Upstox Originals

Saree vs. Fast Fashion: How India Is splitting its fashion wallet

7 min read | Updated on September 22, 2025, 13:25 IST

SUMMARY

Sarees or ₹999 tops, what’s really winning India’s wardrobe? Sarees hold the premium space for weddings and heritage, while fast fashion drives impulse buys and weekly wardrobe refreshes. Millennials are splurging on both, blending tradition with trend effortlessly, fueled by digital platforms, influencers, and sustainability initiatives. But which is truly shaping India’s fashion future?

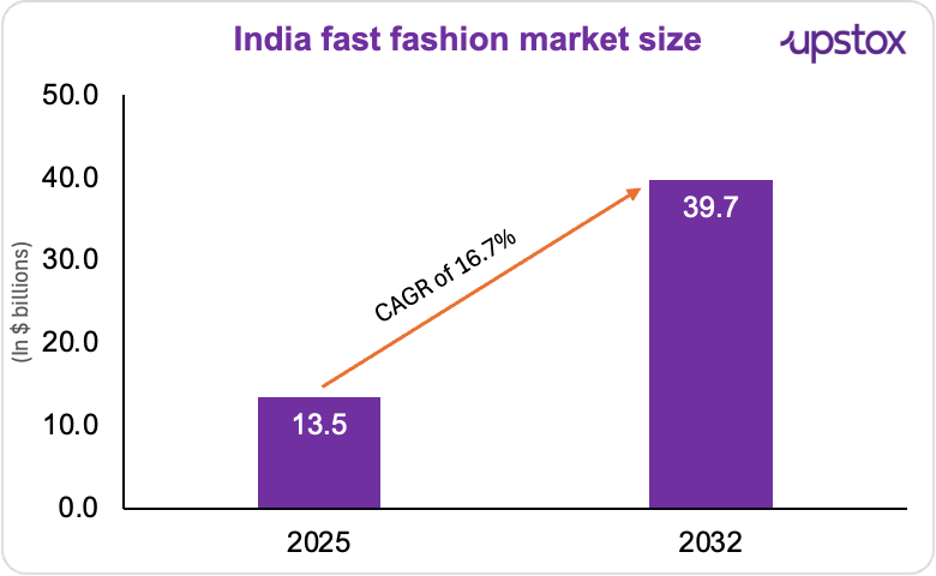

Fast fashion is an approximately $13.5 billion industry growing at a around 16.7% CAGR

India’s women’s wear market in 2025 is a two-horse race, heritage vs hype. On one side, sarees, the six-yard classic that still holds 33% of the market and fuels a $6.2 billion industry. On the other, fast fashion, a $13.5 billion juggernaut growing at a blistering 16.7% CAGR and flooding our feeds (and closets) with weekly trends.

The real story? It’s not just a fashion choice, it’s a clash of cultures. Sarees are riding the wave of handloom revival, conscious consumption, and wedding demand. Fast fashion is thriving on #OOTD culture, D2C disruptors, and impulse online buys.

And with India’s e-commerce market set to hit $345 billion by 2030, both sides are armed with the same digital slingshot, Flipkart, Amazon, ONDC, and Instagram influencers.

So how are these two carving their own paths? Let’s find out.

The Saree: India’s original power dress

Story in numbers

-

Sarees contributed 38% of India’s ethnic wear sales in 2023.

-

Overall handloom exports touched $ 10.9 billion in FY23, with saree manufacturing hubs like Varanasi and Kannur leading the charge, and the - US alone bought 29.4% of all handloom exports.

-

India’s handloom sector supports 3.5+ million artisans, 72% of them women, and runs on 2.8 million looms, making sarees a livelihood, not just a garment.

-

Kanchipuram and Mysore silk sarees make up ~50% of the national market. Gujarat & Maharashtra hold 19% share (Bandhani, Paithani), West Bengal & Odisha add another 19% (Jamdani, Sambalpuri). North brings the classics: Banarasi and Chikankari dominate with 14% market share from Punjab, Rajasthan, and Uttar Pradesh.

-

Rural India still accounts for 60% of saree sales by volume, but urban buyers are driving higher revenues with silk and designer pieces.

-

India’s saree industry offers millions of SKUs, built from 75+ fabrics and 70+ print techniques, meaning no two sarees need to look the same.

