Upstox Originals

Not just child’s play: India’s toy export surge explained

8 min read | Updated on September 18, 2025, 17:42 IST

SUMMARY

Remember a time when all toys in India were Made in China! The trend is changing and how, India’s toy exports have increased ~240% in the past decade! Toys in India aren’t just rattles and puzzles anymore; they’re a $1.9 billion business as of 2024, projected to reach $4.7 billion by 2033. Backed by smart policy, rising innovation, and a new wave of consumers, the sector is turning into one of the country’s most exciting growth stories.

India’s toy exports have jumped 239% in a decade

Would it surprise you to know that:

-

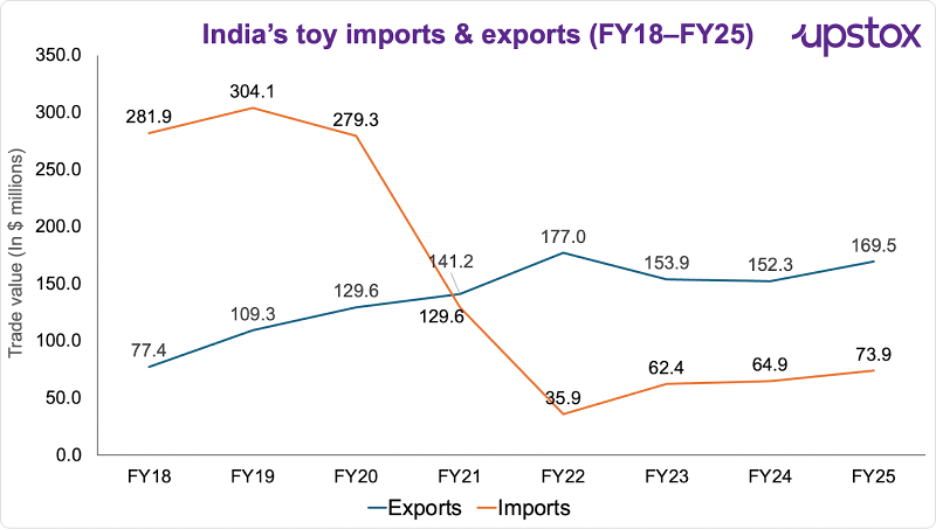

India’s toy exports have jumped 239% in a decade, from $96 million (FY15) to $326 million (FY23).

-

Imports have crashed 74%, from $282 million (FY15) to $74 million (FY23).

-

The domestic toy market is worth $1.9 billion (2024), projected to reach $4.7 billion by 2033.

