Upstox Originals

What is fuelling the revival in the packaging sector?

.png)

7 min read | Updated on June 26, 2025, 10:37 IST

SUMMARY

This is one of the largest sectors in India and its activities cater to multiple sectors right from food to pharma. After weathering a few weak years, the packaging industry is once again back on the growth track - both revenue and margins. Read on to find out the changing fundamentals that are expected to drive this growth.

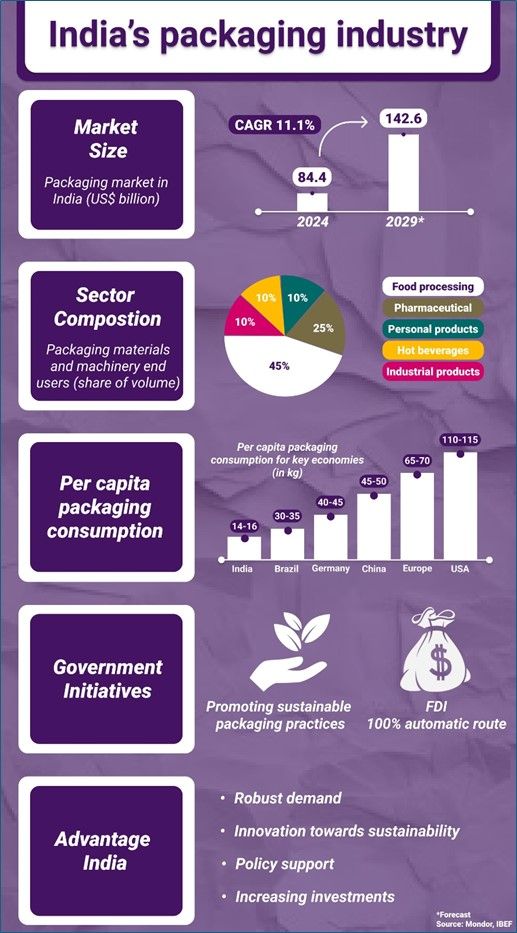

Packaging sector is expected to grow by 11% over FY24-29

The packaging sector is one of India’s biggest sectors and is expected to grow by 11.1% on a CAGR basis for the period FY 24-29 to be valued at around $142.6 billion. Catering to multiple stakeholders, this one industry encompasses a wide range of:

- Materials: Paper, plastic, cardboard, metal, glass, etc

- Formats: Rigid, flexible plastic packaging, etc.

- Applications: Containers, preforms, caps & closures, pumps & dispensers, etc

- Diverse end-use sectors: Food, beverage, pharma, e-commerce, etc

In the past couple of years, this sector has faced a double whammy in the form of:

- Demand weakness: Export demand has been slow in the past few years, adversely impacting capacity utilisation for most players.

- Overcapacity: Significant capacity expansion in both India and China has caused a massive oversupply causing supply to outstrip demand.

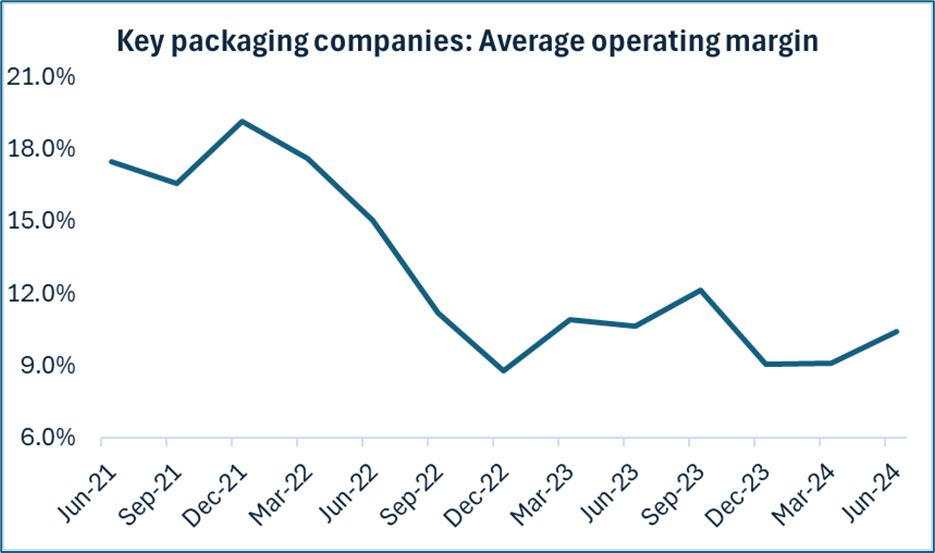

As a result, prices of key products like BOPP and BOPET films (the two major types of packaging finished goods) have seen a sharp correction. They corrected by ~50% in 2023 alone, impacting operating margin and profitability

Source: Screener.in; *Average operating margin of the 10 players listed below

That said, in the past few quarters, there have been some greenshots. Most packaging companies have posted strong results in Q1FY25 (see table below). They have guided for a sustained performance improvement driven by continued strength of domestic demand, revival of exports and correcting demand-supply imbalance.

Besides that, margins have also been helped by an improving sales mix - higher proportion of specialty packaging products made from BOPP/BOPET due to demand from emerging sectors like electronics, e-commerce, among others.

Consequently, prices of BOPP and BOPET films have spiked as much as 40-45% and ~85-90% respectively in the past few months.

