Upstox Originals

The Indian telecom revolution

11 min read | Updated on October 07, 2024, 15:49 IST

SUMMARY

In the early 2000s, seamless connectivity was a luxury few could afford. Teledensity was just 3.5% in 2001,fast forward to 2024, teledensity has soared to 85.7%. The telecom sector now fuels about 6.5% of India's GDP. Join us as we explore this remarkable journey and its profound impact on modern India.

Teledensity in India has increased from 3.5% in 2001 to 85.7% in 2024

In the early 2000s, seamless connectivity was a luxury few could afford. Teledensity, which measures the number of telephone connections per 100 people, was just 3.5% in 2001, and making a simple phone call was often out of reach for many.

This transformation has reshaped our world, turning once-unimaginable dreams into everyday realities. Remote education and telemedicine have become commonplace, small businesses are thriving with newfound digital tools, and the telecom sector now fuels about 6.5% of India's GDP.

Join us as we explore this remarkable journey and its profound impact on modern India.

….

The 2G and 3G Era

The 2G era, starting in the 1990s, marked the introduction of mobile data services, SMS texting, and digital voice communication. By 2009, the 3G technology revolutionized mobile internet access with video calling and faster data transmission, leading to a surge in mobile applications.

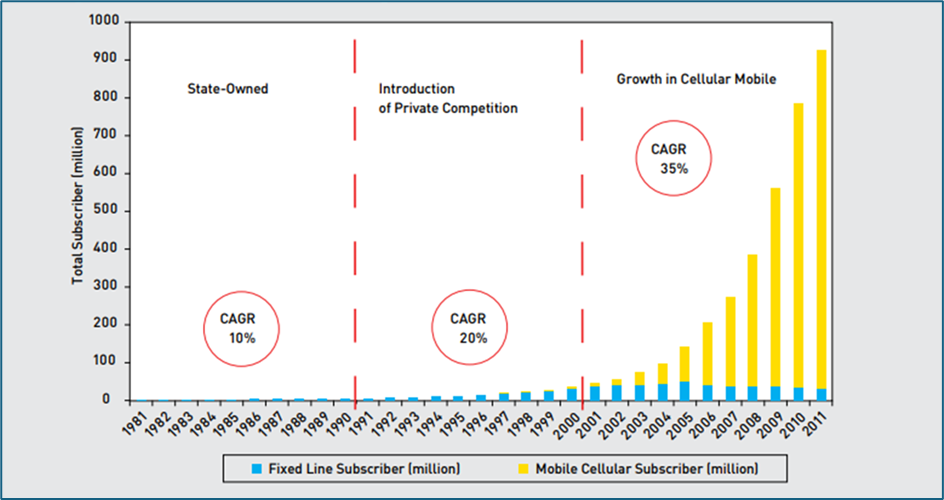

Take a look at this graph: it highlights how the entry of private players in 1991 led to a significant shift from fixed wireline to mobile cellular subscribers between 2000 and 2011. This trend is closely linked to the decreasing cost of mobile phones during that time.

Growth in Telecom Subscribers

Source: World Development Indicators, Telecom Regulatory Authority of India (TRAI)

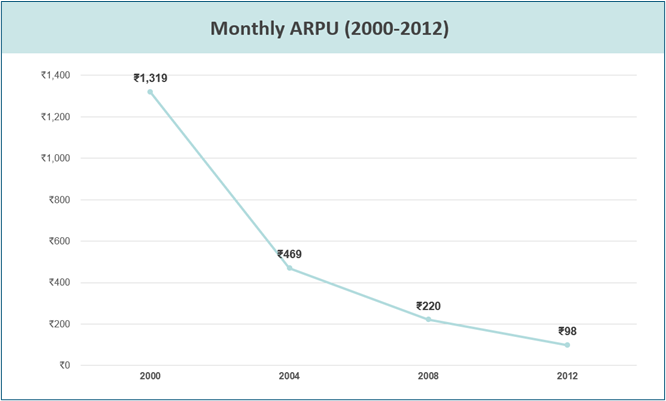

This intense competition is also reflected in the Monthly Average Revenue per User (ARPU), which represents the average amount spent on mobile services each month. ARPU fell sharply from over ₹1,300 in 2000 to just ₹98 in 2012, driven by the influx of operators who cut prices to attract subscribers.

Monthly ARPU (2000-2012)

Source: Telecom Regulatory Authority of India (TRAI)

….

The 2G Spectrum Scandal: A Watershed Moment in Indian Telecom

The 2G spectrum scandal of 2008 shook India’s telecom sector. The then-Telecom Minister A. Raja was accused of allegedly selling 122 spectrum licenses at outdated 2001 prices, leading to a massive loss of ₹1.76 lakh crore in government revenue. The licenses were controversially awarded on a first-come, first-served basis, bypassing more transparent auction methods.