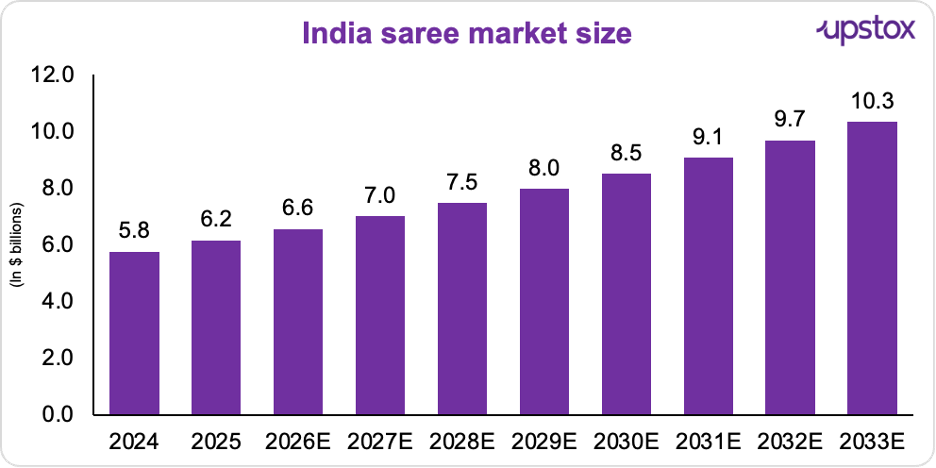

The saree remains more than just clothing. India’s saree market, currently valued at $6.2 billion, supports millions of weavers, dyers, and retailers. The market is expected to grow at a steady 6.5% CAGR through 2028, driven by wedding demand, ongoing urban interest in handlooms, and moderate growth in exports catering to global “heritage chic.”

Source: BS

Fast fashion: The challenger

Now look at the other side of the aisle. India’s fast fashion market was worth $13.5 billion in 2025 and is hurtling towards $39.7 billion by 2032, that’s a blistering 16.7% CAGR.

But what exactly is “fast fashion”? Think of it as clothing on steroids - brands that spot a trend on the runway or Instagram today and have it hanging on a store rack (or in your cart) within weeks. Short production cycles, cheap materials, and high volumes keep prices low and wardrobes constantly refreshed.

Source: ET

The drivers?

Global brands everywhere

Zara and H&M together clocked ₹7,600+ crore in revenue in FY24, proving that fast fashion is no niche play anymore.

Let’s break it down.

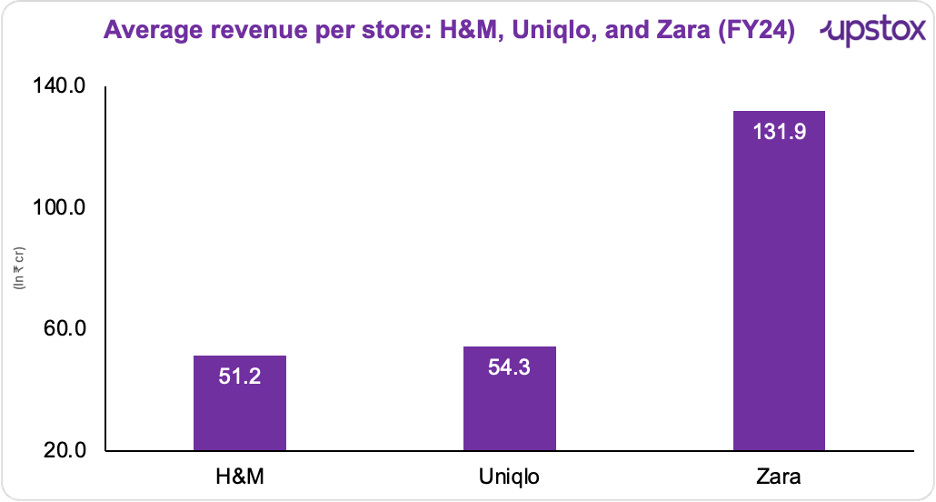

H&M led the charge with ₹3,278 crore in revenue, growing 11.4% YoY from FY23. Its 64 stores are busy selling everything from basic tees to statement coats — and yes, apparel, accessories, and footwear make up 100% of that number.

