Upstox Originals

Paneer vs. cheddar: A dairy race across continents

6 min read | Updated on September 04, 2025, 15:58 IST

SUMMARY

Paneer is having its big moment. India’s creamy staple is no longer just a kitchen classic, it’s now a billion-rupee business rewriting the rules of dairy. Meanwhile, across the ocean, America’s cheddar ages gracefully in cellars, slower in growth but rich in craft and heritage. Together, they show how technology, culture, and consumer tastes are reshaping the global dairy playbook

The Indian paneer market is worth ~$8.9 billion in 2025

In Gujarat, dairy looks nothing like the old days. Cows wear digital sensors, milking machines run on autopilot, and blockchain platforms track milk from farm to fridge. Paneer today travels in refrigerated trucks, guided by AI tools that predict where demand will spike next week. Add digital ads, and paneer has gone from a local kitchen staple to a branded product with national and global ambitions.

Now, in Wisconsin, walk into a small-town cheese shop and see rows of cheddar, some aged for years, others smoked or spiced. Behind the artisanal feel is a modern system. Cold storage preserves flavor, AI aligns production with demand, and campaigns make cheddar part of a lifestyle across the US and beyond.

So why paneer and cheddar? Because they tell two sides of the same dairy story. Paneer is racing ahead on scale and speed; cheddar is pacing itself with craft and depth. Together, they reveal how culture and supply chains can shape the future of what ends up on our plates.

Paneer: From kitchen staple to billion-rupee superstar

For generations, paneer was simple. Milk, heat, a squeeze of lemon, curds pressed into white blocks for curries and snacks. It was never “industry,” just tradition. But somewhere between old village kitchens and today’s urban supermarkets, paneer reinvented itself.

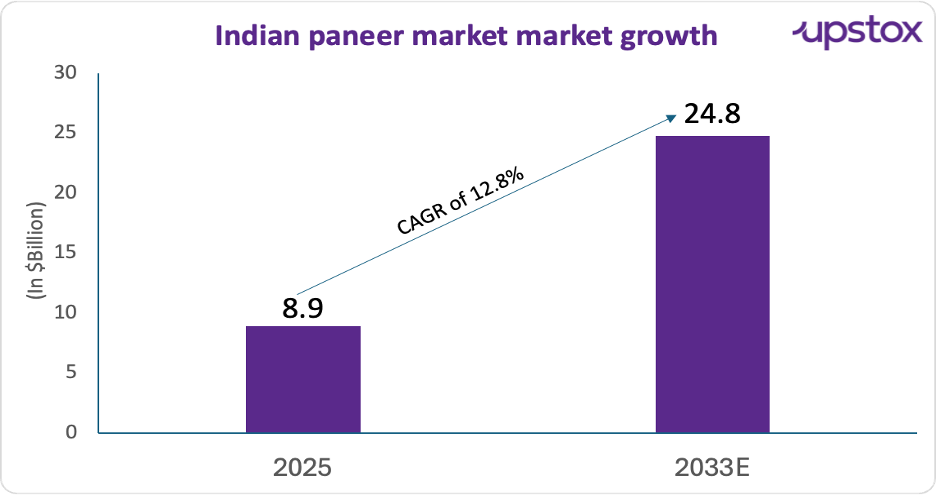

The Indian paneer market is worth ₹732 billion ($8.9 billion) in 2025 and is forecast to soar to ₹2 trillion ($24.8 billion) by 2033 with a CAGR of 12.8%.

Source: www.imarcgroup.com

So, what changed? Technology walked into the dairy shed. By using genomic testing, a process that studies a cow’s DNA to identify traits like higher milk output or disease resistance, farmers are able to breed stronger herds.

Automated coagulation and whey-separation machines deliver a paneer that’s consistent, hygienic, and scalable. Paneer production has moved from uneven, small-scale setups to more standardised systems that make it easier to supply supermarkets and restaurants nationwide.

The rise of the protein hero

Paneer has caught the wave of India’s protein obsession. With gyms sprouting everywhere and diet trends flooding social media, young Indians are looking for protein-packed foods that fit vegetarian lifestyles. Paneer ticks every box - versatile, tasty, and close to animal proteins like chicken and eggs.

And the demand isn’t staying domestic. Paneer is turning up in Indian grocery stores abroad, in London or New Jersey, sitting next to feta and halloumi. By 2025, the global paneer market is valued at around $10.8 billion, and it’s projected to grow steadily to approximately $18.5 billion by 2033. India isn’t just consuming, it’s exporting culture through food.

The quiet giants behind paneer’s boom

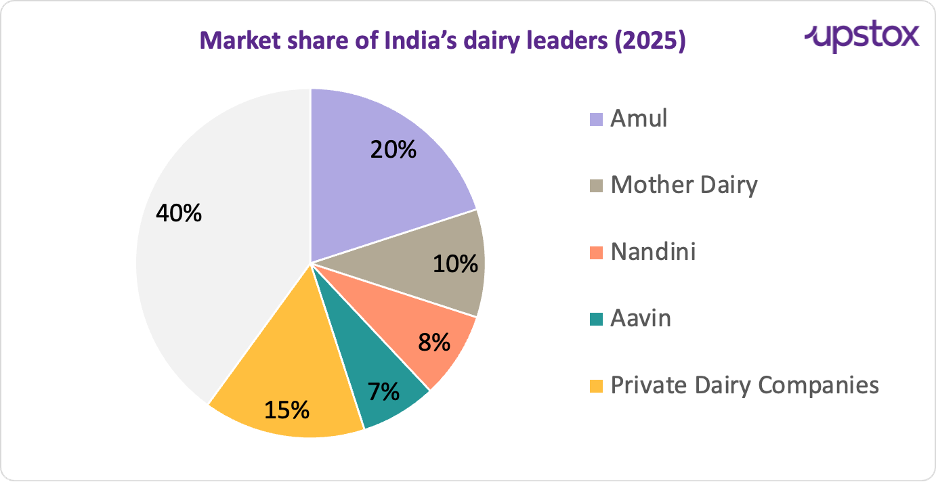

Interestingly, India’s paneer story isn’t being led by flashy startups or venture-backed disruptors. Instead, it is shaped by a powerful network of cooperatives and established dairy companies that dominate the market. Amul remains the undisputed leader with an estimated 20% national market share and revenues of around $8 billion.

