Upstox Originals

Indian smartphones once trending now tough to spot

.png)

6 min read | Updated on July 21, 2025, 14:30 IST

SUMMARY

Remember when Hugh Jackman was selling Indian smartphones? Yep, that happened. Back then, brands like Micromax were on top, making budget smartphones for the masses. Fast-forward to today, and they’ve pretty much vanished, squeezed out by slick Chinese rivals, missteps of their own, and after-sales mishaps.

Indian smartphone brands stumbled from 2015 onwards

Smartphones play an essential part in our daily life, and chances are you're reading this on a device from brands like Apple, Samsung, Oppo, or Vivo. While many of these are assembled in India, they aren't Indian brands.

Rewind to the early 2010s, the story was different. Back then, Indian smartphone makers like Micromax, Lava, Karbonn, and Intex once dominated the market, offering budget-friendly innovations that catered to homegrown needs.

Yet, within a decade, these native brands struggled to keep pace. Their rise and fall marked a pivotal chapter in India’s digital evolution, one worth reflecting on as the country continues its push for self-reliance in tech.

The rise of Indian smartphone brands

India’s love affair with smartphones took off in the early 2010s. Back then, global giants like Nokia were still grappling with touchscreens, and Apple was beyond most consumers’ budgets. Into this gap stepped Indian brands with one big promise: affordable smartphones packed with features, and the first one to do the spotlight was Micromax.

Indian smartphone market share early 2010’s years

| 2011 | 2011 | 2012 | 2012 | 2013 | 2013 | 2014 | 2014 | 2015 | 2015 |

|---|---|---|---|---|---|---|---|---|---|

| Nokia | 38% | Samsung | 32% | Samsung | 38% | Samsung | 24% | Samsung | 23% |

| Samsung | 25% | Nokia | 27% | Micromax | 16% | Micromax | 20% | Micromax | 17% |

| Micromax | 6% | Micromax | 9% | Karbonn | 10% | Karbonn | 8% | Intex | 11% |

| Blackberry | 5% | Karbon | 6% | Sony | 5% | Motorola | 5% | Lenovo | 6% |

| Karbon | 4% | Others | 26% | Lava | 5% | Lava | 8% | Lava | 7% |

| Others | 21% | Others | 26% | Others | 35% | Others | 36% |

Source: News articles

Between 2012 and 2013, smartphone shipments into the Indian market tripled from around 16 million to 44 million units, fuelled by rising demand and affordable options. Riding this wave was Micromax’s “Canvas” series which became hugely popular, especially after the brand pulled off a marketing campaign featuring Hugh Jackman as its ambassador, bringing a touch of blockbuster charisma to India’s smartphone revolution.

These brands found success by offering feature-rich, budget-friendly phones, often outsourcing production to Chinese manufacturers to keep costs low and launch new models quickly. For example, A Micromax Canvas HD (A116) with a quad-core processor and Jellybean OS was priced under ₹15,000, while the Samsung Galaxy Grand, with similar features, was priced just over ₹20,000.

Financially, Micromax was thriving, securing significant investment as it aimed to expand further. At their peak, Indian brands helped make smartphones accessible to millions of first-time users, rewriting the country’s digital landscape.

Yet this success was short-lived. Here’s how the tide turned.

Decline of Indian smartphones

Despite their strong rise, Indian smartphone brands stumbled from 2015 onwards. Once a market leader, Micromax quickly lost ground as its market share shrank and shipments dropped.

Indian smartphone market share multiple years

| 2016 | 2016 | 2017 | 2017 | 2018 | 2018 |

|---|---|---|---|---|---|

| Samsung | 25% | Samsung | 24% | Samsung | 30% |

| Micromax | 11% | Xiaomi | 21% | Xiaomi | 26% |

| Lenovo & Motorola | 9% | Vivo | 10% | Vivo | 11% |

| Intex | 7% | Micromax | 4% | Micromax | 3% |

| Reliance Jio | 6% | Oppo | 9% | Oppo | 8% |

| Other | 42% | Others | 34% | Others | 22% |

Source: News article, Canalys.com

How did it happen?

