Upstox Originals

India's jewellery market: Polishing tradition into modern brilliance

.png)

4 min read | Updated on September 05, 2024, 21:07 IST

SUMMARY

Indians love jewellery! In a year there are only 2 months where we don't have an excuse to buy jewellery! Till a few years back, this industry was largely unorganised and so investors were wary of participating. But, the jewelry shopping landscape is rapidly evolving, with a noticeable shift towards organised players (~40% share). Several factors are driving this, including enhanced shopping experiences, efforts to increase customer trust, and a broader range of products.

Organised players now have a ~40% market share in the jewellery industry

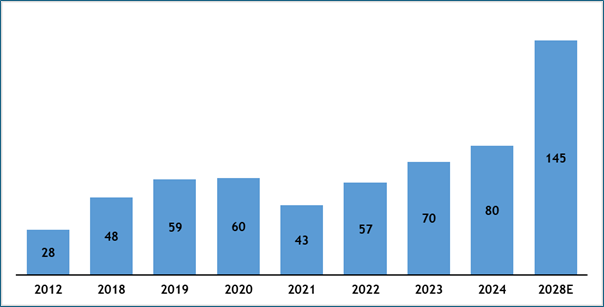

To give you some context, the Indian jewellery retail sector was worth around $80 billion in FY24, and it’s expected to keep growing, with a pretty solid CAGR of 16% from 2023 to 2028.

Indian jewellery market size ($ billion)

Source-Technopak

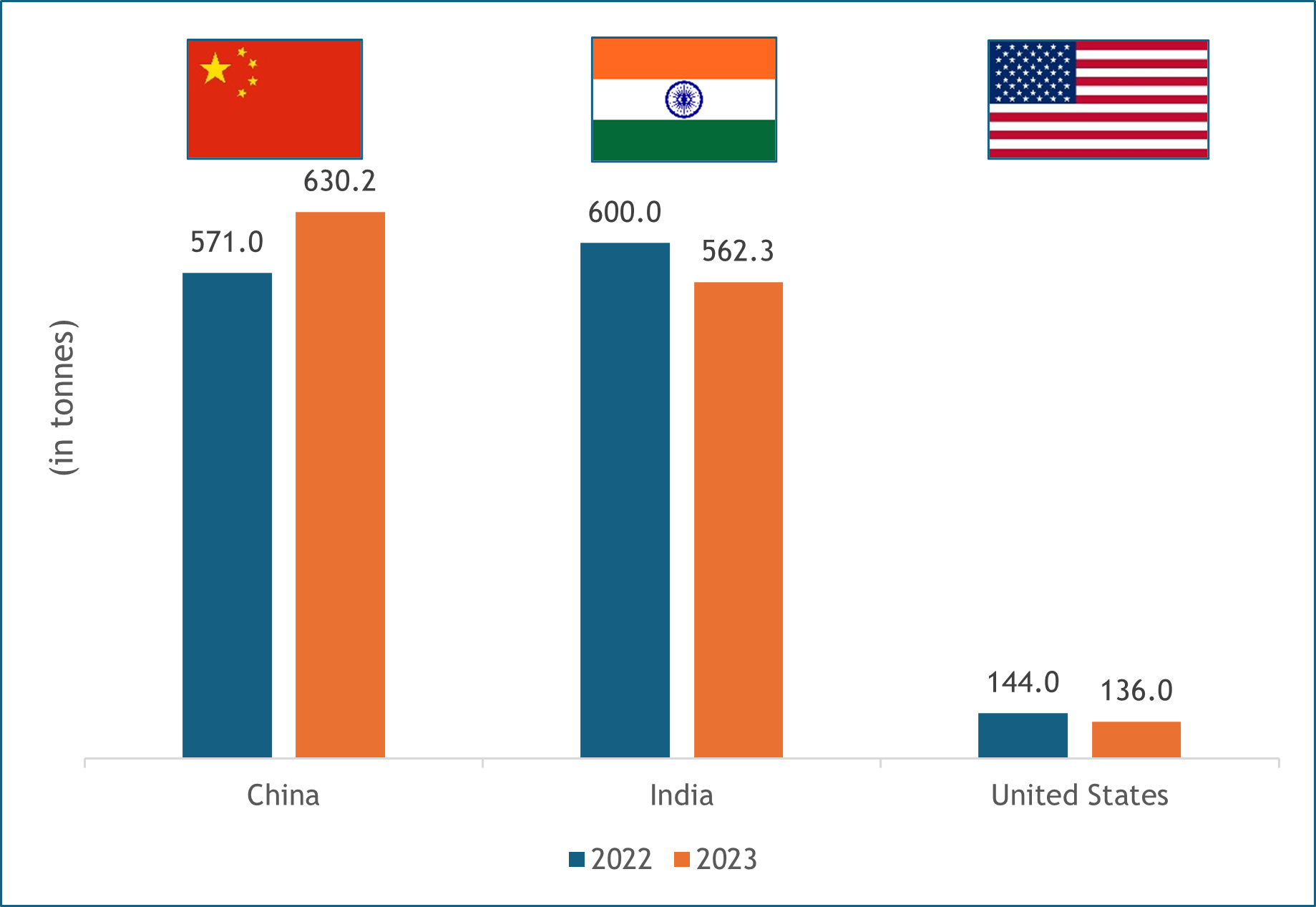

India is one of the leading countries for jewellery demand, accounting for 562.3 tons in 2023, or 26.9% of overall demand. China leads with 630.2 tonnes (30.1% share), followed by the United States with 136 tonnes (6.5% share). The remainder of the world accounts for the remaining 36.5% of the market.

