Upstox Originals

Vi’s government lifeline: What does it mean for investors?

.png)

8 min read | Updated on April 02, 2025, 12:26 IST

SUMMARY

Vi has received a fresh lifeline from the government with ₹36,950 crore of spectrum dues converted into equity. While this relieves short-term liquidity pressures and signals policy support, it also brings long-term concerns: steep equity dilution, unresolved AGR dues, shrinking subscriber base, and lagging capex. This article breaks down the implications for Vi’s survival, competitiveness, and shareholder value.

Stock list

The government has converted ₹36,950 crore of Vi’s spectrum dues into equity.

The Indian government has given Vodafone Idea (Vi) another lease of life. By converting ₹36,950 crore (~₹369 billion) worth of spectrum dues into equity, the government has boosted its stake in Vi to nearly 49%. While this move eases immediate cash flow pressures, it brings fresh concerns around ownership dilution and the company’s long-term future.

What just happened?

Vi has struggled with large spectrum and AGR (Adjusted Gross Revenue) dues for years. Under a relief measure first announced in 2021, the government has now agreed to take a bigger chunk of Vi’s spectrum dues as equity. In return:

- The Government of India’s stake rises from ~23% to nearly 49%

- Promoters’ stake drops to just 25.5%; though the promoters will continue to have operational control.

- Public shareholders now hold around 23.8%, down from ~36%

| Shareholding (%) | Current | Post conversion |

|---|---|---|

| Vodafone Plc | 24.4 | 16.1 |

| Aditya Birla Group | 14.3 | 9.4 |

| Government of India | 22.6 | 49.0 |

| Vendors | 2.6 | 1.7 |

| Public | 36.2 | 23.8 |

Source: Company filings, BSE, NSE

This gives Vi some breathing room by easing pressure on cash outflows. But there’s more to the story.

Why is the government taking a stake in private telecom players?

The Government of India is converting the outstanding spectrum auction dues into equity shares as part of the September 2021 Reforms and Support Package for the Telecom Sector. This move aims to ease the financial burden on telecom companies by reducing their liabilities and helping them focus on growth and infrastructure development.

It also helps the government maintain healthy competition in sectors of strategic importance by financially supporting the telecom players who are facing financial issues.

How does it will benefit Vodafone Idea?

- Reduces spectrum repayment pressure in the near term i.e. for FY26 & FY27

- Allows Vi to redirect cash towards operations like 5G expansion

- Provides comfort to vendors like Indus Towers, who have long-awaited payments.

| Gol dues repayment (₹ crore) | FY26-28* |

|---|---|

| Deferred spectrum dues | 67,000 |

| Spectrum payments converted to equity | 36,950 |

| Spectrum due remaining | 30,100 |

Source: Company, TRAI; *rounded numbers

What it doesn’t solve?

AGR dues still looming: Vi still has to repay ~₹16,500 crore annually starting March 2026, which hasn’t been waived or converted as part of the reform package announced in 2021.

