Upstox Originals

Markets calling: Say hello or hang up?

.png)

5 min read | Updated on May 23, 2025, 17:20 IST

SUMMARY

Markets typically swing like a pendulum between hope and fear. But the first five months of 2025 have been some of the most volatile ever, leaving investors to ponder how the markets currently stack up. More importantly, are there any changes in the underlying fundamentals? We break down how India’s market is doing, and whether this rally has legs or is running on fumes.

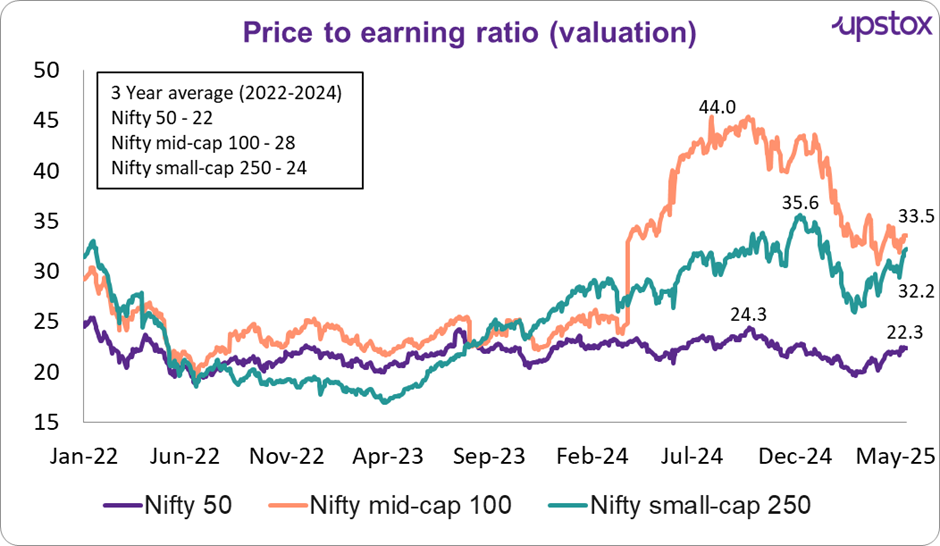

At current levels, valuations for small and midcap indices look frothy

2025 has been a volatile year, to say the least. The year started with a sharp correction in domestic markets (~15% from highs for large caps). Then we moved to an international trade war, weaker-than-expected earnings, and a conflict with a neighbour. And so far, we are not even halfway through the year.

However, this has left a lot of investors in a lurk about where markets are currently - with regards our performance against global peers, how earnings have panned out and what story do valuations tell.

In this article, we do a comprehensive status check of not only the markets give a broader economic overview.

Markets first

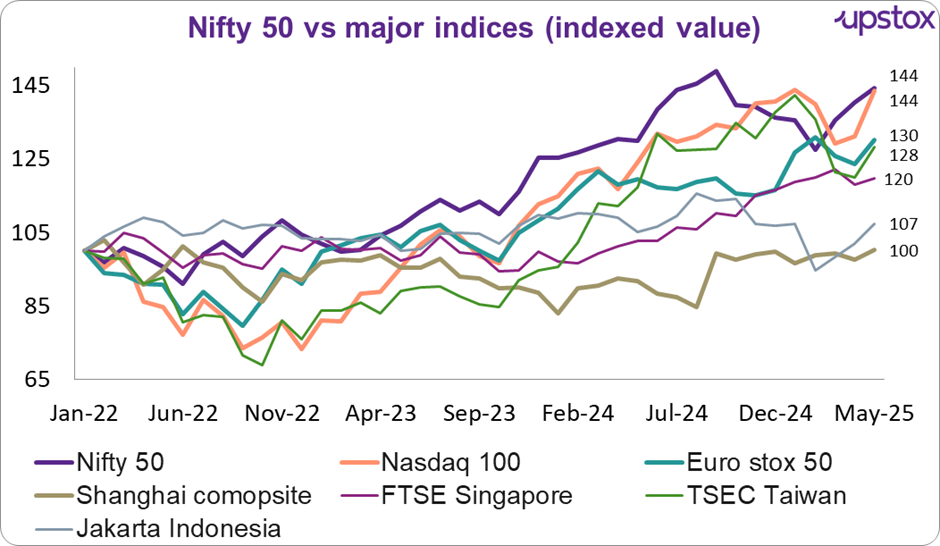

Largecap performance

After a strong show compared to global peers, it's worth noting that the Nifty50 was in a slump from October 2024 to February 2025. It corrected ~15% before bouncing back by 12%, a nice V-shaped rebound. That said, Indian large caps continue to be the best-performing markets compared to their global peers.

