Upstox Originals

Is Hainan China’s most radical experiment in openness?

6 min read | Updated on December 31, 2025, 18:24 IST

SUMMARY

China is quietly building a new kind of global gateway on the island of Hainan, one that mixes free trade and foreign investment, but within tight political limits. The island is Beijing’s latest experiment to prove it can stay global without loosening control. Trade from the island has already tripled, and almost 85 countries have visa-free access. Beijing is betting that this island, 50x the size of Singapore, can do for the services era what Shenzhen did for manufacturing.

China is transforming Hainan into a massive new trade zone—a project 50 times the size of Singapore

On a sun-soaked island off China’s southern coast, something unusual is taking shape. Even as global supply chains drift outward from China, Beijing is quietly building something new inward, a zone that looks more like Singapore than Shanghai.

Welcome to Hainan, a tropical province where you can log on without the Great Firewall, fly visa-free from 86 countries, and import nearly anything duty-free. It’s China’s boldest experiment yet, a place testing whether the country can stay global without giving up control.

Source: India today

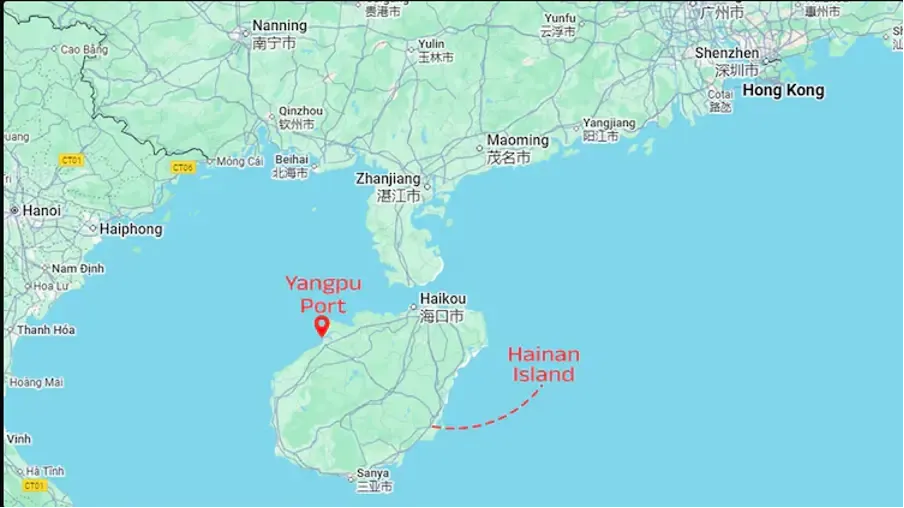

Hainan sits closer to Vietnam than Beijing, but its ambitions sound more like Singapore. Yangpu Port and Haikou are at the heart of China’s “island of openness”.

A quiet revolution

Hainan isn’t China’s first attempt at openness, but could it be its most ambitious yet? Beijing is betting that this island, 50x the size of Singapore, can do for the services era what Shenzhen once did for manufacturing.

The plan goes beyond trade perks. It’s a test of trust, can foreign capital, universities, and medical firms operate freely on Chinese soil without political friction? By ring-fencing this experiment on an island, Beijing hopes to attract global money while keeping ideological risks contained.

China’s next big test in openness

China’s reforms have always begun as regional experiments, small zones testing ideas before they’re rolled out nationwide. Shenzhen tried capitalism in the 1980s; Shanghai tested financial liberalisation in 2013. Hainan now takes that model further, it’s where China is testing openness itself. Here one can find

- Tariff-free trade

- Foreign investors can move capital more freely

- Some firms are granted open internet access, privilege rare elsewhere in China.

These freedoms are geographically ring-fenced and tightly regulated. The island operates under a special legal and customs regime, separate from the mainland, allowing Beijing to monitor and control what happens.

What has the result been?