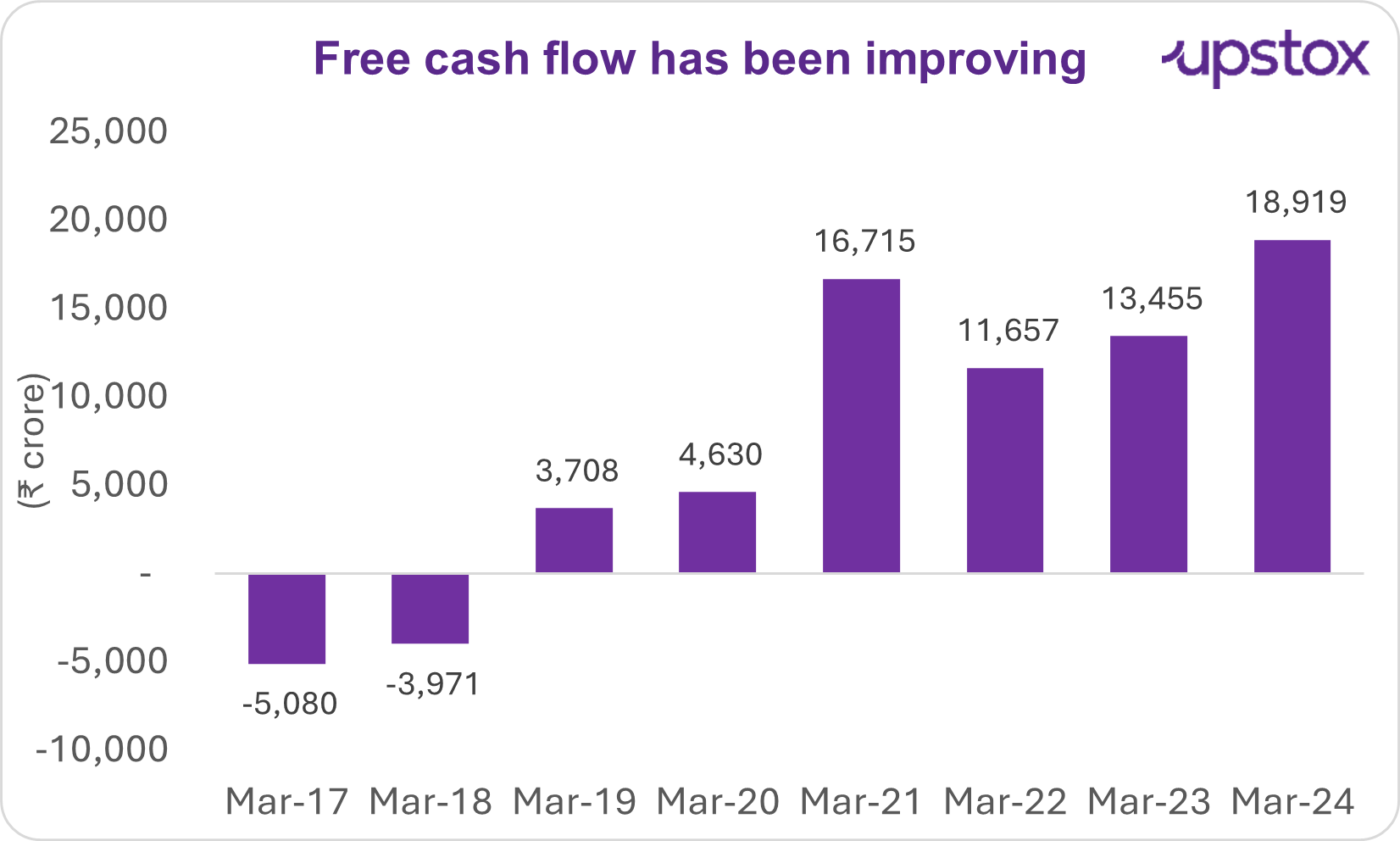

While free cash flows has improved, the challenge of repaying significant government dues and other debts remains, primarily due to the business slowdown and ongoing 5G expansion.

Source: Screener

The subscriber base is shrinking

Despite industry-wide tariff hikes, Vi continues to lose users. Competing networks offer better service and coverage, making it hard for Vi to retain or attract new customers.

| Financials & operating KPIs | Q2 FY24 | Q3 FY24 | Q4 FY24 | Q1 FY25 | Q2 FY25 | Q3 FY25 |

|---|---|---|---|---|---|---|

| ARPU (Average revenue per user) (₹) | 149 | 153 | 153 | 154 | 166 | 173 |

| Subscriber (Mn) | 219.8 | 215.2 | 212.6 | 210.1 | 205.0 | 199.8 |

| Net adds (Mn) | -1.6 | -4.5 | -2.6 | -2.5 | -5.0 | -5.2 |

| Market Share (%) | 18.2% | 17.8% | 17.3% | 17.0% | 16.4% | 15.0% |

Source: Company filings, BSE, NSE

Capex still lagging

With limited investments in infrastructure, Vi risks falling further behind Airtel and Jio, especially in the 5G rollout with the lowest subscriber and lowest 5G infrastructure (spectrums).

| Spectrum (MHz) | VIL | Airtel | Jio |

|---|---|---|---|

| 4G spectrums | 1,812.8 | 2,338.4 | 1,920.8 |

| 5G spectrums | 850.0 | 2,200.0 | 2,880.0 |

| 4G/5G Subscribers (Mn) | 125.9 | 263.6 | 478.8 |

Source: Company filings, BSE, NSE

The bigger risk: equity dilution

Vodafone Idea has been consistently diluting equity shares either to clear debt, pay regulatory obligations, or even for expansion:

| Event | # shares (in Cr) | Amount (₹ in Cr) |

|---|---|---|

| Spectrum dues converted into equity in 2023 | 1,613.3 | 16,133.2 |

| Allotment of equity shares to ATC (Vendor dues cleared through equity conversion) in 2023-24 | 160.0 | 1,600.0 |

| Further, fundraise through FPO in 2024 | 1,636.4 | 18,000.0 |

| Spectrum dues converted into equity in 2025 (Current) | 3,695.0 | 36,950.0 |

Source: FPO Placement document, BSE, NSE. Note:

This is the non-exhaustive list of equity conversions and dilutions, as only large conversions/dilutions have been considered. Ignored smaller conversions like ESOP etc.