-

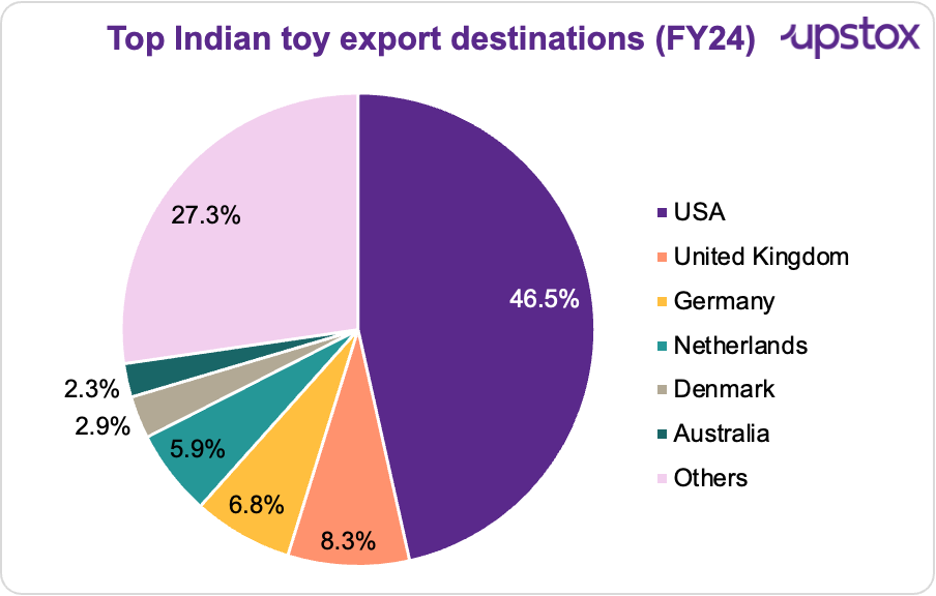

The US is the single largest buyer, importing around $104 million worth of Indian toys in FY23.

-

Tech-toys are booming: valued at $1.6 billion in 2024, set to double by 2030 at ~15% CAGR.

Once dominated by imports, India’s toy industry is now carving its own space, shipping products to more than 153 countries. Exports are rising, supported by stronger quality standards and government initiatives to boost local manufacturing clusters.

Over the last decade, India’s toy exports have surged 239%. Key destinations include the US, South Africa, Denmark, Germany, and the UK. The US is particularly significant with $104 million worth of Indian toys exported in FY23, making it the largest market.

Imports, which once flooded shelves, have dropped nearly 74%, falling from $282 million to $74 million over the same period. From being a market dependent on foreign toys, India is now emerging as a global supplier.

Source: Ministry of commerce and industry

With strong government backing, new manufacturing hubs, and a shift toward tech-driven play, India’s toy industry has transitioned from dependence to self-reliance. The turning point came with the 2020 National Action Plan for Toys (NAPT), which supported clusters in Channapatna, Greater Noida, and Maharashtra in building scale, compliance, and global standards. These efforts have transformed a fragmented, import-heavy sector into a credible player in the $100+ billion global toy market.

Demand side: Fueling the growth story

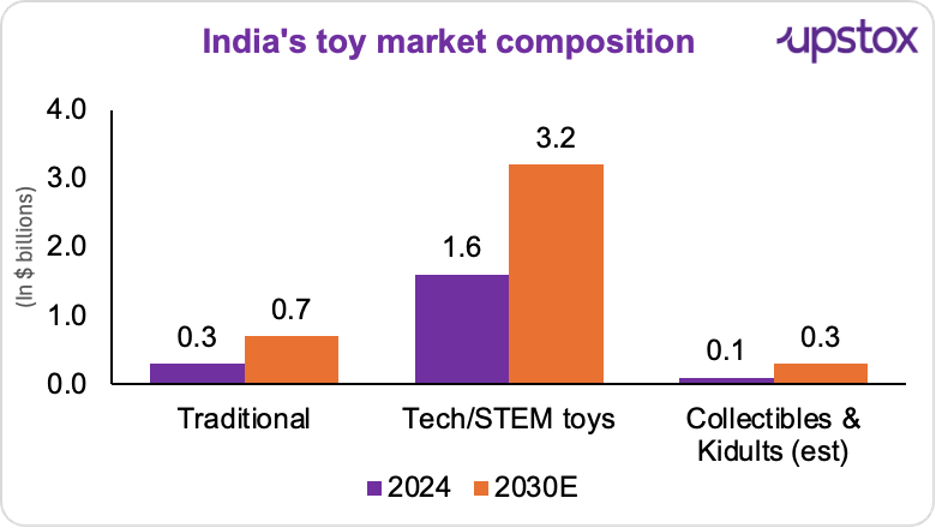

India’s toy market was valued at $1.9 billion in 2024 and is projected to hit $4.7 billion by 2033, growing at about 10% CAGR. The tech-toy segment, spanning coding kits, robotics, and AR/VR-enabled play, is sprinting even faster: $1.6 billion in 2024, set to double by 2030 at nearly 15% CAGR.

Toy segments

India’s toy demand is now split across traditional toys, fast-growing tech-enabled play, and a rising “kidult” collectibles segment, a shift the chart below makes clear.