Quarterly performance of key players

| (₹ crore) | Sales | Sales | Sales | EBITDA Margin | EBITDA Margin | EBITDA Margin | PAT | PAT | PAT |

|---|---|---|---|---|---|---|---|---|---|

| June-23 | March-24 | June-24 | June-23 | March-24 | June-24 | June-23 | March-24 | June-24 | |

| Garware Hi Tech Films | 380.0 | 447.0 | 474.0 | 17.0 | 18.0 | 25.0 | 44.0 | 58.0 | 88.0 |

| Uflex | 3,258.0 | 3,426.0 | 3,654.0 | 8.7 | 10.7 | 11.3 | -416.0 | -271.0 | -98.0 |

| Jindal Poly films | 832.0 | 1,077.0 | 1,233.0 | 1.6 | -0.6 | 2.8 | 98.0 | -19.0 | 168.0 |

| PolyPlex | 1,561.0 | 1,679.0 | 1,686.0 | 3.9 | 5.8 | 9.7 | -10.0 | -31.0 | 97.0 |

| Cosmo First | 658.0 | 641.0 | 690.0 | 5.3 | 6.9 | 9.9 | 14.0 | 15.0 | 31.0 |

| Nahar Polyfilms | 156.2 | 153.1 | 167.8 | 2.2 | 1.1 | 9.5 | -2.2 | 0.9 | 8.3 |

| TCPL Packaging | 361.0 | 384.0 | 391.0 | 16.6 | 17.2 | 17.6 | 24.0 | 29.0 | 32.0 |

| Huhtamaki India | 622.0 | 610.0 | 639.0 | 6.4 | 6.7 | 5.0 | 14.0 | 26.0 | 39.0 |

| Ester Industries | 258.0 | 277.0 | 286.0 | 0.0 | 2.2 | 3.8 | -22.0 | -24.0 | -16.0 |

| EPL | 910.0 | 1,029.0 | 1,007.0 | 17.5 | 18.6 | 18.5 | 56.0 | 15.0 | 66.0 |

Source: Screener.in

Other structural drivers of packaging demand

- Though per capita packaging consumption has grown significantly in recent years, India is underpenetrated in terms of packaging consumption and is below the global average.

- Shift from loose packing products towards rigid packaging products will derive growth of packaging materials.

- The government has laid down Extended Producer Responsibility norms for plastic packaging consumers which mandate the use of recycled packaging material and recycling of packaging material. This will lead to the recycling business doubling in the next 10 years as per report by IMARC.

- Rising personal disposable income, growing e-commerce and organised retail, growing awareness towards packaged food, increased focus on safety and hygiene, premiumisation will aid the demand for packaging materials.

- Technological developments to seek more efficient packaging solutions will aid the demand for the organised sector along with India’s booming consumption demand will further derive growth.

Improvement in underlying factors has also reflected in the share price performance of these companies.

The packaging sector has seen a strong comeback from the 52w lows*

| Company Name | Market cap (₹ Crore) | % down from 52 week high | % up from 52 week low | PE Ratio (x) | ROE% |

|---|---|---|---|---|---|

| EPL | 8,143 | 4.7 | 51.2 | 32.3 | 12.3 |

| Garware Hi Tech Films | 7,585 | 7.1 | 177.0 | 31.3 | 10.4 |

| UFLEX | 5,527 | 11.1 | 104 | 24.9 | 4.9 |

| PolyPlex | 3,834 | 10.6 | 63.7 | 40.9 | 1.1 |

| Jindal Poly Films | 3,566 | 16.1 | 83.7 | 81.8 | 1.7 |

| TCPL Packaging | 3,129 | 1.4 | 103.0 | 28.2 | 21.4 |

| Huhtamaki India | 2,976 | 12.0 | 60.4 | 27.5 | 13.0 |

| Cosmo First | 2,106 | 19.1 | 78.9 | 26.7 | 4.5 |

| Ester Industries | 1,525 | 9.5 | 86.1 | - | -16.6 |

| Nahar Polyfilms | 688 | 25.0 | 67.6 | 42.1 | 0.4 |

| Average | 4.108 | 11.7 | 87.6 | 37.3 | 5.3 |

Source: Screener.in; * As on September 10, 2024

Investor insight

Some takeaways from recent management calls

| Company | Select takeaway |

|---|---|

| EPL | Management is confident that gross margins are sustainable, with expectations for continued improvement in EBITDA margins towards the target of 20% |

| Garware Hi Tech Films | Reported highest-ever consolidated numbers and highest ever quarterly PBT in Q1FY25 |

| Uflex | Guided for ₹2,000 crores EBITDA by FY25 on the back of deleveraging, capacity expansion, recycling business, and a better macro environment |

| Polyplex Corporation | Planning a $142 million capex to establish plants in Turkey, US, Thailand |

| TCPL Packaging | Greenfield Facility in Southern India is on track to commence operations by Q3 FY25 |

| Huhtamaki India | Expectations of a better second half with improved market sentiment and rural recovery. |

| Cosmo First | Targeting an 80%+ volume from the high-margin specialty segment by 2026 with 20% CAGR top-line growth in the next 3 years along with stable margins. |

| Ester Industries | The proportion of value-added products to increase to 40% by FY26 from the current 35% by entering into US markets and sustainable product offerings. |

Conclusion

Most companies have showcased strong financial results, marked by significant sales growth and enhanced profit margins. This improvement was primarily due to reduced raw material costs and increased operational efficiency.

The industry is expected to thrive, fueled by growing consumer needs, urbanisation, and technological progress. The sector is evolving to meet the demands for sustainability and innovation, incorporating eco-friendly materials and smart packaging technologies.

However, potential investors should be cautious. While the sector is vital to India's economy, it faces hurdles like regulatory issues and raw material cost fluctuations, which can affect profitability. Thus, understanding these dynamics is crucial before making investment decisions in this sector.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story