Upstox Originals

Is cash on delivery quietly costing you more?

6 min read | Updated on November 07, 2025, 16:16 IST

SUMMARY

Nearly 60% of online shoppers still choose Cash on Delivery (COD). But this comes at a steep cost: COD orders are 3× more likely to fail, and Return-to-Origin (RTO) losses not only hurt the industry, but consumers as well. Platforms are quietly adding fees, tweaking logistics, and nudging users toward prepaid options.

E-commerce businesses lose over ₹20,000 crore annually due to high RTO rates and failed deliveries

Are you one of those few people, who spend hours browsing, find the perfect item, add it to their cart, and then, at checkout, they hesitate. Card? UPI? Nah… let’s go with Cash on Delivery.

Even in 2025, when UPI works faster than a “Hello” on WhatsApp, cash continues to rule online shopping. According to ET Prime Research (2024), nearly 60–65% of all e-commerce orders in India still happen through Cash on Delivery (COD).

In fact, GoKwik, an e-commerce enabler, reported that in December 2022 alone (the latest available data), COD transactions accounted for a jaw-dropping $30 billion of India’s e-commerce market.

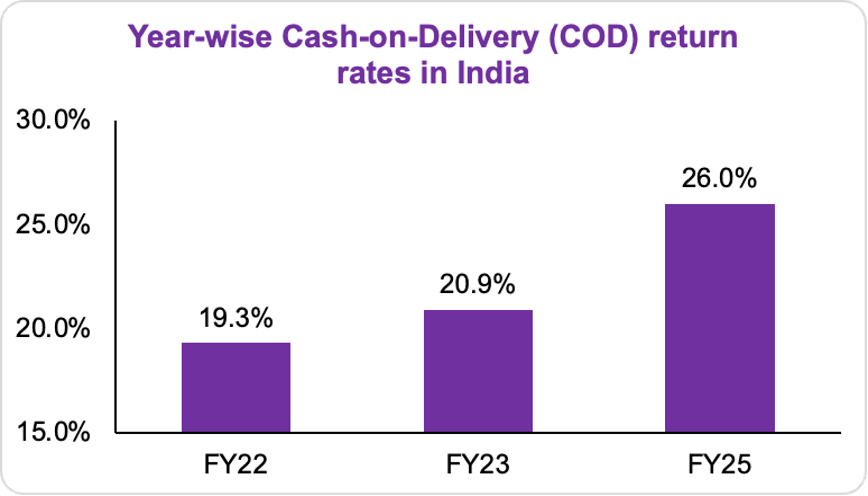

However, that comfort has a catch. The likelihood of return increases as more consumers select COD. And the data tells a clear story; those risks are climbing.

Take a look:

Source: Business line, Bwdisrupt

But why are six out of ten digital orders paid for only when the delivery guy shows up?

The most obvious reason: trust… Or maybe it’s because COD expands reach into smaller towns… Perhaps it reduces cart abandonment, giving hesitant shoppers that final nudge… For some, could it simply simplify payments; no cards, no apps, no anxiety? And for sellers, offcourse, it boosts sales by bringing even the most cautious customers on board.

But behind this also lies a messy web of cash handling, returns, and logistics costs. For platforms chasing growth, it’s a silent trade-off; higher reach at the cost of thinner margins.

And that’s exactly what Meesho discovered the hard way.

Case study: Meesho and the Cash-on-Delivery catch

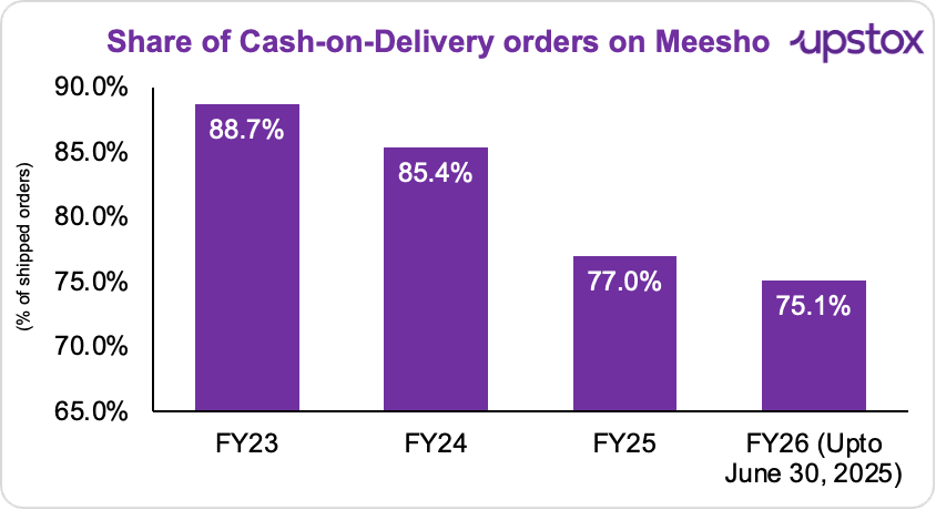

Meesho attracts millions of new customers with cash-on-delivery. However, it's also one of its main problems. More than 75% of Meesho’s orders are Cash-on-Delivery, and of those COD orders, only about 75.5% are fulfilled. Meaning, roughly one in four COD orders fails to reach the customer.

