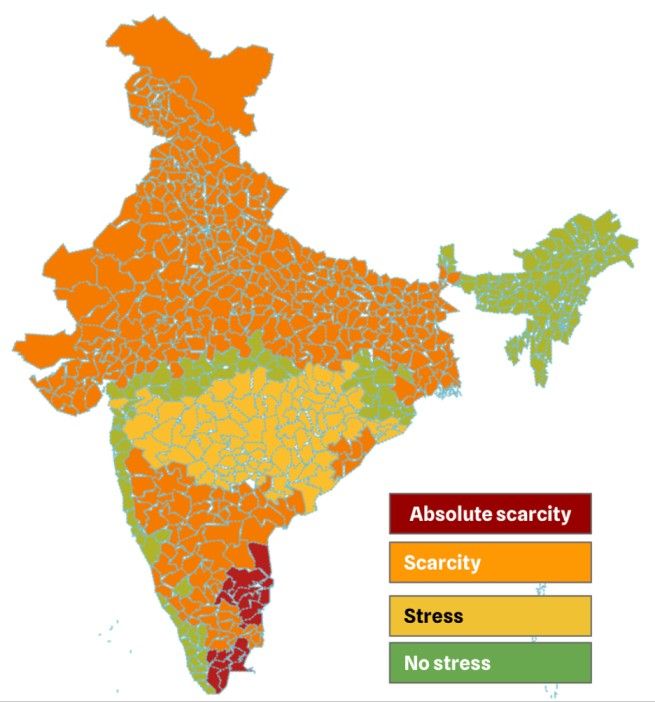

The chart below shows the state-wise water scarcity in 2025. The image presents a striking reality where only a very small portion of this country is actually in the “green zone”. If studies are to be believed, this is only going to get tougher to navigate.

Source: Government data

The question that arises is, why now? Water is not exactly a new theme? Here are some reasons why the water sector could be in focus in the years ahead.

-

Wastewater treatment is projected to grow at a 11.6% CAGR to reach $17.9 billion by 2027. The shift is driven by the transition to "Smart Water" technologies like IoT metering.

-

The government has ramped up funding in the 2025 Union Budget. The Jal Jeevan Mission (JJM) has been extended to 2028 with an enhanced allocation of ₹67,000 cr vs ₹22,000 cr in the previous year.

-

Urban Infrastructure 2.0 (AMRUT 2.0): The AMRUT 2.0 mission has approved over 3,500 water supply projects worth ₹1.18 lakh crore as of early 2026.

So, what are some potential areas one can look at to explore this theme?

| Theme | Explanation |

|---|---|

| Industrial Zero Liquid Discharge (ZLD) | With tightening environmental norms, industries (textiles, pharma, and chemicals) must recycle their water |

| Desalination & Large Infrastructure | As groundwater reserves deplete, seawater desalination is the only scalable solution |

| "Used Water" & Municipal Recycling | Instead of just "treating" sewage, water is being reused. Think STP in buildings |

| Smart Water Management (IoT) | Providers of IoT-based "Smart Meters," leak detection sensors, and cloud-based analytics for city-wide water grids. |

| Supply Chain: Pipes & Logistics | The "backbone" play; they manufacture the large-diameter pipes needed for water grids. |

What are some key risks? The sector is heavily regulated, and changes in environmental policies, tariffs, or government oversight can significantly impact profitability. It is also a high capital‑expenditure industry, which can strain margins and limit growth.

