Upstox Originals

Is India’s $1 trillion export dream in danger?

.png)

6 min read | Updated on August 04, 2025, 15:49 IST

SUMMARY

India has set its sights on a bold target – $1 trillion in exports by 2028. But is the current growth pace enough to get there, or does it need a bigger push? From engineering goods to IT services, let’s decode what’s driving exports and what’s holding them back. Can India turn this ambitious vision into reality? Let’s find out.

India needs structural acceleration to achieve its $1 trillion export target by 2028

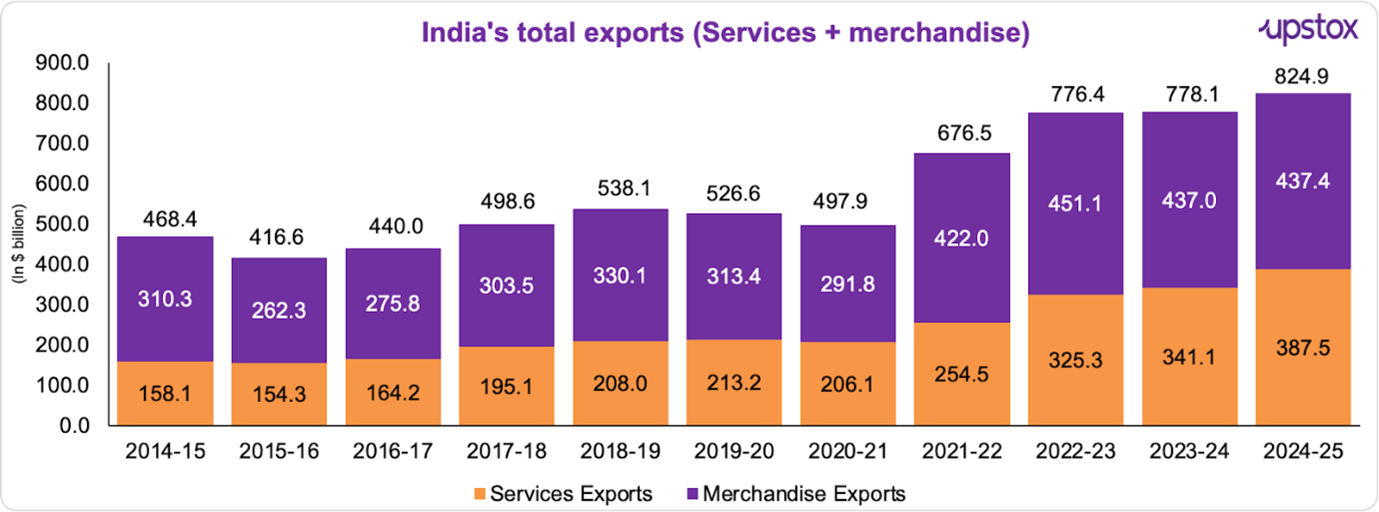

India's total exports touched an all-time high of $824.9 billion (+6% YoY) in the FY2024–25, including both merchandise and services, according to the RBI and the Commerce Ministry.

While this marks a new milestone, it also raises a pressing question: is the current pace enough to hit $1 trillion by FY27-28?

To move from $824.9 billion to $1 trillion in two years, India needs an average annual growth of 10–12%, almost double the current rate of 6%. This means incremental growth won’t cut it - a structural acceleration is essential.

Source: PIB

Services exports achieved a new peak of $387.5 billion in 2024–25, a 13.6% rise from $341.1 billion in the prior year.

Strong sectors, but fast enough?

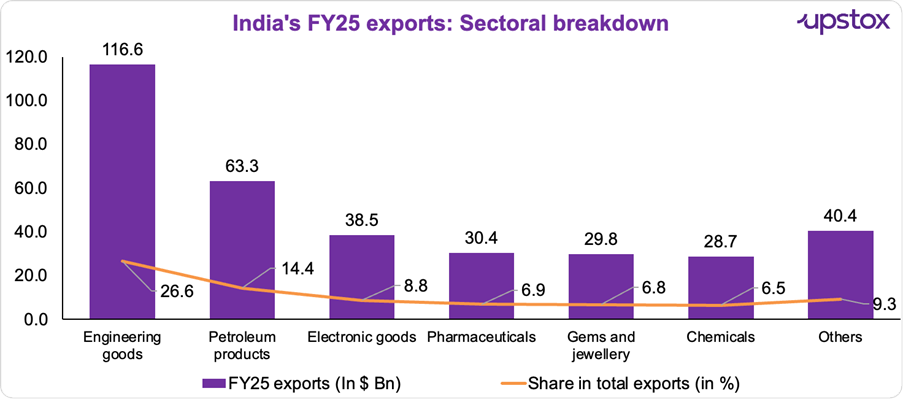

Engineering goods, IT services, electronics, textiles, pharmaceuticals, marine & agriculture, and toys form the backbone of India’s exports.