Source- Metal Focus & World Gold Council Dec 2023

What is driving this growth? Let’s break it down.

Several things are really pushing the jewellery market forward and making it more organised

-

Urbanization and changing tastes: As more people move to cities and consumer preferences evolve, there's a rising demand for jewellery that organised players are perfectly poised to meet. This shift is helping formalise the market.

-

Customer-centric innovations: From introducing Karatometer to jewellery exchange schemes, certificates of authenticity, and buyback programs, jewelers are doing more to earn customer trust. These efforts are making formal market practices more appealing.

-

Franchise expansion: The expansion of franchise models allows brands to standardize and expand their reach, further formalising and growing the market.

-

Building trust: The combined effect of strong branding, certification, and organised retail models is creating a higher level of consumer trust, which is crucial for the market's continued growth and formalization.

-

Multiple buying occasions: As we said above, Indians love jewellery, and we just need a reason to buy it. Be it festivals, or post-harvest celebrations, buying jewellery is always in season. And let’s not forget -weddings, are one of the biggest drivers of jewellery purchases in India. So basically only two months, July and August are the ones when we don't have an excuse to buy jewellery.

Seasonality in jewellery buying

| Reasons to buy | Corresponding months |

|---|---|

| Festivals | Jan, Apr, Sep, Oct, Nov |

| Harvest season | Jan-Apr, Sep-Dec |

| Marriages | Jan, May, Jun, Oct-Dec |

Source- CareEdge Research Report on Indian Gems & Jewellery Sector

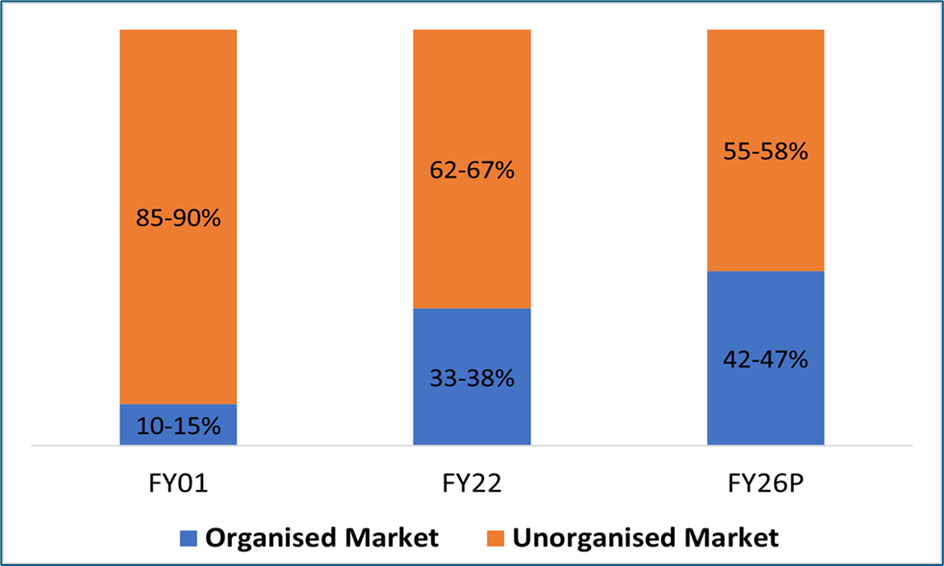

Here’s something cool: The organised market now makes up 33-38% of the total jewellery market in 2022, which is a huge jump from just 10-15% back in FY01. Impressive, right?

Jewellery market share trend

Source-Senco Gold Investor Presentation July 2023

Competition

The organised jewellery scene in India is getting pretty heated, with big names like Titan, Kalyan Jewellers, and Malabar Gold & Diamonds stepping up their game. They're expanding fast, opening new stores everywhere, even in smaller cities, and venturing into global markets.

Sustainability and ethical practices are also becoming a big deal, as more consumers are looking for transparency in how their jewellery is sourced and made. Plus, regional players are making things even more interesting by using their strong local connections to compete with the big national brands.

Reliance Retail’s big move into luxury jewellery

Further intensifying this competition is Reliance Retail. It has made headlines with its strategic foray into the luxury jewellery segment. This new venture, designed to deliver a curated, design-led experience, is aimed at capturing a slice of the high-end jewellery market. Competing with companies like Tata’s CaratLane and other established brands, this marks a notable shift from Reliance Jewels, which caters to the mass market.

Let’s take a look at some of the key listed players and their performance:

| Particulars | Market cap (₹ in Crore)* | PE Ratio | 3 YR Stock Price CAGR % | Gross Profit Margin (%) | Operating Margin (%) | ROE (%) |

|---|---|---|---|---|---|---|

| Titan | 3,30,390 | 95.6 | 23 | 11.4 | 10.3 | 32.9% |

| Kalyan Jewellers India | 66,681 | 106.0 | 113 | 7.6 | 6.2 | 15.2% |

| Senco | 9,322 | 43.6 | NA | 8.1 | 7.0 | 16.3% |

| Thangamayil | 5,886 | 48.6 | 60 | 5.7 | 5.3 | 27.9% |

| Average | 1,03,070 | 73.5 | 68 | 5.7 | 5.3 | 23.1% |

Source-MoneyControl, Screener, *As on September 05, 2024

Conclusion

India's jewellery market is on a fascinating journey, with organised retail taking center stage and reshaping the competitive landscape. Market leaders are increasingly relying on asset-light franchise models to quickly expand their reach. This strategic shift signals a future ripe with growth and consolidation opportunities for the industry.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story