Upstox Originals

Leather at a crossroads - Can India stitch resilience into exports?

6 min read | Updated on November 10, 2025, 16:56 IST

SUMMARY

India's leather and allied export businesses are under strain. In FY26, a 50% US tariff may reduce revenues by 12%, putting factories from Tamil Nadu to Kolkata in danger. Rivals like Indonesia and Vietnam are gaining ground quickly. Can India's leather producers use this tariff shock as a springboard for their next major accomplishment, or will one of the country's oldest export success stories lose its lustre?

A new report suggests that revenues of the leather and allied industry could shrink by 10–12% in FY26

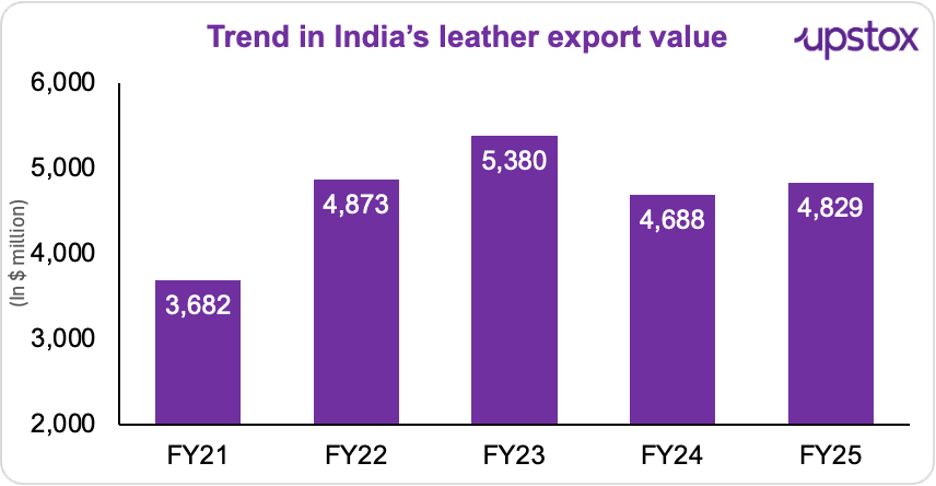

India's $5-billion leather and allied export industry has long been where craft meets commerce; artisans, tradition, and modern sustainability stitched into one story. It’s also one of India’s top ten foreign exchange earners, quietly powering jobs and exports for decades.

And India has always had the raw material muscle to back it up. The nation is home to 11% of the world's goat and sheep stock, 20% of the world's cattle and buffalo, and one of the world's greatest stocks of raw hides. That guaranteed a stable supply chain and competitive advantage for decades.

Source: IBEF, Council for Leather Exports

But you see, the winds are shifting. A new report by CRISIL Ratings suggests storm clouds are gathering. It warns that revenues could shrink by 10–12% in FY26, driven largely by fresh US tariffs.

Even in FY24, leather exports had already fallen by 12%. The industry survived that slowdown, but now this fresh salvo, so soon after the FY24 slowdown, has raised significant challenges for the industry.

This time, Washington has slapped a 50% duty on Indian leather exports; a mix of a 25% reciprocal tariff and a 25% penalty.

The cracks in the hide

The industry is a major source of employment, supporting around 4.42 million people, with women accounting for 30% of the workforce, especially in rural areas. In FY25, the leather and allied products sector generated $6.75 billion with 70% of revenue coming from exports. The tariff shock is already causing visible fractures: factory closures, declining US orders, and rising international competition.

The US market squeeze

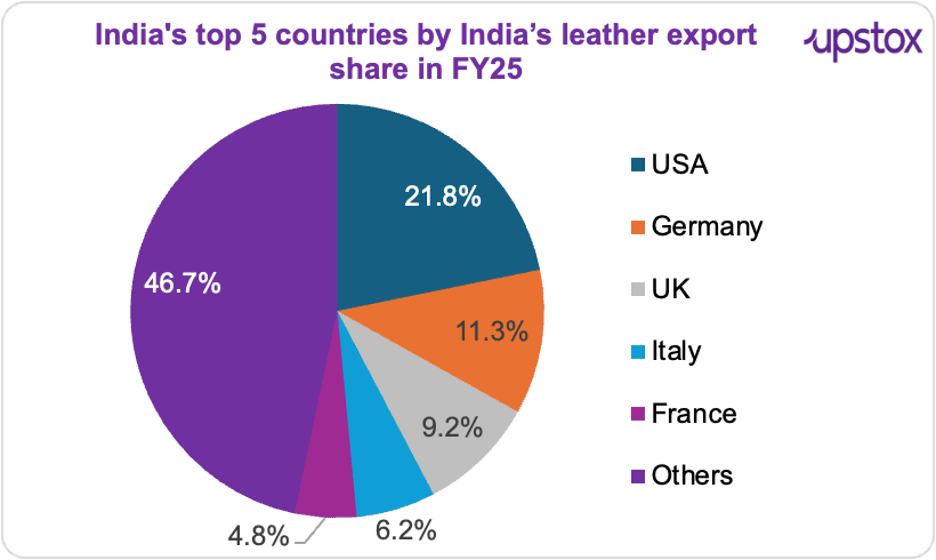

Although India exports leather to more than 50 nations, the United States alone accounts for 21.8% of the total (~$796 million in FY25). Therefore, even though India only makes about 1% of the $100 billion US leather market, it is very crucial. Germany (11.3%, $413 million) and the UK (9.2%, $334 million) are two more important markets.

