Upstox Originals

The fight for sustainability in India’s beverage sector

.png)

7 min read | Updated on May 20, 2025, 15:15 IST

SUMMARY

India’s beverage sector is bubbling with change, but not just in taste. With a booming market and a growing sustainability push, the industry faces mounting pressure to shift away from virgin plastics. From rPET adoption and bold recycling targets to futuristic packaging innovations, the battle against plastic waste is on.

India's non-alcoholic beverage market is valued at ~ ₹1.4 trillion

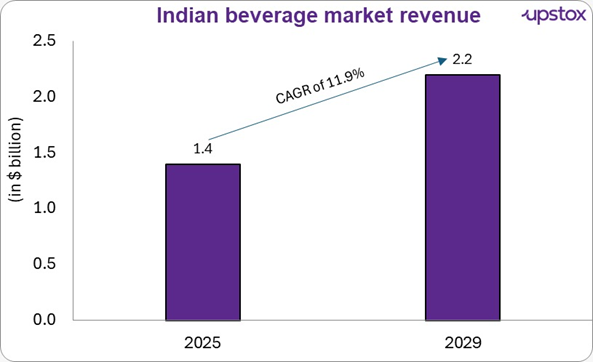

As of the fourth quarter of 2024, India's non-alcoholic beverage market is valued at ~ ̂₹1.4 trillion (~$16.5 billion). India's non-alcoholic beverages market is set to grow significantly between 2024 and 2029. Driven by rising health consciousness, urbanisation, and a shift towards healthier lifestyles, revenue is expected to grow at a CAGR of ~11.9%.

Source: Statista

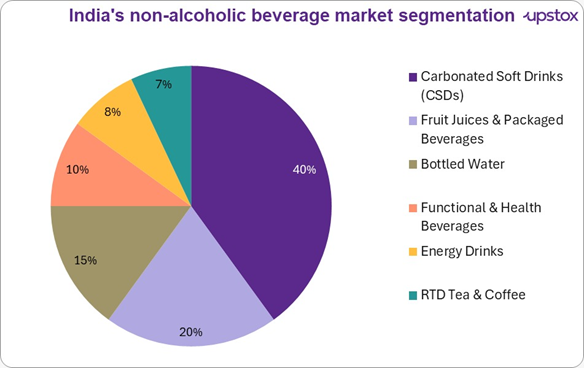

Source: Statista

The need for sustainability

India churns out over 3.5 million tonnes of plastic waste annually, and beverage bottles are a big chunk of that pile. A large part of it gets recycled, but the rest ends up cluttering landfills, choking rivers, or worse—burned, releasing toxic fumes into the air we breathe.

Here’s the kicker: Making new plastic (called virgin PET) creates a lot of pollution—about 2.15 kg of carbon dioxide for every 1 kg of plastic produced. But using recycled PET (rPET) instead can reduce those emissions by around 79%.

Polyethylene terephthalate (PET) is widely used for beverage bottles due to its lightweight, durability, and recyclability. But turning used PET into recycled PET (rPET) isn’t always smooth sailing—contamination, poor sorting, and limited food-grade recycling infrastructure make the process tricky. While global giants are shifting to 100% rPET bottles, India’s path is bumpier, with inconsistent quality and higher costs slowing down adoption. Still, cracking this challenge is key to building a truly circular economy.

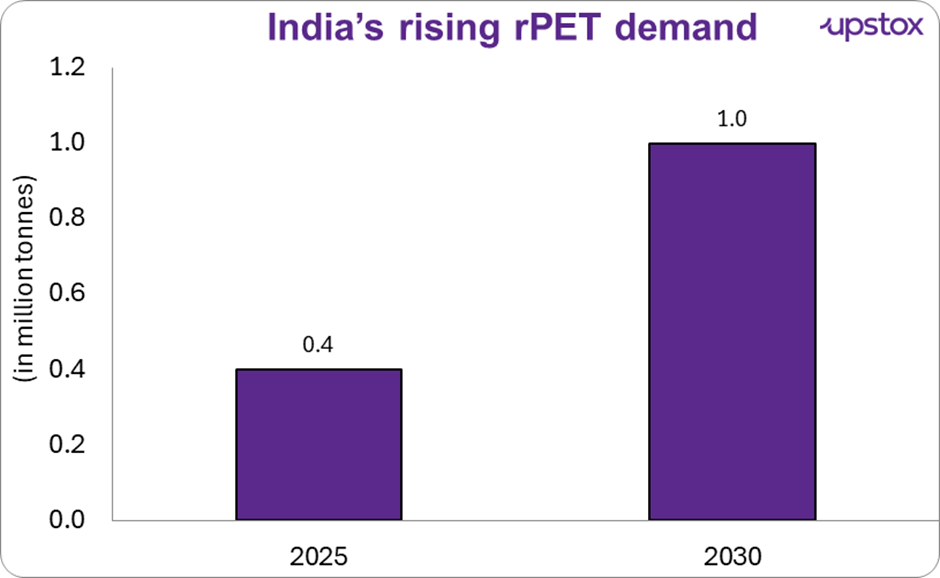

India’s push towards a recycled PET economy is gaining momentum, fuelled by rising demand and strengthened by government regulations. Industry projections suggest demand could grow significantly, from current levels to well over a million tonnes by 2031.

To meet this shift, the Indian government has introduced mandatory targets, requiring 30% recycled plastic content in packaging by 2026, increasing to 60% by 2029. New production facilities are also being developed to support beverage companies striving to meet their ambitious sustainability commitments.

Source- Recycling International

If the beverage industry leans into rPET, using 200,000 tonnes of it instead of virgin PET could slash CO₂ emissions by around 0.8 million tonnes a year. That’s like erasing nearly two years’ worth of emissions from 110,000 autorickshaws—not bad for just reusing a bottle, right?