Investigations uncovered alleged corruption, with claims of laws being violated and bribes exchanged to benefit certain companies, including those with no telecom experience.

….

Telecom Sector Challenges and Consumer Dissatisfaction in India (2011-2013)

The telecom landscape around this time was crowded with numerous players, including Bharti Airtel, Idea Cellular, Vodafone India, BSNL, MTNL, Reliance Communications, Reliance Telecom, Tata Teleservices, Aircel Cellular, Sistema Shyam (MTS), Videocon Telecommunications, all holding licenses from the Department of Telecommunications. This fragmentation led to several issues:

- Inconsistent Coverage: Uneven network coverage and service quality.

- Operational Inefficiencies: Increased costs due to duplicated infrastructure and efforts.

- Limited Economies of Scale: Lack of cost savings from resource consolidation.

- Higher Costs for Consumers: Less competition resulted in higher prices and fewer options.

….

The Rise of Jio: A Turning Point

Jio’s complementary suite of apps, valued at ₹15,000 annually, was available to all active Jio customers until December 31, 2017.

At a time when 3G was still emerging and many were on 2G, Jio’s nationwide 4G rollout was groundbreaking. Its focus on affordability and high-speed data transformed the telecom landscape, setting new standards for the industry. ….

The Jio Effect: Pricing Disruption and Digital Inclusion

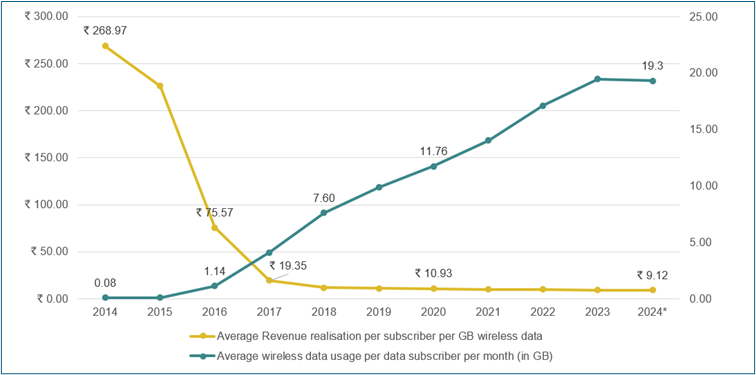

Jio's entry revolutionized the telecom sector with dramatic pricing shifts. The cost per GB plummeted from ₹270 in 2014 to ₹9.2 in Q2 of 2024, driving data consumption up as internet subscribers surged from 267 million in 2014 to over 936 million by 2023.

Data Cost Per GB

Source: *Data for 2024 as on March 31, Telecom Regulatory Authority of India (TRAI)

By 2018-19, industry revenue had fallen to levels seen nearly a decade earlier, highlighting Jio's transformative impact on the telecom landscape.

….

Launch of JioPhone

In 2017, Reliance Jio further transformed the market with the launch of the JioPhone, a feature phone with smartphone-like capabilities, priced effectively at ₹1,500 with a refundable deposit after three years. This innovative pricing strategy made the JioPhone accessible to a vast audience, particularly in rural and lower-income areas, significantly expanding digital access.

Since then, Jio has introduced several versions, with the most recent being the JioBharat J1 4G, launched in July 2024, furthering its mission to make technology widely accessible.

….

Industry Consolidation: The Toll of Jio's Disruption

Merge or Exit: The Telecom Shake-Up

As Jio's disruptive pricing reshaped the telecom landscape, other players faced tough choices:

- September 2018: Vodafone and Idea completed their merger.

- February 2018: Aircel filed for bankruptcy.

- February 2019: Anil Ambani’s Reliance Communications also filed for bankruptcy.

- May 2019: Airtel merged with Telenor.

- July 2019: Airtel’s merger with Tata Tele was finalized.

