Upstox Originals

Slow internet? Look up

7 min read | Updated on August 28, 2025, 16:28 IST

SUMMARY

Ever wonder why internet can be so slow in some places? Low Earth Orbit (LEO) satellites might have the answer. Unlike traditional satellites far out in space, LEOs zip close to Earth, delivering faster, more responsive connections. They can reach places where cables and towers can’t - think mountains, deserts, or disaster zones. How would it feel to stay connected literally anywhere?

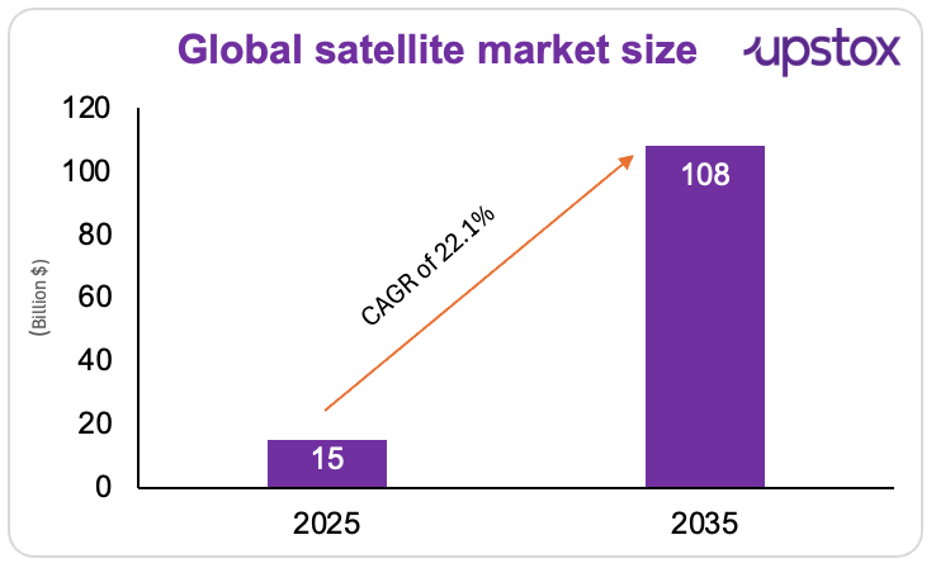

Goldman Sachs estimates the global satellite market is currently worth $15 billion

Nearly one in three people on Earth still can’t get online. Not because they don’t want to, but because cables can’t cross mountains, and cell towers can’t reach the middle of an ocean.

The fix? Not more wires. Not more towers. Just space-powered internet. But an army of 70,000 low-earth-orbit (LEO) satellites set to launch in just the next five years. These machines fly so close to Earth, that you could almost call them our neighbors in space. And it’s coming fast: companies like SpaceX (Starlink), Amazon (Project Kuiper), OneWeb, and Telesat are racing fast.

Why the switch? Traditional geostationary (GEO) satellites, parked high above Earth, have powered internet access for more than 25 years. But here’s the catch: at that altitude, even the fastest signal comes with a noticeable 500–600 milliseconds delay.

That’s fine for TV broadcasts, but useless for high-speed data or military comms. GEO links also need bulky dishes or heavy-duty transmitters. LEOs, flying much closer, slash latency to under 30 ms, lightning-fast enough for video calls, 6G networks, and real-time defense ops.

Goldman Sachs Research estimates the global satellite market, currently worth $15 billion, will balloon to $108 billion by 2035, because of the LEO satellites. And if things break right? The industry could skyrocket to a jaw-dropping $457 billion.

Source: Goldman sachs

What are Low Earth Orbit (LEO) Satellites, and how do they differ from traditional ones?

Think of satellites as “space helpers” orbiting Earth. They carry signals for the internet, TV, weather, maps- you name it. But here’s the catch, not all satellites fly at the same height.

LEO satellites are the new stars. They fly just 100–1,200 miles above Earth, so close they circle the planet in about 90 minutes. Because they’re nearby, signals travel faster, meaning high-speed internet with almost no lag. That makes them perfect for connecting villages, airplanes, ships, and remote regions where cables and towers can’t reach. No wonder companies like Starlink and OneWeb are betting big on LEO.

Traditional satellites, like those in Geostationary Orbit (GEO), sit much higher, around 22,000 miles up. A single one can cover a huge area, which is why they’re used for TV broadcasts, weather monitoring, and cross-continental calls. But since the signal has to travel such a long distance, connections can feel a bit slow.

