Upstox Originals

Pawlicy matters: Because pets deserve more than just treats

.png)

8 min read | Updated on July 29, 2025, 14:55 IST

SUMMARY

More Indians are opening their hearts and homes to pets, but when it comes to insurance, most still haven’t caught on. This piece explores why pet insurance is gaining ground globally, and how India is slowly warming up to the idea, one vet bill at a time.

Did you know over 55% of Indian households now have a pet?

Did you know over 55% of Indian households now have a pet? That’s more than half the country embracing furry (or feathery) companions as part of the family. And just like any loved one, we’re happy to spend on their food, toys, and regular check-ups.

But while most of us wouldn’t think twice about health insurance for our parents, kids, or even ourselves, why not for our pets? With veterinary costs rising and pets living longer, a quiet shift is underway: more Indians are now considering pet insurance as a practical way to protect both their animals and their wallets. After all, if pets are family, shouldn’t they be insured like family too?

A growing trend around the world

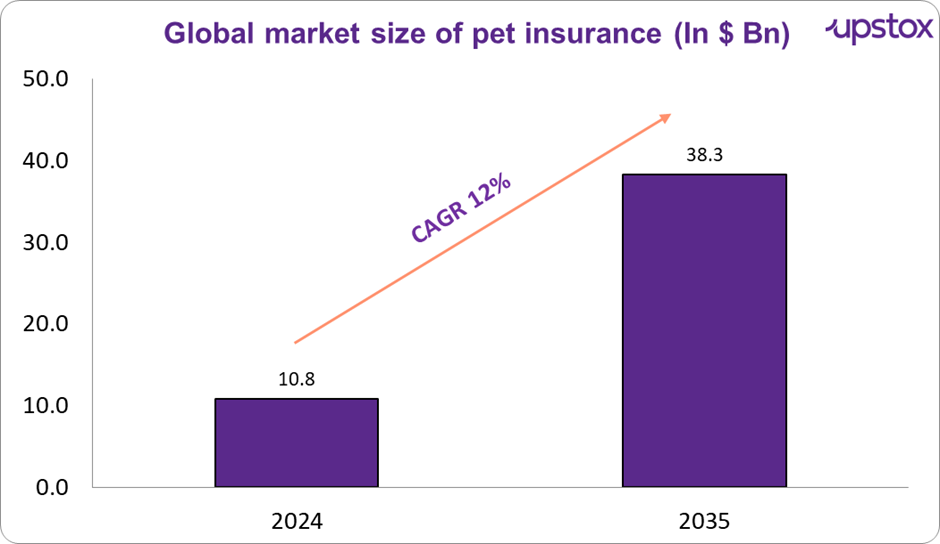

Around the world, pet insurance is no longer just a niche idea, it's quickly becoming big business. In places like the UK, Sweden and the US, loads of pet owners already have insurance for their animals. And it’s not slowing down anytime soon, the global market is expected to grow by 16.4% a year all the way till 2032. So, what’s driving this boom? Vet bills are getting pricier, treatments are getting fancier and most importantly, people are starting to see pets not just as companions, but as family.

Source: Metatech Insights

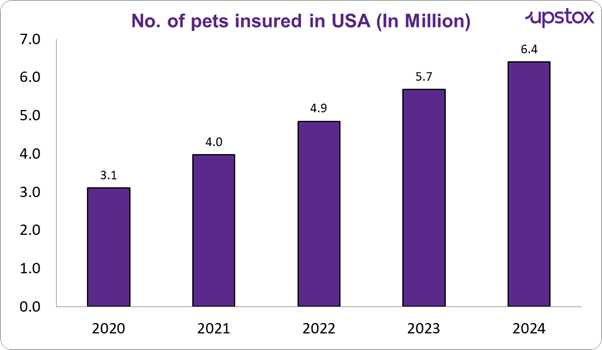

If we look at the number so far, adoption rates vary dramatically. Sweden leads globally (~80% insured), followed by the UK (~30%) and other Northern European countries. But in the US and most of Asia, it’s still early days, with less than 5% of pets covered.

That might sound low, but here’s the twist: in the US, pet insurance has actually grown at 20% a year over the last four years.

Source: Naphia.org

So, what’s driving all this growth?

-

Pets as family: More owners now treat their pets like children—“fur babies”—which makes them more willing to invest in insurance, especially younger generations who are used to subscription services.

-

Soaring vet bills: The average American dog owner spends about $1,242 per year on vet bills, even routine care like check-ups and vaccinations can cost between $700 and $1,500 annually. Emergency surgery? That can easily run $2,000 to $5,000, with some complex procedures climbing to US $6,000–$10,000 per leg in cases like tibial plateau level osteotomy.

-

Pandemic pet boom: Lockdowns led to a surge in pet adoption, creating a larger customer base and deepening emotional bonds—along with concern over costly vet emergencies.

-

Tailored policies: People want more than basic cover. Insurers now offer personalised plans for breeds, senior pets, and even exotics, plus perks like wellness cover, tele-vet services, and multi-pet discounts.

