Upstox Originals

Is diamond certification losing relevance?

.png)

6 min read | Updated on March 13, 2025, 16:58 IST

SUMMARY

The diamond certification industry is witnessing a silent but significant shift. As lab-grown diamonds (LGDs) gain popularity and their prices fall, the need for formal certification—especially for entry-level jewellery—is declining among both consumers and retailers. This article explores the emerging trends in this industry.

Stock list

The rise of lab grown diamonds has led to reduced requirement for certification

When you buy a piece of diamond jewellery—whether it's a ring, a necklace, or a pair of earrings—what you're really buying is more than just beauty. You're buying trust. Trust that the diamond is real. Trust that it’s of the quality you were promised. And that’s where IGI—the International Gemological Institute—comes in.

So, what does IGI do?

Think of IGI as the quality checker for diamonds and gemstones. After diamonds are mined, they go through a journey—cutting, polishing, setting—and before they reach jewellers or consumers, they must be graded and certified. IGI evaluates everything from the cut, clarity, colour, and carat weight of the gem to whether it's natural or lab-grown. But they don’t just stop at loose stones.

IGI also certifies finished jewellery—ensuring that every studded piece meets the highest standards of quality and authenticity.

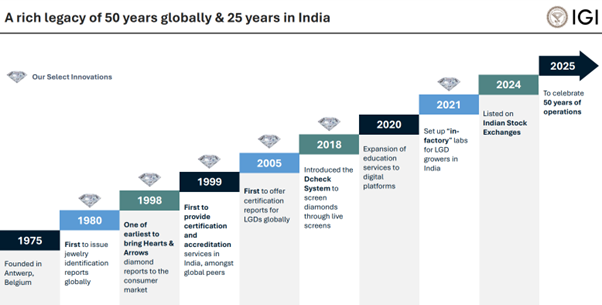

With 19 labs across India and 31 worldwide, and using their proprietary grading software called Swiftcert, IGI brings consistency, credibility, and transparency to the entire jewellery ecosystem.

Source: IP Q2 FY25

Business segments of IGIL

Certification and accreditation services: 99.1% of Revenue The company provides certification of

- Laboratory grown diamond (LGD): 60% of certification revenue

- Natural diamond (ND): 20% of certification revenue (ND and LGD used to be equal in 2021)

- Studded jewellery and coloured stones: 20% of certification revenue

Education & Traded goods: 0.9% of revenue: The company also runs educational institutions for gemmology & provides various courses related to gemology.

Understanding the industry scenario of diamond certification

Globally, GIA (Gemological Institute of America) and IGI (International Gemological Institute (India)) are the two leading players in the industry. IGI holds 33% market share globally, while in India they command 50% market share. They serve 9 out of the top 10 diamond players in India.

However, actual numbers have not been able to keep pace with the forecast. The company reported ~6% YoY growth in Q4CY24 and a 17.3% YoY growth in CY24, which was notably below initial expectations.

| in ₹ crore | Q3CY23 | Q4CY23 | Q4CY24 | YoY | CY23 | CY24 | YoY |

|---|---|---|---|---|---|---|---|

| Revenue | 250.1 | 249.9 | 265.0 | 6.0% | 898.0 | 1053.1 | 17.3% |

| EBITDA | 137.2 | 128.4 | 152.2 | 18.5% | 496.0 | 599.7 | 20.9% |

| PAT | 109.6 | 78.4 | 113.7 | 45.1% | 330.8 | 427.2 | 29.2% |

Source: NSE, Company reports; Note: IGI considers calendar year as accounting year.

What are some of the main reasons behind the same?

Changing consumer preferences

As consumers move to LGDs the need for certification seems to be declining. As per reports, the polished wholesale prices of lab-grown goods are ~50-85% lower than natural diamonds. In this case, customers have started to cut out the cost of certification.

Not that the cost is too prohibitive, but now that the cost of acquiring diamonds has become cheaper, consumers are apparently not keen to go through this additional step. For jewellers, certification is more of an optional service rather than a unique selling point, it's usually the customer who decides which certification they trust.

To a certain extent this is also confirmed by comments of leading Indian jeweller, Goldiam International. It has raised concern over the slowdown in diamond certifications during their recent conference call:

- Decline in demand for certification of LGDs, even for higher-ticket items. The need for certification has fallen compared to the previous year.

-

Large retailers are driving the change, asking suppliers to:

-

Reduce certification costs

-

Skip full certification on lower-value products

-

Opt for partial certification in some cases

-

Global slowdown and uncertainty

Europe, which accounts for 25% of IGI’s revenue, is facing a slowdown. On similar lines, the US market, which is ~50% of the global LGD inventory (for the industry as a whole), the need for certification is weakening due to consumption slowdown.

Lack of customer loyalty

Names like IGI and GIA are used interchangeably, with no strong loyalty to one.

Other (company specific) concerns

IGI updated its investor presentation to correct data discrepancies, resulting in a downward revision of its operational figures for CY24. This is raising concerns over governance since the number of certification reports declined significantly by 10%, which is a very important operational metric.

Particulars for CY24

| Particulars for CY24 | Old Disclosure (Erroneous) | New Disclosure |

|---|---|---|

| Volume growth in certification reports | 27% YoY | 26% YoY |

| Number of certification reports (in Mn) for CY24 | 10.4 | 9.3 |

| CAGR: Number of certification reports | 34.3% | 29.5% |

Source: Investor Presentation

What does it mean for investors?

While demand for lab-grown diamonds continues to rise, consumers are increasingly opting out of certification services compared to a year ago—primarily as a way to reduce overall spending. Apart from this, there is a growing demand for low-carat/low-cost diamonds due to weakening consumer sentiments, which further led to a decline in certification demand considering lower-cost diamonds generally don’t warrant the need for certification to consumers.

The rise of lab-grown diamonds has disrupted not just pricing but also the relevance of traditional diamond certification—particularly for entry-level jewellery. As more retailers skip or partially opt for certifications, and consumer sensitivity to pricing grows, the industry faces structural headwinds.

Add to this the regulatory ambiguity, declining revenue per report, and the lack of mandatory certification in key markets like India, and it’s clear that the diamond certification industry may not be as insulated as once believed.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story