Upstox Originals

Is BFSI entering its most interesting decade yet

8 min read | Updated on December 19, 2025, 16:32 IST

SUMMARY

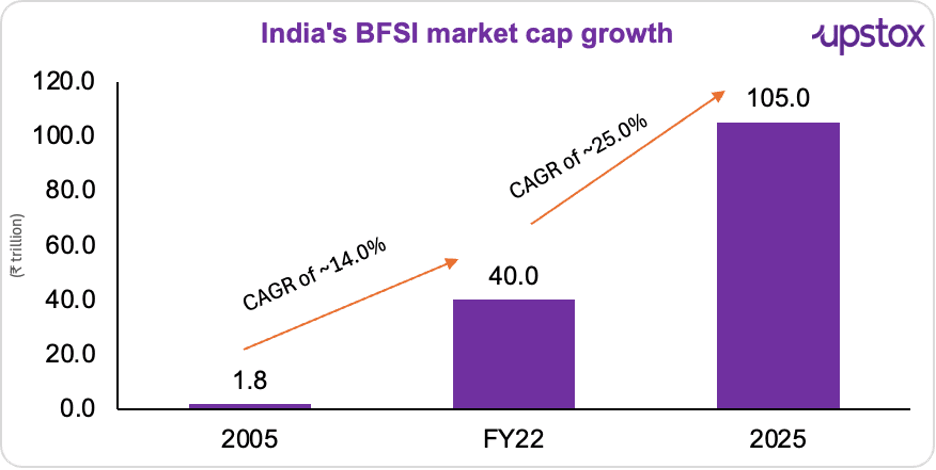

India’s BFSI sector has grown from ~₹1.8 trillion in 2005 to ~₹105 trillion in 2025. Fintech went from invisible to a ₹12 trillion force, and mutual funds swelled 6×. However, the next decade looks nothing like the last: growth isn’t about more branches or loans, but about speed, reach, and digital dominance. Add AI, and the sector is entering one of its most interesting decades. Curious what’s powering this shift —and what could derail it? Read on.

ndia’s BFSI sector has grown from ~₹1.8 trillion in 2005 to ~₹105 trillion in 2025

We all know the BFSI sector is massive today.

But it’s worth pausing to see just how it got here. In 2005, it was worth about ₹1.8 trillion. By 2025, it had grown into a ₹105 trillion giant, a near 60× expansion.

But that headline number isn’t the interesting part.

What’s easy to miss is how this growth has unfolded, and why this phase looks nothing like the last two decades. Because this time, growth isn’t just about more banks, more loans, or more branches. It’s about speed, reach, and depth. Let’s rewind a couple of points for a second (explained in detail ahead..)

- Did you know the real acceleration came between FY22 and FY25, when BFSI shifted into overdrive? Growth jumped to ~25% annually from ~14% earlier, spilling far beyond markets into consumption, housing, entrepreneurship, and everyday economic decisions.

Source: ETBFSI

-

Oh, and two decades ago, BFSI contributed roughly 6% to India’s GDP. By 2025, that number is closer to 27%.

-

In 2015, fintech barely had a footprint. Today, India sits comfortably among the top three fintech ecosystems globally.

-

At the same time, households began shifting how they save. Mutual fund assets jumped more than 6× in just ten years, signalling a quiet move away from physical assets toward financial ones.

Which brings us to the scale of it all.

And that’s what makes this decade interesting.

