Upstox Originals

K-Wave in India – From BTS to Bibimbap

7 min read | Updated on September 02, 2025, 15:07 IST

SUMMARY

Kimchi on your plate, BTS on your playlist, and K-dramas on your watchlist, the Korean wave is sweeping across India, and trade is riding the momentum. From EVs to semiconductors, partnerships are deepening. Bilateral trade hit $27.5 billion in FY24, with Korean exports dominating, but India’s own shipments still finding ground. The real question - can India stay agile, boost its exports, and turn the K-wave into a win-win story?

Since 2020, K-drama streaming has jumped 370%

BTS. K-dramas. Tteokbokki. Korea isn’t just a cultural wave in India, it’s turning into serious business.

From BTS beats to binge-worthy K-dramas and spicy ramen, the unstoppable ‘Hallyu’ (a term coined by Chinese media in the 1990s to describe the global spread of Korean culture) wave is changing what Indians watch, eat, and vibe to:

K-dramas

Why is India hooked on K-dramas? Could it be titles like Crash Landing on You, Goblin, and Descendants of the Sun? And remember the Squid Games? Season 1 stayed in the Top 10 for 39 weeks on Netflix! These shows are now must-watch on Netflix, Amazon Prime, and Disney+ Hotstar. Since 2020, K-drama streaming has jumped 370%. Is this just a trend? Hardly.

Who’s watching? Not just metros, multilingual subtitling and dubbing in Hindi, Tamil, Telugu, and Kannada are driving pan-India appeal.

The FICCI-EY media and entertainment report shows Korean, Japanese, and Spanish shows are the most-watched non-English content on Netflix. Netflix is betting big with $2.5 billion over four years to grow Korean content. Amazon Prime and Disney+ Hotstar are adding more K-dramas. Platforms like Playflix are removing language barriers.

K-Beauty

It’s not just multi-step routines or exotic ingredients, from snail mucin to Jeju volcanic ash, promising flawless ‘glass skin.’ K-beauty is taking India by storm.

A deep dive by Sciative Solutions into 51,000+ SKUs across 38 K-beauty brands (Oct 2024–July 2025) shows just how fast this craze is growing. Portfolios jumped 35% in nine months. Big names expanded: Laneige went from 62 to 87 SKUs, The Face Shop from 77 to 104. New players? Anua, VT Cosmetics, Mixsoon, Round Lab, all hitting shelves in mid-2025.

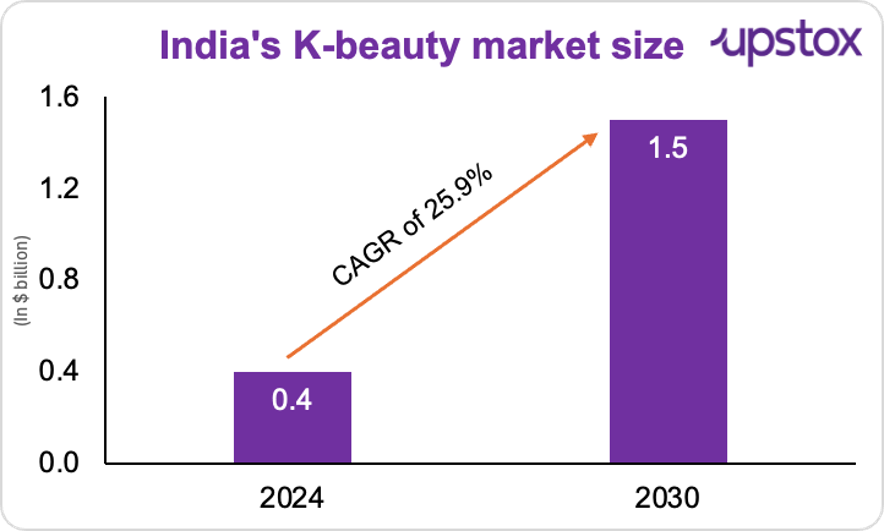

So, how big is the audience? 11.9 million Indians are already hooked, and that’s set to skyrocket past 27 million by 2030.

K-beauty has gone from niche to powerhouse, growing at a whopping 75% year-over-year, notes Siddharth Bhagat, Director, Amazon Fashion and Beauty India.

Adoption is accelerating: buyers are expected to more than double by 2030, while per capita spend climbs from $33.3 to $56.3. Digital-first platforms are driving the craze: 49% shop via marketplaces, 23% via brand D2C sites, and Myntra reports 80% YoY growth. Over 25 brands are active, and momentum is unstoppable.

