Upstox Originals

The IPL journey: Cricket, commerce, and everything in-between

.png)

7 min read | Updated on April 01, 2025, 10:16 IST

SUMMARY

Before the 1990s, the BCCI sometimes had to pay Doordarshan for the privilege of telecasting cricket. Today media rights account for a staggering 70% of the BCCI’s revenue. The IPL has been one of the key factors that has transformed cricket not just in India, but also globally. The IPL is a commercial powerhouse, with its massive fanbase and diverse revenue streams making it a dominant force in India's consumption.

In 2024 IPL reached an audience of ~60 crore, nearly half of India's population

Summers and Sundays are now synonymous with IPL — a time when millions of Indians flock to their screens, making it an integral part of their weekend routine. In 2024, the IPL reached an audience of 60 crore, nearly half of India's population, solidifying its place as one of the most significant sports events in the country.

With such a massive fanbase, IPL stands out not only as a sporting event but also as a business powerhouse.

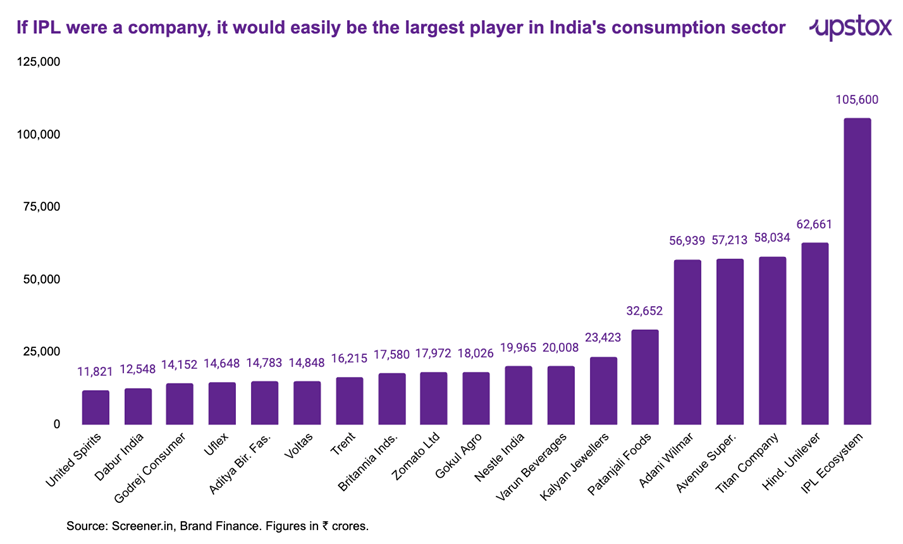

If IPL were a company, it would easily be the largest player in India's consumption sector, thanks to its unparalleled reach and the diverse range of revenue streams it generates — from media rights and sponsorships to franchise revenue and merchandise sales.

Note: For IPL the whole ecosystem has been considered which includes media rights, ticketing, and merchandising. For the others, we have taken twelve months of trailing revenue as of Dec-24.