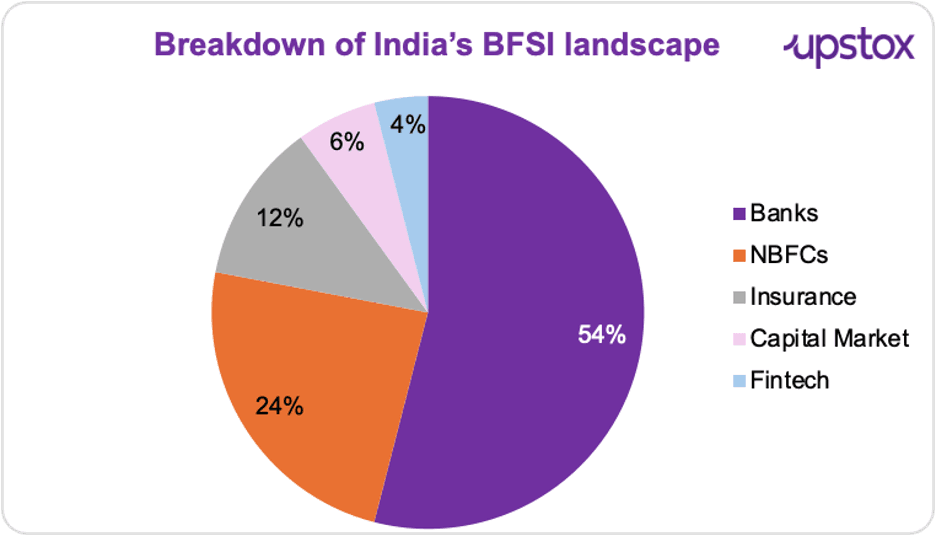

Okay, who owns the pie?

Reaching almost ₹100 trillion is impressive. But who inside BFSI is capturing that value?

-

Banks’ share of the BFSI market cap has fallen from ~85% in 2005 and 70% in FY15 to about 54% now.

-

NBFCs have undergone the sharpest re-rating, with market cap ballooning to ₹25.8 trillion – nearly 100x in two decades.

-

Insurance now makes up ~12% of BFSI market cap.

-

Capital-market entities (exchanges, brokers, depositories, AMCs) contribute ~6%.

-

Listed fintechs, which were effectively zero a decade ago, now account for ~4% of BFSI market value.

Source: BS

The forces behind BFSI’s acceleration

Of course, this growth didn’t happen by accident. It was powered by many reasons (which you probably know), like cleaner balance sheets, tighter regulation after past cycles, deeper digital rails like UPI and Aadhaar, and a macro backdrop that finally favoured credit expansion. But let us understand a couple of others too:

Nifty’s earnings shift

And the comeback has been equally strong on the earnings front.

The sector’s share in Nifty-50 profits has jumped from just 16% in FY10 to 33% in FY24; a quiet but powerful doubling. A mix of cleaner balance sheets, stronger credit demand, and lower provisioning has pushed this post-pandemic recovery into high gear.

The fintech boom

With over 9,000 fintech startups, the country now boasts the world’s third-largest fintech ecosystem. And the momentum isn’t slowing. Analysts believe the industry could rake in over $190 billion in revenue by FY2030.

Consumers aren’t holding back either. India’s fintech adoption rate stands at a staggering 87%, far ahead of the global average of 64%, making it one of the world’s most vibrant digital markets. And remember that fintech firms were practically invisible before 2015. Today, they command ₹12 trillion in market cap across listed and unlisted players. That’s what rapid digital adoption and shifting consumer behaviour can do.

And the headline numbers (as per KPMG)? They tell the same story.

-

$25 billion: India’s fintech revenue in 2023, up 56% YoY.

-

$100+ billion: The industry’s valuation, still in its “middle” phase, with room for explosive growth.

-

35+: The count of Decacorns, Unicorns and Soonicorns, up from just 13 in 2020, clear signs of a maturing ecosystem.

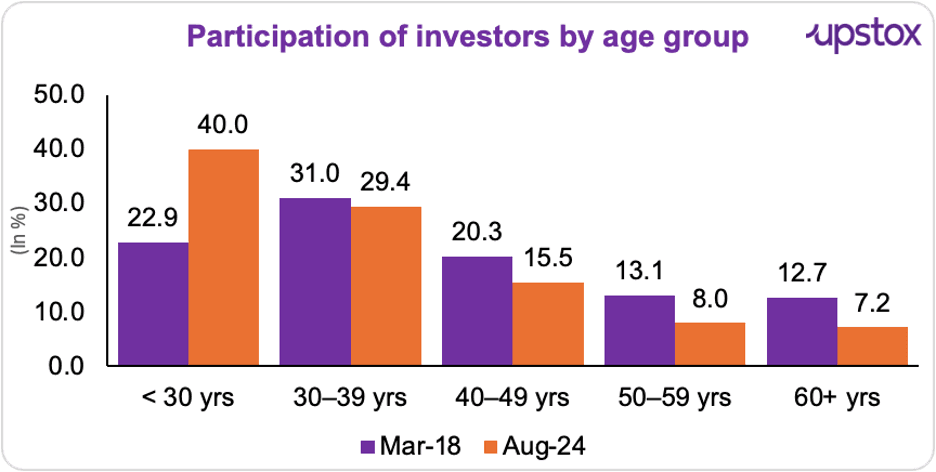

Young India just changed the money game

India’s demographic dividend isn’t just about having a young population; it’s about how that population is reshaping money itself.