Source: Imarcgroup

Educational/STEM toys and eco-friendly toys are also emerging as distinct categories, reflecting shifts in how parents and young adults want to buy smarter play, greener play, and nostalgia-driven play.

With 300 million children under 14, India has the world’s largest child base. Yet, per-child toy spending is still a fraction of developed markets, the US averages $300 per child annually, Europe about $250, while India is estimated at just $3–5. This stark gap highlights a vast untapped opportunity and runway for growth in the Indian toy market.

But demand isn’t just bigger, it’s more diverse:

-

STEM and learning toys: Parents are buying coding kits, robotics sets, and science-driven toys, reflecting a shift to purposeful play. Startups like PlayShifu and Smartivity are riding this wave.

-

Licensing power: Disney, Marvel, and Barbie still rule shelves, but Indian icons like Chhota Bheem and Motu Patlu are creating a homegrown brand effect.

-

Omnichannel access: From Hamleys’ high-street stores to Amazon carts and Blinkit impulse buys, toys have never been more accessible. Kidults and nostalgia: Millennials and Gen Z are fueling collectibles figurines, retro board games, and limited editions. Globally, this segment is worth $17 billion, and India is catching on quickly.

Supply side: policy and infrastructure tilt the balance

On the supply side, the government has rewritten the rules of the game. Stricter safety norms: Since 2025, every toy sold in India, local or imported must carry BIS certification and ISI marks, among the toughest global benchmarks. This reassures buyers and smoothens export approvals.

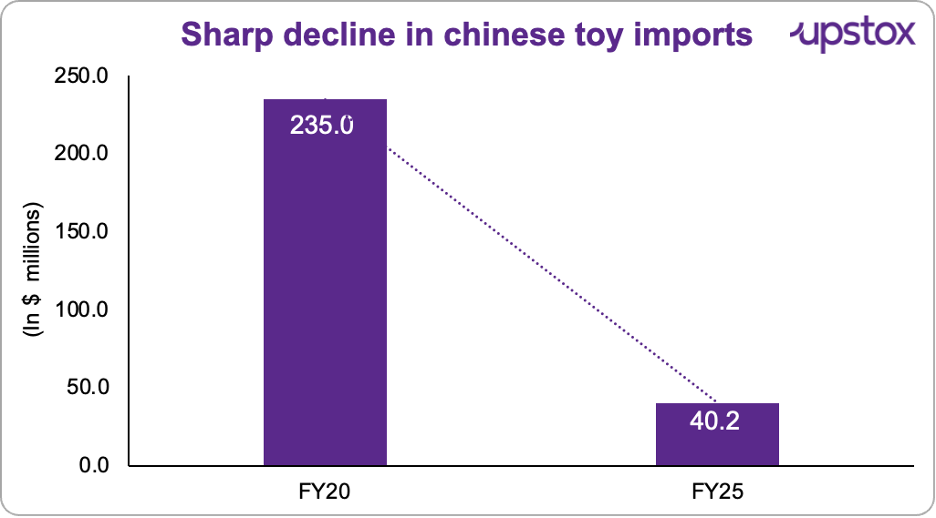

- High import duties: Duties fixed at 70% have throttled cheap inflows. Chinese imports, once $235 million in FY20, plunged over 83% to just $40.2 million in FY25.

Source:economictimes

-

PLI incentives: Nearly ₹3,500 crore (~$425 million) has been earmarked to scale toy manufacturing. A new capex-linked scheme is expected to give fresh momentum, modeled after successful electronics PLI.

-

Cluster connectivity: Under SFURTI and NAPT, 19 toy clusters in Karnataka, Uttar Pradesh, Maharashtra, and NCR now offer shared testing labs, tooling, and design support. Flagship projects like Aequs’ 400-acre Koppal cluster are building end-to-end manufacturing capacity for global majors like Hasbro and Spin Master.

