Upstox Originals

Pharma powerhouses: The pulse of India’s generics industry

.png)

6 min read | Updated on November 25, 2024, 13:32 IST

SUMMARY

India's generic drug industry plays a crucial role in global healthcare by producing cost-effective medicines across branded generics, biosimilars, and APIs. Companies like Torrent Pharma, Biocon, Aurobindo Pharma, and IOL Chemicals maintain growth through strategic product diversification and export leadership.

Stock list

Exports form a significant part of pharma companies' revenue

Key terms you should know before we start

- Generics - Medicines that don't have a brand name and are generally known by their chemical names like amoxicillin and paracetamol

- Branded generic - Generic drugs that have a brand name attached to it.

- Active Pharmaceutical Ingredients (or APIs) - Core components that give medications their therapeutic effects.

Why we choose these companies

Each of these pharmaceutical companies stands out by offering unique products and services, as you will see below:

-

Aurobindo Pharma: Known for in-house API production (52%) and a focus on complex generics and biosimilars in immunology and oncology.

-

Biocon: Diversified across generics, biosimilars, and novel biologics with proprietary technology for insulin production. It also has a strong presence in contract research and manufacturing services via Syngene International

-

IOL Chemicals and Pharmaceuticals: The world’s largest Ibuprofen producer with full backward integration and customized API offerings.

-

Torrent Pharmaceuticals: Focuses on chronic therapies with branded generics and a highly productive, specialized sales force. They operate in over 100 countries and focus on areas like cardiovascular, central nervous system, gastrointestinal and diabetes among others.

Let see their performance

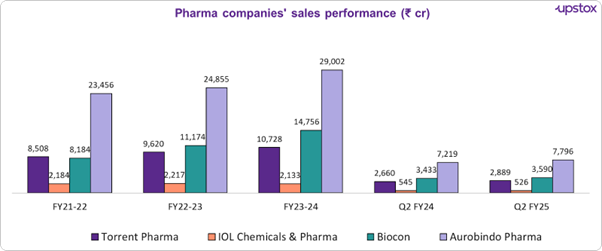

Sales performance

The industry demonstrates consistent growth driven by increasing domestic demand and global export opportunities. At an industry level, the sector has delivered an ~11% revenue CAGR with the top 3 players - Biocon (34% CAGR), Aurobindo (11% CAGR) and Torrent (12% CAGR) leading the growth.

Key drivers: Chronic therapies (e.g., cardiovascular, diabetes) dominate sales in domestic markets, while generics for acute conditions and injectables lead in exports.

Source: Screener.in

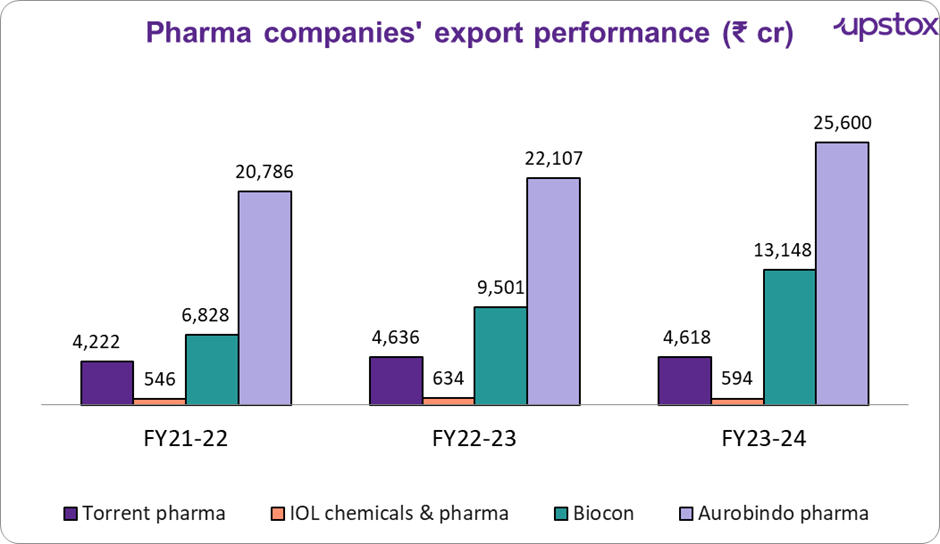

Export contributions

Global market share: India supplies 20% of the global generics demand, with key markets like USA, Europe, and emerging economies accounting for a majority of export revenues.

