Upstox Originals

More power, more patience: Women investors on the rise

.png)

3 min read | Updated on March 10, 2025, 17:36 IST

SUMMARY

For years, investing was seen as a man’s game, but women are proving that wealth creation is for everyone. Instead of chasing quick returns, they’re holding onto their mutual funds longer, showing a shift towards smart, long-term investing. The numbers back it up—women in India are taking charge of their financial futures, and it’s a trend worth watching!

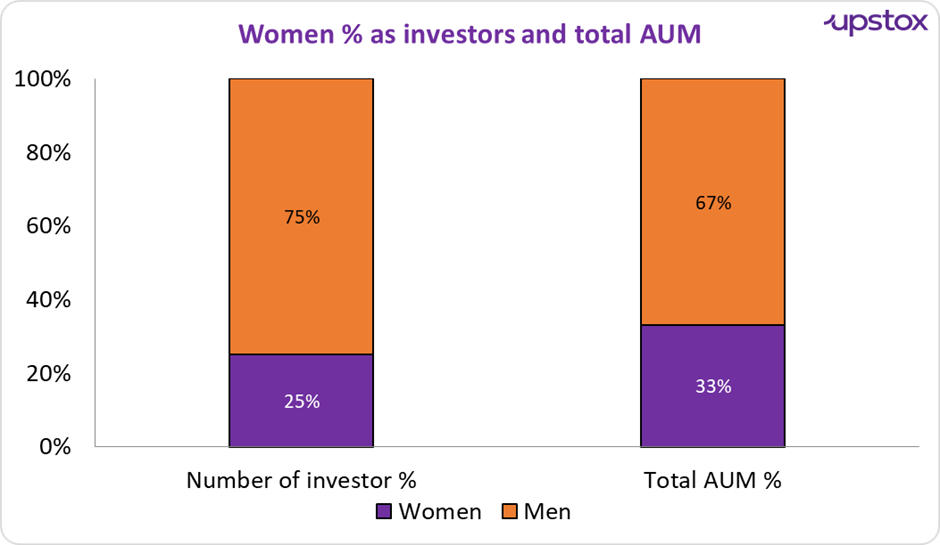

Women make up 33% of India’s mutual fund investors base

Did you know that as per an SBI report on Dec-24, since 2021, an average of ~30 million new demat accounts have been added annually, with almost 25% of these accounts being held by women? With Women’s Day just behind us, it’s only fitting that we talk about a powerful shift in investing—women aren’t just earning more, they’re investing smarter too! A recent report by Crisil and AMFI reveals a number of fascinating data points that highlight the growing participation of women investors.

Let's look at the data. Women comprise a significant percentage of individual investors and of the total assets under management. Delhi boasts the highest female representation among large states at 29.8%, followed by Maharashtra (27.7%) and Tamil Nadu (27.5%).

Source: AMFI, Crisil Intelligence

Women stay with their investments longer than men. A clear pattern emerges from the table below, as the holding period increases, more women investors hold on to their investments than their male counterparts.

| Holding period (in years) | Female investors | Female investors | Male investors | Male investors |

|---|---|---|---|---|

| Mar-19 | Mar-24 | Mar-19 | Mar-24 | |

| <1 | 40.5% | 25.4% | 42.1% | 27.0% |

| 1 to 2 | 27.6% | 19.5% | 27.2% | 19.3% |

| 2 to 3 | 12.0% | 15.1% | 11.8% | 14.5% |

| 3 to 4 | 7.1% | 10.4% | 6.8% | 11.0% |

| 4 to 5 | 4.0% | 8.3% | 3.8% | 8.3% |

| >5 | 8.8% | 21.3% | 8.2% | 19.9% |

| Total | 100.0% | 100.0% | 100.0% | 100.0% |

Source: AMFI, Crisil Intelligence

Women comprise a third of all mutual fund investors. 33% of India’s mutual fund investor base consists of women with these states containing the highest number of women mutual fund investors.