What does equity dilution mean?

Vodafone's recent move has significantly diluted the value of existing shares. The public stake in the company drops from 36.2% to 23.8% after dilution, meaning the value of public holdings has decreased. Similarly, the promoter's stake has reduced from 75% in December 2022 to 39% in December 2025.

Now there is another important issue, i.e. dilution in EPS - even though losses reduced by 10%, they have reduced in terms of EPS by 168%. Basically as the number of shares outstanding has increased, the profit is now spread among a much wider shareholder base, impacting profitability per shareholder

| Dec 2021 | Dec 2024 | % change | |

|---|---|---|---|

| Net Profit (in ₹ Cr) | -7,189 | -6,493 | -10.7% |

| Number of shares (in Cr) | 2,873 | 7,139 | 148% |

| EPS in ₹ | -2.5 | -0.93 | -168.8% |

Source: Screener. In

And it might not stop here.

If AGR dues or future spectrum payments are also converted into equity, the government could cross the 50% ownership mark, effectively turning Vi into a public sector company. That would bring:

- More uncertainty in decision-making

- Change in public perception

- Questions on strategic direction

Lessons from Yes Bank on equity dilution

Yes Bank saw something similar, where increasing equity base (higher number of shares outstanding), has left lower profits per shareholder.

Between 2019 and 2020, Yes Bank faced significant governance and capital challenges. To address these issues and continue operations, the bank issued fresh shares to raise capital from institutions like SBI, HDFC Bank, ICICI Bank, and others.

The issuance of fresh shares led to equity dilution, which means the ownership stake of existing shareholders was reduced. Additionally, these new shares were issued at a discount to the market price.

As a result, existing shareholders had to sell their shares at lower prices, which contributed to the decline in the stock price. This dilution and discounted share issuance ultimately caused Yes Bank’s shares to collapse by over 90% between 2019 and 2020.

Since then, Yes Bank has changed its management, cleaned up its balance sheet, and worked on growing the business. While the share price has recovered to some extent, it has not returned to its previous highs.

Yes Bank’s market cap grew due to the increase in the number of outstanding shares rather than an increase in its share price. So even though Yes Bank is near its previous market capitalisation peak, its share price is almost down by 90%, therefore equity dilution leading to wealth erosion for shareholders

| Financial Year | Market Cap ($ bn) | Adjusted share price | # Shares (in Cr) | PAT (in ₹ cr) | EPS (₹) |

|---|---|---|---|---|---|

| 2025 | 7 | 17 | 3,135 | 2,169* | 0.7 |

| 2024 | 10 | 30 | 2,875 | 1,285 | 0.4 |

| 2023 | 7 | 21 | 2,875 | 736 | 0.3 |

| 2022 | 7 | 21 | 2,505 | 1,064 | 0.4 |

| 2021 | 5 | 14 | 2,505 | -3,489 | -1.4 |

| 2020 | 6 | 18 | 1,255 | -16,433 | -13.1 |

| 2019 | 2 | 47 | 232 | 1,709 | 7.4 |

| 2018 | 6 | 182 | 230 | 4,233 | 18.4 |

Source: Screener. In. For FY25, PAT is based on the trailing twelve months.

What does it mean for investors?

For now, this conversion may appear like a positive development. But it doesn’t change the fundamentals. The company still needs:

- A clear funding roadmap

- Subscriber base recovery

- Relief or restructuring of AGR dues

- Operational improvements

In summary

The government’s move to convert spectrum dues into equity provides Vodafone Idea with near-term financial relief and stability. However, several structural challenges remain. The company still faces high AGR liabilities, declining subscriber numbers, and limited investments in network expansion.

While the support offers a window for operational improvement and strategic realignment, the path ahead will depend on Vi’s ability to raise fresh capital, enhance competitiveness, and rebuild investor confidence over time.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story