Upstox Originals

The electric shift: Challenges with India's EV sector

.png)

6 min read | Updated on July 20, 2024, 18:37 IST

SUMMARY

CII expects over 10 crore EVs to be registered in India by 2030. This raises an important question - do we have the infrastructure to support this growth? In this article, we evaluate the various challenges surrounding EVs. We take a step ahead to look at how these challenges can be converted into opportunities and stocks that could benefit from them.

EV industry still faces multiple challenges

In our last story on electric vehicles (EVs) we covered the rise of EVs in India. While EVs have come a long way, some critical challenges persist as we highlight in this article.

#1 Challenge - High Upfront Costs

Higher acquisition cost is a major deterrent for EV purchases in a value and price-conscious market like India. As we show in the table below, EVs are meaningfully expensive compared to their combustion peers,

Comparison of select EVs and their petrol counterparts

| EV Model | EV Price (in ₹ lakh) | Petrol Variant | Petrol Price (in ₹ lakh) | Difference (%) |

|---|---|---|---|---|

| Tata Tiago EV | 8.3 | Tata Tiago XE | 7.5 | 10% |

| Tata Punch EV | 11.5 | Tata Punch Pure | 7.2 | 37% |

| Citroen eC3 | 12.2 | Citroen C3 Feel | 7.2 | 41% |

| Tata Tigor EV | 13.1 | Tata Tigor XE | 7.4 | 44% |

| Average difference | 33% | |||

| Source: Cardekho |

Note: These prices are without the FAME subsidy and are Mumbai on-road prices of base variants. Under FAME subsidy the buyer would have saved ₹2.8 lakh on an average.

#1 Opportunity

The Ministry for Heavy Industries (MHI) has proposed three proposals for FAME III to push EV adoption. These proposals are likely to have a budget as high as ₹30,000 crore. This presents an opportunity for OEMs to have better pricing.

#2 Challenge - Charging Infrastructure

According to the Bureau of Energy Efficiency (BEE), India currently has ~23,731 operational public EV charging stations with ~42,189 EV chargers. At the end of FY24, there were a total of ~41,35,077 EVs registered. So, the ratio is 1 charging station per 175 EVs or 1 public charger per 98 EVs. According to a white paper by Alvarez and Marsal, released in July 2022, the ideal global ratio is ~1:3 EVs per public charger. This demonstrates the scope and size of this opportunity.

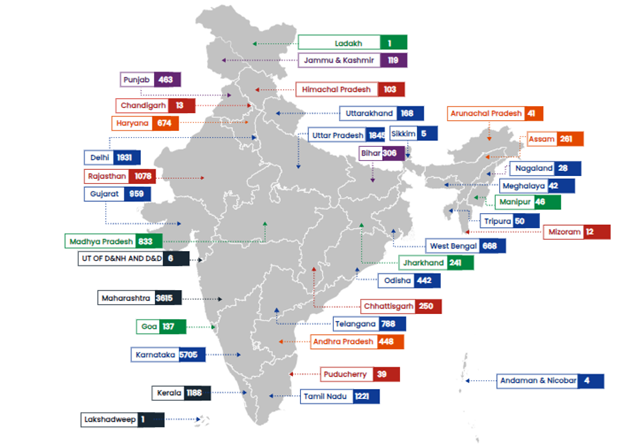

The below image shows state-wise public charging stations in 2024. Karnataka leads with 5,705 public charging stations, followed by Maharashtra housing 3,615 charging stations.

Source: beeindia.gov.in

#2 Opportunity

According to the Confederation of Indian Industry (CII) report, by 2030, ~10.6 crore EVs will be sold annually. While this is a lofty target, the sustained increase in EV sales presents great opportunities for Charging Point Operators (CPOs). Moreover, according to the EY Mobility Consumer Index (MCI) 2022 study, around 80% of global EV owners use home charging. This suggests the need for a strong home charging infrastructure.

With FAME III likely on the cards, the charging infrastructure is likely to get a boost as it did during FAME I and II.

#3 Challenge - EV Batteries

Battery technologies face challenges that slow their widespread adoption. Common issues include limited driving range, high maintenance costs, and a lack of charging stations.

