Upstox Originals

Investing in infrastructure: A look at India's road construction industry

.png)

4 min read | Updated on May 31, 2024, 19:21 IST

SUMMARY

India’s sprawling road network spanning over 5.5 million kilometres carries over 85% of the passenger traffic and 65% of freight in the country. The rate construction of highways has seen a huge boost in the last ten years and is expected to continue. This article explores India's road infrastructure and the key players driving this growth.

Road construction has been growing at a robust pace

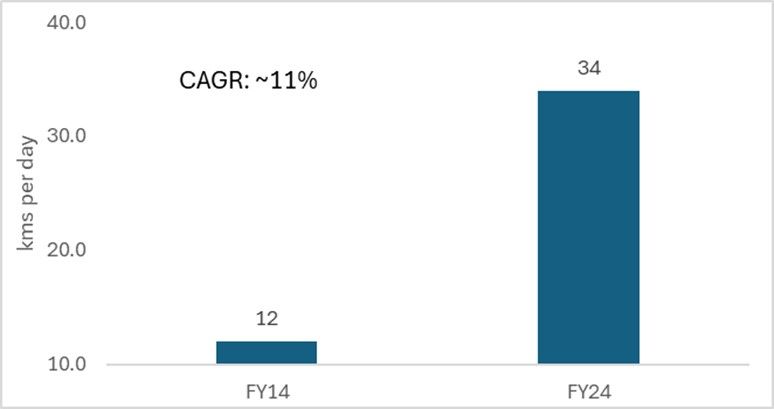

The road and highway market contributes to over 3.6% to the GDP and is a key pillar driving economic progress. As shown in the chart below, construction of national highways has grown almost 3x over the last ten years and averaged about 34 km per day in FY24.

Source: Invest India, Press releases

The length of national highways in the country has increased by more than 60% from 91,287 km in April 2014 to 1,46,145 km as of November 2023.

Going ahead, the Ministry of Road Transport and Highways has set an ambitious target to construct about 60 km per day. In FY24, the central government has raised the Ministry of Road Transport and Highways' budget by 36% to ₹2.7 lakh crore.

This prompts us to look at some key players in the domestic road construction industry.

| Company | Key projects |

|---|---|

| IRB Infrastructure Developers (IRB) | More than ₹ 800 bn highway asset base, one of the largest in India; 15,444 lane km road portfolio |

| GR Infraprojects (GRINFRA) | Since 2006, has executed more than 100 road construction projects and more than 20 Hybrid Annuity Model (HAM) projects |

| PNC Infratech (PNCINFRA) | Won a ₹ 11,740 mn HAM project contract for constructing the Western Bhopal bypass as a four-lane in Madhya Pradesh. |

| Dilip Buildcon (DBL) | Got an order worth ₹ 4,129.2 mn from the MP government |

| ASHOKA Buildcon (ASHOKA) | Cable-stayed bridge from the Government of Telangana, for a total consideration of ₹ 1,460.2 mn |

| Bharat Road Network (BRNL) | Management experience of road assets worth ₹ 70,000 mn with 10 Toll Management System (TMS) enabled Toll plazas with an under construction 4 lane project. |

| Hazoor Multi Projects | Received orders worth ₹ 11,300 mn to upgrade and rehabilitate a section on NH-66 in Ratnagiri. |

Source: Company reports, press releases

Let's now dive in and look at some key performance metrics of each of these players

| Company | Market cap (₹ mn) | ROCE (%) | ROE (%) | P/E | EV/EBITDA | 3 yr CAGR stock Price growth (in %) |

|---|---|---|---|---|---|---|

| IRB | 4,08,710 | 8.7 | 5.4 | 74.7 | 16.9 | 84.0 |

| GRINFRA | 1,32,450 | 21.6 | 26.1 | 11.4 | 7.9 | -6.7 |

| PNCINFRA | 1,11,300 | 14.8 | 16.2 | 16.9 | 10.0 | 23.0 |

| DBL | 69,060 | 5.3 | -7.5 | 117 | 9.7 | -6.5 |

| ASHOKA | 48,230 | 38.6 | 26.5 | 14.2 | 2.9 | 26.0 |

| Hazoor Multi Projects | 6,830 | 83.8 | 85.9 | 11.1 | 7.9 | 310.0 |

| BRNL | 4,530 | -2.4 | -52.5 | -1.07 | 18.2 | 24.0 |

| Average | 1,11,587.1 | 24.3 | 14.3 | 34.9 | 10.5 | 64.8 |

Source: Screener; *Data as of 15/05/2024

Conclusion

The increased pace of construction should help in enhancing connectivity, reducing transportation costs, and boosting economic growth across the country.

Observations on the roads and highways sector:

- Most companies benefit from increased business in this fast-growing sector.

- As a capital-intensive sector, inventors should track capital allocation and efficiency metrics as key investment criteria.

- However, as with any investment, it is important to perform a comprehensive analysis and due diligence to assess the potential risks and returns before making any investment decisions.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story