They want speed and convenience. That’s why they gravitate toward instant personal loans, BNPL checkouts, and even AI-led investment platforms that promise quick, personalised advice.

And you can see this shift in the markets too. Since March 2020, nearly half of all new Demat accounts in India have been opened by people under 30.

And when it comes to borrowing, the generational shift is even clearer. Millennials and Gen Z account for nearly 75–80% of digital loan disbursals, powered by BNPL and embedded finance products that offer fast, flexible credit.

Source: News articles

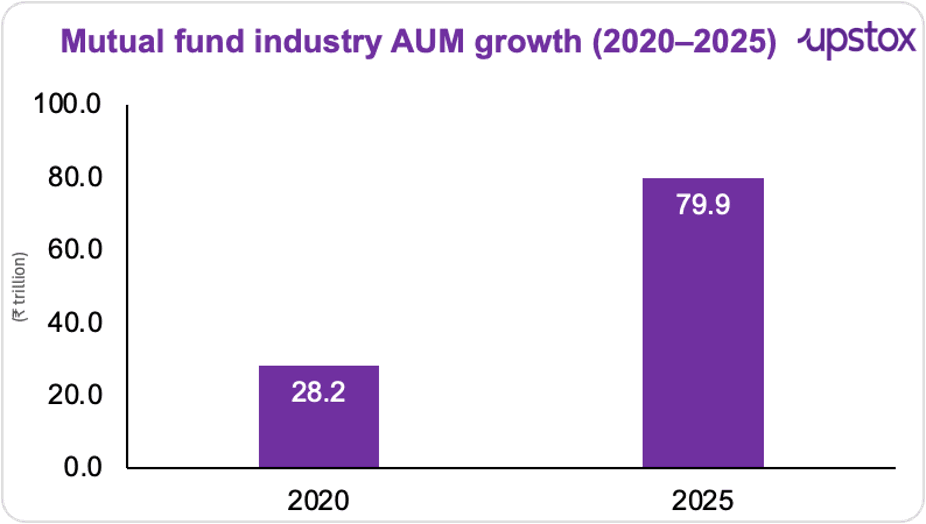

Mutual funds go big

If you need more proof that India’s financialisation wave is in full swing, just look at mutual funds. In October 2025, the industry’s average assets under management (AAUM) touched a massive ₹79.79 lakh crore, while the month-end AUM clocked in at ₹79.88 lakh crore.

To put that in perspective, a decade ago, in October 2015, the entire industry managed just ₹13.24 trillion. That means MFs have swelled over 6x in ten years, powered by SIP culture, rising disposable incomes, and a growing comfort with equity investing.

Even the last five years tell a dramatic story. In October 2020, AUM was ₹28.23 trillion. Fast forward to 2025, and it’s nearly ₹80 trillion; a threefold jump.

And the milestones came thick and fast.

- The industry first crossed ₹10 trillion back in May 2014.

- Just three years later, by August 2017, it zipped past ₹20 trillion.

- By November 2020, ₹30 trillion was in the bag.

Cut to today, and the mutual fund industry is sitting pretty at an all-time high of ₹79.88 trillion.