Source: Investing.com, internal research; *Data upto May 20, 2025

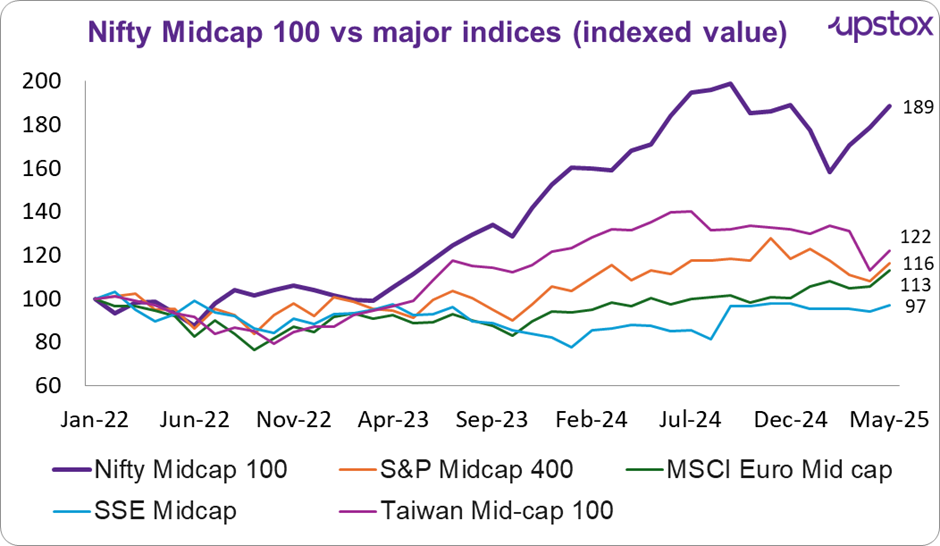

Midcap performance

The Nifty midcap index has left global peers far behind, with a stellar CAGR of ~89%, compared to an international mid-cap average of just 12%.

Source: Investing.com, taiwanindex.com, internal research; *Data upto May 20, 2025

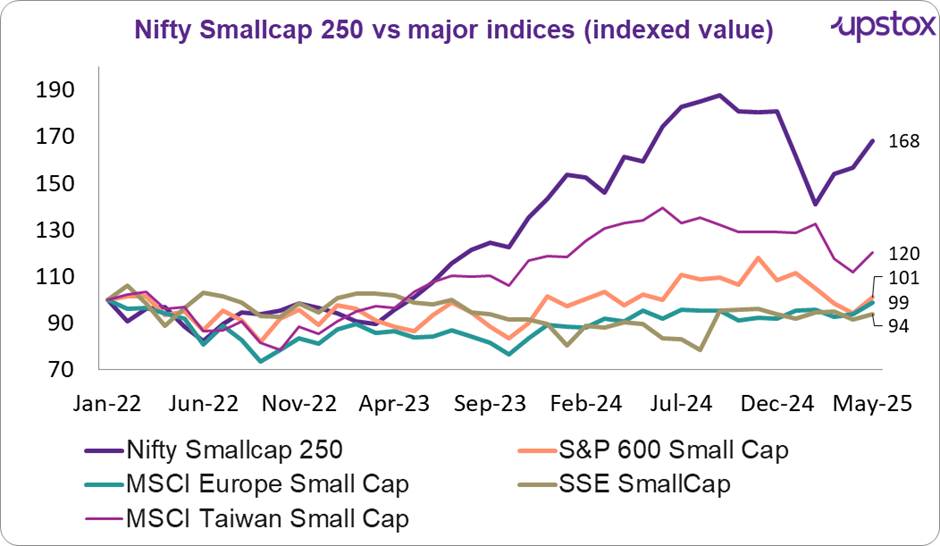

Smallcap performance

Nifty smallcaps show a similar story: India’s small-cap CAGR stands at 68%, while others lag at an average of 3%.

Source: Investing.com, internal research*Data upto May 20, 2025

With markets making new highs across each category, a natural question to ask is – are markets overvalued, or do earnings justify this rise?

Are earnings supportive?

Earnings present a mixed picture. Since June 2024, earnings across market capitalisations have been volatile. Despite relatively healthy growth, earnings have failed to keep up with expectations, leading to investor disappointment. While earnings growth for March 2025 does look healthy, at current levels, they need to beat investor expecations, or some more volatility is possible.

Please note, in the table below, we used the Nifty 500 as a proxy for the overall market. Nifty Smallcap has been excluded due to challenges in consistent data availability.

Growth in adjusted profit after tax*

| Sep-23 | Dec-23 | Mar-24 | Jun-24 | Sep-24 | Dec-24 | Mar-25E | |

|---|---|---|---|---|---|---|---|

| Nifty 50 | 12.5% | 17.4% | 32.5% | 8.3% | 19.8% | 11.2% | 11.3% |

| Nifty Midcap 150 | 64.9% | 50.2% | 14.8% | 8.6% | 14.4% | 41.8% | 17.6% |

| Nifty 500 | 33.8% | 30.9% | 16.2% | 7.8% | 8.9% | 15.8% | 11.0% |

Source: Ace Equity; *Adjusted for extraordinary or one-time items. At the time of writing, not all companies have reported results, so the March 2025 quarter numbers are estimates

So are our markets fairly valued? Short Answer: It's a mixed bowl

Given the run-up in the markets, valuations across the small and midcaps seem frothy. On a 3 year average basis, large caps look relatively fairly valued. At these levels, however, the margin of error is limited, and market levels will need consistent earnings support as well as a supportive marco environment.

