Upstox Originals

Shifting gears: Driving toward a $73 billion used car market

.png)

5 min read | Updated on August 23, 2024, 11:12 IST

SUMMARY

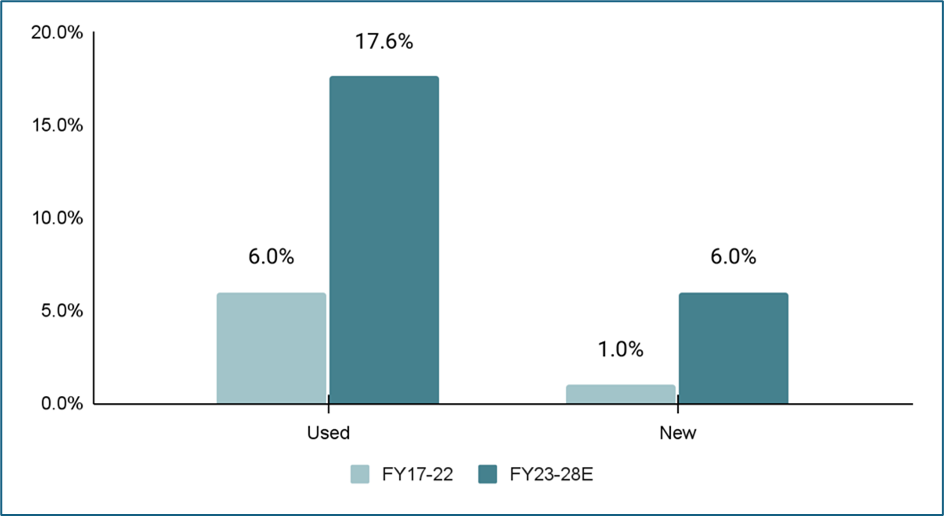

India's used car market is revving up - expected to grow at 17.6% over the medium term, versus only 6% for new cars. What is driving this bustling market and how will it impact new car sales? Let's dive into this high-speed lane.

Used car sales are projected to grow at a CAGR or 17.6%

India's used or pre-owned car market is not just growing – it's accelerating at breakneck speed. Fuelled by rising incomes, savvy consumers, and improving financing, among others this sector is poised to become a ~$73 bn industry by 2028, zooming ahead at a 17.6% CAGR. In contrast, India’s new car market is currently valued at ~$50-55 billion and is projected to reach ~$75-78 billion by 2030.

Used car sales growth expected to outpace new car sales

Source: Car&bike

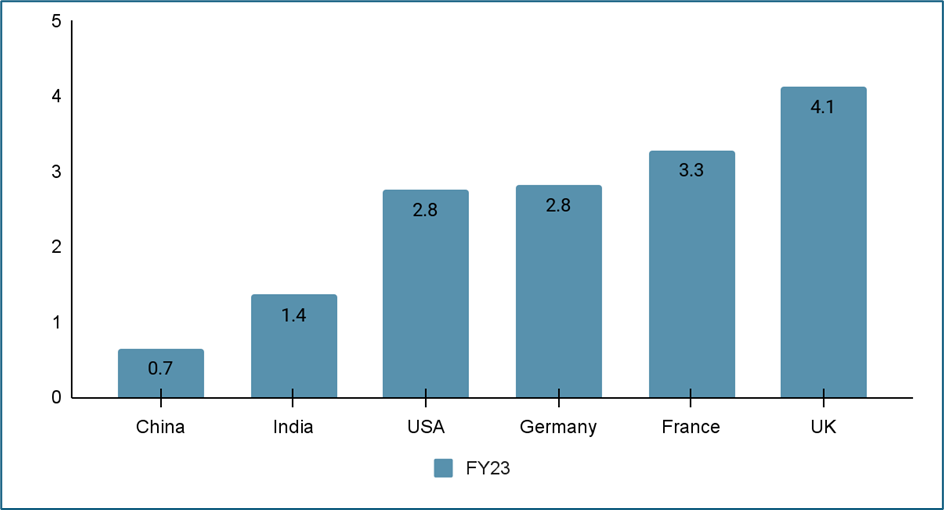

Compared to global peers, the ratio of used cars to new cars in India indicates a huge scope for market expansion. Reports by Car & Bike indicate that this ratio is expected to reach ~2.0x by FY33, which would still mean that the market remains under-penetrated.

The ratio of used to new cars by country (by volume)

Source: Car&Bike

Why are used cars in the fast lane?