Zara wasn’t far behind, pulling in ₹2,769 crore — up 8.4% YoY. With just 21 stores, it’s a classic case of less is more, and it even managed to turn a ₹244 crore profit while doing it.

And then there’s Uniqlo - the Japanese giant that only entered India in 2019. It’s growing too, with ₹815 crore in revenue and a 31% jump YoY, expanding from metros into new cities with 15 stores already in place. Now, let’s have a look at the average revenue per store:

Source: ET

The Shein factor.

Guess who’s back? Shein.

Banned in 2020, Shein returned in 2024 via Reliance Retail, targeting $2 billion GMV by 2027. The strategy: Western wear at ₹350+, weekly drops, and feeds designed for impulse buying. For Reliance, it’s a bet on India’s Gen Z and their appetite for fast, Instagram-ready fashion.

Social media + influencer economy

India now has over 100 million content creators, and influencer marketing spend is expected to hit ₹3,000 crore ($360 million) by 2025 (up 25% YoY). #OOTD and haul videos are powerful triggers - a Bain report found that 40% of Gen Z purchase decisions are influenced by Instagram and YouTube trends, accelerating wardrobe churn and pushing demand for new drops almost every month.

Affordability & aspiration

₹999 tops, ₹1,499 dresses, fast fashion has made style accessible for Tier-2 cities. With growing demand for affordable, trend-driven clothing among urban youth and tier-2/3 consumers, it’s now a major driver of retail growth.

Homegrown hustlers

It’s not just the global biggies calling the shots. Homegrown challengers are thriving too.

Take Urbanic, Snitch, and NewMe - they’ve cracked the code by “Indianising” global trends and selling them at price points that don’t burn a hole in Gen Z’s pocket. And then there’s Zudio, Tata’s youth-focused fashion rocket ship. It’s already scaled to 765+ stores across India, making trend-driven wear accessible everywhere from metros to mini-metros.

A quick comparison

| Aspect | Saree | Fast Fashion (Modern Wear) |

|---|---|---|

| Key Market Drivers | Weddings, heritage revival, exports, handlooms, luxury demand | Youth-driven trends, impulse buys, social media influence, affordable fashion |

| Major Players | FabIndia, Suta, Tilfi, Sai Silks Kalamandir, Avantra, Taneira | Zara, H&M, Shein (via Reliance), Urbanic, Zudio, Snitch |

| Gen Z Buying Behavior | 20–50% of Gen Z buyers; preference for ready-to-wear, contemporary | High impulse purchases; trend-driven by Instagram & YouTube; affordable price points mostly under ₹1,500 |

| Consumer Insights | Sarees still own the premium space – 72% of urban millennials own one (or more). | Fast fashion is the everyday winner – 60% of millennials buy five or more pieces a year, often online. |

| Price Segments | 27% purchases above ₹10,000, showing strong premium segment growth | Majority of items priced sub-₹1,500 to appeal to wide urban and tier 2/3 customers |

| Sustainability Focus | Handloom sarees are already the OG slow fashion – 100% biodegradable and often passed down for generations. | Fast fashion is catching up: Iro Iro, Lovebirds, and Doodlage are championing natural dyes, organic fabrics, and recycling methods, while Virgio, once a fast-fashion D2C, has reinvented itself as a vegan-certified, circular model that investors love. |

The final drape: Living together, not competing

So, the story is actually about how India is splitting its fashion wallet. Sarees are going mainstream and aspirational at the same time – Sai Silks Kalamandir has filed for a ₹1,200 crore IPO, while Avantra and Taneira are expanding retail chains nationwide. Government push is strong too, with ₹30 crore for mega clusters and 15% yarn subsidies under NHDP and RMSS making the sector more competitive.

Fast fashion? It’s growing – companies like Savana, a digital-first brand with the same design DNA but a sharper price point, are going mass market. With most products under ₹1,000, Savana is positioned to compete with offline fast fashion players. At its massive warehouse in Gurgaon, Urbanic processes 6,00,000 to 10,00,000 pieces weekly, with a monthly capacity of over 3 million units. And brands like H&M and Zara are growing too.

Put all this together and you get one clear takeaway, this isn’t a battle for market share. It’s a coexistence story. Sarees will keep their crown for heritage and occasion wear, while fast fashion will dominate impulse and everyday buys.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story