Please note: The sharp increase in Nifty Midcap valuations in March 2024 is largely due to a change in the index constitution.

Source: NSE

Finally, we look at the overall economic environment in India.

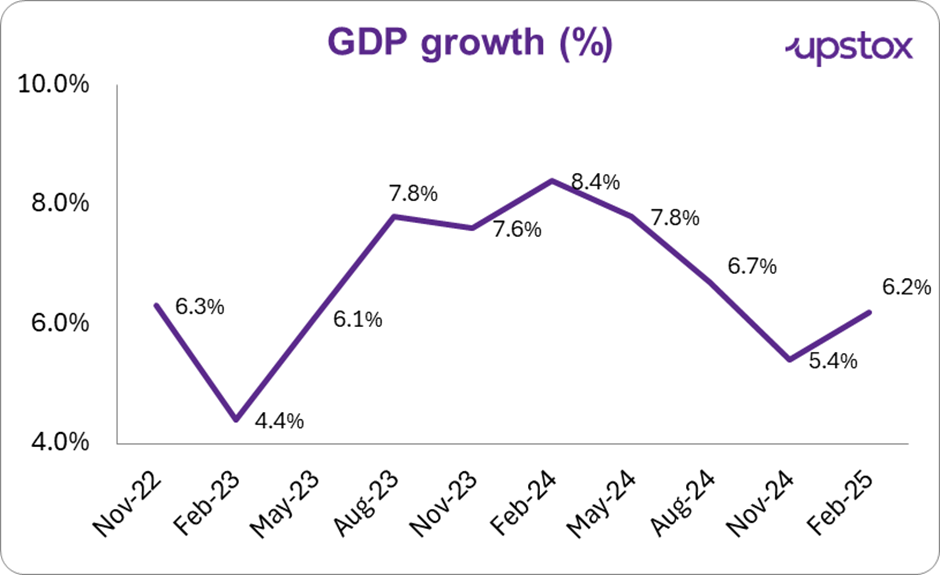

GDP growth

The pace of GDP growth has been consistently slowing down since early 2024. While it has picked up recently, overall economic growth remains subdued compared to the past. To a large extent, the slowdown in government spending last year, was a key reason for this slowdown.

With government spending reviving, growth is expected to pick up. On a more encouraging note, as shown in the next section, slowing inflation should also bode well for the economy. Rate cuts by the RBI should buoy growth.

On a more balancing note, conflicts with the neighbouring country and overall geopolitical uncertainties (skirmishes, trade wars, etc) could continue to weigh on overall economic growth.

Source: Investing.com

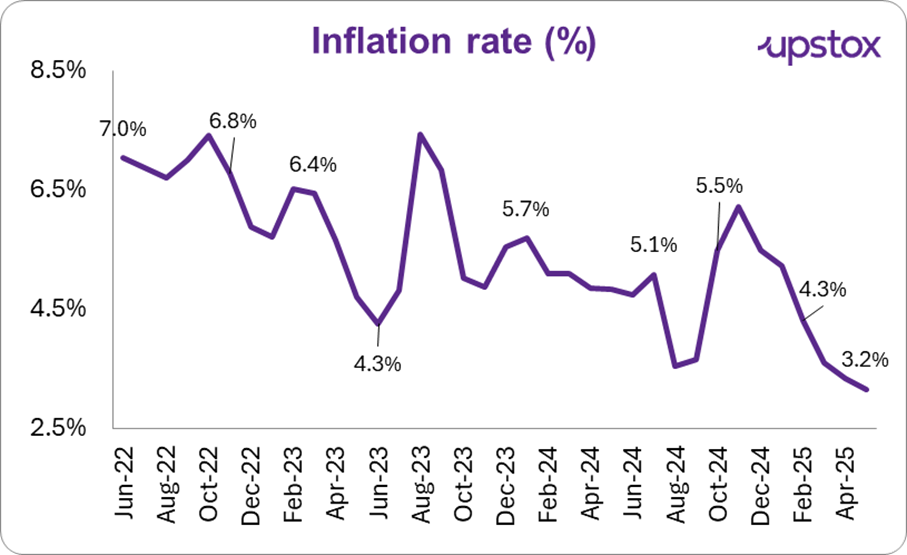

Inflation

Inflation dropped to 3.2% the lowest since August 2019, therefore showing some moderation. Food inflation printed in March 2025 stood at 2.69%.

Source: Moneycontrol

So, where does that leave us?

While the Nifty 50 is back near its average valuation, suggesting some potential headroom, mid and smallcaps seem to be expensive.

Investors should take a step back and do a temperature check by analysing finer things such as index valuations and economic indicators, to have a fair idea of where the market is heading. A volatile market is also a stock picker’s market, and as suc,h a deeper analysis of stocks would also be a good step before taking any major decisions.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story