Growth focus: As can be seen from the chart below, exports form a meaningful part of their total revenues, going as high as 90%. Companies like Biocon and Aurobindo lead exports in niche areas like biosimilars and specialty generics, tapping regulated markets with FDA and EMA approvals

Source: Annual report

Gross margins

Gross margins in the Indian generic drug industry reveal its manufacturing cost efficiencies and strategic focus on high-value products. The average gross margin across key players hovers around 58-59%, with consistent performance due to:

-

Raw material sourcing: Proximity to cost-effective raw material suppliers and backward integration in API production help sustain competitive margins, for eg: Aurobindo focuses on local sourcing and backward integration to cut costs and reduce dependency on Chinese suppliers. IOL emphasizes complete backward integration for Ibuprofen and is expanding this to other APIs to ensure cost control and supply chain security.

-

Product mix: Branded generics command higher margins, especially in domestic markets, while exports of specialty generics and biosimilars ensure stable profitability. While companies focusing on branded formulations and biosimilars report margins between 67-70%, those reliant on APIs or bulk generics face more variability due to pricing and demand shifts.

Gross margins trend

| Company | FY22 | FY23 | FY24 | Q2 FY24 | Q2 FY25 |

|---|---|---|---|---|---|

| Torrent pharma | 71% | 72% | 75% | 75% | 77% |

| IOL chemicals & pharma | 28% | 30% | 34% | 35% | 32% |

| Biocon | 67% | 67% | 67% | 67% | 67% |

| Aurobindo Pharma | 57% | 55% | 57% | 55% | 59% |

| Average | 56% | 56% | 58% | 58% | 59% |

Source: Screener.in

EBITDA and margins

Over the past three fiscal years, the industry has experienced steady growth, with an average EBITDA margin stabilizing between 19-21%.

This margin is driven by:

-

Specialty generics: Niche investments, and high-margin products such as biosimilars and injectables have boosted margins for companies focusing on innovation. For eg:- Biocon came up with advanced biosimilars, AI-powered drug discovery with Syn.AI, and focus on next-generation therapies including cell and gene therapies. Others like IOL have continuous flow technology, enzymatic bioconversions, that have helped boost margins.

-

Economies of scale: Leading players leverage large-scale production to minimize per-unit costs, especially in high-demand export markets like the U.S. and Europe. For eg:- Biocon maximizes value through integrated operations and strategic convergences in therapy areas like diabetes and oncology.

-

Geographical diversification: Companies benefit from revenue streams across regulated and emerging markets, balancing pricing pressures in developed economies with volume growth in others.

EBITDA (₹ cr) performance

| Company | FY21 | FY22 | FY23 | Q2 FY24 | Q2 FY25 |

|---|---|---|---|---|---|

| Torrent pharma | 2,431 | 2,842 | 3,368 | 904 | 939 |

| IOL | 257 | 227 | 232 | 51 | 42 |

| Biocon | 1,793 | 2,412 | 3,216 | 717 | 685 |

| Aurobindo Pharma | 4,396 | 3,707 | 5,826 | 1,373 | 1,566 |

| Average | 2,219 | 2,297 | 3,161 | 761 | 808 |

Source: Screener.in

Trend in EBITDA margin

| Company | FY21 | FY22 | FY23 | Q2 FY24 | Q2 FY25 |

|---|---|---|---|---|---|

| Torrent pharma | 29% | 30% | 31% | 32% | 32% |

| IOL | 12% | 10% | 11% | 12% | 8% |

| Biocon | 22% | 22% | 22% | 21% | 19% |

| Aurobindo Pharma | 19% | 15% | 20% | 19% | 20% |

| Average | 21% | 19% | 21% | 21% | 20% |

Source: Screener.in

Valuations

Finally, we look at some of the key valuation metrics in this space in the table below

| Company | Mar cap (₹ Cr)* | CMP / BV | EV / EBITDA* | ROE % | 3-Year Stock Return % (2019-24)* | 3-Year Profit Growth % (2019-24) |

|---|---|---|---|---|---|---|

| Torrent Pharma | 1,05,098 | 14 | 30 | 24 | 31 | 10 |

| Aurobindo Pharma | 71,426 | 2 | 10 | 12 | 26 | 5 |

| Biocon | 38,791 | 2 | 11 | 5 | -3 | 27 |

| IOL Chemicals | 1,998 | 1 | 9 | 9 | -9 | 3 |

| Average | 54,328 | 5 | 15 | 12 | 11 | 11 |

Source: Screener.in; *Data as on November 21, 2024

Conclusion

The Indian generic drug industry exemplifies the blend of scale, innovation, and operational excellence. Companies leveraging branded generics, specialty formulations, and biosimilars are poised for sustained growth. Despite challenges like pricing pressure and global scrutiny, strategic investments in R&D and product diversification ensure the industry’s leadership in global healthcare.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story