50% increase in the cost of a new car

Per SIAM reports, the average selling price (ASP) of new passenger vehicles or cars has increased from ₹7.6 lakh in FY19 to ₹11.5 lakh in FY24, up by over 50%. Some of this price increase can be attributed to premiumisation and faster adoption of SUVs. However, other factors like an increase in regulatory stringency have all led to a sharp spike in new car prices in a relatively short period.

As a result, buyers are increasingly considering alternatives like used cars. As we show in the table below, consumers can buy a used car, which is only 3 years old - at a discount of around 15-20%

The table below compares the prices of new cars ex-showroom prices to similar used cars that are ~3 years old. We assume an average daily distance driven of ~20 km per day. Based on that, we have chosen used cars that have driven between 20,000 to 25,000 km.

Comparison of new and used car prices*

| Car | New car price (₹) | Used car price - 3 years old (₹) | Difference |

|---|---|---|---|

| Maruti Swift | 7,75,000 | 6,55,000 | -15% |

| Honda Amaze | 9,84,000 | 7,95,000 | -19% |

| Toyota Fortuner | 42,32,000 | 34,00,000 | -20% |

Source: Carwale; *Cars listed above are just listed for examples

Banks financing used cars

Used car loans have transformed. The emergence of online platforms has simplified the application process. Besides, while previous loans might have covered only 50-60% of a car's value, it's now common to secure up to 90% financing, even for used cars. Essentially, the industry with limited financing options now has more flexible loan terms, boosting used car ownership.

Favourable government policies

Used cars enjoy a significant tax advantage. Here’s a breakdown of GST rates for new and used cars

| Car type | New car GST | Used car GST |

|---|---|---|

| Small cars | 18% | 12% |

| Mid-size cars | 18% | 18% |

| Luxury cars | 28% | 18% |

Source: Cars24

Reduced ownership period

The average car ownership period has significantly shortened from 6-7 years just a few years ago to 4.1 years in 2023 and is projected to decrease to 3.5 years by 2028. This resulted in an increased supply of quality used cars.

Roadblocks ahead

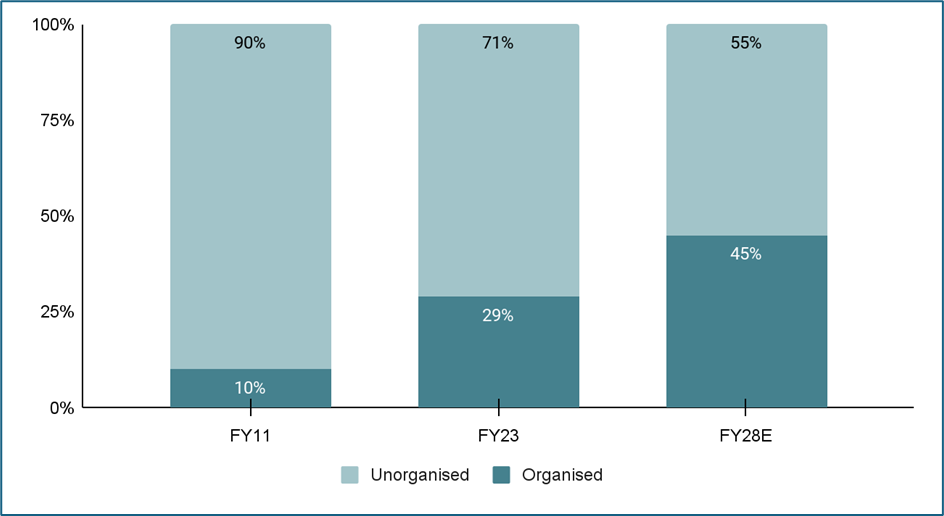

The Indian used car market remains largely unorganized, with only 29% of sales transacted through established dealerships. While this presents significant challenges for organized players, it also underscores the immense untapped potential of the market.

Organised dealer market share on the rise

Source: Car&bike

Another problem is supply constraints. Maintaining a consistent supply of quality used cars in the 4-6-year range creates a problem. Cars newer than four years are typically under warranty, and this is less likely to be sold out by consumers. While those older than ten years approach scrappage age, limiting availability. With the new car market growing slowly (as seen in the first chart), supply challenges for used cars could be further exacerbated.

Moreover, new car loans start as low as 8.5%, lower than the ~10-11% or more for used cars.

