Upstox Originals

India’s financialisation: From physical to financial assets

.png)

4 min read | Updated on January 08, 2025, 18:43 IST

SUMMARY

India's journey towards the financialisation of household savings is a transformational story. The transition from physical assets like real estate and gold to financial assets like equities and mutual funds underscores a nation realigning its savings with growth. This article highlights the key trends reflecting India's rise as a financial powerhouse.

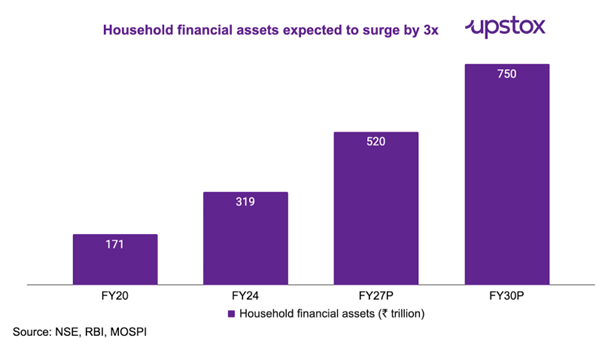

Financial assets in India have grown almost 100% since COVID-19

Financialisation describes a move away from investments in traditional, ‘physical’ assets such as real estate and gold towards financial assets.

As per RBI, Indians hold almost ₹319 lakh crores (or ~$3.7 trillion as of December 24) of financial assets. To put this in context this is more than India’s GDP of ~$3.3 trillion. By the way, this number excludes direct market investment.

Of this, ~44% is in bank deposits, down from ~47% in June 2021. Financialisation has been a gradual journey in India, which gathered a staggering pace since COVID-19. As can be seen in the chart below, financial assets have grown almost 100% since then.

This surge can be attributed to ease of opening bank accounts, increase in UPI penetration, and technology enabling easier investments. Consequently, participation in asset classes like mutual funds has almost doubled over the same time period (June 2021 - December 2024).

Premiumisation of Indian households

A key long term driver of this trend is the premiumisation of Indian households. Elite and affluent households are projected to double, while aspirers and the next billion households will outpace low-income ones. As wealth in the households rises, so will the need to channel it into productive assets.

| Income Bracket | 2010 | 2010 | 2019 | 2019 | 2030F | 2030F | Growth (2019-30F) |

|---|---|---|---|---|---|---|---|

| % of HH | No. of HH (in Cr.) | % of HH | No. of HH (in Cr.) | % of HH | No. of HH (in Cr.) | ||

| Low income (<1.5L) | 33.0 | 7.9 | 22.0 | 6.4 | 11.0 | 4.0 | 0.6x |

| Middle Income (1.5L-5L) | 46.0 | 10.8 | 45.0 | 13.9 | 40.0 | 14.2 | 1.1x |

| Aspirers (5L-10L) | 15.0 | 3.5 | 21.0 | 5.0 | 26.0 | 9.3 | 1.6x |

| Affluent (10L-20L) | 5.0 | 1.3 | 9.0 | 2.6 | 16.0 | 5.6 | 2.1x |

| Elite (>20L) | 1.0 | 0.3 | 3.0 | 1.0 | 7.0 | 2.3 | 2.3x |

| Total households | 100.0 | 23.8 | 100 | 28.9 | 100 | 35.4 | - |

Source: Crisil; HH - Households

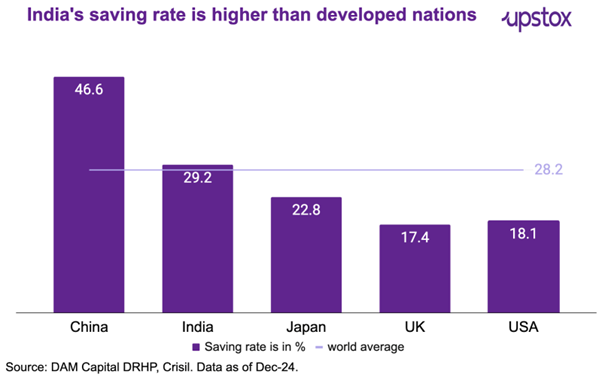

India’s saving rate

Encouragingly, India has always had a healthy conventional savings rate. Think about it, right from childhood, we are taught to save money and set some aside in a piggy bank. Consequently, India’s gross saving rate is higher than the global average. As financial literacy further increases and Indians start to participate in the overall growth, financialisation towards higher yielding asset classes is only expected to increase.