The Chinese playbook was sharper

Chinese competitors like Xiaomi, Oppo, and Vivo did not just copy the Indian strategy; they refined it. They offered better specs at lower prices, thanks to direct manufacturing, lean supply chains, and thin margins. Flash sales, online launches, and competitive pricing helped them dominate the ₹6,000–₹8,000 sweet spot, an Indian brand bastion.

Lack of R&D and long-term vision

Indian brands had established their success on Chinese imports repackaged, usually without possessing core technology of their own. With the OEMs they were importing from now directly entering the Indian market, local brands had little to compete with. Big plans for in-house R&D, such as Micromax's planned Bangalore centre, stayed on paper because of a lack of investment and internal squabbles.

Inefficient after-sales service

As Chinese brands aggressively expanded service networks, Indian players lagged behind. Customers complained about waiting perpetually for repairs and unavailable spare parts. In a competitive market, this eroded people's confidence in a short while, and once eroded, the confidence did not come back.

Internal conflict and lost opportunities

Leadership issues hounded firms such as Micromax. Investment flops, founder-new management disagreements, and ill-conceived brand extensions (such as Yu) prevented them from turning around fast enough. In the meantime, the competition was coming out with back-to-back phones with glitzy branding and Hollywood celebrity status.

Squeezed at both ends

Chinese players ruled the online battle. Samsung complemented its offline strength with low-cost offerings like the J-series. Indian players, lacking the deep pockets or distribution muscle, were caught in the middle, priced out, marketed out, and ultimately out of business.

Current brands that are doing well in the Indian market?

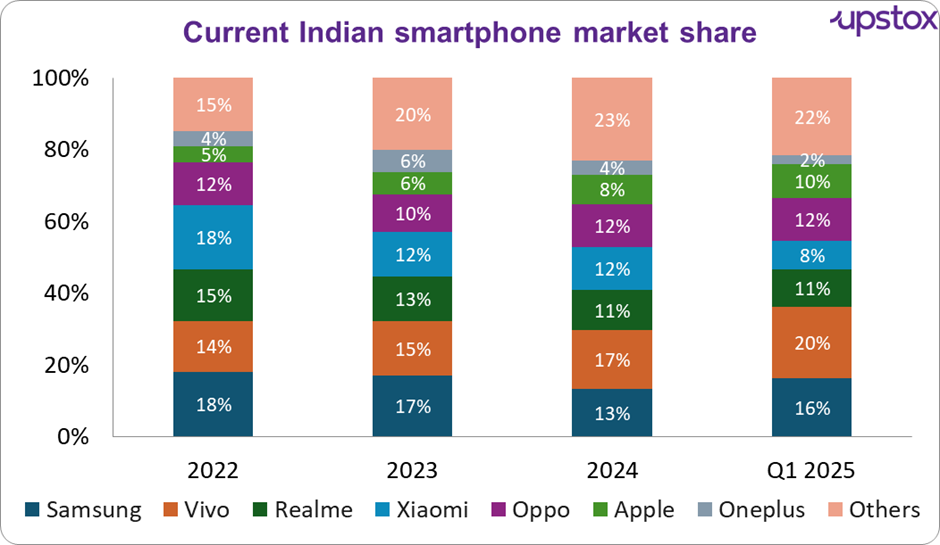

Today in the Indian market when we look at the top 5-7 brands of smartphones, local names are nowhere to be found. It's mostly Chinese and Korean brands that have taken a huge chunk of the market with Indian brands holding less than 1% of the market as of 2023.

Source: IDC

Outlook

Looking ahead, India’s smartphone market will remain fiercely competitive. While Chinese and global brands dominate, there’s still potential for homegrown players to stage a comeback, especially with government support and a push for local manufacturing. But they’ll need innovation, strong branding, and top-notch service to reclaim their lost glory.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story