Upstox Originals

India’s 5G: All bars, no buzz?

.png)

7 min read | Updated on August 18, 2025, 15:59 IST

SUMMARY

India’s 5G journey is one of extremes, blazing-fast rollout, but lukewarm adoption. In just two years, the country has achieved 95% population coverage, rivaling China. That’s a ₹36.4 trillion digital upgrade. But here’s the twist: despite all that coverage, user uptake is still catching up. The network’s ready. The question is - are the users? As India eyes a bold leap into 6G, can it unlock the full promise of 5G first?

As of mid-2025, India has around 1.15 billion mobile connections, yet only about 300 million have moved to 5G so far.

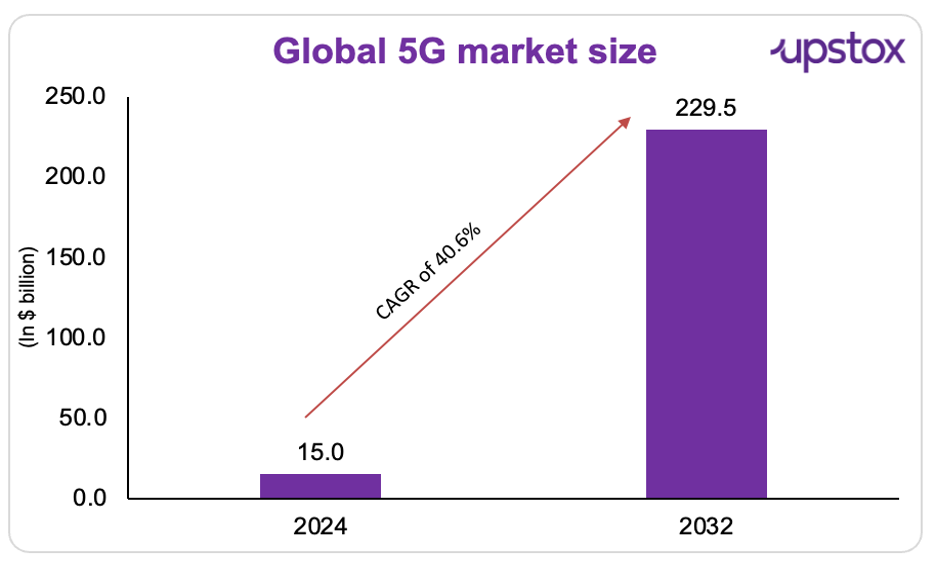

5G may not make daily headlines, but it’s transforming daily life. The global market is projected to grow at a CAGR of 40.6% from 2024 to 2032, driven by smarter devices and stronger networks. Key players include Airtel, Ericsson, Verizon, Huawei, and China Mobile.

Source: Market research

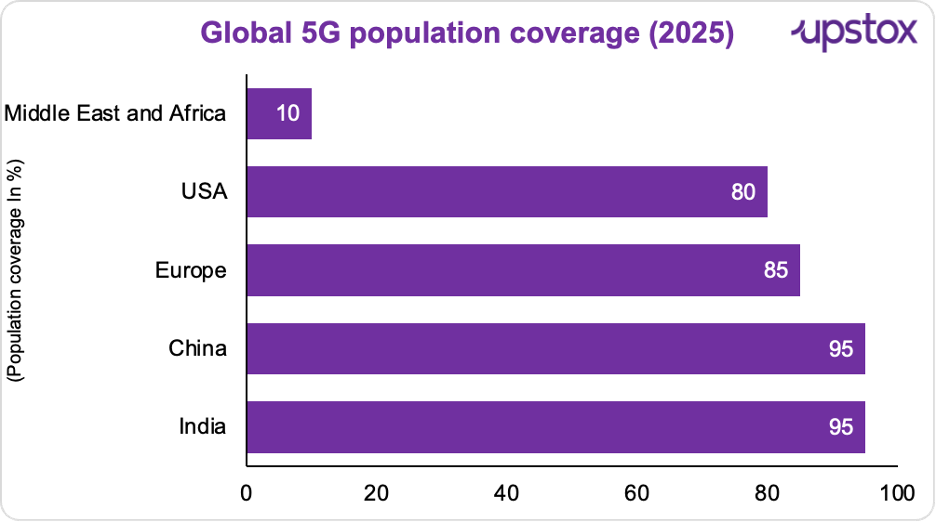

Globally, which countries lead in 5G population coverage? Let’s take a quick look.