Source: IBEF

The AI wave

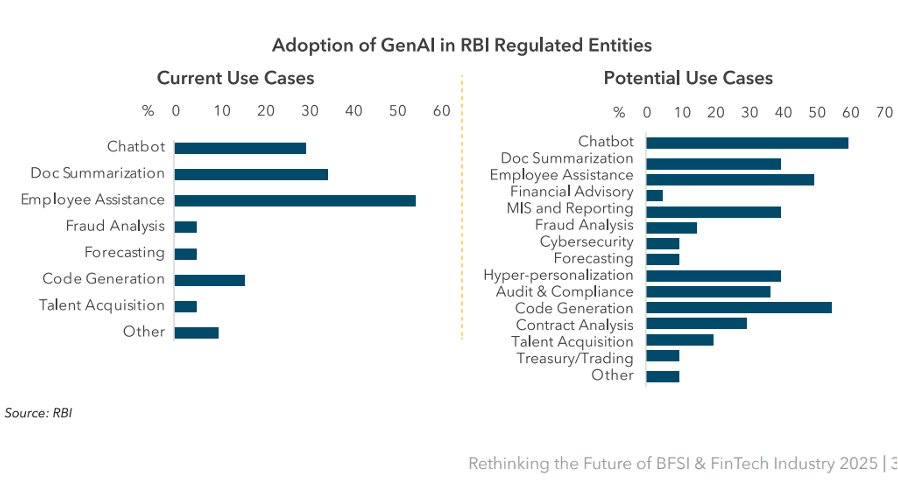

And one big reason the BFSI engine is firing on all cylinders? AI.

If you thought the fintech wave was big, the AI wave might be even bigger. Today, 68% of India’s financial firms already use AI in some shape or form. And by 2028, the market is expected to balloon into a $3.9 billion opportunity.

This isn’t just about chatbots or faster processes anymore.

It signals a shift to a world where digital finance is powered by AI that can think, scale and secure; the kind of intelligence that helps banks manage risk better, personalise products, and tighten fraud controls.

..But, every rise has its risks

-

There’s a stubborn truth hiding behind the optimism, insurance penetration is still stuck at 3.7%, slipping from 4% the previous year. And when you pit that against the global average of 7%, the gap becomes glaring. It signals opportunity, yes, but it also highlights how hard it still is to take insurance deeper into Tier 2 and Tier 3 cities and rural India.

-

NBFCs, meanwhile, have been sprinting ahead and powering India’s credit boom. But the RBI isn’t waving pom-poms. Instead, it’s issuing a gentle, but firm, reminder: “don’t chase growth at any cost.” The worry is simple, some NBFCs may be expanding a little too aggressively, and if the cycle turns, that kind of rapid growth can cut both ways: great when the wind is at your back, painful when it shifts.

-

Cyber risks are also climbing the charts. Economic Survey 2025 reveals that roughly 1 in 5 cyberattacks in India in 2024 targeted the BFSI sector, and the volume is only expected to rise. In just H1 2025, an application-security report found that Indian enterprises, including BFSI players, blocked 4.26 billion attacks ,up 15% from H1 2024. On average, that’s about 4.1 million attacks per enterprise website, a staggering reminder of just how exposed digital-heavy banks and NBFCs have become.

-

And then there’s asset quality. RBI’s July 2025 Financial Stability Report flags rising stress in NBFC microfinance portfolios. Stressed assets, including write-offs, climbed to about 5.9% in March 2025, up from 3.9% in September 2024, driven by higher slippages and write-offs in retail and personal-loan books. It’s a signal that even with strong credit growth, pockets of vulnerability are beginning to surface.

Way forward

India’s BFSI must now shift from reach to quality. Under Panch-Jyoti, the priority is real usage, small-ticket credit, insurance and pensions; with the Inclusion Index at 67 and 55.9 crore Jan-Dhan accounts already in place.

The next leap is deep digital: AI-led banking, open finance and BaaS pushing toward a $1-trillion digital-banking market by 2030, backed by full-stack journeys and secure, standardised APIs.

This demands strong cyber resilience; zero-trust, 24×7 SOCs, red-teaming and RBI-mandated testing; as phishing, ransomware and API abuse rise.

Regulation must get simpler and sharper: harmonised KYC/UBO, integrated oversight and data-driven supervision using granular reporting, LEIs and transaction-level monitoring.

A climate-ready BFSI is essential too; new disclosure norms and the 2025 taxonomy require climate scenarios in ICAAP, pricing and sectoral limits, along with scaled green lending.

And to power India’s 2047 vision, institutions need stronger capital and risk systems; higher CET1, dynamic provisioning and tighter ALM; supported by better talent, governance and tools like RBI’s MuleHunter.AI to protect customers in a digital world.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story