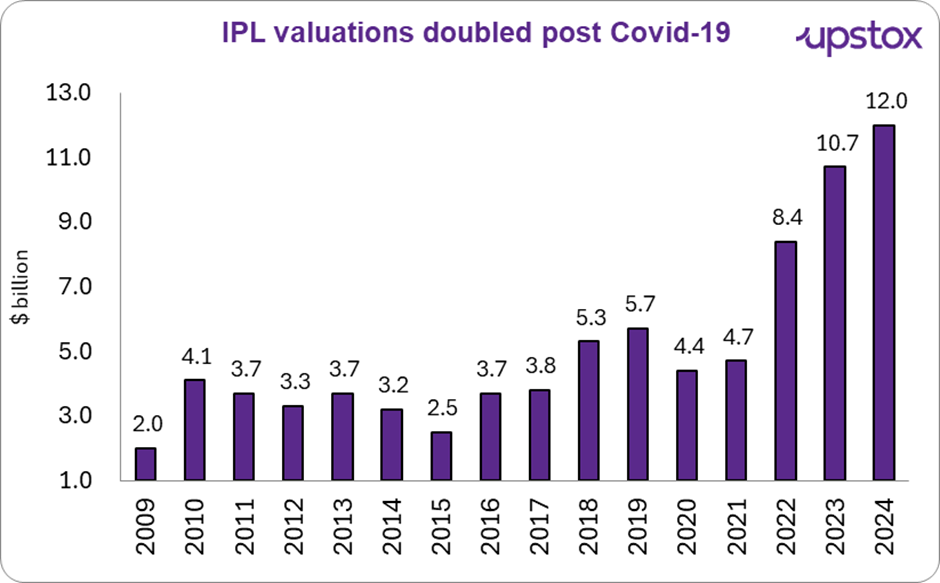

Today, the IPL’s $12 billion business encompasses not just media rights, but also tourism, sports merchandise, hospitality, ticketing revenue, and other allied services, making it a multi-faceted economic engine with widespread influence.

Source: Brand Finance

Two key events have significantly boosted the IPL ecosystem’s valuations. First, the 2023-2027 media rights deal, which separated digital and TV rights, increased valuations as digital rights were sold for nearly the same amount as TV rights, which were previously combined.

Here is the bird overview of how IPL business model is stacked up

| Category | Details |

|---|---|

| Media rights | 2023–27 media rights sold for ₹44,075 crore TV rights (Star India): ₹23,575 crore Digital rights (Viacom18/JioCinema): ₹20,500 crore Revenue sharing: 50% to BCCI, 45% to franchises, 5% performance-based distribution |

| Sponsorships | Title Sponsorship: The Tata’s have paid ₹2,500 crore (5-year deal) Segment Sponsorships: Brands like CRED (Powerplay), CEAT (Strategic Timeout) Contribution to BCCI and team revenues |

| Franchise revenue | Central pool share (media rights & sponsorships) (60% of revenue) Team-specific sponsorships (20-25% of revenue) Ticket sales & Merchandising (10-15% of revenue)The above breakdown of revenue varies from franchisee to franchisee. |

| Franchise fees | Teams pay fees to the BCCI for participation rights. |

| Prize money | Winning team: ₹20 crore, Runners-up: ₹13 crore 50% retained by owners, 50% distributed among players |

Source: BCCI, Brand finance, media reports, franchisee website

Sectors that could potentially benefit from IPL:

Hotels

The Indian hotel sector is defying the broader consumption slowdown, with Indian Hotels, a sector leader, forecasting double-digit revenue growth in Q4 FY25, typically a lean period.

This growth is being driven by mega events like the IPL, Mahakumbh, and others, which fuel demand for hospitality.

We’ve discussed this trend in greater detail here.

Aviation

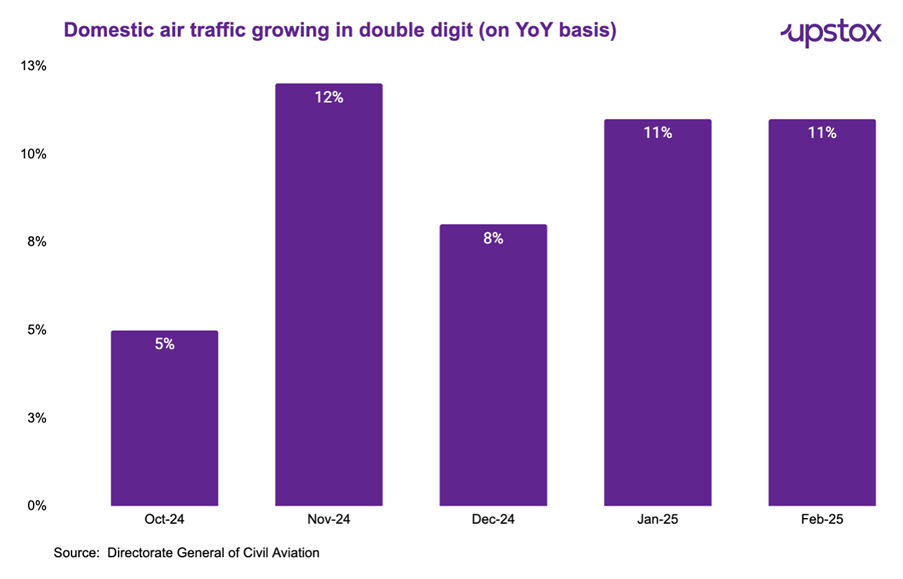

Similar to the hotel sector, the aviation industry is also seeing strong growth, with sector leaders predicting double-digit growth in Q4 FY25, driven by mega events mentioned above and summer vacations. The rise in demand is evident from the year-on-year growth in domestic air traffic:

Media and Entertainment

The IPL 2025 ecosystem is set to generate ₹6,000-₹7,000 crore in advertising revenue across TV, digital platforms, team sponsorships, and on-ground ads. JioStar, the official rights holder, expects to generate ₹4,500 crore in revenue, as reported by ET.

Quick commerce & food delivery

The IPL season presents a notable opportunity for companies like Zomato and Swiggy, with the increased viewership driving higher food orders, especially during match days.

Franchisee owners like Reliance Industries (owner of Mumbai Indians) and Sun TV Network (owner of Sunrisers Hyderabad) could benefit from the thriving IPL business. Their valuations saw significant growth in the 2024 season, increasing by 36% and 76% respectively, as reported by Brand Finance.

Investors should note that while the IPL plays a key role in driving demand, it is not necessarily a major contributor to the overall business of the sectors and companies mentioned above.

These companies benefit from the IPL's positive impact, but their success is driven by a range of factors beyond the tournament itself.

Here is the non-exhaustive list of companies that might see positive business activity due to IPL:

| Company | PE | ROCE | PB | 3Y Revenue CAGR (%) | 3Y PAT CAGR (%) | 3Y Stock CAGR (%) |

|---|---|---|---|---|---|---|

| Reliance Industries | 24.9 | 9.6 | 2.1 | 24.0 | 16.0 | 2.0 |

| Sun TV Network | 14.5 | 26.2 | 2.2 | 10.0 | 9.0 | 13.0 |

| Viacom 18 | - | -0.3 | 0.5 | 25.0 | - | -20.0 |

| Varun Beverages | 68.0 | 24.8 | 10.9 | 31.0 | 55.0 | 62.0 |

| Swiggy | - | -24.4 | 10.1 | 64.0 | -24.0 | - |

| Zomato | 295.0 | 1.1 | 9.2 | 82.0 | 34.0 | 37.0 |

| Interglobe Aviation | 32.5 | 24.5 | 52.9 | 68.0 | 47.0 | 38.0 |

| Spicejet | - | 1.6 | 138.0 | 11.0 | 17.0 | -7.0 |

| Indian Hotels | 73.0 | 15.1 | 11.2 | 36.0 | 50.0 | 50.0 |

| Lemon Tree Hotels | 58.4 | 11.4 | 10.3 | 47.0 | 0.6 | 24.0 |

Source: Screener.in. Data as on 27-03-25

Growth Potential

- Still headroom for more franchises (IPL has 10 teams vs. NFL's 32, NBA's 30)

- India’s cricket fandom, strong digital infrastructure, and monetisation innovations mean this is just the beginning.

- Leading franchises of IPL are considering buying franchisee teams in other sports as well as buying foreign franchisees of cricket teams to replicate the success of IPL's business model as per the Business Standard report.

Risks and Limitations

- Overreliance on star players: CSK with Dhoni, RCB with Kohli

- Saturation of digital ad space could slow revenue growth

- Challenges in scaling up newer franchises (e.g., LSG, PBKS with lower brand recall)

- Global brands like Amazon and Apple not investing as heavily in IPL media rights as initially expected, leading to less financial backing from major players.

- The OTT merger of Jio and Disney Hotstar has resulted in a monopolistic market, reducing competition and potentially limiting the future growth of media rights revenue.

In summary

The IPL is a masterclass in monetising passion, building community, and creating commercial value around the sport. With rising viewership, booming valuations, women’s league expansion, and international investor interest, it stands tall as India’s biggest entertainment export. Its business model is robust, diversified, and built to last. As long as cricket remains a religion in India, the IPL’s business scoreboard could remain robust.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story