Mother Dairy follows with nearly $2.1 billion in revenues and a commanding presence in Delhi-NCR. Together, these two giants anchor India’s dairy economy, proving that cooperative strength outweighs startup buzz.

Source: IMARC Group report

Amul and Mother Dairy together anchor nearly one-third of India’s organised dairy market.

Also, startups like Akshayakalpa Organic, clock a monthly turnover of about ₹30 crore. Others, such as Country Delight and Puresh Daily, are also expanding steadily.

The challenge behind the boom: Fake paneer

As India’s paneer market grows rapidly, it faces an equally swift challenge: the rise of adulterated or “fake” paneer. Often made with starch, detergents, synthetic agents, palm oil, or skimmed milk powder, this counterfeit product compromises not just taste and quality, but consumer health.

Recent food safety raids underscore the scale of the issue: in Pune, 1,400 kg of fake paneer was seized; Uttar Pradesh destroyed 2,500 kg, while Delhi-NCR saw an interstate racket busted for supplying synthetic paneer using harmful additives. Health experts warn that consuming such paneer can lead to food poisoning, organ damage, allergic reactions, and even long-term cancer risks.

Regulatory bodies like the FSSAI are stepping up, conducting over 500 enforcement actions in 2025 alone. However, fragmented supply chains, low consumer awareness, and weak testing infrastructure continue to pose significant hurdles. For India’s dairy sector to scale globally, ensuring product safety and trust must go hand in hand with growth. Paneer’s future relies not only on quantity but on quality assurance at every step of the value chain.

Meanwhile, in America’s cheddar world…

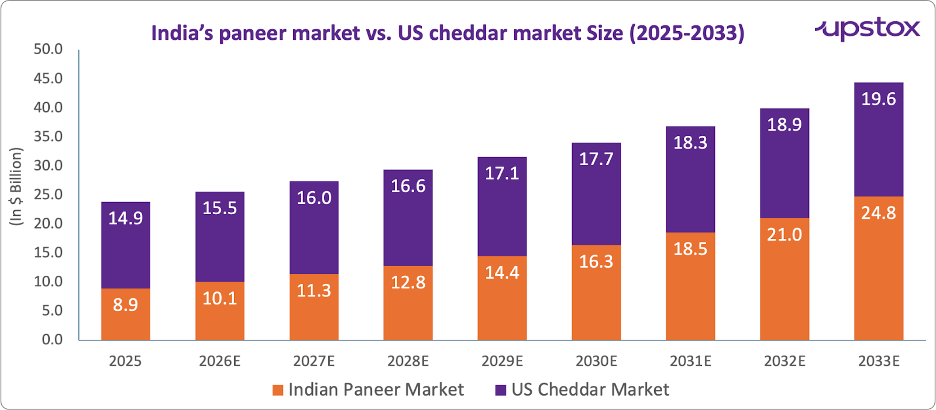

Now let’s head west. In the United States, cheddar is part of everyday life layered in burgers, melted over sandwiches, or grabbed as a quick snack. The market is valued at $14.9 billion in 2025 and is projected to grow steadily to $19.6 billion by 2033, at a consistent 3.45% CAGR. For the US dairy industry, cheddar stands as a symbol of stability, slow, steady expansion anchored in everyday consumption.

Source:imarcgroup.com

Per-capita cheddar consumption in the US has risen nearly 20% over the past decade, powered by subtle innovation, smarter retail strategies, and cheddar’s deep entrenchment in fast-casual dining and ready-to-cook meals. Even as plant-based and artisanal cheeses carve their niches, cheddar continues to command nearly a third of all US cheese consumed.

Its strength lies in reliability. Cheddar has adapted to new packaging, healthier variants, and sustainability-focused production but always without losing its identity as America’s comfort staple.

Paneer vs. cheddar: The showdown

Put the two markets side by side and the contrast is striking. Paneer is scaling fast, while cheddar is holding its ground through reinvention.

Source: imarcgroup

| Metric | Indian Paneer Market | US Cheddar Market |

|---|---|---|

| Growth drivers | Tech adoption, protein demand, retail expansion, rising incomes, urbanisation | Fast food consumption, household staples, steady demand for familiarity |

| Innovation focus | Automation, premiumisation, blockchain traceability, cold chain, digital supply chains | Cleaner labels, smarter packaging, sustainability upgrades |

| Consumer trends | Vegetarian/flexitarian diets, protein-rich foods, rising preference for clean-label and organic | Everyday cheese for families, trusted comfort food, slow adoption of health-focused variants |

| Market structure | Fragmented: co-operatives + thousands of small farmers | Concentrated: large corporations + regional producers |

| Distribution | Kirana stores, growing modern retail, online grocery | Supermarkets, convenience retail, foodservice chains |

In summary

The future of dairy is being shaped less by tradition and more by infrastructure, consumer preferences, and trusted supply chains. Paneer is leaping from Indian kitchens to export shelves, much like basmati rice once did, while cheddar holds steady in the US, expanding into premium and health niches. What connects them isn’t just taste but economics—where scale, efficiency, and consistency define who wins in a trillion-dollar global industry.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story