But it’s not just about emissions. Better recycling means less plastic clogging our cities and oceans, fewer fossil fuels dug out of the earth, and more jobs created in waste collection and processing. In short, recycling isn’t just good for the planet—it’s smart business.

All recycling is not the same

India’s recycling system relies heavily on mechanical recycling, which degrades plastic quality over time. More advanced chemical recycling—which breaks plastic down to its original molecules—could help, but costs 2–3x more than mechanical methods. The lack of centralised collection centers and efficient sorting means that much of India’s plastic waste ends up in landfills or low-grade applications like textiles, rather than being turned back into bottles.

The role of Extended Producer Responsibility (EPR)

The Indian government has mandated EPR for plastic waste management. This means beverage companies are legally required to take responsibility for collecting and recycling their plastic packaging. Companies, like Coca-Cola and Bisleri, are actively collaborating with NGOs and local governments to implement EPR more effectively.

However, compliance remains a challenge due to:

-

A lack of uniform waste collection infrastructure across states.

-

The reliance on the informal sector (ragpickers and small-scale recyclers) for waste management.

-

The absence of strict penalties for non-compliance.

Innovations in sustainable packaging

Beyond rPET, brands are exploring alternative packaging solutions:

-

Tetra pak & carton-based packaging: Used by Paper Boat and Dabur’s Real juice, these cartons are recyclable and reduce reliance on plastic.

-

Edible & biodegradable packaging: Startups are experimenting with materials like seaweed-based packaging for single-use drinks.

-

Aluminum cans & glass bottles: While more sustainable, higher costs and breakability limit their large-scale adoption in India.

Government regulations & policies shaping the future

-

Plastic waste management rules (2022): Stricter guidelines on single-use plastic bans and rPET adoption.

-

Production-linked incentives (PLI) for Green Manufacturing: Incentives for companies investing in sustainable packaging.

-

Ban on single-use plastics: Many states have already banned plastic straws and cutlery, pushing brands to switch to paper-based or biodegradable alternatives.

India’s non-alcoholic beverage industry: A market in motion

India’s beverage industry is booming, offering a diverse range of drinks catering to evolving consumer preferences.

| Beverage category | Key players & brands | Market insights |

|---|---|---|

| Carbonated soft drinks (CSDs) | Coca-Cola, PepsiCo | Dominant market, segment, led by global giants |

| Fruit juices | Tropicana (PepsiCo), Real (Dabur), Frooti (Parle Agro) | Growing popularity as a healthier alternative |

| Bottled water | Bisleri, Kinley | Essential in hot climates, strong market demand |

| Energy drinks | Red Bull, Monster Energy, Zing | Rapid expansion, driven by fitness-conscious consumers |

| RTD tea & coffee | Starbucks, Paper Boat, Nestlé, Girnar | Emerging as a convenient option with innovative flavours |

| Functional beverages | Yakult , Activia (Danone), Propel (PepsiCo) | Increasing traction among health-conscious consumers |

Source: Press releases, news articles

The market leaders are making a splash in PET recycling

| Company | Sustainability initiatives |

|---|---|

| Coca-Cola India | Targeting 50% rPET usage in bottles by 2030. Partnering with UNDP and NGOs for better waste collection. Investing in food-grade recycling infrastructure. |

| PepsiCo India | Aiming for 100% recyclable/compostable/biodegradable packaging by 2025. Using rPET in select Aquafina bottles. Collaborating with waste management startups to boost plastic recovery. Balancing sustainability with affordability for mass-market products. |

| Varun Beverages (PepsiCo’s Largest Bottler in India) | Plans to recover and recycle over 100,000 tonnes of PET annually by 2025. Partnered with Indorama Ventures for two large-scale PET recycling plants. Addressing inconsistent collection systems to ensure steady rPET supply. |

| Parle Agro (Frooti, Appy Fizz, Bailley) | Introduced Bailley Green Label, a 100% rPET water bottle. Investing in collection and recycling programs. |

| Bisleri International | Running the “Bottles for Change” initiative to promote bottle-to-bottle recycling. Expanding collection networks beyond metro cities. Educating communities about plastic waste management. |

| Manjushree Technopack (Major Plastic Packaging Manufacturer) | Investing in advanced PET recycling facilities. Launched a state-of-the-art recycling plant in Karnataka. Scaling up to meet rising demand for food-grade rPET while maintaining safety standards. |

Source: Press releases, news articles

Challenges in achieving sustainability goals

Despite ambitious sustainability pledges, several roadblocks remain:

-

rPET availability: Only 30% of the collected PET in India is food-grade recyclable due to contamination and poor sorting.

-

High costs: Virgin PET costs ₹80/kg, while food-grade rPET can go up to ₹120/kg, raising beverage prices.

-

Consumer perception: According to the Plastics for Change show, 60% of Indian consumers see recycled bottles as lower quality.

-

Supply chain inefficiencies: Lack of bottle-to-bottle recycling plants forces companies to rely on third-party recyclers.

Potential solutions & industry concerns

To overcome these challenges, industry leaders are considering:

-

Government Support: Tax benefits and subsidies for rPET adoption.

-

Infrastructure Investments: More bottle-to-bottle recycling plants to meet demand.

-

Consumer Education: Campaigns to promote rPET bottles and shift consumer perception.

-

Industry Collaboration: Partnerships between brands, recyclers, and policymakers to create a circular economy for plastic.

Final thoughts

India’s beverage industry is feeling the heat to go green, but challenges like poor recycling systems, limited food-grade rPET, and uneven regulations make progress tough. While brands are stepping up, real change will need collective effort from companies, policymakers, and consumers. The shift to sustainable packaging is possible—if we act now.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story