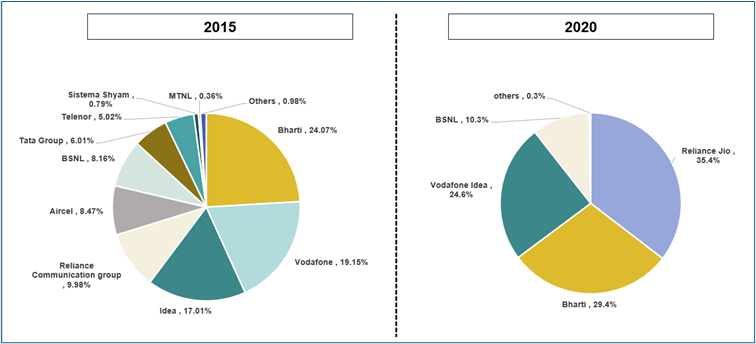

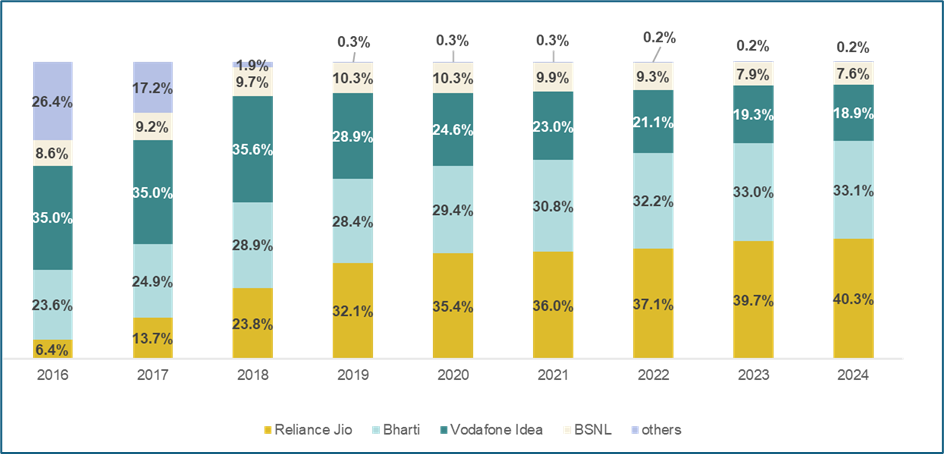

Market share based on the wireless subscriber base

Source: Telecom Regulatory Authority of India (TRAI)

The Vodafone-Idea merger faced significant financial and operational challenges, leading to a weakened network and subsequent financial difficulties. Over time, Airtel's ability to navigate the Jio effect and strengthen its position is evident when examining market share trends.

Market Share (2016-2024)

Source: Telecom Regulatory Authority of India (TRAI)

Airtel’s Premium Strategy and Market Resilience

In response to Jio’s disruptive pricing, Bharti Airtel adopted a strategy centered on premium service and quality. By focusing on high-value customers, Airtel boosted its average revenue per user (ARPU) to ₹200, surpassing Jio’s ₹180.

….

Jio’s Comprehensive Ecosystem and Affordability

Conversely, Reliance Jio prioritized affordability and broad access by creating a comprehensive telecom ecosystem that integrated content, mobile hardware, and network infrastructure. By bundling data plans with Jio apps and services like JioTV, JioMusic, and JioCloud, Jio provided subscribers with exceptional value and convenience.

….

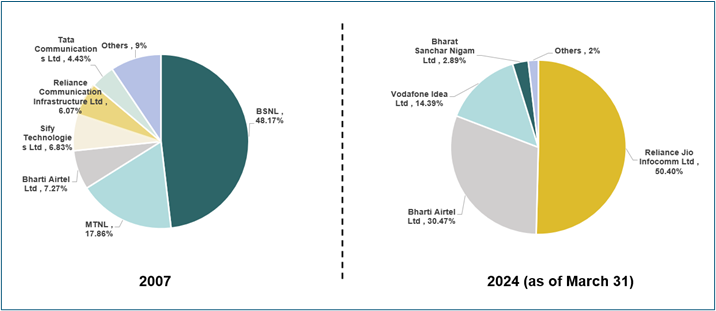

BSNL's Journey: From Dominance to Revival

Market share of top 10 Internet Service Providers

Source: Telecom Regulatory Authority of India (TRAI)

In October 2019, the government approved a ₹69,000 crore revival plan for BSNL, targeting cost reduction, debt restructuring, 4G spectrum allocation, and asset monetization.

This was followed by a ₹1.64 lakh crore package in July 2022 to upgrade services, secure spectrum, and expand the fiber network.

A third package of over ₹89,000 crore was approved in June 2023 to expand 4G coverage, enhance high-speed internet, and support captive networks, though the BSNL-MTNL merger has been delayed due to high debt.

….

AGR Controversy and Reforms

The telecom industry’s financial woes weren’t just limited to competition and operational challenges; regulatory battles also played a significant role. A prime example of this is the Adjusted Gross Revenue (AGR) dispute. AGR is key for calculating revenue sharing and fees between telecom operators and the government. Disputes arose over whether AGR should include only core telecom revenues or also additional non-telecom revenues. (source)

- October 2019: The Supreme Court sided with the DoT, requiring telecom operators to pay over ₹1.4 lakh crore by January 2020, including penalties. This decision strained the industry.