A quick look at the key differences:

| Technology | Speed | Delay (Latency) | Where it works |

|---|---|---|---|

| LEO Satellite | Fast (~100 Mbps) | Very low (<30 ms) | Almost everywhere on Earth |

| GEO Satellite | Slow (<25 Mbps) | Very high (>500 ms) | Most of the world, but laggy |

Source: News articles

How much do satellite launches cost?

Because LEO satellites orbit so close to Earth, each one covers only a tiny patch of the planet. To serve millions of users, you don’t need a handful of satellites; you need thousands. Roughly 2,000 satellites, at about $10 million each, adds up to $20 billion just for the hardware. Getting them into orbit isn’t cheap either: a Falcon 9 launch costs $50 million and carries around 100 satellites. That means 20 launches, another $1 billion in costs. All in, you’re looking at a $21 billion price tag just to build and launch a constellation.

Then you go with GEO satellites. Think of them as five giant skyscrapers hovering 36,000 km above Earth. Each one costs nearly $200 million to build and needs its own rocket ride - another $80 million each. Do the math, and the whole system runs up to around $1.4 billion.

So what’s the trade-off?

- GEO = few satellites, huge coverage, but pricey and laggy.

- LEO = tons of satellites, cheaper, faster, but you need a mega swarm to make it work.

How are countries using LEO satellites?

Use cases of LEO satellites

| Use case | Real-world example |

|---|---|

| Maritime & Aviation | Royal Caribbean cruise ships use Starlink for onboard Wi-Fi; Delta Airlines taps Viasat LEO for faster in-flight internet |

| Emergency & Disaster Response | Scottish Ambulance Service streams patient vitals and video from remote areas; disaster teams coordinate rescue after hurricanes or earthquakes |

| Rural & Remote Connectivity | UK trialed LEO broadband in the Lake District where terrestrial networks fail |

| Human Spaceflight | International Space Station orbits 320–400 km above Earth, visible without a telescope |

| Earth Observation & Monitoring | Planet Labs’ LEO satellites regularly image Earth for agriculture and climate studies |

Source: ADB

What is India doing?

41% of the rural population in India still lacks access to the internet. LEO is gradually entering India’s digital plans, aimed at reaching areas that remain offline. Here’s how the country is playing its LEO hand:

Satellites over cables

Tata group company Nelco has inked a deal with French satellite giant Eutelsat to roll out OneWeb’s LEO satellite services across India. Under the pact, Nelco will work with OneWeb India Communications (Eutelsat’s local arm) to deliver secure, low-latency connectivity. And this isn’t just about getting Wi-Fi in villages.

Nelco says- “coverage will stretch across India’s borders, territorial waters, and remote corners, powering government, defense, and enterprise applications.” The rollout? Services will go live as soon as OneWeb’s commercial LEO operations kick off in India.

National security

This isn’t just about streaming movies faster in Ladakh. OneWeb already kept India’s defense forces online during the Myanmar earthquake, when nothing else worked. As Lt Gen Anil Kumar Bhatt (retd) puts it: “Today, the Army, Navy, and Air Force use GEO satellites. Tomorrow, LEO constellations will run their comms and even support weather forecasting, vital for defense ops.”

Start-ups shooting for the stars

India’s space start-up scene is exploding, 250+ players and counting, says IN-SPACe.

So how is India compared globally?

India takes a focused, purpose-driven approach to LEO constellations, using them to bridge the 41% rural connectivity gap and strengthen defense networks through global partnerships, defense pilots, and start-up innovation.

Globally, the focus is on scale and commercial dominance — Starlink leads with 6,000+ satellites, while Amazon’s Kuiper, China’s “GW,” and Russia’s “Sfera” rush to blanket the planet. The global model faces high costs, regulatory hurdles, and orbital congestion, highlighting India’s more targeted, hybrid strategy.

Why is it time for investors to get into low-earth orbit satellites?

The LEO satellite market is on the verge of a boom. Both private sector mega-constellations (SpaceX, Amazon Project Kuiper, OneWeb) and governments worldwide are investing heavily in LEO satellite technologies and deployments.

At the same time, they deliver sharper accuracy (less than 10 cm), faster connections, and reach places where GPS simply can’t.

The use cases? Everything from autonomous cars and smart cities to defense, telecom, farming, and disaster response. With regulators like Europe’s FutureNav already stepping in, the window to get in early is closing fast — which means investors who move now are likely to capture the biggest gains.

In summary

LEO satellites aren’t just a tech upgrade, they’re a whole new way to connect the world. They bring fast, low-latency internet to places cables and towers can’t reach, while also helping with defense, disaster response, and real-time applications.

With India and other countries jumping on board, space-powered internet is quickly turning from a cool idea into a reality we can actually use.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story