Upstox Originals

No IPO? No problem!

.png)

6 min read | Updated on April 14, 2025, 14:17 IST

SUMMARY

India’s secondary market is coming of age, with over $6 billion in big-ticket exits in 2024 alone. It’s giving investors a quicker, smarter way to unlock returns—no more waiting a decade for an IPO—and opening the door for broader participation in the country’s booming $124 billion private market.

India saw secondary deals of over $6 billion in big-ticket exits in 2024.

In 2018, when Walmart acquired Flipkart in a blockbuster $16 billion deal, it wasn’t just the founders who struck gold. Early investors like Tiger Global, Accel, and SoftBank made multi-billion-dollar exits through secondary sales—selling their shares to new investors without waiting for an IPO. Fast forward to 2023, and you’ll see Peak XV (formerly Sequoia India) doing the same, offloading a stake in Go Fashion through a secondary transaction. The move let them return capital to their LPs while still riding the growth wave.

These headline-grabbing deals are just the tip of the iceberg. What’s really exciting is how secondaries are going mainstream. Once the playground of VCs and institutional giants, the secondary market is now opening up to startup employees, smaller funds, and even retail investors through platforms that enable fractional ownership and curated access. Employees holding ESOPs can now monetise part of their equity without leaving the company. Early-stage investors can de-risk their portfolios, and everyday investors can get exposure to startups that were once out of reach.

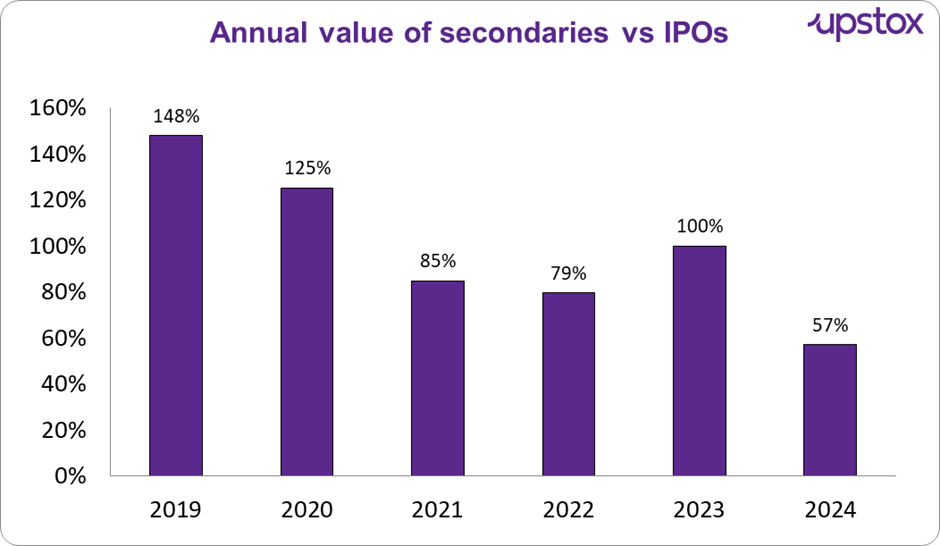

Still don't believe us, check out the chart below !

Source: Chittorgarh.com

Interesting right? For many years the annual value of secondary deals has exceeded total funds raised via mainboard IPOs. Secondaries have emerged as a strategic tool for liquidity, flexibility, and smarter capital recycling—not just for the wealthy, but for anyone looking to participate in India’s private market boom.

So, what exactly are secondaries? And why are they becoming one of the most important shifts in how people invest—especially retail investors? Let’s break it down.

What are secondaries, anyway?

Secondaries are all about buying and selling existing stakes in private companies or VC funds. Unlike primary investments (where fresh cash is pumped in), secondaries give early investors an exit while new ones jump in. There are two main types:

-

LP-led secondaries – When limited partners (LPs) sell their stake in a VC fund to someone else.

-

GP-led secondaries – When fund managers (GPs) restructure or extend investments, letting them cash out some investors while keeping hold of promising assets.

Why do they matter?

- Liquidity without the wait – Startups take time to mature, but investors don’t always have that luxury. Secondaries let them cash out before an IPO or acquisition.

- Less risk, more flexibility – Investors can de-risk by selling part of their stake instead of waiting for a big payday.

- Keeping the VC engine running – Fund managers can recycle capital into fresh deals rather than being stuck in illiquid assets.

- Helping founders too – Founders can sell a slice of their shares without having to exit the company.

- Retail impact – Even if retail investors can't directly participate, secondaries improve liquidity in private markets, benefiting future IPO pipelines.

The big shift: Secondaries are taking off

Investors and fund managers are finally warming up to the idea that buying and selling stakes doesn’t have to be a last resort—it can actually be a smart strategy.

