Upstox Originals

The $2.5 billion leak in India’s aviation industry

6 min read | Updated on October 13, 2025, 17:16 IST

SUMMARY

India’s aviation story is moving from the skies to the hangar floor. With airlines expanding fleets and global players setting up shop, aircraft repair is fast turning into India’s next billion-dollar opportunity. The country isn’t just buying more planes, it’s finally learning to keep them flying.

Indian airlines have ordered 1,359 new planes in the last two years, yet nearly 90% of their maintenance happens abroad

It’s called MRO, which is maintenance, repair and overhaul, the aviation world’s version of a garage. You can think of it like cars or bikes: buying one is exciting, but keeping it running is where the real work (and expense) lies.

And that’s where India’s story takes an unexpected turn. Despite building for the world, we still send most of our aircraft abroad for repairs.

Our airlines have ordered 1,359 new planes in the last two years, yet nearly 90% of their maintenance still happens abroad, mostly in Singapore, Dubai, or Kuala Lumpur. Every year, nearly $2.5 billion leaves India just to keep its planes flying.

It’s a quiet leak, but one that could turn into a billion-dollar opportunity if India decides to fix its own aircraft instead of exporting the work.

The global MRO boom and India’s missing piece

Every time airlines announce record orders, another side of the business quietly takes off, that is, maintenance.

With aircraft deliveries delayed and older jets flying longer, airlines are spending more just to keep their fleets airworthy.

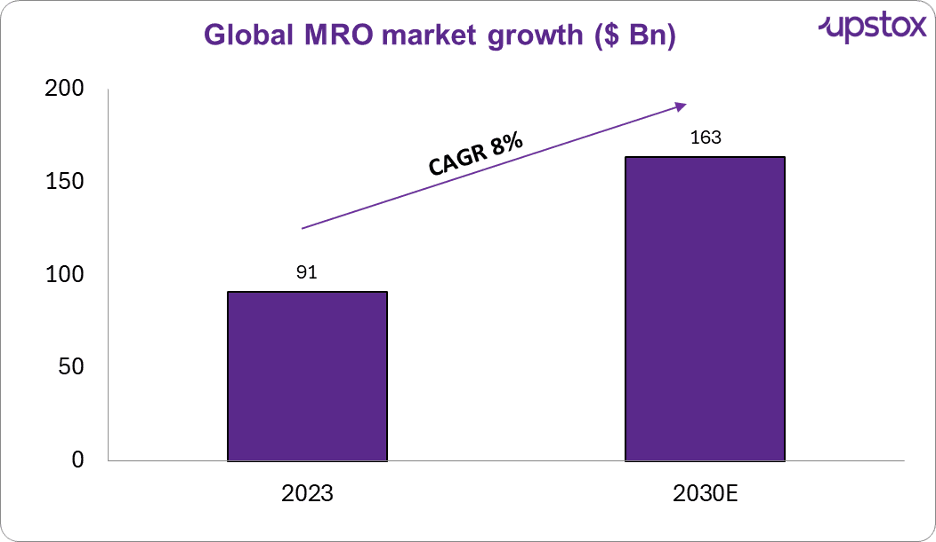

Sources: Grandview Research

That steady climb works out to a CAGR of roughly 8%, fuelled not by new aircraft rolling out of factories but by ageing ones that need more time in the hangar.

What’s happening beneath that growth is even more telling: manufacturers can’t keep up. Supply chains are tight. Repair capacity everywhere is stretched. In other words, the hangar has become the new factory floor, and that’s showing in the numbers. The average age of the world’s airline fleet has climbed to around 14 years, up from about 10 years a decade ago, as carriers hold on to older aircraft longer while waiting for delayed deliveries.

And as airlines scramble for maintenance slots, India’s underused ecosystem suddenly looks like the next big opportunity.

