Upstox Originals

Sneakers aren’t just shoes, they’re assets

6 min read | Updated on September 11, 2025, 18:44 IST

SUMMARY

The first thing you do when you walk into a room is make a visual expression. And for Gen Z and millennials, sneakers do just that! Indians have a new obsession with the sneaker culture and they are going crazy to get their hands on the limited-edition pairs. The interesting thing is, they are investing (and not just buying) sneakers. This may sound surprising to many, so here’s a peek into India’s fast-growing sneaker market.

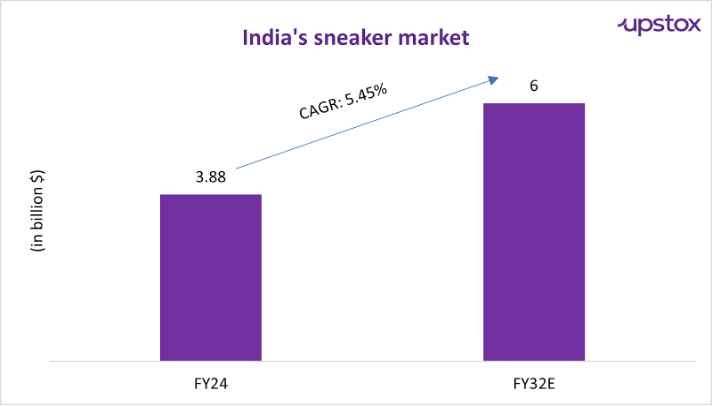

The sneaker market in India was worth $3.8 billion in FY24

If you have some extra savings, where would you invest?

Stocks, mutual funds, gold, real estate? Most of us would think of these conventional asset classes.

How about we tell you that sneakers are the latest asset class in town? (No, we’re not kidding!)

You can not only buy sneakers, but also invest in them!

Millennials and Gen Z surely know what we’re saying, but for others, here’s some tea!

Nike’s Air Jordan 1 OG Chicago sneakers were originally priced at $65 in 1985. Can you guess its current resale price? Drumrolls please. It's a whopping $30,000. That’s a return of 462x.

Nike Air Yeezy 2 Red October, released in 2014, carried an original price tag of $250. The current price for this pair is $9,500 — an impressive 3700% return in 11 years.

Clearly, sneakers can become solid wealth generators if the time and condition is right. A perfect example is Michael Jordan’s Bred Air Jordan 13s sneakers from the 1998 NBA Finals, which were sold for a record $2.2 million.

In case these numbers boggle your mind, wait till you find out more interesting facts!

Size of “Sneakerverse” in India

According to market estimates, Indians spent around ₹27,000 crore on buying sneakers in 2025.

The sneaker market in India was worth $3.88 billion in FY24 and is projected to reach nearly $6 billion by FY32, growing at a CAGR of 5.45%.

Source: Markets & data

But the Indian market is still in its nascent stage compared to the global sneaker market, which is projected to reach $120 billion by FY26.

The numbers show that there is immense growth potential in this market! Now you know why Indians are spending so much money on buying a pair of sneakers, the amount of money that could buy a few latest iPhones, fund a round-trip to Dubai, or even cover a month's rent in Mumbai (iykyk).

If you look at the sneaker resale market, it is almost 8x bigger than the primary market. Even investors are putting crazy money in this market –

| Company | Amount raised | Investors |

|---|---|---|

| Yoho | ₹47 crore | Gulf Islamic Investments (GII) and others |

| Comet | ₹42.3 crore | Elevation Capital |

| CHK | ₹21 crore | Accel and Bluestone |

| Mainstreet Marketplace | ₹16 crore | Nikhil and Nithin Kamath, Deepinder Goyal and others |

| SoleSearch | ₹6 crore | Venture Catalyst, Anthill Ventures and others |

| Find Your Kicks | ₹50 lakh | Shark Tank India with an all-shark deal |

What is getting investors excited about this market? Well, it’s because sneakers are an emerging investment product and a booming market.

What is driving the sneaker craze in India?

Well, there are several factors.

Firstly, growing “sneakerhead” culture among Gen Z and millennials, which together account for almost 70% of India’s total population. Gone are the days when sneakers were mere utility footwear. Today’s younger generation views sneakers as an expression of their identity and style, a status symbol and even an investment.

Besides, the cultural shift is driven by desi hip hop culture, international fashion trends, social media mania and the advent of NBA games in India.

Interestingly, sneakers are seen as conversation starters. Sneaker clubs, meetups and sneaker-focused communities are actively engaging to foster their shared passion. Adidas and Myntra even host “Sneaker Saturdays” to keep the hype alive. Social media platforms like Instagram, YouTube and Facebook further drive the obsession, turning every “drop” into an event.

Secondly, celebrity endorsements and influencer collaboration create hype among fans and followers, surging the demand and skyrocketing the value. For example, Adidas's Yeezy line collaboration with Kanye West and Nike's collaborations with Travis Scott and Off-White.

Thirdly, there is a theory called the “diamond water paradox”, which explains that the scarcer an item, the more value it holds. People are willing to pay a high cost to get their hands on it, simply because it's rare and hard to get. This is exactly what the “drop” culture taps into. Brands often release limited-edition sneakers, creating a sense of scarcity (FOMO) among buyers. The exclusivity and rarity drive up demand and consequently price appreciation on resale platforms.

Lastly, the marketplace is evolving. With the presence of specialist sneaker stores in India, such as VegNonVeg, SuperKicks, Hustle Culture, CrepDog Crew, etc., the sneaker culture has gained a lot of traction.

Food for thought: India’s sneakernomy is booming, with no end in sight. Sneakerheads don’t treat sneakers as just shoes; they buy them as investments. So, how does this asset class perform in comparison to other asset classes? Let’s find out!

Comparison of returns across other asset classes

While there isn’t a standard benchmark or a specific index that tracks return from sneaker reselling and returns vary widely depending on the brand, rarity, demand, and timing, here’s an idea of how they’ve performed in different cases to give a sense of the potential.

To make it simple, we’ve categorised sneakers into three broad categories:

- Average pairs: Most limited-edition sneakers resell for 20%–50% above retail price within weeks of launch.

- High-demand pairs: Iconic releases like Nike Air Jordans, Yeezy collabs, and rare Nike Dunks fetch anywhere between 200% and 500% returns.

- Ultra-rare pairs: Exceptional pairs like Air Jordan 1 OG Chicago can fetch returns of more than 10,000% over decades.

Here’s how the returns from other asset classes compare across timeframes:

| Timeframe | Equity (Nifty 50 TRI) | Gold | Real Estate (NHB Residex) |

|---|---|---|---|

| 1 year | 0.5% | 42.2% | 7.4% |

| 3 years | 14.3% | 27.6% | 6.9% |

| 5 years | 18.9% | 14.4% | 5.7% |

| 10 years | 12.6% | 15.2% | 5.2% |

| 15 years | 12.1% | 11.8% | 6.4% |

| 20 years | 14% | 14.7% | 7.7% |

Source: FundsIndia Wealth Conversations – August 2025 (Data till 31 July 2025)

Looking at the comparison above, we can say that sneakers have the potential to beat traditional asset returns, but let’s not forget, it’s a high-risk niche market driven by hype, scarcity, and culture. While most sneakers deliver modest returns, they also carry a risk of counterfeits, liquidity, and market volatility. So, one should invest wisely.

The question is no longer why Gen Z invests in sneakers, but would you?

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story