Upstox Originals

Tracking the index, beating the experts: The passive fund rise

7 min read | Updated on November 04, 2025, 20:53 IST

SUMMARY

While everyone talks about active funds, passive market is quietly pulling ₹12.2 lakh crore into low-cost, set-and-forget investments. Most inflows? Gold & silver ETFs, not equities - are investors playing it safe or missing the real game? The appeal is clear: simplicity, low costs, and steady growth. But when markets wobble, will “set-and-forget” really stay calm?

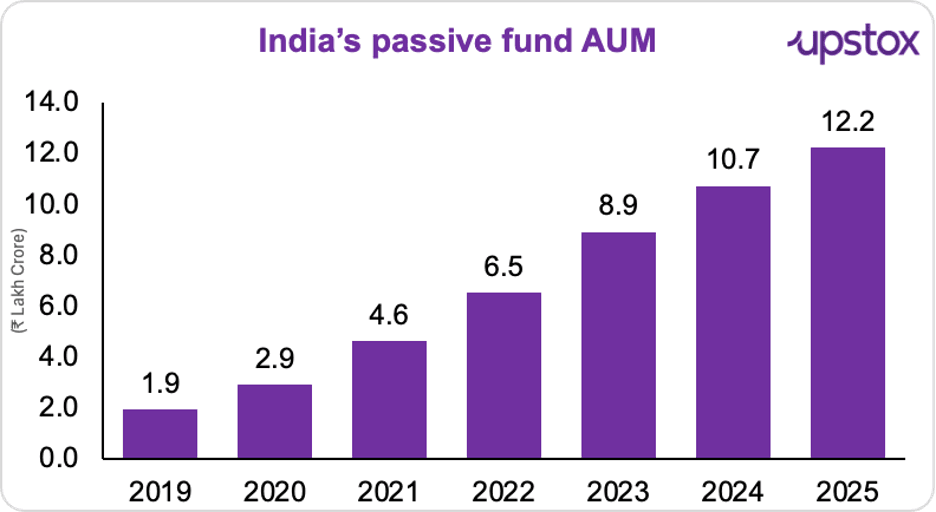

Passive funds manage ₹12.2 lakh crore now versus ₹1.91 lakh crore in 2019

What if we told you that, without any well-known fund managers or eye-catching stock selections, a small segment of the Indian mutual fund market has grown 6.4x in just six years?

Greetings from the passive investment world.

Passive funds, which don't strive to beat an index like the Nifty or Sensex but instead just track it, handled around ₹1.91 lakh crore in 2019. By 2025, the sum had increased to ₹12.2 lakh crore, with a compound annual growth rate of 36%. Passive funds now account for around 17% of India's ₹74 lakh crore mutual fund industry, which is six times larger than it was just six years ago.

In the lead? SBI Mutual Fund, Nippon India Mutual Fund, and UTI Mutual Fund, with ₹3.73 lakh crore, ₹1.95 lakh crore and ₹1.60 lakh crore in passive AUM, respectively.

Source: BS

In other words, India’s investors are embracing “boring” index funds faster than ever before.

And it’s not just India. Globally, passive investing is booming.

Take the USA for example, passive investing is growing. In Q1 2025, passively managed assets grew to over $16 trillion, while actively managed assets stood at just over $14.1 trillion (Morningstar). Over the trailing 12 months ending June 30, 2025, passive mutual funds and ETFs saw net inflows of $899 billion, compared with outflows of $230 billion from active funds. The largest disparity was in US equities, where active funds lost $325 billion while passive funds gained $457 billion.

What are passive funds, and how are they different from active funds?

Active funds are led by star managers who select stocks, change strategies, and attempt to outperform the benchmark; ambitious leaders seeking for glory. Passive funds just reflect the index; if the Nifty 50 gains 1%, so do they, with no stock-picking drama. In summary, active fund managers decide whether stocks or bonds enter or exit the portfolio, whereas passive fund managers have no control over asset movements.

What’s driving the boom?

Active funds lag benchmarks

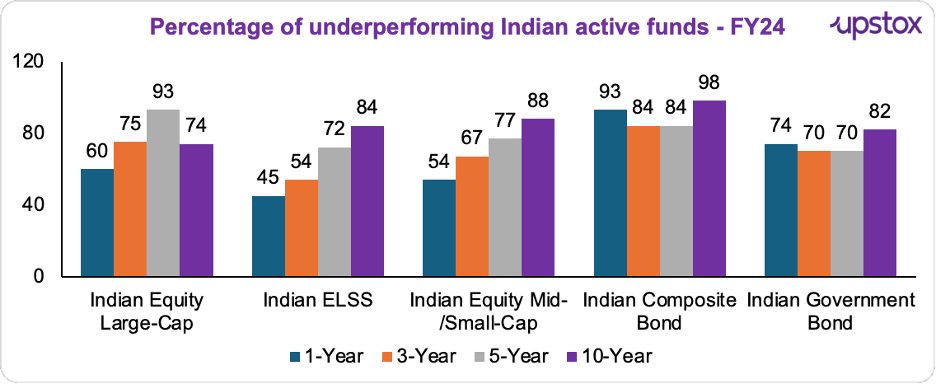

It has been difficult for many active funds in India to continuously outperform their benchmarks. For example, the SPIVA India Year-End 2024 report, provides a clear picture:

Source: SPIVA

The SPIVA India Mid-Year 2025 report is another. It reveals that throughout the past ten years, over 80% of mid- and small-cap active funds and ~66% of large-cap active funds underperformed their benchmarks. Due to exorbitant management fees and poor returns, investors are increasingly looking for dependable, affordable alternatives. Naturally, this change has contributed to the rise in passive investing, in which funds merely follow benchmarks such as the Sensex or Nifty.