Challenges? Sure - price, complexity, authenticity. But fans aren’t slowing down: 72% plan to increase usage, and 80% will pay a premium for quality.

Source: Business Standard

Today, 60+ Korean beauty brands, from Laneige and The Face Shop to Etude, Cosrx, and Sulwhasoo, are making waves in India, mostly via offline stores and platforms like Nykaa and Amazon. Here’s a peek at the top 5 best-selling products of 2025.

K-Beauty Product

Source: Tira

K-Pop

Most Indians got hooked on K-Pop back in 2012, thanks to PSY’s Gangnam Style—one of the most-watched YouTube videos ever! That viral hit didn’t just get people dancing; it opened the door to K-Pop and the Korean Wave (Hallyu) fever across the globe.

When it comes to K-Pop, BTS, Blackpink, and EXO are the crowd favorites, adored for their catchy songs, stellar performances, and massive fan followings.

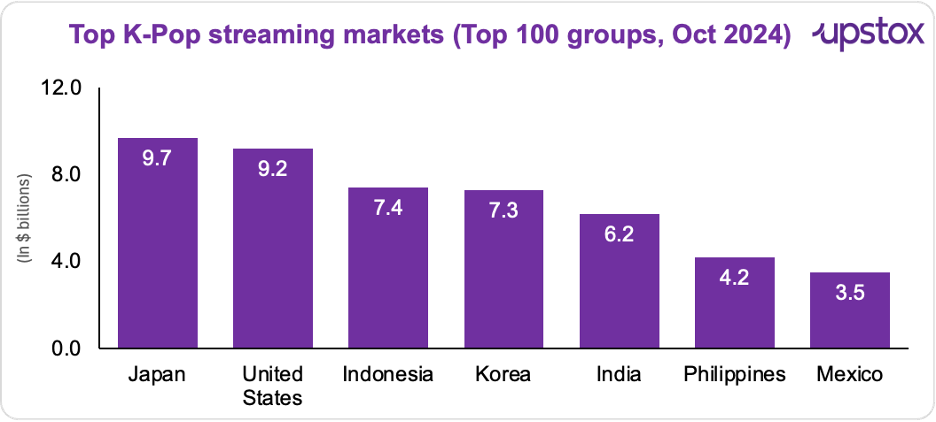

India now boasts over 15 million K-Pop fans, streaming Korean music like never before. The top 100 K-Pop groups generated 6.2 billion on-demand streams in India last year, placing India among the top five global K-Pop streaming markets. And it’s only getting bigger—Hybe, the powerhouse behind BTS, plans to launch a subsidiary in India by October 2025, signaling just how serious the market has become.

Here’s how India stacks up globally in K-Pop streaming (Oct 2024):

Source: Data from Luminate’s weekly report on the Top 100 K-Pop Groups (as of Oct. 24, 2024); figures represent cumulative streams for the year-to-date.

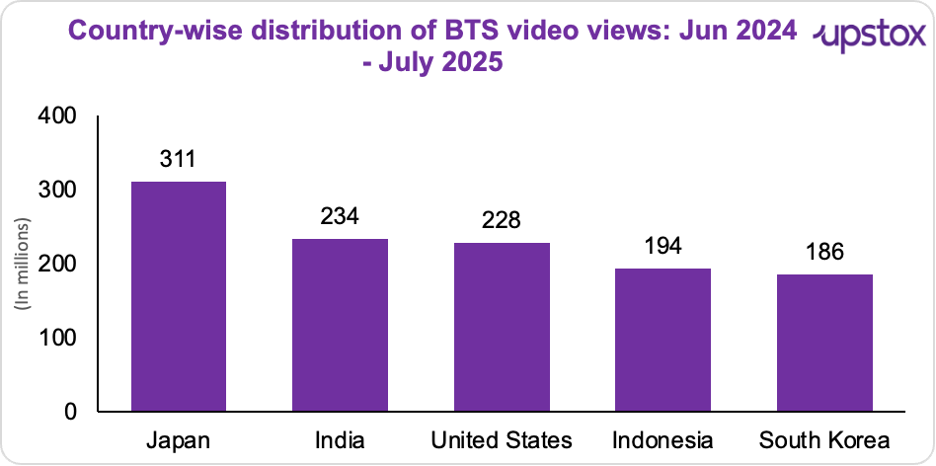

When it comes to BTS video views on YouTube (June 2024–June 2025), India is right up there too (the views in India are more than even South Korea!!):

Source: Youtube charts

Where in India are BTS videos getting streamed the most? Bengaluru leads with 13.4M views, followed by Delhi (12.7M) and Hyderabad (11.8M). Chennai hits 10.8M, Mumbai clocks 9.38M, and Pune and Guwahati round out the top cities with 7.86M and 7.3M views. From tech hubs to cultural capitals, K-Pop fever is everywhere.