Source: Mygov.in *Note: The US data referenced here is as of 2023.

China continues to lead the global 5G market with 95% population coverage, thanks to strong infrastructure investments. It built 993,000 5G base stations by 2021, covering over 95% of counties and 35% of rural townships. India isn’t far behind, having now achieved the same coverage milestone.

How is 5G better than 4G?

Many of us still rely on 4G today, and it works just fine. But over the next few years, a shift to 5G is expected. Why the change? Because 5G brings clear advantages across several key areas:

-

Ultra-Low Latency: 5G offers latency as low as 1 ms vs 30–50 ms on 4G (30–50x faster).

-

Device Density: 5G handles 1 million devices/sq km vs 100,000 on 4G – crucial for smart cities, connected farms, and industrial IoT, where dense networks would otherwise overload on 4G.

-

Energy Efficiency: 5G’s optimised power and narrowband IoT let mIoT devices last up to 10 years on a single battery, ideal for agriculture, logistics, and utilities.

India’s 5G story: Speedy rollout, Sluggish adoption?

Just a couple of years ago, India was trailing behind in mobile tech, slowed down by regulatory delays, infrastructure gaps, and cautious investments.

India has pulled off one of the fastest 5G rollouts in the world. As per the government, in just about 30 months, it has built over 469,000 5G base stations, and achieved coverage in 99.6% of its districts. Sounds interesting, right?

The real question is - has India delivered on its 5G promise?

While coverage now spans almost the entire country, the number of users is still catching up. As of mid-2025, India has around 1.15 billion mobile connections, yet only about 300 million have moved to 5G so far.

Reliance Jio, the market leader, boasts 191 million 5G users, yet that’s only about 39% of its 488 million subscribers. Bharti Airtel reports 120 million 5G users out of a smartphone base of 273 million, meaning nearly half haven’t upgraded. Even with ARPUs at ₹206.2 for Jio and ₹245 for Airtel, monetisation has been slow, many users still consume 5G on old 4G plans, despite a 20% tariff hike in 2024.

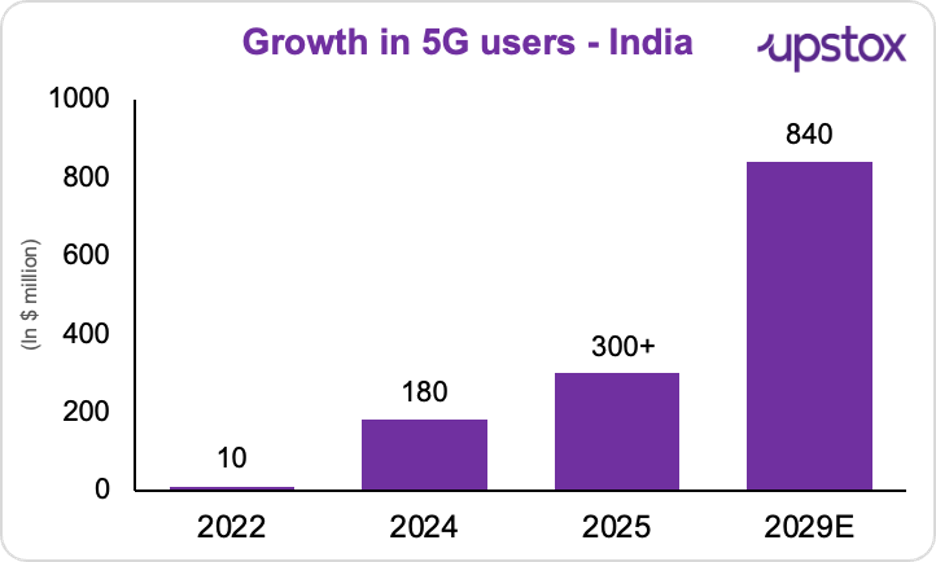

So, will this gap narrow down quickly? In 2022, India had just 10 million 5G users. By 2024, it reached 180 million and is projected to cross 840 million by 2029. So while 5G towers are everywhere, the true transformation will come only when more people upgrade their devices and data plans.