Because they either deny it, are unreachable, or decide to change their mind. Even while the percentage of COD orders has somewhat decreased, it's still a significant figure and a major concern, particularly in smaller towns where payment reliability and trust are still issues.

Meesho recently submitted its draft papers (DRHP) and was approved by SEBI to raise over 4,250 crore through a new offering. And, it listed reliance on Cash-on-Delivery as one of its main business risks in the same document.

Source: Meesho

On the contrary, prepaid orders stand at 24.9%, with 96.3% success rate in the first three months of FY26.

| Particulars | Fiscal 2023 | Fiscal 2024 | Fiscal 2025 | Three months ended June 30, 2025 |

|---|---|---|---|---|

| Prepaid orders as % of Shipped Orders | 11.2% | 14.6% | 23.0% | 24.9% |

| Shipped Orders (in millions) | 866.9 | 1,146.3 | 1,587.9 | 477.1 |

| COD orders success rate | 77.7% | 78.6% | ||

| Prepaid orders success rate | 97.2% | 97.8% |

Source: Meesho

What’s the hidden economics behind COD?

The Return to Origin (RTO) trap

On paper, COD is great. But peel back the numbers, and you’ll find that RTOs quietly hollow out the business from within. RTO, or Return to Origin, happens when an order never reaches the customer and is sent back to the seller. It could be because the address was wrong, the customer wasn’t home, or they simply changed their mind.

Sounds simple, but in e-commerce, RTO hurts profits. Studies show that RTOs make up nearly 20–30% of all COD orders, compared to just 2–3% for prepaid ones. Even though the sharp rise in digital sales has been accompanied by increasing customer confidence in these transactions, RTO levels have remained sticky over the past few years.

A RedSeer report estimates that Indian e-commerce businesses lose over ₹20,000 crore annually due to high RTO rates and failed deliveries.

Dark patterns

Major platforms are starting to factor in these costs; and consumers are beginning to feel it.

According to reports, several major e-commerce platforms have started adding extra fees for COD orders, usually between ₹7 and ₹10 per order.

During festive sales, these costs climb further. According to The Economic Times, several e-commerce platforms and food delivery apps quietly raised “platform fees.” For instance, Myntra bumped its handling fee from ₹20 to ₹25 for certain users right before Diwali sales.

This is often referred to as “dark pattern.” A “dark pattern” is when websites trick or pressure users into decisions they might not otherwise make; think “only 1 item left” banners or hidden convenience charges revealed only at checkout.

Officials say these extra COD fees qualify because they’re not disclosed upfront. Customers often see a last-minute ₹10 “handling” or “convenience” charge that wasn’t visible before. It’s small enough not to cause outrage, but when multiplied across millions of orders, it adds up; for both sides.

The operational burden

Then there’s the logistics side. Every COD order costs more to handle. All major courier and logistics partners charge an extra ₹25–₹30 per COD shipment, or a small percentage of the total order amount, whichever is higher. The reason? Handling physical cash; collecting it, counting it, reconciling it, and safely remitting it, is slow and costly.

For businesses operating on thin margins, these additional charges make a significant dent.

In a nutshell

COD brought millions of first-time shoppers from Tier-2 and Tier-3 cities online; people who didn’t trust cards, wallets, or UPI yet. But it also became the industry’s biggest profitability trap.

That’s because COD orders have nearly 3× higher Return-to-Origin (RTO) rates than prepaid ones. Every failed delivery means double logistics cost and zero revenue; a brutal hit to margins.

So, the goal isn’t to kill COD. It’s to kill RTO.

According to BePragma, brands that implemented balanced RTO-reduction strategies; like AI-based risk scoring, address validation, pre-dispatch confirmation calls, NDR automation, and delivery-time flexibility; reported a 42–48% drop in RTO rates, while retaining ~89% of COD conversion volumes. In just 90–120 days, contribution margins improved by ₹3.2–₹4.1 per order. That’s what smarter COD looks like.

The smart middle path? Keep COD as a “trust gateway” for new users, but incentivise digital payments for repeat ones. Track RTO rate as a profitability KPI, not just order volume.

Meanwhile, regulators are watching too. The Ministry of Consumer Affairs has launched probes into deceptive “convenience fees.” Recently, FirstCry was fined ₹2 lakh for misleading pricing; showing MRPs “inclusive of taxes” but tacking on GST at checkout.

So yes, COD shouldn’t die. It should just be disciplined. If managed right, it is still that bridge of trust.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story