-

Tech upgrades: AI-based claims, mobile apps, and wearable health trackers are transforming the experience—faster, easier, and more transparent.

-

Better regulation: Rules like the NAIC’s Pet Insurance Model Act in the US bring clarity and protection, encouraging more people to trust and buy in.

-

Growing awareness: Vets, employers, and animal charities are educating pet owners, normalising insurance as part of responsible pet care.

So, while Sweden’s pets are practically card-carrying insurance members, what’s happening in India?

Turns out, we’re not there yet, but we might be on our way. As more Indians welcome pets into their families and face rising care costs, pet insurance is slowly starting to get a paw in the door

India’s pet insurance: Early days, but gaining ground

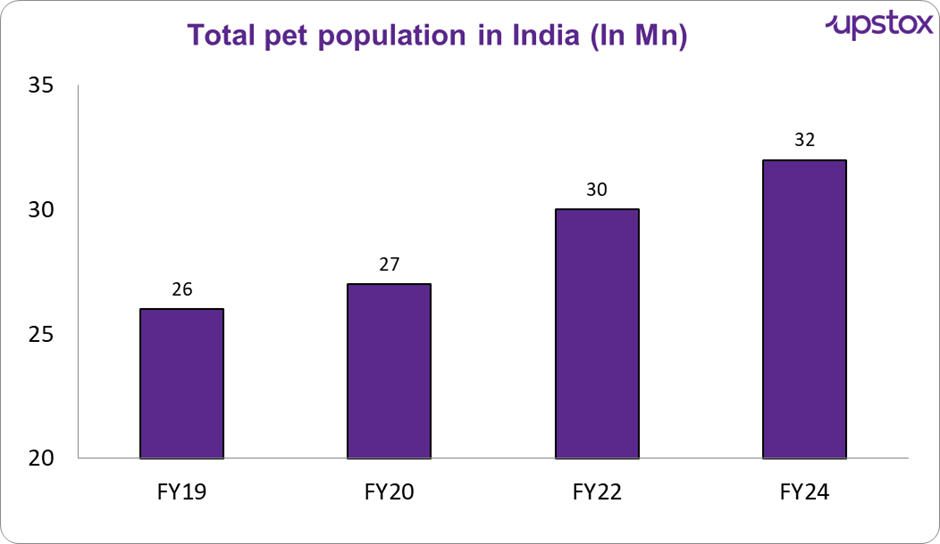

Source: Redseer Strategy Consultants, From Kibble to Care

Pet ownership in India has grown modestly, up by around 4–5% since 2019. Part of this increase can be traced back to the pandemic, when lockdowns led many to adopt strays or rescue animals in search of companionship. It was a time when pets didn’t just fill homes, they filled hearts.

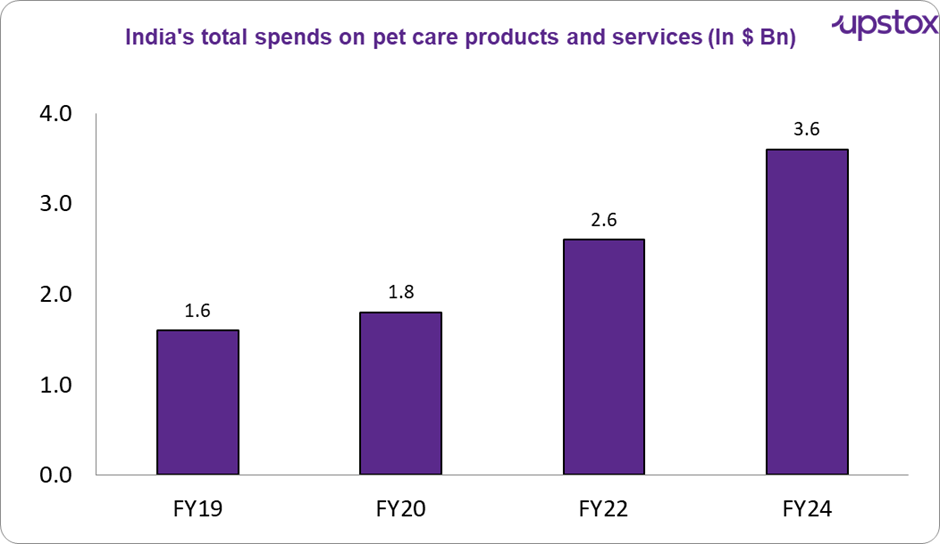

Source: Redseer Strategy Consultants, From Kibble to Care

Pet care spending in India has doubled since 2019. As of 2024, the split is quite clear: around 53% goes to services like grooming, boarding and vet visits, while 47% is spent on products such as food, toys, and accessories. It’s a telling sign of how pet parenting is becoming more involved and service-driven.

