Upstox Originals

India's EV landscape and the impact of subsidies

.png)

4 min read | Updated on July 04, 2024, 18:07 IST

SUMMARY

Electric vehicles (EVs) are all the rage now! Look around and you will find several vehicles with green registration plates! Is this growth driven only by government subsidies? Contrary to popular belief, data indicates EVs are gaining traction not just because of government subsidies. Other growth drivers are supporting their sales.

EVthumb.jpg

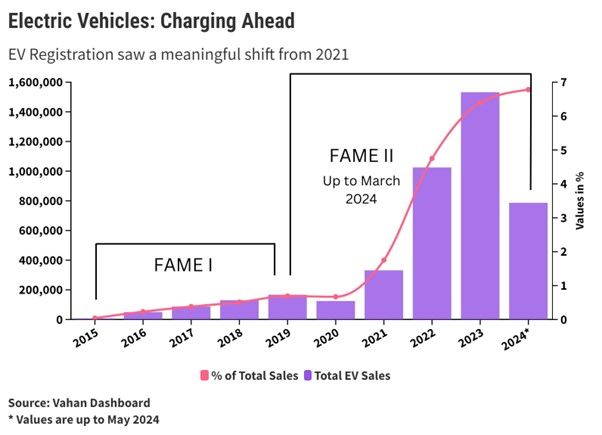

According to a Fortune Business Insights report, India’s EV market size is anticipated to grow to $117.7 bn in 2032 from $8 bn in 2023, a CAGR of 46.7%. Despite a sharp uptick in EV adoption since 2021, they account for only about 7% of total sales across vehicle classes. This demonstrates the huge potential for EV penetration in India.

What's driving this trend?

To bolster sales of EVs, one of the key early drivers was government subsidies offered under policies like Faster Adoption and Manufacturing of Electric Vehicles (FAME). Under the most recent phase, FAME-II, all EVs (except electric buses) were offered subsidies of ₹10,000 per kilowatt-hour (kWh), capped at 15% of the vehicle’s ex-factory price.

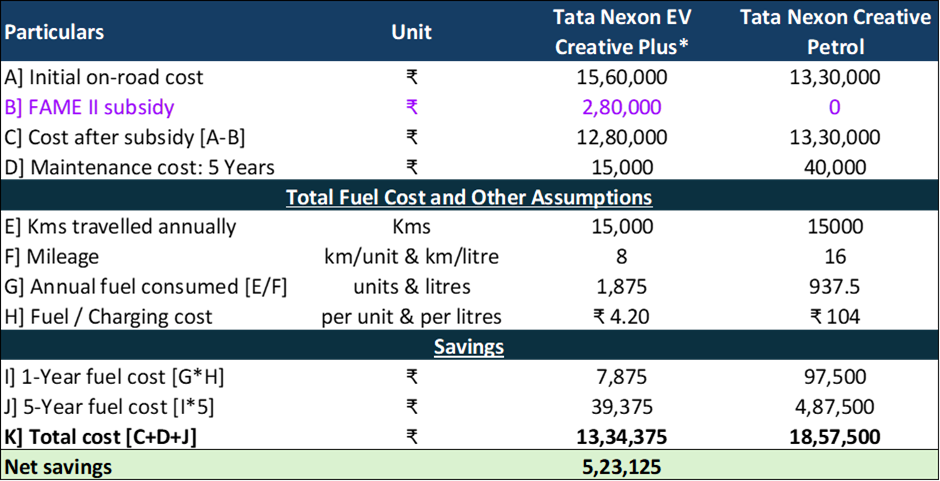

How much does it impact overall purchase? Let’s take a look at an example.

Ownership costs: Electric versus petrol vehicle

Source: CarWale; *Please note: Our analysis has ignored resale price of vehicles, since the EV resale market is still at a very nascent stage.