K-food

Are Korean noodles slurping their way into Indian kitchens? The instant noodles market in India, worth $1.8 billion in 2023, is on fire, set to hit $3.8 billion by 2028 at a sizzling 15.3% annual growth. And the Korean slice of that pie? Mind-blowing. Sales of Korean instant noodles have jumped 400% since 2021—from just ₹2 crore to over ₹65 crore in 2023, according to NielsenIQ.

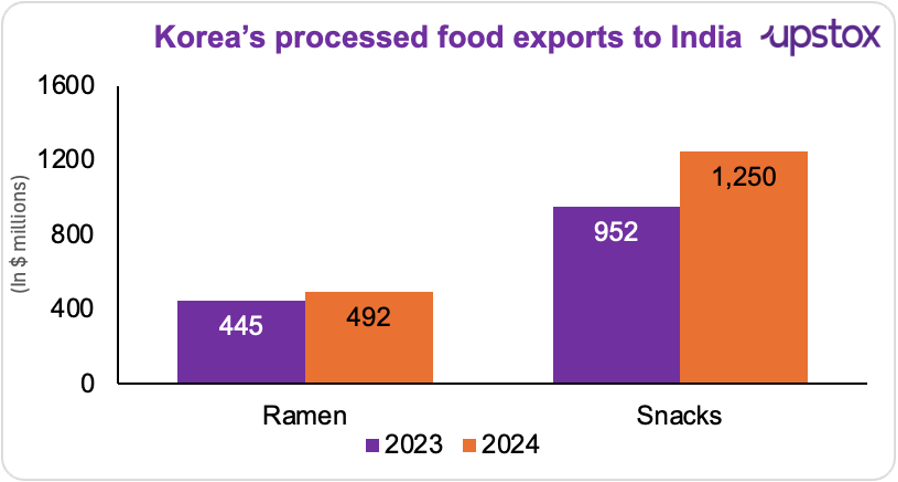

Why the frenzy? Urban lifestyles, bigger wallets, and the love for quick, tasty meals are fueling the craze. South Korea’s processed food exports to India have surged to a record ₩6 trillion ($4.1B), showing just how hungry India is for K-food. On Swiggy, orders for Korean dishes shot up 50% YoY in July 2025, and it’s not just metros: non-metro cities like Surat, Vadodara, Thiruvananthapuram, Mysuru, and Mangaluru are catching the K-food fever, with a 59% YoY jump in orders.

Korea’s top food giants - Lotte Wellfood, Nongshim, and Orion - are going all-in, and slurp by slurp, K-food is winning hearts across India.

Source: News articles

Looking ahead

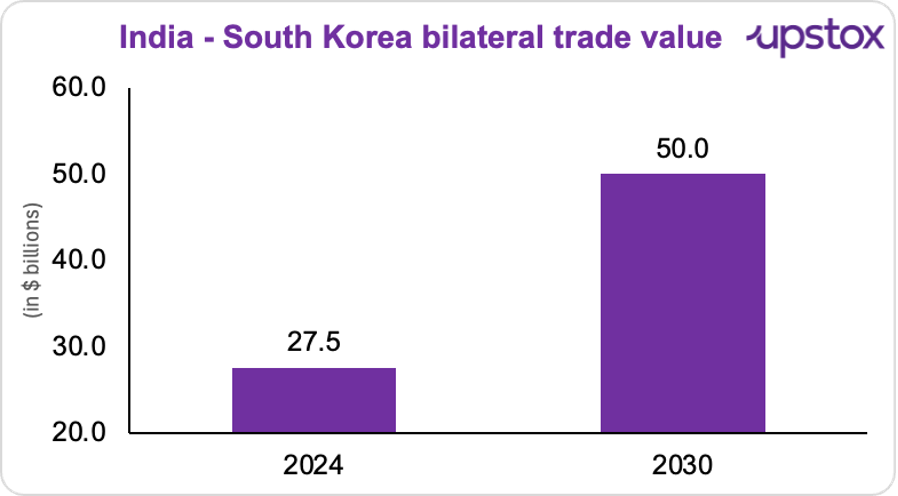

Trade between the two countries touched $27.5 billion (₹2.36L crore) in FY24 and could touch $50 billion (₹4.3L crore) by 2030.

