Upstox Originals

The rise and risks of gold-backed credit in India

6 min read | Updated on September 17, 2025, 16:50 IST

SUMMARY

Gold loans have stormed ahead while credit cards and personal loans have hit the brakes. Policy tweaks, rising gold prices, and changing borrower behaviour have fuelled the boom, but with higher loan-to-value caps, the risks are climbing if prices slip. The real test? Whether this glittering growth can survive a gold price fall.

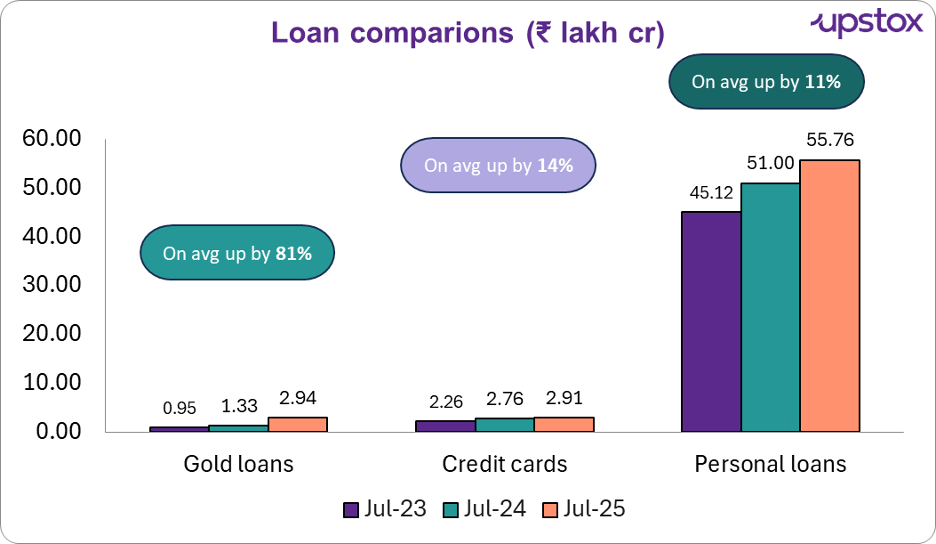

While gold loans remain a fraction of total personal loans, their growth rate is 10x higher than the rest

In India, gold has always been more than just metal. It is family heritage, a cultural safety net, and now, the fastest-growing source of credit. Over the past year, credit cards and personal loans have lost some of their shine. Loans against gold jewellery have soared to record highs.

What explains this rise? A mix of policy shifts, rising gold prices, and a change in borrowing behaviour is turning gold into the centrepiece of India’s credit landscape.

Gold loans grow faster than cards and personal loans

Source: RBI, note: Personal loans does not include gold loans and credit card loans

While gold loans remain a fraction of total personal loans, their growth rate is 10x higher than the rest which shows how quickly borrower and lender preferences are changing.

What’s really driving this gold loan surge?

On the surface, it looks like Indians have suddenly become obsessed with pledging gold for loans. But the real story is a bit more layered.

In May 2024, the Reserve Bank of India (RBI) allowed banks to reclassify agricultural loans secured by gold under the loans against gold jewellery category instead of keeping them within agricultural credit.

This one-off policy change alone caused a sharp jump in gold loan figures from July 2024, even though much of the lending was still for farm or rural needs.

How big was this jump?

We analysed the RBI data to compare gold loan growth with and without the policy change:

| Period / Metric | Actual (₹ lakh cr) | Projected organic (₹ lakh cr) | Extra growth vs trend ((₹ lakh cr) | Extra growth % vs trend |

|---|---|---|---|---|

| Jul 2023 (Baseline) | 0.95 | – | – | – |

| Mar 2024 (Pre-change) | 1.03 | 1.03 | 0 | 0.0% |

| Jul 2024 (post-change) | 1.33 | 1.06 | +0.26 | +24.6% |

| Mar 2025 (Actual) | 2.09 | 1.14 | +0.94 | +82.4% |

| Jul 2025 (Actual) | 2.94 | 1.19 | +1.75 | +147.8% |

Source: RBI, internal research

Even without the policy change, gold loans were growing at a steady +7–8% annually before 2024. If that organic trend had continued, the total gold loans would have reached only ₹1.19 lakh crore by July 2025. Instead, the May 2024 reclassification created a one-time +0.26 lakh crore boost by July 2024, taking gold loans far above their organic trajectory.

But here’s the real surprise, rather than stabilising after the policy jump, growth kept accelerating. By March 2025, gold loans were already +82% above trend, and by July 2025 the gap had widened to +148%, a scale of increase never seen in the same months of previous years. Making sense of the surge

So what does this really tell us?

The May 2024 policy change gave gold loans a one-time bump, sure. But the growth that followed shows this isn’t a blip, it’s a clear sign that India’s retail credit story is shifting, with gold loans suddenly at the centre.

Why are gold loans soaring while other credit slows?

