Upstox Originals

Is there a new player in the global battery race?

7 min read | Updated on January 14, 2026, 15:52 IST

SUMMARY

Lithium’s decade-long boom is starting to lose charge as China shifts gears to sodium-ion batteries. These batteries are supposedly cheaper, safer, and an easier chemistry to scale. Could this reset the global battery race? For India, the clock’s ticking to turn its lithium success into something bigger before the chemistry changes again

In 2026, sodium-ion batteries aren’t just prototypes anymore, they’re rolling off production lines

Lithium powered one of the biggest industrial booms of the century. It turned a once obscure mineral into a trillion-dollar cornerstone of the clean-energy economy.

Yet the same growth story that made lithium indispensable now threatens to make it vulnerable. If the energy transition were built around one element, what would happen when the world’s biggest battery maker starts backing another?

In China, that pivot has already begun. A new chemistry, sodium-ion, is emerging as lithium’s potential successor: cheaper, easier to source, and better suited for mass-market electric mobility and grid storage. The shift could reshape global battery supply chains, and test how fast India’s chemical industry can adapt.

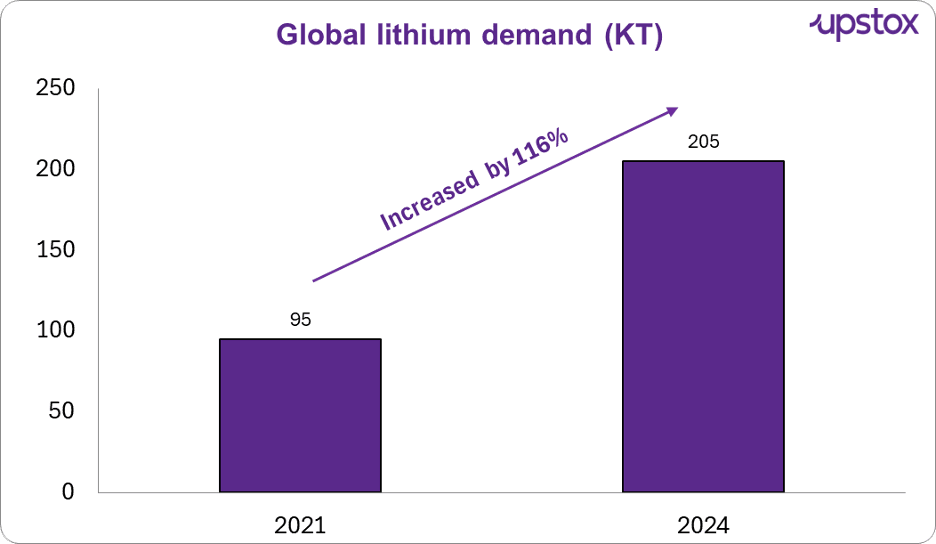

Global lithium demand has jumped 116% in just three years, as electric vehicles and energy storage went from government targets to boardroom priorities. The rush to secure supply triggered a wave of mining, refining, and battery investment worth hundreds of billions of dollars.

But the world’s battery metal is facing a slowdown, and the next chemistry is already taking shape.

Source: IEA.org

China’s catalyst: the sodium-ion pivot

Every big technology shift starts quietly, and this one’s already humming in China. Back in 2021, battery giant CATL unveiled its first sodium-ion prototype. At the time, it seemed like a side project, a backup plan if lithium prices got out of hand.

But three years later, that experiment is becoming a full-blown production line. CATL now plans to start large-scale sodium-ion manufacturing by 2026, marking the first commercial rollout of a post-lithium chemistry.

| Cost Factor | Lithium-ion cell | Sodium-ion cell |

|---|---|---|

| Raw material cost (carbonate) | ~$10,000–$11,000/ton | ~$600–$650/ton |

| Production cost | ~$80 per kWh | ~$80-90 per kWh (2025), will drop next few years |

| Availability | Rare (0.0017% of crust) | Abundant (2.6% of crust) |

Source: Bonnen Battery

The numbers tell the story better than any press release. Sodium carbonate, the base ingredient, is nearly 90% cheaper than lithium carbonate. That price gap alone gives sodium-ion batteries a massive head start before a single cell is made.

At the production level, the costs are currently neck and neck, around $80 per kWh for lithium and $80–90 for sodium, but sodium has a key advantage. It’s simpler to process and far easier to source. As Chinese factories scale up, those costs could fall another 30–40%, making sodium-ion one of the most affordable energy-storage technologies out there.

And this isn’t just a chemistry swap; it’s an industrial strategy. China’s battery industry has realised that building more lithium plants doesn’t guarantee an edge. So it’s now focusing on building smarter ones. Sodium-ion gives them exactly that, a chance to lead the next battery wave before anyone else even catches on.

From prototype to production: China’s next battery bet is real

-

From prototype to production:- In 2026, sodium-ion batteries aren’t just prototypes anymore, they’re rolling off production lines. Both CATL and BYD have begun manufacturing limited batches for small electric vehicles and stationary storage, marking the first real commercial rollout of a post-lithium chemistry. The BYD Seagull, launched in 2023, now includes a sodium-ion variant for the affordable EV segment, proof that this isn’t a lab experiment anymore.

-

Scaling up, fast:- Sodium and lithium batteries share nearly identical manufacturing processes, which means companies can retrofit existing lithium lines instead of building new ones. That’s why China’s sodium-ion battery capacity doubled from 0.7 MWh to 1.5 MWh last year. CATL’s second-generation cells, launched in late 2025, now hit 200 Wh/kg energy density, while BYD has logged 10,000+ charge cycles in early tests for electric two-wheelers and energy storage systems.