-

Ports and customs: Major ports such as Mumbai, Mundra, and Chennai handle the bulk of toy shipments. But India still lags peers on efficiency: while Vietnam clears containers in 1–2 days, India averages 4–6.

Digitisation efforts are helping, but delays remain a challenge.

Together, these reforms are gradually transforming India from a fragmented base into an export-ready ecosystem. The next step will be closing logistics and cost gaps with peers.

Beyond policy pushes and manufacturing clusters, a few players are now emerging as champions of India’s toy story.

Who’s driving the toy boom

While India’s toy industry is still largely powered by MSMEs, a few names are stepping into the spotlight. Reliance Industries, through Hamleys, has expanded its retail presence across the country. Startups like playShifu and smartivity are making waves in the fast-growing STEM and AR/VR toy categories.

Global comparison: India vs. other toy hubs

While India’s toy sector is gaining momentum, it still competes head-on with established manufacturing hubs.

-

China dominates with nearly 80% of global exports, leveraging clusters, integrated supply chains, and ultra-low costs. Yet, tariffs, regulations, and IP risks are prompting brands to diversify.

-

Vietnam and Thailand enjoy 25–30% lower costs than India and smoother logistics, though their small domestic markets make them export-reliant.

-

Mexico, supported by strong IP laws and US proximity, is gaining as a nearshoring hub but lacks Asia’s scale.

-

India, though costlier, offers a hybrid model: a vast consumer base plus growing exports positioning it uniquely in the global supply chain.

Risks and roadblocks

Progress has been strong, but the road ahead isn’t without bumps:

- Tariff shocks – The US, India’s largest buyer (nearly half of exports), imposed a 50% tariff in 2025, triggering an 8–10% dip in shipments and forcing buyers to consider Indonesia.

The chart below highlights this dependency, nearly half of India’s toy exports head to the US, while other major markets like the UK, Germany, and Australia account for much smaller shares. This heavy reliance makes tariff shocks particularly disruptive.

Source: seair

-

Import loopholes – CKD and SKD imports (shipped in parts and assembled locally) still slip through, undermining domestic players.

-

Cost disadvantage – Toy production in India remains 25–30% costlier than Vietnam or Thailand due to higher logistics and compliance costs.

-

Fragmented industry – With 90% unorganised, small workshops often fail BIS compliance or IP protection. The skills gap in design, robotics, and 3D printing risks slowing down future competitiveness. Strategic opportunities: Where smart money is headed

Despite these hurdles, the opportunities are substantial:

-

Contract manufacturing: Already handling 65% of India’s exports, contract players like Aequs’ 400-acre Koppal cluster (serving Hasbro, Spin Master, Chicco) are scaling fast. For global brands leaving China, India is a ready partner.

-

Premiumisation: Urban consumers are paying more for eco-friendly, licensed, and experiential toys. Disney and Marvel collaborations, plus local heroes like Chhota Bheem, are reshaping margins.

-

Omnichannel retail: From Hamleys’ flagship experiences to Amazon’s reach and Blinkit’s instant delivery, omnichannel access is redefining distribution.

-

Startups driving STEM: PlayShifu, Smartivity, and Shumee are building niches in STEM and sustainable toys, attracting investor attention. Policy and trade tailwinds: FTAs with the UK, UAE, and Australia are opening new export doors, while SFURTI clusters are upgrading MSMEs’ compliance capacity.

For investors, this isn’t just a consumption story, it’s about plugging into a reshaped global toy supply chain.

The bigger picture

The question isn’t whether India can make toys, it’s how far and how fast it can scale. Exports are up 239%, imports down 70%, and clusters are winning global trust. The real challenge now is competing without the crutch of tariffs, by closing the cost gap with Vietnam and Thailand and investing in R&D, design, and advanced manufacturing.

But here’s the twist: nearly half of India’s toy exports go to the US. To build lasting leadership, India needs to spread its bets across new markets. Because in the global toy game, it’s not just about making the pieces, it’s about playing the board smartly.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story