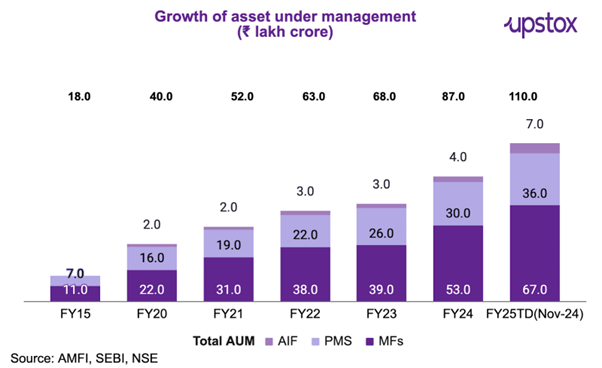

Savings channelised into markets

What gives us this confidence that savings will get channelised into more productive assets? Assets under management via mutual funds, PMS, and AIF have grown almost threefold since the pandemic, suggesting a trend towards organised financial products.

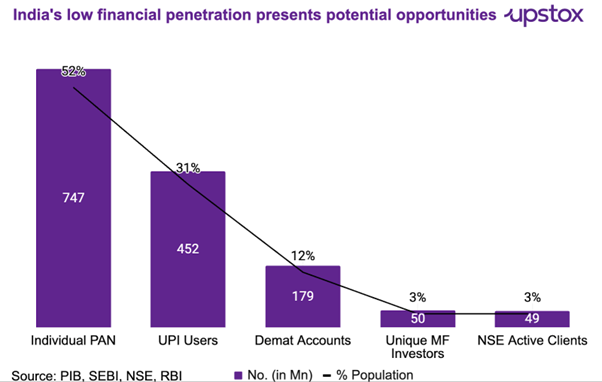

A long way to go

Despite the recent surge in financialisation, the potential is huge. Considering only 3% of Indians actively trade and invest via equities and mutual funds. With the growing digital penetration and rising financial inclusion trend through UPI, PAN cards, and demat accounts, India's investing tribe is set to grow multifold.

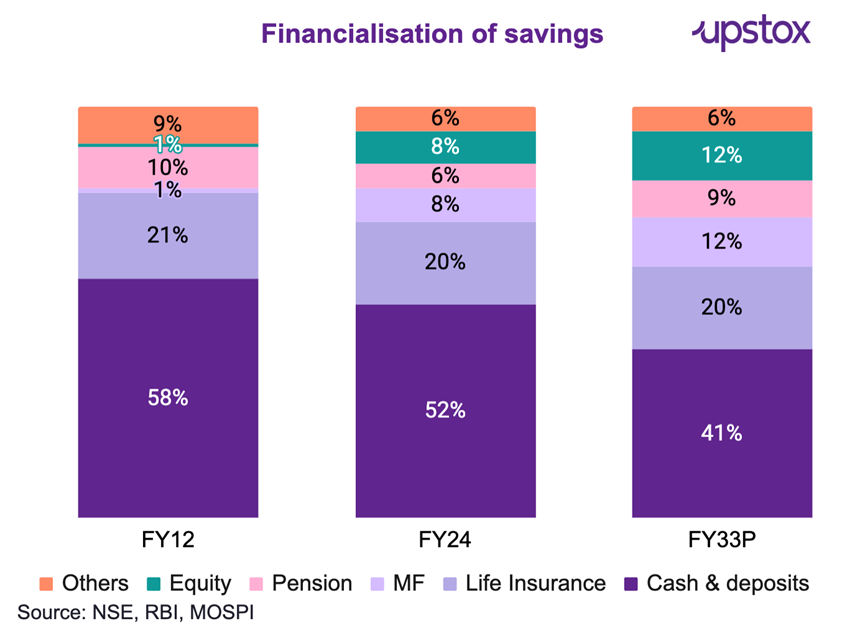

Equity as % of total household financial assets set to surge from 8% to 12% as per NSE. Interestingly, among household financial assets, the share of equity, mutual funds and insurance is expected to increase while cash and deposits are expected to see a decline in overall household financial assets.

Insight for investors

Investors always have the choice of directly participating in this growth by investing in benchmark indices. But that said, investors looking to bet on financialisation trends can invest via the Nifty Capital Market Index which invests in businesses catering to financialisation.

Here are the top constituents of the Nifty Capital Market Index as of 31st December 2024:

| Income Bracket | 2010 |

|---|---|

| Company | Weightage % |

| BSE | 19.7 |

| HDFC Asset Management Company | 13.3 |

| Multi Commodity Exchange of India | 9.9 |

| Central Depository Services (India) | 9.8 |

| 360 ONE WAM | 7.6 |

| Computer Age Management Services | 7.6 |

| Kfin Technologies | 5.5 |

| Angel One | 5.3 |

| Motilal Oswal Financial Services | 4.4 |

| Indian Energy Exchange | 4.3 |

Source: NSE

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story