Source: Council for Leather Exports

Tamil Nadu’s tanning towns feel the heat

The US tariff hike is shaking Tamil Nadu’s leather belt. Production is shifting to tariff-friendly countries like Vietnam and Ethiopia and 75,000 jobs are at risk.

The state makes most of India’s leather goods and sends 30% of exports to the US. Some companies rely on the American market for up to 60% of sales.

“US buyers are demanding 20% discounts they expect us to absorb. That’s not viable,” says Abdul Wahab, MD of KH Shoes. The statement underscores the pressure being felt by the small to mid players in the area. New orders are on hold until the trade dispute is resolved.

India has around 2,000 tanneries and 2,000 leather-goods manufacturers, concentrated largely in Tamil Nadu as well as Kanpur, Noida, and Agra. In Ambur (Tamil Nadu) alone, at least 50 of the roughly 300 leather factories have already shut, leaving workers uncertain about their future, according to a TOI report. Nearly 100 tanneries are staring at possible closure, pushing the sector to a critical tipping point.

According to M Karthikeyan, Technical Manager (Asia) of US-based Tannin Corporation, "the northern states are famous for safety shoes and upholstery leather." "Fashion leather factories are requesting that employees refrain from working three days a week. In the last few months, no fresh orders have been placed. It is evident that Tamil Nadu, which used to be the backbone of India's leather exports, is suffering from tariffs, lost business, and unstable employment.

Competitors gain ground

India isn’t the only player in the global leather game; and the US tariffs are making that painfully clear. While India faces a 50% duty, competitors are far better positioned. For example, total exports of Vietnam's leather and footwear industry were worth over $14 billion in value in the first half (H1) this year; a 10-per cent growth year on year (YoY), according to the National Statistics Office (NSO).

| Country | US Tariff (2025) |

|---|---|

| Vietnam | 20% |

| Cambodia | 19% |

| Indonesia | 19% |

| China | 30% |

| Bangladesh | 35% |

Source: TOI

Kanishk Maheshwari, co-founder of Primus Partners India, sums it up with an example:

Margins under pressure

Not only is the shop floor affected by the tariff, but the books are as well. Credit profiles may deteriorate and operating margins may decrease by 150–200 basis points, as reported by CRISIL. With 70% of its revenue coming from foreign markets, the leather and related products business, which made Rs 56,000 crore in FY25, is mostly dependent on exports.

What is India’s response?

Indian leather and footwear exporters can breathe a little easier. The UK presently receives only $440 million out of total exports worth over ~$5 billion. The India-UK Free Trade Agreement (FTA), signed recently, reduces taxes on leather, fur, and footwear from 16% to 0%. Sustained demand from other markets, as well as initiatives to diversify exports, may help to offset the decline in overall revenues. India and the UK will now proceed with legal review, Prime Ministerial signing, parliamentary ratification (expected within 9–12 months), and phased implementation.

According to Commerce Minister Piyush Goyal, India's leather and footwear export could reach $1 billion, within three years following the agreement, marking a major leap forward for the sector.

Exporters are even exploring ‘Made in Europe’ workarounds. By shifting a part of the production, like final stitching or finishing, to Europe, the product can legally carry a “Made in Europe” label and avoid the US tariff altogether.

At the same time, Indian exporters are diversifying their buyer base, redirecting shipments to Russia and African markets to cushion the revenue hit.

With GST on intermediate leather goods brought down from 12% to 5%, working‑capital intensity should improve and pressure on external borrowings ease; supporting the forecast that corporate leverage levels will remain stable.

In September, The Council for Leather Exports and the Federation of Indian Export Organisations (FIEO) engaged with Nirmala Sitharaman, and requested an interest equalisation scheme, strengthened market access initiatives, and temporary support for exports to the US to prevent job losses amid punitive tariffs and statutory contributions.

The income tax benefits announced in the Union Budget, combined with lower interest rates resulting from policy rate cuts by the RBI and stable inflation rates, are likely to boost consumption.

In summary

India's leather business is being tested for adaptability in addition to tariffs. Success will depend on how exporters innovate, diversify markets, and strategically harness policy assistance. Those who pivot effectively have the potential to turn upheaval into growth, but those who are reluctant to adapt risk losing momentum on the global stage. The future years will show who genuinely owns the leather tradition.

Disclaimer: Views and opinions expressed in the article are the author's own and do not reflect those of Upstox.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story