Upstox Originals

Is UPI’s next big win waiting in rural India?

6 min read | Updated on October 31, 2025, 14:55 IST

SUMMARY

UPI has transformed how India pays, growing sixfold in just four years and making digital payments second nature in cities. The next leg of the journey? Taking that ease to rural India. Patchy networks and basic phones aren’t hurdles; they’re the next opportunity to innovate. Because UPI’s success isn’t just about urban speed, it’s about nationwide reach.

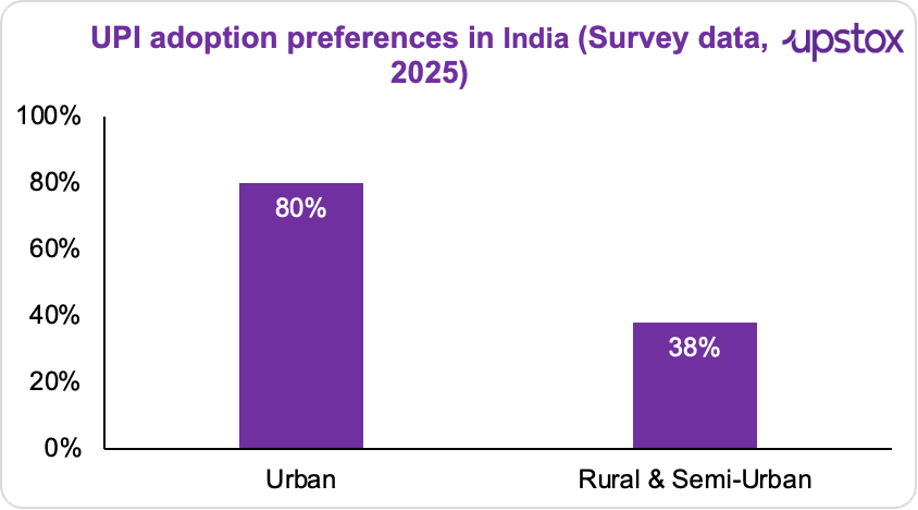

Surveys show that only about 38% of rural and semi-urban Indians prefer UPI for transactions, compared with over 80% in urban centres

India’s UPI is the world’s poster child for digital payments. It’s quick, seamless, and universal, at least, that’s the vision. Finance Secretary M. Nagaraju even called it “a very substantial intervention” in India’s payments landscape.

But the story isn’t done yet. After transforming how cities pay, UPI’s next big win lies beyond them, in rural India. Surveys show that only about 38% of rural and semi-urban Indians prefer UPI for transactions, compared with over 80% in urban centres - a stark contrast that reveals how connectivity, not curiosity, is the real constraint.

Source: ET BFSI

The numbers tell only part of the story. Millions in villages aren’t staying offline by choice; they’re simply waiting for the right access, the right tools, and the right push.

And there’s never been a better time.

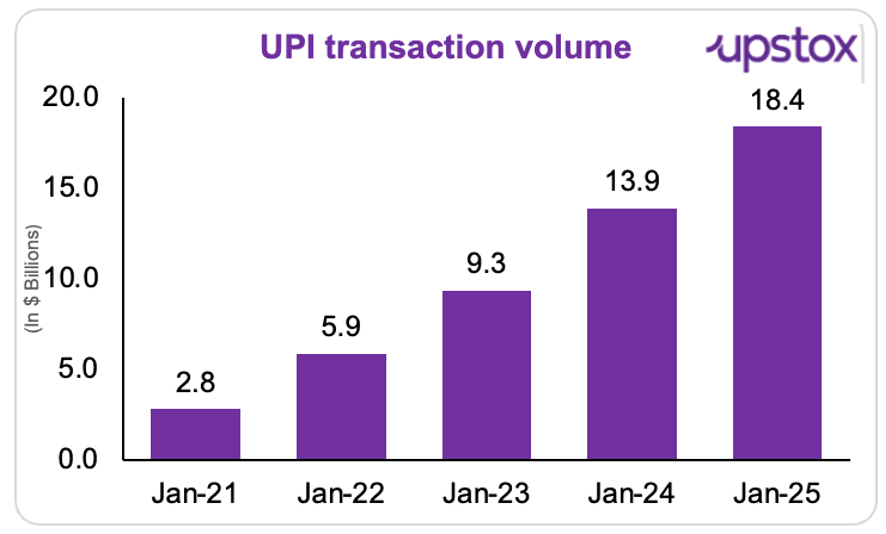

In just four years, transaction volumes have jumped from 2.8 billion in January 2021 to a staggering 18.4 billion in January 2025 — that’s a sixfold leap. The growth hasn’t slowed either; each year has added billions more to the tally as digital payments go mainstream.

From small kirana stores to urban professionals, everyone’s tapping and scanning their way through daily life.