-

Beyond cars:- Sodium-ion batteries are already finding a place in China’s grid-storage network, especially in colder regions like Inner Mongolia and Heilongjiang, where lithium cells lose efficiency. Projects by HiNa Battery, Datang Group, and Sunwoda show that the technology is proving itself outside of test labs, reliable, stable, and commercially viable.

For Indian chemical suppliers, this progress is less a threat and more a signal. The same expertise used to make lithium-based materials can easily pivot to sodium-ion systems. In a market where chemistry keeps changing, the real advantage will belong to those who can adapt the fastest.

Lithium vs sodium: how they perform in the real world

| Parameter | Sodium-ion batteries | Lithium-ion batteries |

|---|---|---|

| Gravimetric energy density | 75–160 Wh/kg | 120–260 Wh/kg |

| Volumetric energy density | ~100–200 Wh/L | ~250–700 Wh/L |

| Cycle life | 2,000–5,000 cycles | 2,000–10,000 cycles |

| Efficiency (round-trip) | 85–92% | 92–98% |

| Discharge rate | Stable at high discharge rates | Drops at high discharge rates |

| Operating temperature range | –30°C to 60°C | –20°C to 45°C |

| Safety (thermal stability) | Low fire risk, stable | Higher risk, needs thermal control |

| Technological maturity | Emerging, early commercial | Mature, mainstream in EVs |

Source: Voronoi

On paper, lithium still wins on energy density, it packs more power in less space. That’s why it remains the go-to chemistry for high-performance EVs. But sodium has other strengths that make it a serious contender in the next phase of electrification.

For one, sodium-ion cells handle temperature swings far better, performing reliably in both scorching summers and freezing winters, conditions that degrade lithium batteries faster. They’re also safer, less prone to catching fire, and cheaper to scale because the materials are widely available.

That combination makes sodium-ion perfect for mass-market applications like two-wheelers, city cars, and stationary power storage, where safety, cost, and stability matter more than maximum range.

So this isn’t a lithium-versus-sodium fight. It’s more of a tag team. Lithium will stay the choice for premium EVs and fast-charging devices, while sodium steps in for everyday mobility and grid storage.

Lithium players aren’t exactly losing sleep, yet. Most are already adapting, testing hybrid packs and new chemistries to keep their edge while sodium finds its footing. In other words, the two chemistries won’t compete, they’ll coexist.

India’s lithium clock is ticking, but it’s not China’s to stop

For India’s chemical industry, lithium is still very much a growth story.

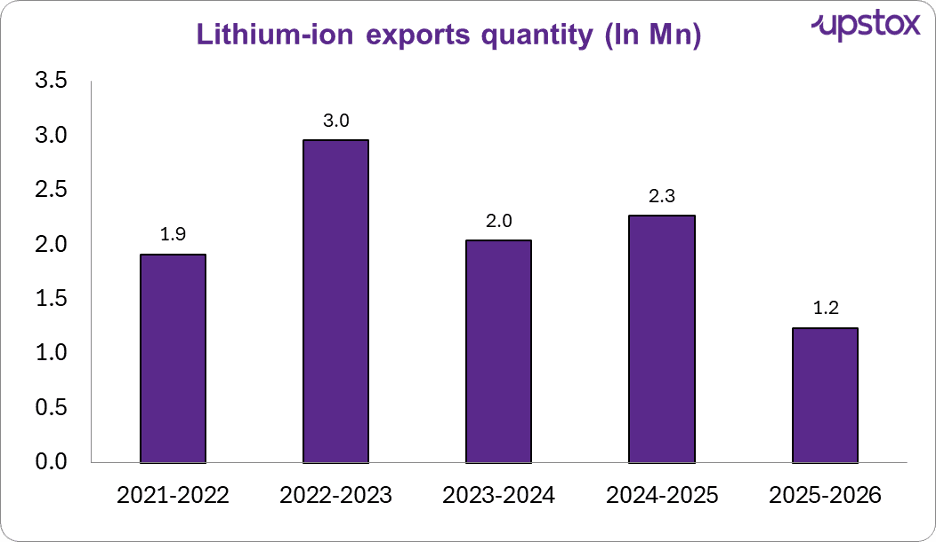

Over the last few years, a few speciality exporters have built a steady niche in lithium salts and fluorinated materials that feed into the global EV and battery supply chain. Unlike China, which is now grappling with overcapacity, India is still in its build-out phase. Lithium-related exports have averaged around 2.1 million units a year over the past five years, peaking at 3 million in FY23 before easing to 1.2 million in FY26.

Source: Government of India

That may look modest next to China’s numbers, but it’s a solid foundation for a country still exporting chemical inputs rather than finished cells, and that’s precisely what keeps India flexible as global battery chemistry begins to shift.

Sodium-ion’s rise in China doesn’t spell the end of India’s lithium play. The two chemistries serve different markets: sodium is being deployed mainly in China’s domestic EV and grid-storage sectors, while lithium continues to power global high-performance batteries used in premium EVs and renewable storage.

Rather than racing to match China’s scale, India’s opportunity lies in building adaptability, strengthening its refining, recycling, and speciality chemical base to serve whichever chemistry dominates next.

China may be rewriting the battery playbook, but India’s best move is to stay nimble, ready to supply whatever molecule powers the next energy wave.

India’s lithium moment: still bright, but shifting

India’s lithium story isn’t ending, it’s evolving.

The era of breakneck volume growth is giving way to one where chemistry flexibility beats capacity.

Instead of chasing scale, India’s strength will lie in broadening its chemical base, the same processes that make lithium salts and fluoropolymers can easily pivot to sodium-ion, potassium-ion, or solid-state systems.

That adaptability is India’s edge. Lithium still has room to run, but the next big opportunity will belong to those who move fastest when the chemistry changes. In the energy decade ahead, the winners won’t just store power, they’ll switch chemistry faster than anyone else.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story