New fund offers and big players pulling the crowd

The quarter concluding June 2025 saw 46 new fund offers (NFOs) raising a total of ₹6,506 crore. But most of the action was concentrated with just five major AMCs accounting for the lion’s share of inflows showing that while interest in passive funds is growing, investor money still flows to the big names.

As of July 2025, there are a total of 642 schemes:

- Equity index funds: 212

- Equity ETFs: 191

- Target maturity funds: 96

- Funds of Funds (FoFs) in active overseas funds: 39

- FoFs in passive overseas funds: 13

This shows that investors are now experimenting with ETFs, target maturity funds, and even foreign options in addition to traditional index funds, increasing market diversity and competition.

Innovative products

Passive investing is becoming more innovative with sectoral, thematic and smart beta products attracting investor attention.

According to Siddharth Srivastava, head of ETF product and fund management at Mirae Asset Investment Managers (India), "people are looking at passive funds for differential solutions, not just as substitutes for active ones."

The data backs it up. According to NSE data, roughly 40% of all passive funds fall into these creative categories by 2025, with niche passive funds accounting for 11% of total passive assets.

Low costs

One of the biggest draws of passive funds is their razor-thin costs. Unlike active funds that charge higher management fees, SEBI regulations cap expense ratios for ETFs at just 1%. And fund houses are pushing that limit even lower.

Take JioBlackRock’s recent lineup, five index funds launched as low-cost offerings. The Nifty 50 and G-Sec Index Funds come with a Total Expense Ratio (TER) of just 0.10%, while the Nifty Next 50, Midcap 150 and Smallcap 250 index funds are priced at 0.15%. All schemes are direct-plan, growth-only; a clear signal that keeping investor costs down is the new mantra.

Gold & silver ETFs lead inflows

When markets are erratic, investors seek refuge. And in the passive space, that is precisely what is happening. Gold and silver ETFs accounted for 72% of the ₹19,057 crore in inflows into passive funds in September 2025 alone (about ₹13,700 crore). The preferred hedge in times of global market turbulence is precious metals.

And it is supported by the folio data. In a year, accounts for silver ETFs have increased by more than 250%, and gold ETFs have increased by 52%. Due to a scarcity of physical silver and high local premiums, Tata Mutual Fund has joined other fund houses in temporarily suspending subscriptions to its Tata Silver ETF Fund of Fund. The date of the freeze is October 14, 2025.

| Top 5 Passive Categories by Folio Growth (Sep 2024–Sep 2025) | Sep 2024 (Nos.) | Sep 2025 (Nos.) | Growth (%) |

|---|---|---|---|

| Silver ETF | 4,24,295 | 14,86,584 | 250.37% |

| Income/Debt Oriented Index Funds (Ex-TMIF) | 14,577 | 30,668 | 110.39% |

| Equity Oriented ETFs (International) | 5,69,371 | 9,94,969 | 74.75% |

| Gold ETF | 57,10,499 | 86,63,662 | 51.71% |

| FOFs Investing Overseas in Active Funds | 7,16,175 | 9,20,618 | 28.55% |

Source: Moneycontrol

Are there any risks?

Although passive funds have been gaining popularity, they do carry some risk. The greatest weakness? Restricted protection against market declines.

Consider the recent correction from September 27, 2024, to February 28, 2025. Passive funds, including smart-beta and low-volatility strategies, largely fell in line with their benchmarks, while many active funds managed to soften the blow:

| Category | Passive Returns Since 52-wk High | Active Returns Since 52-wk High |

|---|---|---|

| Nifty 500 / Largecap | –18.8% | –15.5% |

| Flexicap / Multicap | –18.5% | –15.2% |

| Midcap | –20% | –16.7% |

| Smallcap | –25% to –28% | –16% to –23% |

| Large & Midcap | –17.8% | –14.5% |

Source: Money control

Why does this happen?

-

Rigid replication: Passive funds closely follow their benchmarks. If the index falls, they will also fall.

-

Model Risk: Smart-beta rules frequently rely on historical patterns that do not always apply in volatile markets.

New investments increase risk. Why? A big share of passive fund inflows come from first-time investors who are drawn to the low fees and simplicity. When markets sway, fear creeps in and many investors sell prematurely, missing out on the power of time and compounding. In contrast, experienced investors ride the storm and see their money rise.

In summary

Passive funds offer a simple reminder; you don’t need to beat the market to grow your money. They are a fantastic choice for novice investors because of their primary benefits, which include diversity, cheap expenses and consistency. They do, however also fluctuate in tandem with the market. Is it possible for investors to remain patient when uncertainty arises?

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story