Source: PIB

The next phase of growth lies where 70% of India lives, in villages and small towns. Here, patchy networks and low 4G reach still slow things down. According to TRAI, over 45,000 villages don’t have 4G coverage, and another 1.1 lakh struggle with weak signals. So even when a shopkeeper has a smartphone and UPI, a “network error” can still get in the way.

But that’s not a roadblock, it’s the next big opportunity.

The infrastructure paradox

The irony is striking. India has built one of the most advanced digital public infrastructures (DPIs) in the world - Aadhaar, Jan Dhan, and UPI form what’s known globally as the “India Stack.”

Yet, the last-mile infrastructure - mobile towers, broadband fiber, stable electricity - still lags.

BharatNet, the government’s ambitious rural broadband project, was supposed to connect 2.5 lakh gram panchayats via optical fiber by 2023. As of mid-2025, official data shows only 1.9 lakh have been connected, and many of those remain non-functional due to power cuts or cable vandalism.

Fintechs that depend on uninterrupted connectivity for real-time payments now face a structural dilemma — the hardware is ready, but the network isn’t.

The UX problem that needs to be solved

On paper, India’s digital payment system looks flawless. But out in the villages, the experience tells a different story.

The RBI’s 2024 survey found that 30% rural users faced UPI failures - apps freezing, payments timing out, or biometric scans not working. And it’s not just users. NITI Aayog reported that 20% Business Correspondents (BCs) — the very people who help villagers access cash and digital services — struggled with device errors or server delays.

Meanwhile, the rural banking network is quietly shrinking. India lost 2.37 lakh BC outlets in just one year (2023–24). In Rajasthan, about 65% of villages rely entirely on BCs because there isn’t a single bank branch within 5 km. But here’s the kicker — only 58% of BCs show up regularly. The rest stay offline thanks to low incentives, bad signal, or broken biometric machines.

In other words, digital payments may have gone national, but reliability hasn’t.

Enter offline UPI

Recognising this gap, NPCI launched UPI 123Pay in 2022 — designed for feature phones without internet. Users can:

- Dial *99# to access basic UPI services through voice menus

- Use IVR or missed call-based systems

- Make payments via sound-based proximity tech like “ToneTag”

In theory, it was a game-changer. But adoption has been tepid. As of FY 2024-25, UPI 123Pay accounted for less than 0.1% of total UPI transactions.

Why? Because using a USSD-based system takes about 4–5 minutes per transaction and costs telecom providers per session. Most users either don’t know about it or find it cumbersome compared to scanning a QR code when they do have connectivity.

The same goes for voice-based payments — NPCI piloted a model called “Hello! UPI” in 2023 in collaboration with Bhashini for regional-language voice commands. But scaling that in remote areas requires low-latency connectivity, ironically defeating its “offline” purpose.

The device divide

The other unspoken issue? Devices.

About 300 million Indians still use feature phones. Many low-income smartphone users rely on budget 2G/3G handsets that struggle with UPI app updates or storage.

So, even before connectivity, there’s a device-performance barrier that limits sustained adoption.

The economics of going offline

For banks and NBFCs, supporting offline UPI isn’t just a tech challenge — it’s an economic one.

Running a stable UPI node requires cloud servers, real-time fraud detection, and compliance monitoring. Offline syncing adds complexity — you need store-and-forward mechanisms, tokenisation, and multi-layer reconciliation to prevent duplicate transactions.

Each additional layer increases cost, which small banks hesitate to bear for low-value transactions.

Yet, ignoring rural users isn’t an option either — the next 100 million digital payment users will come from these areas, according to a NITI Aayog study.

That’s where the Public-Private Partnership (PPP) model could play a role — shared rural data hubs, community Wi-Fi networks, and co-funded offline transaction gateways.

What the world can teach us

Compare this to Kenya’s M-Pesa, which runs largely on SMS. Even with patchy 3G, it covers 96% of adults and handles about half of Kenya’s GDP in transaction value. Or look at Brazil’s Pix, where the central bank designed a built-in offline mode using encrypted time-stamped QR codes. Users can complete transactions that sync automatically once they reconnect.

India, despite leading the world in real-time digital transactions, still depends heavily on 4G data signals — a single point of failure for financial inclusion.

Policy and the road ahead

The government is aware of the gap. The Digital Payments Mission 2025 aims to bring offline UPI to every panchayat through sound-based and near-field technologies. NPCI is also working on “UPI Lite Offline”, which allows small-value payments (below ₹500) to be processed without an active internet connection.

UPI Lite Offline has already been tested with a few banks, using an on-device wallet model — funds are stored locally and updated when connectivity resumes. However, widespread rollout needs strict checks against double-spending and reconciliation mismatches.

The next leap

The next phase of India’s digital payments story won’t be about faster QR scans in cities — it’ll be about reliable transactions in zero-bar zones.

The innovation frontier will shift from speed to stability. Fintechs will have to design for patchy signal, power cuts, and old phones — essentially, a “low-infrastructure India.”

Because true financial inclusion isn’t when everyone can pay digitally. It’s when everyone can rely on it.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story