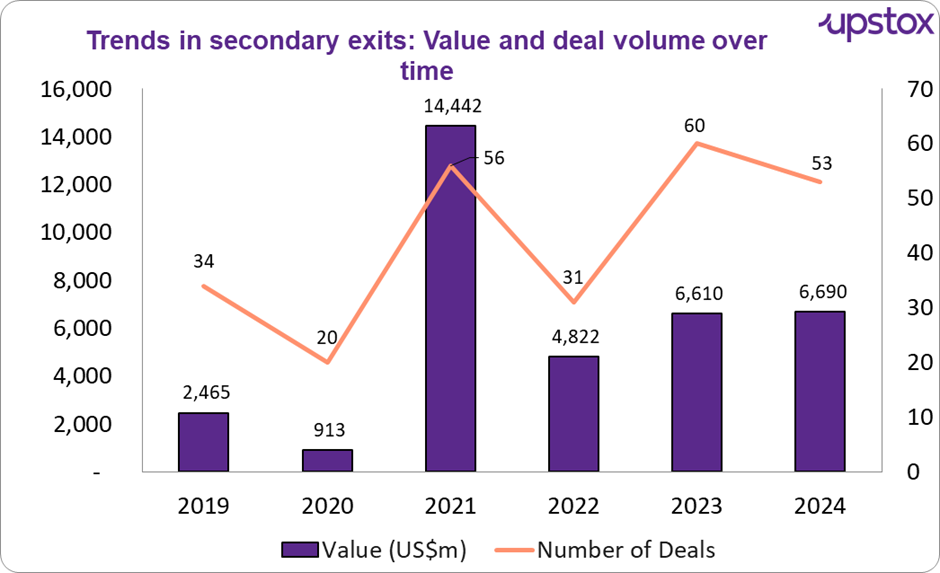

Source: EY

Private equity investors are increasingly focusing on mature companies with strong growth potential. In 2024, 90% of exits were big deals over $100 million, totaling $6.1 billion. These companies are attractive because they allow faster and more efficient exits than IPOs, enabling quicker cash-outs while still targeting high-growth opportunities.

A few notable examples of PE secondary exit was

-

PAG, an Asia-focused private equity firm, acquired Manjushree Technopack Ltd., India’s largest rigid plastic packaging company, for $1 billion. This deal saw Advent International sell its 97% stake, after initially planning to list the company with a ₹3,000 crore IPO.

-

Manjushree, founded in 1978, produces packaging for industries like food, drinks, and cosmetics and serves major clients like PepsiCo and Coca-Cola. Its revenue grew from ₹1,474 crore in FY2022 to ₹2,130 crore in FY2024. Advent had acquired Manjushree in 2018, buying out Kedaara Capital and the Kedia family, which brought management changes.

Here’s what’s changed:

- Fund managers are embracing secondaries to generate returns before raising their next round of funding.

- New secondary funds are popping up, offering fresh exit options beyond IPOs and M&As.

- More investors are trading stakes in private companies, particularly in large deals ($100 million).

- Direct secondaries are thriving, as India’s young companies go through various growth stages, making ownership swaps a necessity.

- Founder secondaries (where founders sell shares) are now a thing, giving them a way to cash out while staying involved.

Why’s this happening now?

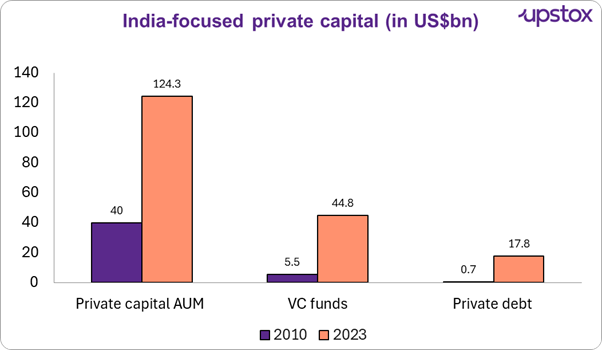

Source: Investor Daily

India’s private investment scene is rapidly becoming a sought-after space. The money managed by private funds has doubled to a staggering $124.3 billion by the end of 2023. With strong GDP growth, a young workforce, massive infrastructure projects, India’s becoming impossible to ignore.

India's VC funds have seen significant growth due to a booming startup ecosystem, with sectors like consumer tech, SaaS, and fintech attracting over 60% of the funding. Government policy reforms, such as the removal of angel tax, easier foreign investor registration, and lower capital gains taxes, have boosted investor confidence.

India's strong economic growth, young population, and digital infrastructure have made it the second-largest VC market in Asia.

Despite a post-2021 slowdown, 2024 saw a 43% increase in funding, with companies like Zepto and Meesho leading the way.

Private debt growth has been driven by regulatory changes like the Insolvency and Bankruptcy Code, more infrastructure spending, and flexible financing from private lenders, especially for underserved businesses in real estate and infrastructure.

The overall economic expansion, with a steady 6-7% GDP growth, urbanisation, and a young workforce, continues to attract global capital, while private equity exits surged from 49 in 2022 to 85 in 2023, driven by strong public market performance.

Why this matters for India

As the country’s wealth base expands, more individuals are stepping beyond traditional assets and exploring private equity, startups, and alternative investments. Here’s the big picture: the number of High Net Worth Individuals (HNIs) in India is expected to more than double by 2027. That’s a clear signal—more capital is looking for smarter, more flexible opportunities.

This shift is encouraging greater participation in private equity, venture capital, and structured products, opening up new opportunities for investors. It's not only benefiting wealth managers and the economy but also shaping a more dynamic and inclusive investment ecosystem.

Final thoughts: a market growing up

India’s secondary market is still young, but it’s growing fast. As the private investment scene matures, secondaries are becoming a vital tool for investors who need liquidity.

Investors no longer need to wait endlessly for an IPO—there’s now a proper marketplace for exits. It’s a game-changer, and if India follows the US model, this is just the beginning.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story