Source: ET

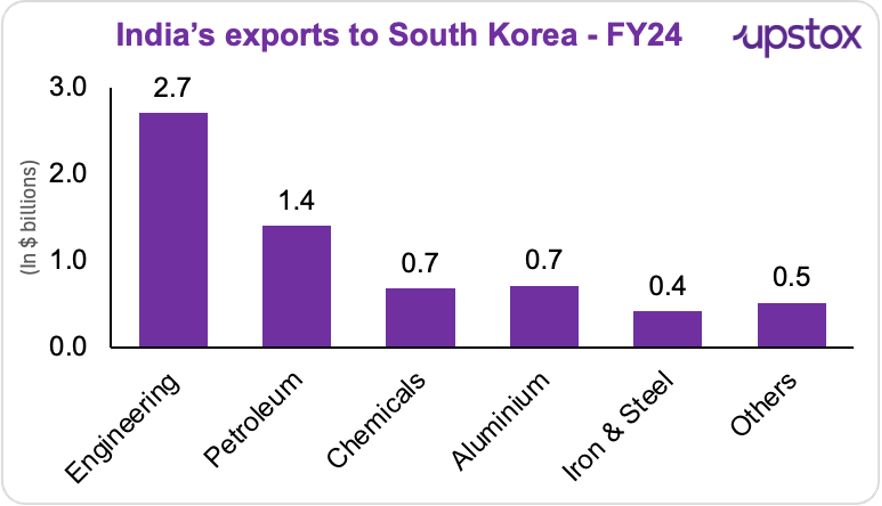

But behind that big number lies an imbalance. India shipped $6.4 billion worth of goods to Korea…

Source: Trading Economics

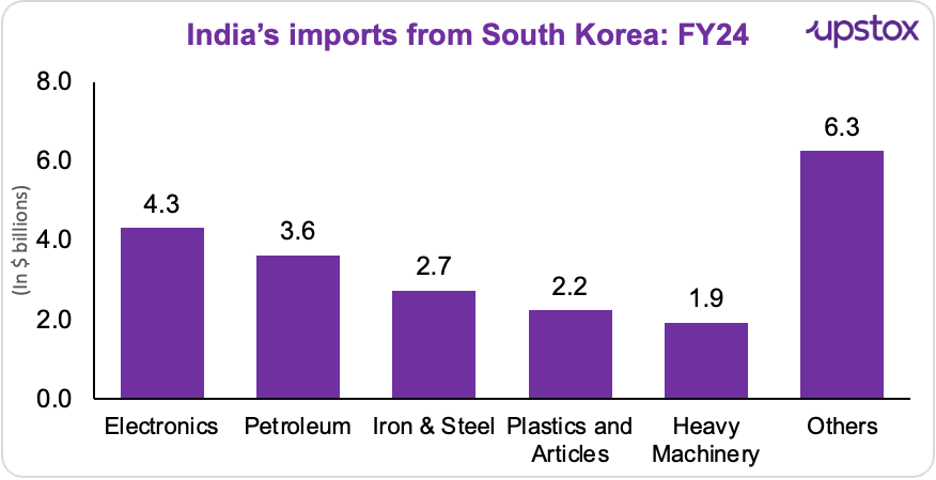

…Now flip the coin, South Korea shipped goods worth $21.1 billion our way:

Source: Trading Economics

India’s trade deficit with South Korea is hard to ignore. So, what’s the plan to flip the script?

In 2025, CEPA signed in 2010 is under review. Can cutting non-tariff barriers and easing market access really boost exports by $1.2 billion by 2026? India is betting yes.

And.. Korean firms are making moves too. Good thing for India, right? Hyundai is pumping $2.5 billion into India’s EV ecosystem. LG Electronics is building a $600 million Andhra Pradesh plant with 1,495 direct jobs. Hwaseung Footwear plans a ₹1,720 crore (~$208 million) Tamil Nadu facility for 20,000 jobs.

Even a 6MTPA steel plant from POSCO-JSW ($1.5–2 billion) is on the horizon. Will local manufacturing be the game-changer?

High-tech collaboration is also taking center stage. Green hydrogen, semiconductors, shipbuilding, and medical devices are on the table, backed by 15+ joint research projects. Ambassador Kumar notes: “South Korea is among the top four or five nations in green hydrogen technologies, but they don't have much renewable energy due to geographical limitations.

Therefore, they are looking at countries like India to forge green hydrogen partnerships. Both countries have very ambitious roadmaps for the deployment of green hydrogen. I see this as a promising area for future collaboration.”

So, is India just watching the deficit grow? Not a chance. By blending exports, strategic investments, and high-tech collaboration, India is turning the trade gap into an opportunity and building a stronger, balanced partnership with South Korea.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story