A select few companies that operate in and around this segment are mentioned below.

| Company | Market Cap (₹ crore) | ROE | 5Y EPS CAGR | FY25 FCF |

|---|---|---|---|---|

| Rossari Biotech | 2,850 | 12.2% | 16% | Negative |

| Prince Pipes | 2,644 | 2.7% | -18% | Negative |

| EMS Ltd | 1,882 | 20.7% | 20% | Positive |

| VA Tech Wabag | 6,842 | 14.6% | 26% | Positive |

| Triveni Engineering | ,134 | 8.1% | -6% | Negative |

Source: Screener; * As on Jan 20, 2026

Theme 3: Copper

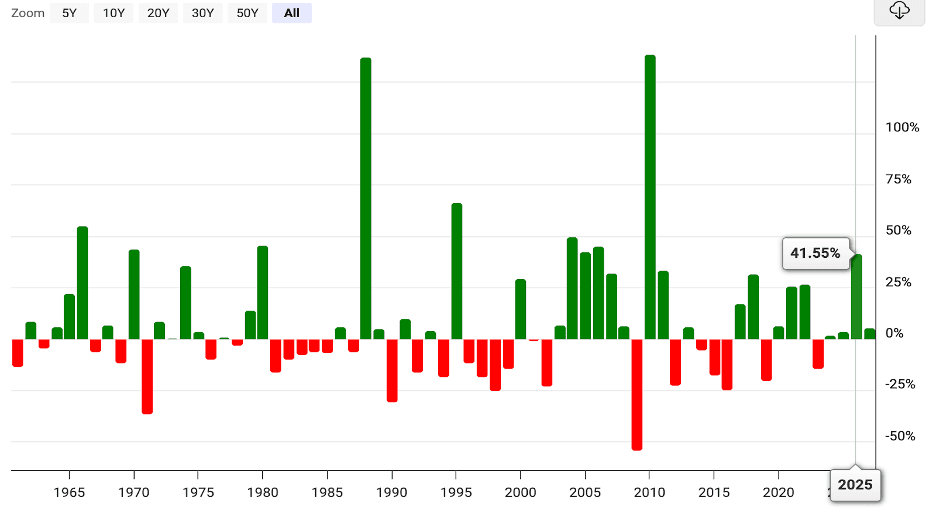

2025 was a year for precious metals. Gold prices rose over 60%, while silver was up over 130% in the calendar year. While the outlook for both the metal looks positive currently, investors could take a look at copper.

YoY copper price movement in USD

Source: Macrotrends; * As on Jan 20, 2026

After an almost 40% price rise in 2025, copper has started the year on a positive note. Here a few significant drivers of copper prices:

- Electric Vehicles: EVs require ~4x more copper than ICE vehicles. As global EV penetration increases, copper demand is expected to benefit, boosting prices

- Renewable Energy: Sources of renewable energy, like solar and wind, require ~3.5x times more copper than traditional forms of power generation.

- AI effect: Data centers require up to 10x the electrical load, translating into higher copper demand

To further boost prices, copper is also seeing a structural deficit. Copper supply has not been able to keep pace with the sharp spike in copper demand. To add to it, the Grasberg mine (one of the world's largest) in Indonesia was flooded last year, which continues to weigh on overall copper supply. As per JPMorgan, the market imbalance is expected to persist, with a global refined copper deficit of ~330 kmt (thousand metric tons) in 2026.

Below are a select few companies that operate in and around this segment

| Company | Market Cap (₹ crore) | ROE | 5Y EPS CAGR | FY25 FCF |

|---|---|---|---|---|

| Hindustan Copper | 53,056 | 18.7% | 23% | Positive |

| Vedanta | 2,62,035 | 38.5% | 2% | Positive |

| Hindalco Industries | 2,10,352 | 14.0% | 33% | Positive |

Source: Screener; * As on Jan 20, 2026

What are the key risks? Investors should be aware that copper is a highly cyclical commodity. Copper consumption is largely driven by international factors, and price movements are not always within India’s control. As a result, investments remain exposed to fluctuations in global supply‑demand dynamics, geopolitical events and commodity market volatility.

In summary

2026 promises to be an interesting year, with major global volatility impacting financial markets. As such, being selective with investments could be crucial for investors. While the aforementoend themes are present compelling avenues for investors to explore, they should viewed as starting points rather than definitive investment advice.

Investors are encouraged to conduct their own research, assess risks carefully, and evaluate how these ideas align with their individual goals and risk tolerance before making any decisions.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story