Upstox Originals

Union Budget 2025: Key sectors to watch and stocks that could benefit

5 min read | Updated on January 31, 2025, 14:56 IST

SUMMARY

Ahead of the Union Budget 2025, the government will focus on three crucial strategic areas: bolstering agriculture to support rural growth, driving infrastructure development, and focusing on EVs. In this article, we list some stocks that have technical support and should be monitored by investors.

The Union Budget 2025 is poised to drive significant momentum across agriculture, automobile, and infrastructure sectors.

In the run-up to the Union Budget 2025, investors are closely monitoring fiscal measures that could impact economic growth and sectoral performance. With growth-oriented policies expected, investors remain optimistic yet watchful for policy clarity and fiscal discipline.

Sectors like agriculture, automobiles (especially EVs) and infrastructure remain in focus, with expectations of strategic policy measures to drive economic growth, job creation, and sustainability. We present insightful technical charts highlighting stocks that investors should watch closely.

Given the government's focus on economic growth, employment generation and sustainability, stakeholders from these industries have high expectations of the budget.

Agriculture: Strengthening the rural economy

The government plans to increase the agriculture sector's budget by approximately 15%, marking the most significant rise in over six years. This boost aims to support rural incomes and control inflation, with a focus on high-yield seed varieties, improved storage and supply infrastructure, and enhanced production of pulses, oilseeds, vegetables, and dairy.

Additionally, there is an emphasis on generating a surplus for increasing farm exports to $80 billion by 2030.

Here are two prominent charts that warrant our attention:

UPL Limited

A leading global agrochemical company, UPL specialises in crop protection and solutions, making it a significant player in India's agricultural advancements.

UPL has rebounded off its recent lows and trades above key moving averages. The stock also shows strong improvement in its Relative Strength. A move above ₹573 needs to be closely watched.

PI Industries Limited (PIIND)

Known for its strong presence in agrochemicals and custom synthesis, PI Industries is well-positioned to benefit from increased agricultural investments.

PIIND has suffered a strong corrective downside after having peaked at ₹4,804 in September last year. Currently, following a sizable retracement, the stock has strongly attempted to put a potential base in place. RSI has shown a bullish divergence against the price, and any move above ₹3,600 may lead to a potential trend reversal.

Infrastructure: Paving the way for growth

Infrastructure development remains a cornerstone of India's economic strategy. The government has announced plans to maintain capital investment at a record ₹11.1 trillion to sustain economic growth. This includes significant allocations for developing infrastructure and technology in various states, aiming to boost rural development and job creation.

From the large-cap universe, here are some stocks to monitor.

Larsen & Toubro Limited (L&T)

As India's largest infrastructure company, L&T is set to benefit from increased government spending on projects, having reported a 5% rise in profit due to faster project execution.

Following a strong rally in 2023, L&T has been consolidating for the past twelve months. The stock has hardly moved; for the entire year, it has traded sideways in a defined trading range between ₹3,250 and ₹3,750.

While the stock exhibits inherent strength and resilience, investors can consider monitoring the stock for opportunities during market pullbacks as long as it stays above ₹3,200. Such stocks lend a component of resilience to the portfolio.

Automobile: Accelerating the EV revolution

The automobile sector, especially the electric vehicle (EV) segment, anticipates a policy push aimed at making India a global EV hub. Industry leaders seek measures that will make EV adoption more accessible and financially viable.

From the large-cap basket, these key stocks would be likely beneficiaries in the long run.

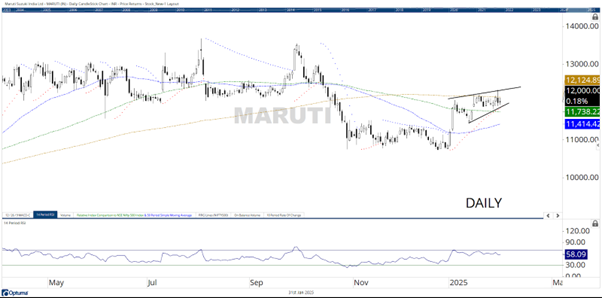

Maruti Suzuki India Limited

As India's largest car manufacturer, Maruti Suzuki is expected to benefit from policies promoting vehicle ownership and potential incentives for fuel-efficient models. It is also expected to have multiple new model launches in the coming quarters.

MARUTI has rebounded off its lows following a base formation in the last quarter of 2024. Presently, it is seen consolidating just below the key 200-DMA positioned at ₹12,125. Any move above this level needs to be closely monitored for potential price appreciation.

Tata Motors Limited

With a diverse portfolio spanning passenger and commercial vehicles, Tata Motors is poised to gain from infrastructure development and increased mobility demands.

TATAMOTORS has underperformed relatively over the past months. However, the most recent phase of the down move has come with the RSI showing a bullish divergence against the price. The stock recently suffered a jitter following a downgrade, but it is seen in the final phase of a bottoming-out process. The stock is expected to improve its relative performance meaningfully over the coming months.

In summary

The Union Budget 2025 is poised to drive significant momentum across agriculture, automobile, and infrastructure sectors, shaping investment strategies in the stock market. With policy support and fiscal incentives, key sector beneficiaries stand to gain from government initiatives.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story