India’s place in the race

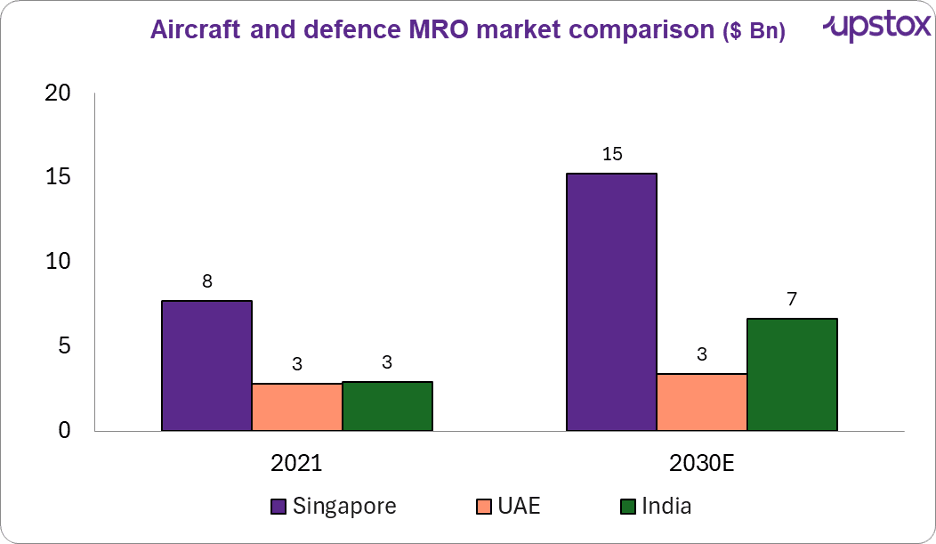

Now zoom in a little closer. Among Singapore, the UAE and India, the real story isn’t size, its speed.

Sources: Grand View Research

Singapore’s MRO market is growing around 8% a year, but that’s off a mature play, the post-pandemic rebound, not new momentum. It’s steady, not surging. The UAE shows a similar pattern, consistent 8% growth, driven by a few dominant carriers and its transit-hub advantage.

India’s curve, though, is different. With a projected 10% CAGR, it’s expanding from a smaller base, not plateauing from the top. That kind of acceleration doesn’t happen in saturated markets; it happens when an ecosystem finally clicks into gear.

And timing couldn’t be better. Global maintenance slots are full, OEM shops are booked out, and airlines are hunting for new, cost-efficient bases. India fits that gap perfectly, central, affordable, and now backed by policy momentum that’s making local repair work practical at last.

So, while Singapore and the UAE remain the benchmarks, India’s a startup in a legacy market, smaller today, but growing into the opportunity faster than anyone else, with the help of policies.

The policy pivot:- Taxes, timing and tailwinds

For years, India’s MRO industry was weighed down by policy friction, high duties, short customs windows and inconsistent tax rules that made it cheaper to service aircraft abroad. That’s finally changing.

-

Uniform 5% IGST (July 2024):- The government standardised import taxes on aircraft and engine parts, bringing India’s tax regime closer to regional MRO hubs such as Singapore and Malaysia.

-

Legal clarity (July 2025):- A Supreme Court ruling removed the risk of retrospective IGST on re-imported parts, a long-standing concern for airlines and MRO operators.

-

Simpler customs rules:- Re-export timelines for repaired components have been extended from six months to one year, easing turnaround pressure for local providers.

-

Infrastructure tailwinds:- While the 2025–26 Budget didn’t earmark funds for MRO directly, the broader airport-infrastructure expansion is freeing up land and logistics access for future hangar capacity.

These may sound like small tweaks, but they’ve cleared years of procedural turbulence. India didn’t need a flashy subsidy, just rules that stopped punishing those building here.

Building the hangar muscle

Policy reforms may have cleared the runway, but it’s the hangars that tell you how high India’s ambitions can really fly.

After years of scattered facilities and foreign dependence, the country’s aircraft-repair network is finally beginning to look like a connected ecosystem.

Here’s how India’s MRO map is taking shape:

| Location | Key players | Why it matters / What’s happening |

|---|---|---|

| Hyderabad | GMR Aero Technic, Safran | Hyderabad is emerging as India’s engine hub, with Safran’s new facility bringing work that once went to Singapore back home. |

| Nagpur | AIESL, Boeing | Nagpur’s hangars are taking on international airline clients, a first step toward global credibility in aircraft overhaul. |

| Jewar (Delhi–NCR) | Yamuna International Airport Ltd | North India’s upcoming aviation hub will have a dedicated MRO zone, expanding local repair capacity near Delhi. |

| Thiruvananthapuram | AIESL | Handles checks for domestic and regional fleets, now cleared to serve overseas carriers after new approvals. |

| Navi Mumbai | Adani Airports | The new airport’s plan includes a full-scale MRO zone, expanding capacity along India’s western aviation corridor. |

Source: IBEF, PIB, Aviation Week Network, Business Standard, Moneycontrol.

Together, these hubs mark the start of an MRO corridor, Hyderabad leading with engines, Nagpur anchoring heavy checks, Jewar and Navi Mumbai adding fresh capacity, and Thiruvananthapuram keeping regional traffic flight-ready.

It’s a shift you can see on the ground: hangars rising, partnerships forming, and a once-fragmented business finally connecting into a national industry.

Outlook

India’s aviation story is shifting from flying more planes to fixing its own. With global OEMs investing and local hangars finally scaling up, the country’s long-overdue MRO engine is starting to hum.

If the momentum holds, India won’t just assemble aircraft; it’ll keep them flying.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story