#3 Opportunity

India should focus on a policy for battery swapping and uniform standards for EV batteries. Via battery swapping, EV owners can exchange a depleted battery for a fully charged one, without waiting for the depleted battery to be fully charged.

India has traditionally imported EV battery cells from China, South Korea, and Japan due to its limited local manufacturing capabilities. However, this is expected to change as India strives for self-sufficiency to meet the surging demand. S&P Global Mobility predicts that by 2030, 13% of India's EV battery demand will be met domestically.

#4 Challenge - Charging Time

People are used to waiting no longer than 5 minutes to fill up their combustion cars. The EV industry will need to align with this time frame. Today, rapid charging takes between 30-60 minutes.

Charging Time for Various Types of Chargers

| Charger Type | Speed | Time |

|---|---|---|

| Slow | 3 kW to 3.6 kW | About 8 to 12 hours |

| Fast | 7 kW to 22 kW | About 3 to 6 hours |

| Rapid | 43 kW to 50 kW | About 30 to 60 minutes |

Source: ackodrive.com

#4 Opportunity

Fast charging technology has made significant advancements, high-power charging stations can charge an EV battery to 80% capacity in just 15-20 minutes. Solid-state batteries, though still in development, offer faster charging times, higher energy density, and improved safety compared to traditional lithium-ion batteries.

Companies Likely to Benefit

The following are the listed companies that have their foothold in the charging infrastructure and battery manufacturing space. Moreover, the infrastructure, battery, and charging time challenges open new opportunities for these companies.

CPOs*

| Market cap (₹ crore) | ROE (%) | P/E | EV/EBITDA | 3 yr CAGR stock price growth (in %) | |

|---|---|---|---|---|---|

| Private companies | |||||

| Reliance Industries | 21,04,371 | 9.2 | 30.6 | 13.1 | 17.4 |

| Tata Power | 1,32,335 | 11.3 | 38.4 | 12.9 | 50.4 |

| Adani Total Gas | 97,718 | 20.5 | 146 | 84.8 | 2.9 |

| PSUs | |||||

| Power Grid | 3,08,966 | 18.3 | 19.8 | 10.5 | 36.7 |

| Indian Oil | 2,33,692 | 25.8 | 5.6 | 4.5 | 33.0 |

| Bharat Electronics | 2,23,899 | 26.4 | 56.2 | 37.2 | 71.8 |

| Bharat Petroleum | 1,31,804 | 41.9 | 6.8 | 4.9 | 10.2 |

| Bharat Heavy Electricals | 1,02,407 | 1.1 | 363 | 86.0 | 67.0 |

| Hindustan Petroleum | 72,697 | 40.4 | 4.5 | 4.9 | 22.9 |

Source: screener.in; *Data as of 19th July 2024; While revenue contribution from charging is currently low, these companies are likely to benefit from the opportunities in this space.

Battery manufacturers*

| Market cap (₹ crore) | ROE (%) | P/E | EV/EBITDA | 3 yr CAGR stock price growth (in %) | |

|---|---|---|---|---|---|

| Exide Industries | 45,942 | 7.1 | 54.3 | 25.0 | 44.7 |

| Amara Raja Energy & Mobility | 28,201 | 14.0 | 31.5 | 16.5 | 29.3 |

| Exicom Tele-Systems | 5,228 | 17.0 | 78.7 | 37.2 | 92.4* |

Source: screener.in; Data as of 19th July 2024; *The stock was listed on March 2024, hence, the returns are from 5th March 2024 to 19th July 2024.

EV component manufacturers*

| Market cap (₹ crore) | ROE (%) | P/E | EV/EBITDA | 3 yr CAGR stock Price growth (in %) | |

|---|---|---|---|---|---|

| Hindustan Copper | 29,765 | 13.5 | 101.0 | 49.7 | 31.0 |

| Tata Chemicals | 26,602 | 2.3 | 54.6 | 10.0 | 11.2 |

| JBM Auto | 23,032 | 16.3 | 129.0 | 40.8 | 113.0 |

| Himadri Speciality Chemical | 19,778 | 15.7 | 44.2 | 26.3 | 97.5 |

Source: screener.in; *Data as of 19th July 2024

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story