Part of the story is regulation. When the RBI raised risk weights on unsecured loans in late 2023, credit cards to 150%, personal loans to 125% the banks suddenly had to set aside more capital for every rupee lent without collateral.

The impact showed up quickly:

-

Credit card usage dropped from 32.6% to 15.6% within one year.

-

Personal loans (other than gold loans) decreased to only 9% YoY by July 2025 from nearly 18% previously.

Gold loans, however, went the other way, rising 122% YoY by July 2025 and doubling in FY'25 alone.

Why? Two basic reasons:

-

Borrowers liked gold loans better because they were cheaper, speedier, and more affordable compared with pricier personal loans or credit cards.

-

Banks liked them because they carried lower risk where gold as collateral can be liquidated if needed, making recovery simpler and safer.

What happens if the gold price party ends?

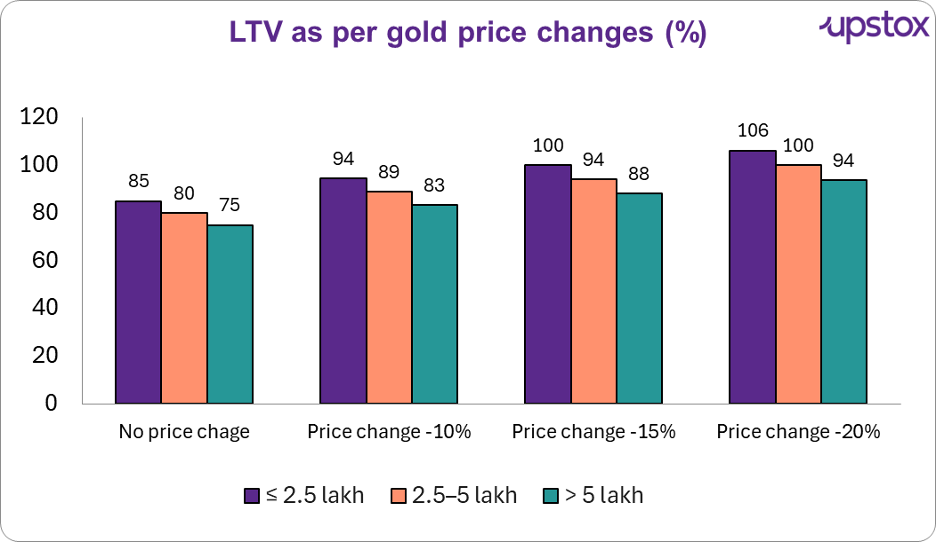

Let's talk about risk first, but let's first clarify the terminologies. LTV, Loan-to-Value ratio, simply gives the ratio of the bank loan and the gold value.

Example: if you pledge gold worth ₹1,00,000 and you are borrowing ₹75,000, your LTV is 75%. Suppose gold prices fall by 15%, your gold is now only worth ₹85,000 but your loan remains ₹75,000. Instantly your LTV increases to 88%, and the bank only has a very thin buffer if you default.

That is where the RBI's June 2025 step comes into the frame. It increased the LTV ratios for small-ticket gold loans up to 85% (from 75%) and up to 80% for ₹2.5–5 lakh loans and did not alter the 75% threshold for big loans.

Good for borrowers. But the risk increases fast if the prices decline for gold, the lower the grade.

Source: RBI, internal research, Note: The figures reflect an internal sensitivity analysis on how LTV ratios shift under varying gold price scenarios.

The above chart is basically a “what if” exercise to see how the numbers change under different conditions. We tested how loan-to-value ratios would react if gold prices fell by 10%, 15% and 20%. It shows how quickly the safety margin for lenders disappears when the price of gold drops.

The message is simple: with LTV now at 85% for small loans, even a modest fall in gold prices wipes out the safety buffer for lenders. A 15% drop leaves small-ticket loans fully underwater, and larger loans with almost no cushion left.

It's important to understand that gold loans usually make up a small portion of a person's total borrowings or investment portfolio. In contrast, a home loan is typically a large financial commitment, with substantial monthly payments. Since a house often represents a major part of an individual's net worth, any change in property prices can significantly affect the borrower's financial position.

From a lender's point of view of as well, gold loans are typically not a major portion of a banks lending book. But, the risk could be meaningful for NBFCs involved only in gold lending.

Outlook

Gold loans have raced ahead, powered by policy changes, digital lending, and a clear shift in borrower and lender behaviour. While personal loans and credit cards slowed after the RBI tightened norms, gold loans doubled in just a year, turning household gold into the fastest-growing source of credit in India.

But the new LTV and a sharp concentration of growth in small-ticket loans also raise the stakes. If gold prices fall, the same segment driving today’s boom could become tomorrow’s risk headache.

For now, gold loans are the poster child of India’s retail credit story. The real test will be whether this growth holds up when the price of gold, and the comfort it provides lenders, stops glittering.

About The Author

Next Story