Source: Niryat.gov.in

But here’s the catch – According to a study by the Ministry of Commerce and Industry, these focus sectors are expected to generate around $670 billion in exports by FY30.

This timeline raises a red flag. If these sectors are projected to reach $670 billion only by 2030, can they accelerate sharply enough to bridge the gap to $1 trillion by FY27? Without a rapid scale-up and structural push, India’s trillion-dollar export dream risks remaining just that – a dream.

Where are India’s exports headed?

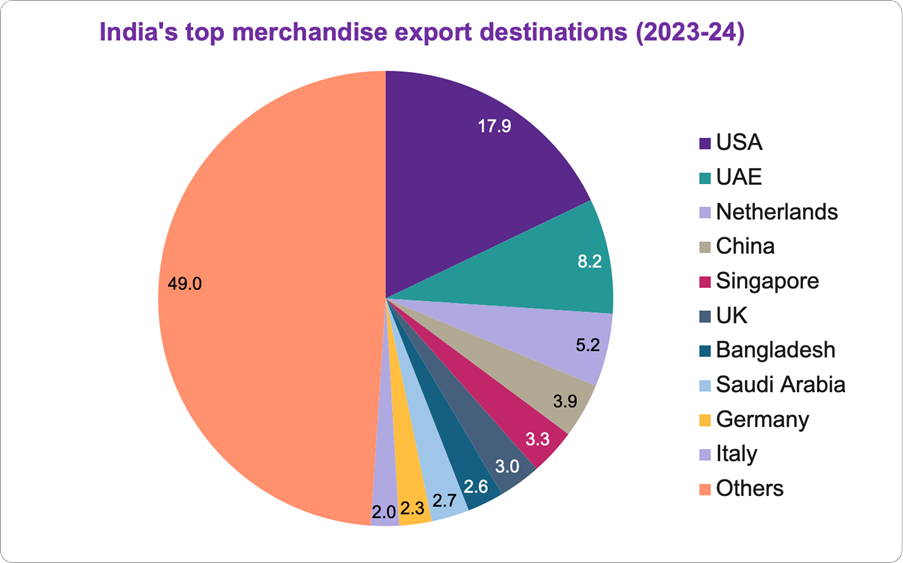

Despite diverse sectors, India’s exports are concentrated – 10 countries took 51% in FY24.

Source: PIB

As showcased above, the US is India’s top merchandise export destination, but storm clouds are gathering.

CRISIL warns India’s goods exports could face headwinds in FY26, with US reciprocal tariffs kicking in from August. A bilateral trade deal is under negotiation, and its outcome is crucial.

Adding to worries, the WTO expects global merchandise trade to shrink by 0.2% in 2025, reversing the 2.9% growth seen in 2024. Global growth is also set to slow to 2.9% from 3.3%.

US growth, vital for Indian exports, is projected to dip to 1.7% from 2.8%, piling on the pressure.

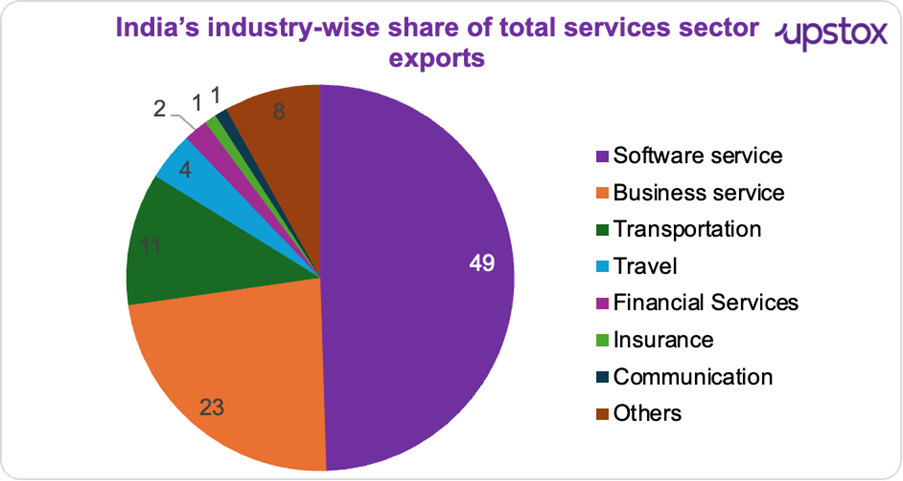

Can services hold the fort?

Services exports, particularly IT and business services, form a critical pillar of India’s export growth.

Source: KPMG

As showcased above, IT services still dominate, but challenges are mounting. Take Trump’s proposed reciprocal tariffs, for instance. They may not directly target Indian IT giants like Infosys, TCS, Wipro, HCL, and Tech Mahindra, but the indirect risks are hard to ignore. If US clients face higher import costs, what’s their first move? Cut IT budgets, delay contracts, or put digital projects on hold.