FAME -II discontinuation and the silver lining

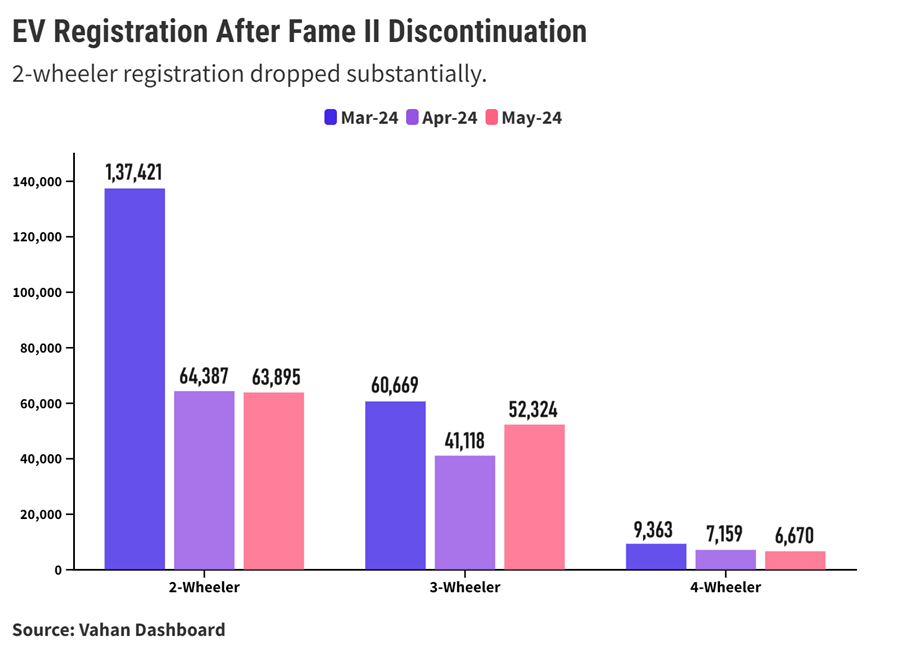

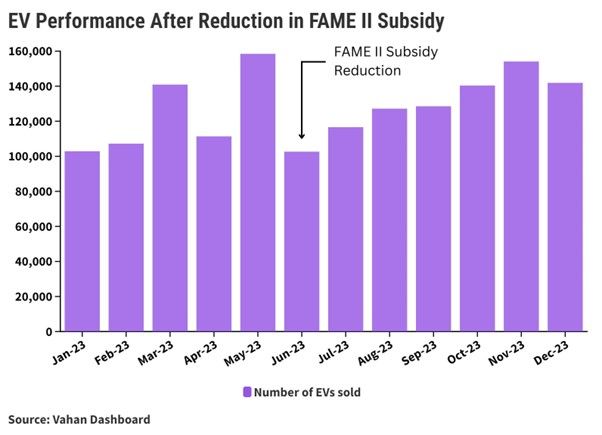

However, in March 2024, the discontinuation of FAME-II impacted sales of EVs as seen in the chart below. While sales were adversely impacted, they have since stabilised. Across all vehicle classes, retail sales (as seen in the chart below) have either been stable.

We take consolation in the past when in June 2024, when the government reduced subsidies. In addition to reducing the per kWh incentive by ₹5,000, the ministry reduced the maximum subsidy cap to 15% of the ex-factory price from 40%. While retail sales were impacted in the immediate months, sales have since rebounded to normal levels

What does this indicate?

Even though EV penetration is still in single digits, we believe EVs are reaching a stage of maturity. Consumers are appreciating the benefits of owning EVs even without the FAME-II benefits. Besides this, sales are also supported by the following factors:

- Even without FAME-II, buying an EV still translates to savings over 5 years

- EV charging infrastructure has been multiplying. From February 2022 to March 2024, the number of public charging stations surged from 1,800 to 16,347—a 9x increase. While still not enough, the growth continues unabated.

- The growing number of EV models launched across vehicle classes is keeping consumers hooked. For instance, 12-15 new electric cars were launched in FY24, and reports estimate that the number is expected to double in the current year.

Select EV investment opportunities

While there are no pure-play EV investment opportunities as yet, below is a list of key OEMs that are advancing EVs in India.

Four-wheeler / passenger vehicle manufacturers

| Market cap (₹ crore) | ROCE (%) | ROE (%) | P/E | EV/EBITDA | 3 yr CAGR stock Price growth (in %) | |

|---|---|---|---|---|---|---|

| Tata Motors | 3,64,190 | 49.4 | 20.1 | 11.3 | 6.4 | 43.3 |

| M & M | 3,64,180 | 18.4 | 13.7 | 32.3 | 16.3 | 55.3 |

Source: screener.in; *Data as of 14th June 2024

| Market cap (₹ crore) | ROCE (%) | ROE (%) | P/E | EV/EBITDA | 3 yr CAGR stock price growth (in %) | |

|---|---|---|---|---|---|---|

| Bajaj Auto | 2,78,112 | 26.4 | 33.5 | 36.1 | 26.7 | 33.7 |

| Hero MotoCorp | 1,16,044 | 22.5 | 29.8 | 30.1 | 19.1 | 26.2 |

| TVS Motor Company | 1,18,958 | 27.5 | 18.8 | 70.5 | 23.2 | 60.1 |

Source: screener.in; *Data as of 14th June 2024

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story