| States | % of woman investors |

|---|---|

| Mizoram | 44% |

| Nagaland | 39% |

| Sikkim | 38% |

| Goa | 37% |

| New Delhi | 37% |

| Pan-India | 33% |

Source: AMFI, Crisil Intelligence

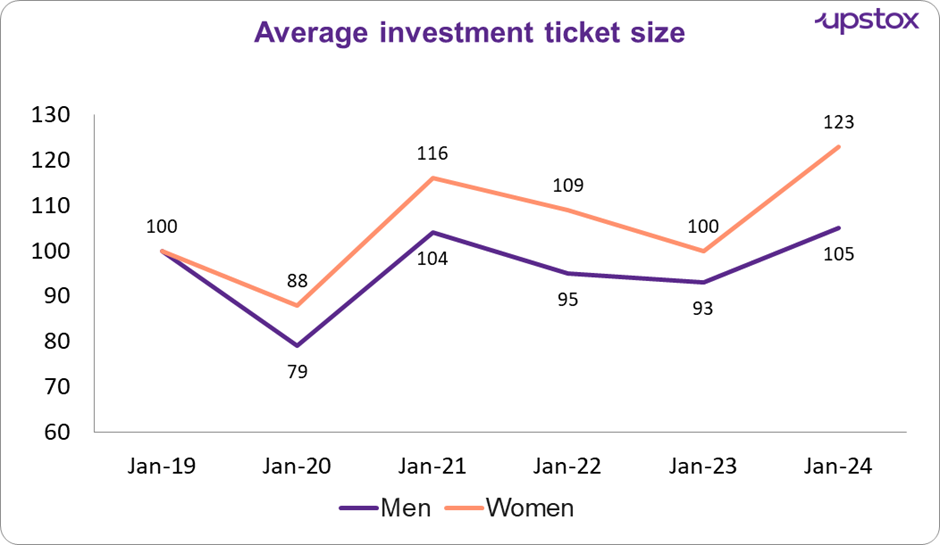

There has been a rise in women's average investment ticket size as women's average ticket size surged by 23% from 2019 to 2024, significantly outpacing the 5% growth for men.

Source: AMFI, Crisil Intelligence, Note: Portfolio size as of March 2019 has been taken as base – ₹ 100

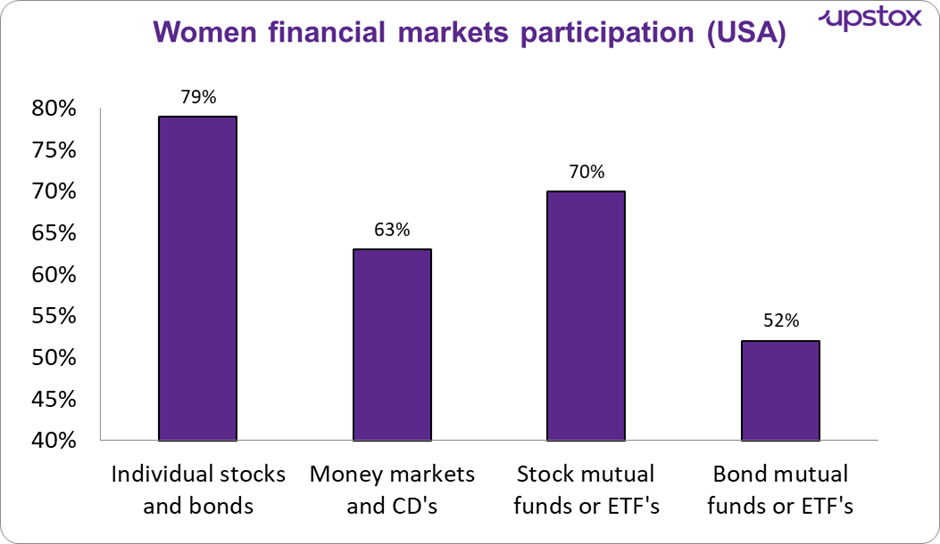

Comparison with USA

While this growth is undeniably impressive, there is still significant ground to cover when compared to developed nations like the USA, which enjoy a much higher percentage of women participating in financial markets. As shown in the chart below, 60% to 80% of American women currently invest in financial instruments. According to a Fidelity report published in Oct-24

Source: Fidelity investments

Outlook

This shift is important because it signals greater financial independence for women and contributes to the stability of mutual fund markets. As more women invest with a long-term perspective, it benefits not just their personal wealth but also the broader economy.

While Indian women participation might seem low as compared to developed countries (USA), the progress made in India to make investing inclusive is nothing short of commendable.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story