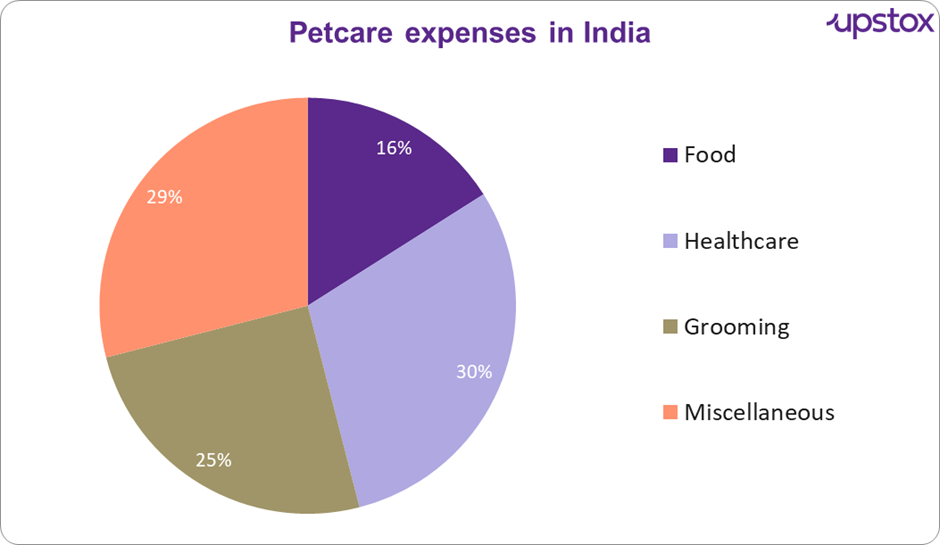

What about how much is being spent on pet here

Source: Redseer Strategy Consultants

Pet spending in India is rising fast, Redseer’s recent study found that pet parents in India spend an average of around ₹50,000 per year on pet care, with over half of that going toward services like grooming, boarding and vet visits. The rest covers essentials like food, toys and accessories.

What’s covered in the insurance

Most Indian pet insurance offers the basics, and a bit extra. While the level of cover varies between firms, this is what is normally included:

Core medical cover

- Accidental injury – fractures, cuts, and emergency treatment

- Illnesses – infections, bowel disorders, long-term illnesses

- Hospitalisation and surgery – emergency or elective surgeries

- Death due to illness or accident – covers cremation/burial costs in certain policies

Other benefits (dependent on the plan)

-

OPD consultations – routine pet visits or follow-up tests

-

Diagnostic examinations – X-rays, blood work, scans

-

Preand post-hospitalization care – medication, follow-up, home recovery

-

Third-party liability – cover against harm or damage caused by your pet to other individuals

-

Pet loss or theft – especially of expensive breeds

-

Wellness and vaccination cover – preventative treatment like deworming and vaccinations

-

Death rites or funeral fees – a specialty but more extensively offered

These are typically provided as add-ons or packages. Tele-vet access, protection against grooming, and multi-pet discounts are also offered by some insurers to families with multiple pets.

So what do these policies actually look like?

Most pet insurance providers in India, including Bajaj Allianz, HDFC ERGO, Universal Sompo and Future Generali, offer standard plans that cover accidents, surgeries, illnesses, hospitalisation, and optional add-ons like OPD visits, vaccinations and even funeral costs.

Monthly premiums usually start around ₹300 to ₹700, while more comprehensive annual plans can range from ₹2,000 to ₹15,000, depending on what’s covered. Coverage limits typically fall between ₹50,000 and ₹1 lakh per year.

Premiums vary based on factors like the pet’s breed, age, size and location, with cats generally costing less to insure than dogs. Exotic and pedigree breeds also tend to have higher premiums, given the increased health risks and cost of care.

Challenges this sector faces

Low awareness and mindset gaps

To the average pet owner, insuring a pet remains alien or unnecessary. While they'll spend money freely on treats and toys, insurance is rarely on the agenda, largely due to ignorance or not realizing it's an option.

Limited coverage limits

All but the very expensive Indian pet insurance policies have a limit of about ₹50,000 to ₹1 lakh annually. But one surgery or one emergency hospitalization can eat up most of that, and pet parents are left with the rest. More expensive plans exist, but they're not very popular and expensive.

Fine print and exclusions

Policies usually feature an extremely long list of exclusions, pre-existing conditions, genetic conditions, pregnancy-related expenses, and even some breeds. This might enrage pet parents, particularly when claims are rejected for reasons they never anticipated.

Focus on dogs alone

The majority of the present policies in India insure dogs only. Cats, birds, and other animals are not included in the insurance debate despite growing ownership in these classes.

Poor vet infrastructure

As compared to cover for human health, which is based on a large network of hospitals, pet cover has no definite vet network, cashless claims are hence not feasible. Reimbursement is the usual pattern but entails paperwork and delay.

Lack of standardised prices

Vet expenses can differ greatly among clinics, cities and even breeds. This makes underwriting difficult for insurers and leads to varying claim experience for pet owners.

Outlook

Pet insurance in India may still be in its early stages, but the fundamentals are falling into place, rising pet ownership, costly treatments, and increasing emotional investment. For insurers, the opportunity lies in building trust, expanding offerings beyond dogs, and simplifying the claims experience. If done right, pet insurance could soon become as common as health cover for humans because after all, pets are family too.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story