Upstox Originals

OpenAI’s rise: A pillar or a pressure point?

7 min read | Updated on November 14, 2025, 18:21 IST

SUMMARY

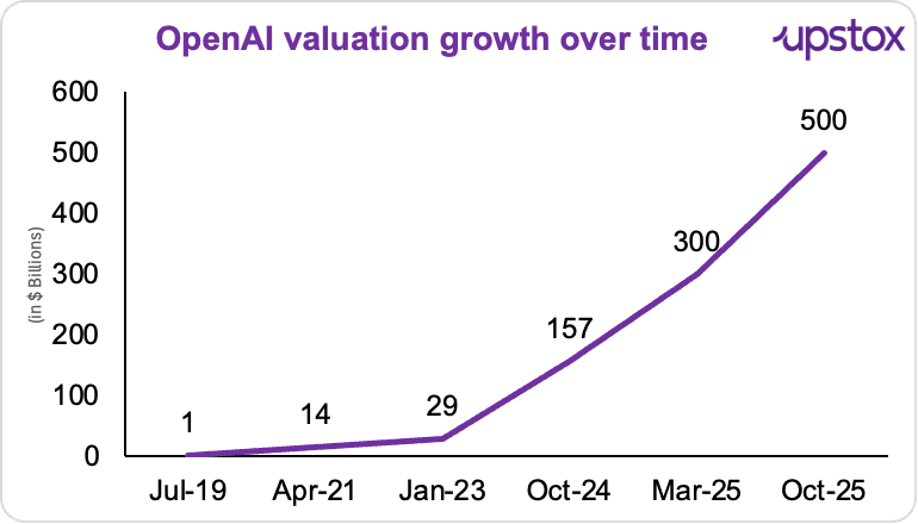

OpenAI's transformation from a nonprofit lab in 2015 to a $500 billion tech behemoth has changed the global AI landscape. It was once a research experiment, but it is now at the center of trillion-dollar infrastructures built by Microsoft, Nvidia and Oracle. Despite never making a profit, its impact extends from cloud computing to national policy, posing a critical question: is OpenAI a pillar of global AI infrastructure or has it reached a point where failure is not an option?

In 2023, OpenAI generated ~$1.6 billion in sales. That amount had nearly tripled to $3.7 billion by 2024.

OpenAI grew gradually, then suddenly, into a juggernaut that is difficult to comprehend. Founded in 2015 as a nonprofit research lab, it has now grown to become the world's most influential and arguably systemically essential startup.

The company operates on a hybrid business model; combining consumer subscriptions (ChatGPT Plus, Team, and Enterprise) with enterprise API licensing and large-scale infrastructure partnerships, which powers its cloud backbone. This structure embeds OpenAI across both enterprise and consumer layers of the digital economy.

Its valuation has increased to $500 billion, with $13 billion in annualised revenue in July 2025, doubling from $6 billion in January and up 3x from $4 billion in 2024, according to Sacra.

Source: Visual Capitalist

Although the company has yet to turn a profit, it is already present in nearly every part of the global technology stack, including semiconductors, cloud computing and national economic policy.

Because of this interconnection, an unsettling issue typically reserved for Wall Street has emerged: Has OpenAI become too massive to fail?

In 2023, OpenAI generated ~$1.6 billion in sales. That amount had nearly tripled to $3.7 billion by 2024, while the first half of 2025 brought in $4.3 billion, topping the previous year's total. Investors now expect revenues of $13 billion for the entire year.

On the other hand, costs continue to pile up as well. For the first half of 2025, OpenAI's R&D and computing expenses exceeded $6.7 billion. Net annual cash burn is expected to reach $8–9 billion. At this rate, profitability is distant.

Why its failure can have systemic imoact?

Infrastructure magnitude

-

Huge expenditures in hardware, energy and computation are being made. According to certain calculations, OpenAI is a key node in AI-infrastructure agreements worth over $1 trillion.

-

The phrase "too big to fail" becomes more structural and less figurative when a business is this important to such capital-intensive infrastructure.

| Year | Global AI Infrastructure Investment (Data Centers, Chips, Cloud) | Major Contributors |

|---|---|---|

| 2023 | $200 B | Microsoft, OpenAI |

| 2024 | $400 B | Nvidia, Oracle, OpenAI |

| 2025 | $1 T (committed) | Nvidia, Oracle, OpenAI |

Source: News articles

An economy betting on AI The US economy; facing over $30 trillion in national debt and slowing productivity; has pinned much of its hope on AI as the next great growth engine.

The core of that promise for policy is OpenAI. Its tools, which enable workers to automate jobs, boost creativity, and raise output across sectors, are being lauded as productivity multipliers. However, if that goal fails, it may reveal a macroeconomic vulnerability that is uncommon for a private firm.