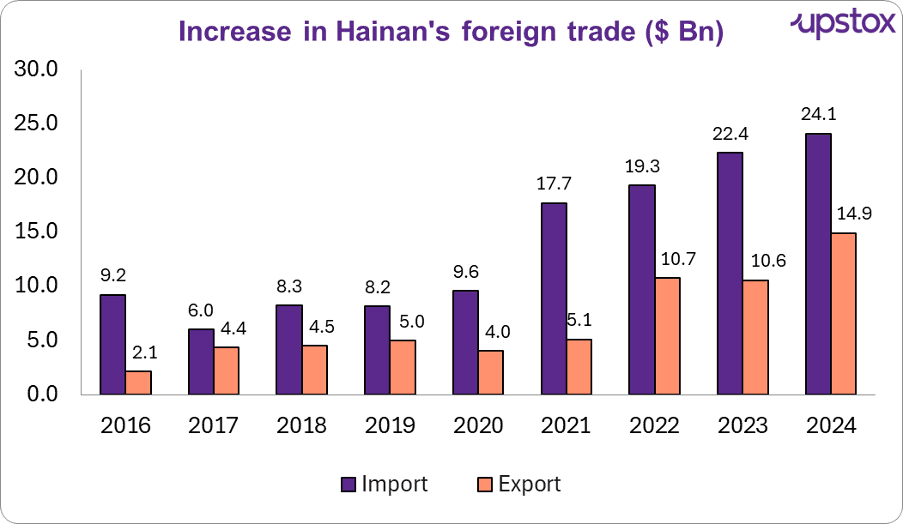

Hainan’s trade volumes have more than tripled since 2020, when it was officially designated as a Free Trade Port. While the trade is still below 1% of China’s total trade, the prospects and potential are significant. At $24.1 billion, the exports are almost 3% of India’s total exports.

Source: China Briefing

If successful, Hainan could serve as a template for selective globalisation, zones that welcome capital and innovation but keep ideology contained

Why Hainan matters now and what incentives make it different

Beijing’s timing with Hainan isn’t random. As global firms rethink China, the island is emerging as the country’s insurance policy against isolation, a way to keep trade, talent, and trust flowing in.

Part of that choice is geography. Hainan sits at the mouth of the South China Sea, closer to Hanoi than to Beijing, giving China a natural bridge to ASEAN markets and Indian Ocean trade routes. Its isolation also makes it ideal for experimentation, a place where Beijing can loosen controls without political spillover.

And the government is backing that bet with powerful incentives. Hainan enjoys zero tariffs on most imports, a 15% corporate tax rate (one of China’s lowest), and visa-free entry for visitors from 86 countries. Professionals and foreign talent pay a reduced 15% personal income tax, while offshore financing, duty-free shopping and open-internet access for firms add to the island’s allure.

Here’s why it matters now:

A hedge against decoupling

- With Western firms diversifying supply chains, China needs a friendly front door, and Hainan is it.

- Companies can manufacture, assemble, or test products here and still access the mainland market tariff-free if 30% of value is added locally.

- In effect, it’s a re-export hub, “Made near China,” not necessarily in China

A magnet for cautious capital

- Foreign investors wary of mainland restrictions get a lighter regime here. Special accounts allow free movement of money in and out, avoiding China’s tight forex rules.

A signal of selective openness

- Hainan allows what the rest of China restricts: open internet, foreign campuses, global drug approvals. This “gated globalisation” model could become China’s template for future coastal zones.

A medical and innovation shortcut

- Drugs and devices approved anywhere in the world can be sold or used here — even if banned on the mainland.

- That rule alone has made Hainan a medical tourism hub, attracting patients from across Asia.

- It’s a practical way for China to import innovation without rewriting national regulations.

A reputation play

- Beyond economics, Hainan helps China signal that it hasn’t shut itself off.

- It’s a soft-power move: an island that looks global, feels modern, and offers an alternative to Hong Kong’s political turbulence.

- In Beijing’s quiet calculus, Hainan repairs China’s image without changing its system.

For India and the rest of Asia, Hainan isn’t just an economic experiment, it’s a strategic signal. It shows that Beijing isn’t retreating from globalisation; it’s trying to redesign it. And for New Delhi, which is building its own version of openness through manufacturing incentives and digital reforms, the island offers both a challenge and a lesson.

Implications for India and Asia

Beijing is using Hainan to show that it can stay global on its own terms. The island’s free trade status, fast-tracked tax cuts and visa-free access are all signals that China wants to keep capital and talent flowing, even as it tightens political control at home. It’s openness by design, tightly ring-fenced, carefully managed, and measured in controlled doses.

India’s approach, by contrast, is more organic. New Delhi is betting on broad-based liberalisation through production-linked incentives (PLI), easier FDI rules, digital infrastructure, and experiments like GIFT City. The difference is one of style, not ambition. China opens from the top down, one order, one blueprint. India opens from the bottom up, one reform, one state at a time.

That contrast tells a larger story. China moves fast because it decides first and debates later. India debates first and then decides, which slows execution but builds legitimacy. The Free Trade Port in Hainan went from plan to policy in three years; India’s coastal SEZs have taken nearly a decade to find traction. One trades speed for control, the other trades time for trust.

There’s still a quiet lesson here. India doesn’t need to replicate Hainan’s model, but it can borrow its discipline in execution, clearer deadlines, unified clearances, and less bureaucratic drift between the Centre and states. At the same time, Hainan’s experience is a reminder of what India must guard: reforms that move too fast can outpace accountability.

If Hainan succeeds, it could become Asia’s blueprint for controlled globalisation. If it doesn’t, it will quietly reaffirm India’s case, that sustainable openness isn’t built on permission, but on predictability and public trust.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story