- January 2020: Telecom operators missed the payment deadline and filed a review petition, which was rejected. Vodafone Idea and Bharti Airtel later challenged the dues calculations.

- September 2021: The government approved a relief package with a four-year moratorium on AGR and spectrum charges, rationalized AGR definitions, and revised penalties. By then, Vodafone Idea owed ₹58,254 crore (paid ₹7,854 crore), and Bharti Airtel owed ₹43,980 crore (paid ₹18,000 crore).

- February 2023: The government converted ₹16,000 crore of Vodafone Idea's interest liability into equity, acquiring a 33% stake in the company.

- October 2023: Vodafone Idea and Bharti Airtel sought a Supreme Court review for alleged errors in AGR calculations, which the court later agreed to.(source)

….

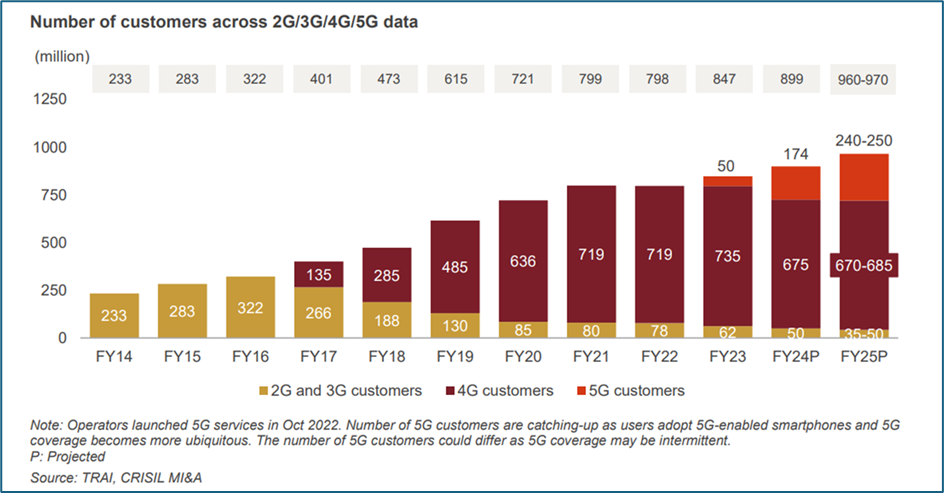

Where Do We Stand Today?

India joined 70 countries in adopting 5G technology following the 2022 auction, marking a significant leap forward in the global telecom landscape.

2G & 3G → 5G

However, with a wireless teledensity of just 82.5 per 100 people in fiscal 2023, India lags behind other leading markets and emerging economies, highlighting substantial growth potential.

CRISIL MI&A forecasts average data usage to reach 24-25 GB per customer per month by fiscal 2025.

This increase will be driven by higher consumption of social media, video calls, gaming, and mobile content, bolstered by expanded high-speed internet in rural areas and increased smartphone usage. Data consumption will also rise across sectors such as entertainment, education, banking, healthcare, and retail.

….

Satcom: Expanding Connectivity Beyond Terrestrial Networks

Satcom (satellite communication) is transforming how we connect, offering global coverage and bridging gaps where traditional networks fall short. Using satellites for internet and communication, Satcom bypasses the need for extensive ground infrastructure and provides vital services in remote areas.

Key Differences:

- Coverage: Broader and more flexible than terrestrial networks.

- Infrastructure: Less reliance on ground-based infrastructure.

- Latency: Higher latency in geostationary satellites, but newer systems are improving.

- Speed and Cost: Slower and pricier than cable broadband.

Applications: Satcom is essential for connectivity in remote areas and emergencies, as seen with Starlink’s support in Ukraine. It also aids in maintaining banking services during crises.

Players in this space: Companies such as Reliance Jio’s JV with Luxembourg-based SES; Starlink; Amazon; Bharti-backed OneWeb; and the Tata-Telesat combine are working on creating a constellation of satellites to deliver ‘broadband-from-space’ services in India.

Earlier, most satellite internet came with larger equipment, including a dish, but nowadays most internet providers have smaller, more compact equipment. Most satellite internet now only comes with a modem, wireless router and network cable. Earlier, geostationary (GEO) satellites were used for Satcom, but now low-Earth orbit (LEO) as well as medium-Earth orbit (MEO) satellites are used.

Crafting India’s Connected Tomorrow

As Satcoms carve out their niche in the connectivity landscape, the telecom sector remains on the brink of a new era, where innovation and competition will redefine how we connect and communicate.

With 5G expanding rapidly and affordable data becoming the norm, India is poised to become one of the most connected nations in the world, driving digital inclusion and economic growth across urban and rural areas alike. The future of telecom promises to not just keep us connected but also empower millions with unprecedented access to information, services, and opportunities

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story