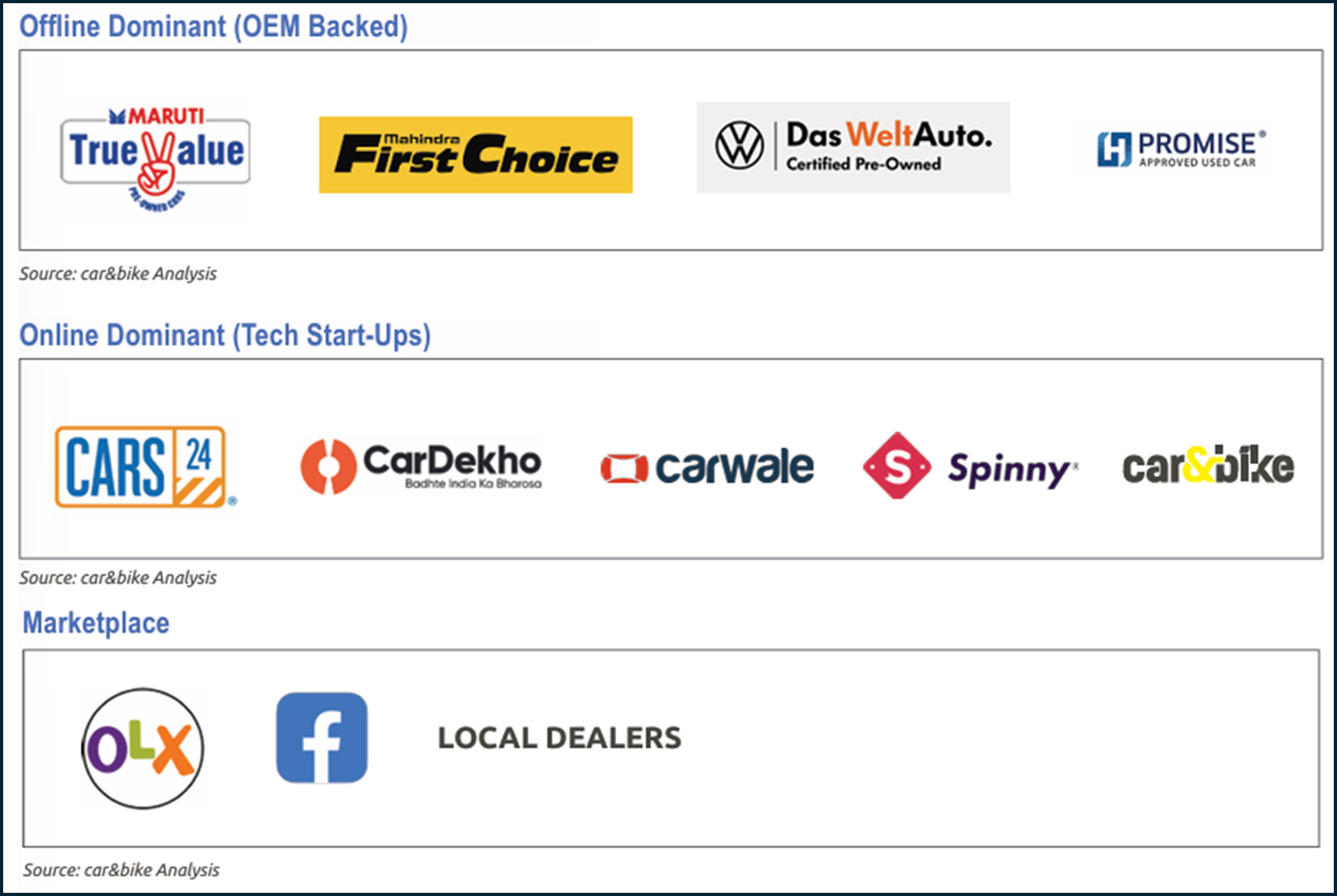

Let’s see a few of the key players in the used car market

Cars24: Gearing up for an IPO

Will this be a challenge for new car growth?

The key question now is - does this pose a major concern for car manufacturing companies? Here are a few points to consider:

-

Car sales continue to grow in developed countries, where used car penetration is high

-

Domestic companies are already offering used cars, capitalising on the trend and augmenting their business

-

With regulations like scrappage policy, consumers will be forced to discard cars beyond a certain age, which could support new car sales

-

Finally, in India, cars remain an aspiration. As such, the preference to buy new cars will likely persist, driving demand.

Conclusion

As the market matures and consolidates, early movers and well-positioned companies stand to benefit from this rapidly evolving sector. The used car market's growth trajectory suggests it could become a cornerstone of India's automotive industry, offering diverse investment opportunities across the value chain.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story