A Human-Scale Impact

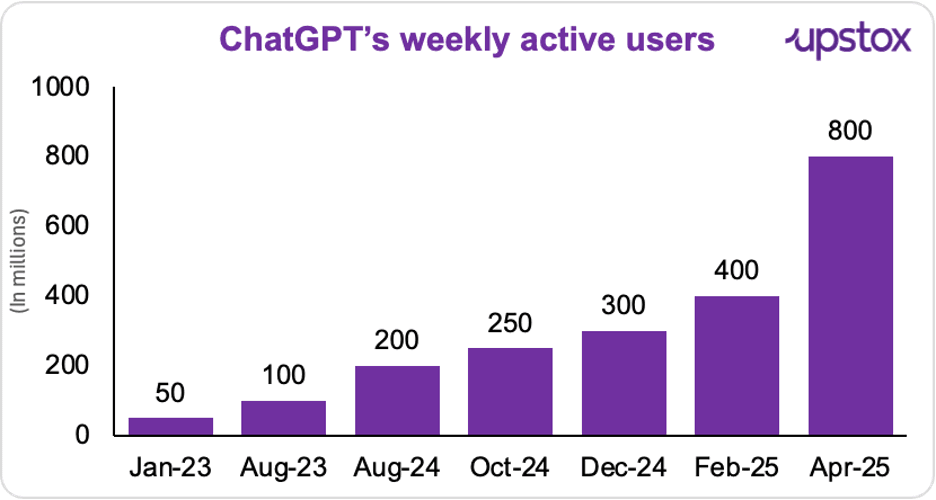

OpenAI’s influence now extends beyond technology; it touches global users, enterprises, and digital infrastructure at an unprecedented scale.

- ChatGPT usage at scale: As of 2025, the platform records 193.33 million daily visits, 5.8 billion monthly visits, and 800 million weekly active users, processing over 2 billion daily queries and 2.5 billion user prompts each day. With an 81.13% market share in generative AI, 64.27 million app downloads, and 10 million ChatGPT Plus subscribers, OpenAI generates US$10 billion in annual recurring revenue.

Source: Demandsage

-

Enterprise adoption: With 1 million business customers, ChatGPT has become the fastest-growing enterprise software platform in history. Clients include Amgen, Commonwealth Bank, Booking.com, Cisco, Lowe’s, Morgan Stanley, T-Mobile, Target, and Thermo Fisher Scientific. The education sector alone contributes $230 million annually, underscoring its role in personalised learning and EdTech innovation.

-

Ecosystem expansion: OpenAI’s Company Knowledge allows ChatGPT to reason across enterprise tools like Slack, SharePoint, Google Drive, and GitHub, using a version of GPT-5 optimised for workplace analysis and citations.

-

Developer impact: Adoption of Codex, OpenAI’s model for code generation and automation, has surged 10x since August 2025. Cisco reports 50% faster code reviews and projects reduced from weeks to days.

-

Enterprise automation: The AgentKit framework enables rapid AI agent deployment, allowing teams to move from idea to production in days. The Carlyle Group achieved 50% shorter development cycles and 30% higher agent accuracy through its use.

Presence across the AI value chain

OpenAI is deeply entrenched across the AI value chain; spanning model training, semiconductors, APIs, and consumer applications. As of 2025, ChatGPT serves over 250 million users monthly, and 92% of Fortune 500 companies use its models directly or through Microsoft’s Azure OpenAI Service.

Microsoft provides nearly all of OpenAI’s cloud infrastructure and holds a 27% stake in its for-profit arm. OpenAI has committed an additional US$250 billion in Azure cloud purchases to support future growth. In September 2025, NVIDIA and OpenAI announced a letter of intent to deploy 10 gigawatts of NVIDIA systems (equivalent to millions of GPUs) for OpenAI’s next-generation AI infrastructure, with NVIDIA planning to invest up to $100 billion.

Apple has integrated ChatGPT across iOS 18, iPadOS 18, and macOS Sequoia, allowing users to access AI capabilities directly within native experiences. Meanwhile, OpenAI is set to rent 4.5 gigawatts (GW) of data center power capacity from Oracle in the US, as part of a $30 billion expansion plan to meet rising compute demands.

Echoes of the 2008 financial crisis

That phrase, "too big to fail," evokes the 2008 banking crisis. Back then, banks bundled risky subprime loans into complicated financial products (CDOs) that few people understood, all under the presumption that house values would continue to climb, which caused the disaster.

A similar dynamic might be developing today to finance the AI boom. By 2030, $7 trillion in data center investment will be needed, according to a New York Times piece that cited McKinsey. Tech companies are using an increasing number of intricate debt financing options, such as corporate debt, securitization markets, private financing, and off-balance sheet vehicles, to finance this.

With the data centers themselves serving as collateral, these businesses are increasingly repackaging their debt as asset-backed securities. Such securities have been issued for $13.3 billion this year alone, a 55% rise.

If the expected demand for AI does not materialise and the value of those data centres plummets, the collateral vanishes, leaving someone liable for hundreds of billions of dollars.

Revenue, reality, and the trillion-dollar dream?

Despite its massive rise, OpenAI's expected yearly revenue of $13 billion is tiny when compared to the trillions of dollars in AI-related pledges it has drawn from various industries. Analysts doubt whether the underlying economics really add up.

To justify these large capital flows and valuations by 2029, OpenAI would conservatively need to increase its annual revenue more than 20x to justify valuations (when compared to peers like Google)

At this scale, OpenAI has definitely transcended its status as a startup. It has evolved into a systemic entity, with every public remark able to impact markets and every infrastructure collaboration able to influence global chip, cloud capacity, and computing resource price.

Before you go

With a vision based on unpredictable economics and high aspirations, OpenAI stands at the nexus of innovation and instability. Its impact today goes well beyond software, influencing worldwide perception, legislation, and infrastructure. However, this supremacy has a systemic risk: the modern digital economy could be rocked if OpenAI falters. Therefore, the question is not only whether OpenAI will be successful, but also whether the world can afford for it to fail.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story