And here’s the clincher, over 50–70% of Indian IT revenue comes from US clients, especially in sectors like retail, manufacturing, and pharma that are most exposed to these tariffs.

Add to that the visa roadblocks. Stricter H-1B and L-1 policies and the “Hire American” push mean Indian firms may have to ramp up local hiring in the US, driving up operational costs. Political backlash against offshoring could also intensify, particularly in sensitive sectors.

So, what’s the way out? Indian IT majors aren’t waiting around. They’re diversifying rapidly into Europe, Asia-Pacific, and Latin America, while setting up nearshore hubs in Mexico, Poland, and Canada to cut down their dependency on the US market.

But it’s not just IT services facing headwinds.

India’s exports as a whole are being shaped by shifting global trade dynamics and rising protectionism:

-

Protectionism is back: In 2025, global trade is becoming more restrictive. G20 countries have imposed 4,650 import restrictions, a 75% jump since 2016 and nearly 10 times more than in 2008. The US has sharply raised its average tariff from 2.5% to 27%.

-

EU’s green rules may block exports: From 1 January 2026, the EU will roll out three big rules — EUDR (to stop deforestation), CBAM (a carbon tax on imports), and ESPR (eco-friendly product standards). These rules make it harder for Indian MSMEs to export.

-

New EU rule tracks full product lifecycle: Also from 1 Jan 2026, the EU’s Digital Product Passport (DPP) will track products like electronics, batteries, textiles, and building materials from start to finish. It’s a big challenge for Indian MSMEs without detailed supply chain records.

How can India bridge the gap?

A step beyond IT

Global Capability Centres (GCCs – offshore units that handle strategic, digital, and operational functions for multinational companies) are pushing India’s services exports beyond traditional IT into high-value innovation. India hosts ~1,800 GCCs, aiming for 3,400–5,000 by 2030 with strong policy and ecosystem support.

He noted 67% of Fortune 500 and 77% of Forbes Global 2000 companies are yet to set up GCCs, while mid-market firms contributed 35% of new setups in the past two years. This growth could support 20-25 million jobs by 2030, including up to 5 million direct jobs.

Today, GCCs cover BFSI, engineering R&D, fintech, and digital product development, making India a global innovation hub.

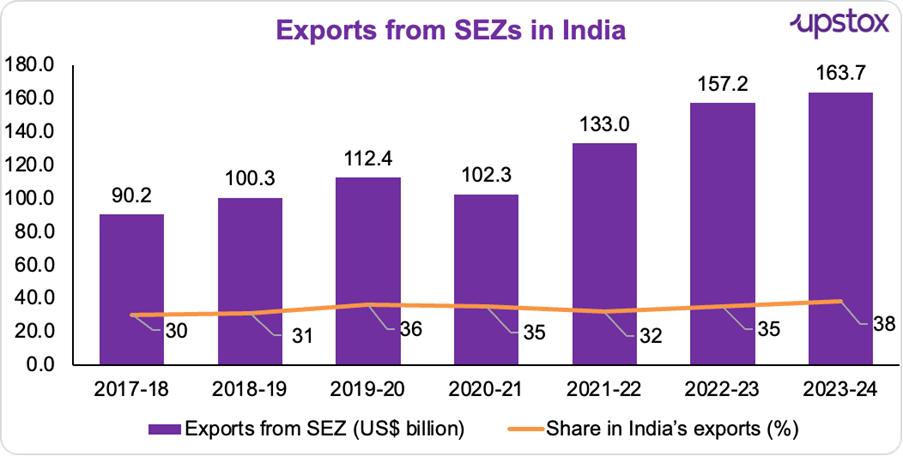

Special Economic Zones (SEZs)

India has 270+ operational SEZs spanning IT, pharma, textiles, and engineering, already contributing significantly to exports.

Source: SEZ India

Many SEZs remain underutilised due to location gaps, policy hurdles, and poor connectivity. Strengthening their infrastructure and governance, and linking them with industrial corridors and global value chains – like China did with Shenzhen – can unlock their export potential.

Research & Development (R&D)

India spends under 1% of GDP on R&D versus China’s 2.4% and South Korea’s 4.8%. Raising it to 2-3% is key for innovation and global competitiveness in semiconductors, AI, biotech, and clean tech.

Beyond these enablers, India is strengthening its trade ecosystem through strategic FTAs to access new markets. To diversify beyond the US, the government has identified 20 countries – including Australia, Brazil, China, and France – along with six focus sectors each in commodities and services to achieve the $1 trillion export vision.

Final thoughts

Reaching $1 trillion in exports isn’t just about selling more – it’s about exporting smarter. India needs to build strengths in high-value services, advanced manufacturing, and innovation-led products. Schemes like PLI, new FTAs, and policy reforms show intent – but proper execution will define success. Ultimately, can India transform its export story from volume-driven to value-driven in time?

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story