Source: News articles

Status of 5G network deployment

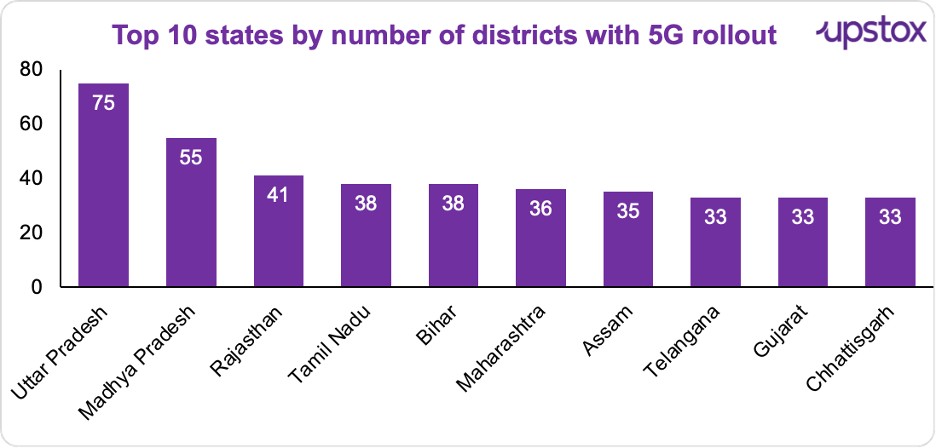

The chart provides an overview of the state-wise distribution of districts where 5G services have been launched:

Source: PIB

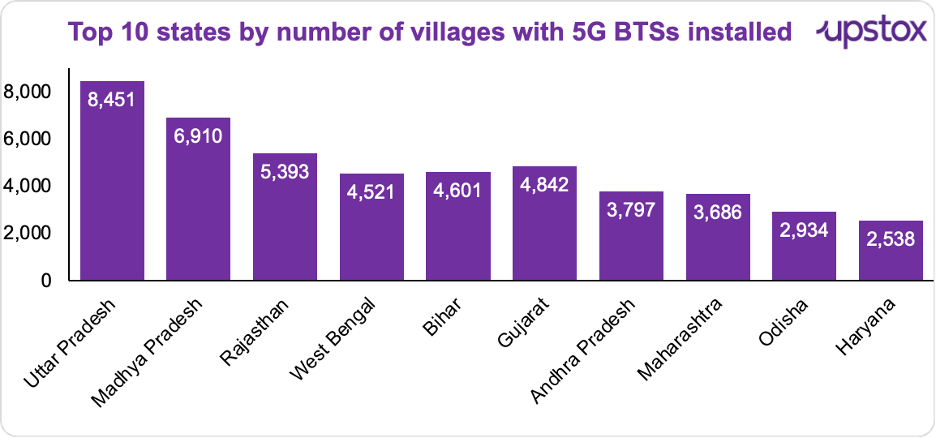

Now, let’s zoom in on where India’s 5G towers are going up, and it’s not where the users are. States like Uttar Pradesh are seeing over 8,000 villages wired with 5G BTSs, with Madhya Pradesh and Rajasthan close behind. On paper, it signals a push for rural digital inclusion.

Source: PIB

But in reality, it raises a bigger question: Are we building ahead of need? With device readiness and awareness still low in rural India, much of this infrastructure may end up underutilised, a high-speed highway without enough vehicles.

Telcos face a cold response?

India’s telcos may have flipped the switch on 5G, but the buzz hasn’t caught on. Vodafone Idea and BSNL, which together serve over 296 million subscribers, are still largely stuck on legacy networks, most users continue to rely on 2G, 3G, or 4G. Vi’s 5G presence is limited to a handful of metros, while BSNL is yet to fully launch. But infrastructure isn’t the only hurdle.

A major drag on demand is that many users don’t own 5G-capable smartphones, and few are keen to buy a new device just to access faster speeds. As of Q4 FY25, even market leaders Airtel and Jio have seen just 43% of their smartphone users transition to 5G.

What’s the challenge beneath?

So, for a faster 5G rollout, we need more than towers, we need spectrum (the invisible radio waves that carry mobile signals).

At a recent industry event, telecom operators raised a red flag. The message was clear: we’re running out of spectrum, and fast.

Let’s put that in perspective. A GSMA report projects India will need five times more spectrum by 2030 than it has today. To break it down: we’ll need about 2,000 MHz, but only 400 MHz is currently available. At a recent industry event, telecom operators raised a red flag. The message was clear: we’re running out of spectrum, and fast.

Add to that the rise of 30 billion IoT devices globally, and we’re looking at a traffic jam on the airwaves.

And it’s not just about volume. Data demand is also set to explode - from 5,400 billion GB today to 54,000 billion GB in the near future. That’s a tenfold jump.

Telecom players are pushing for solutions:

-

Spectrum swapping (give up unused bands like 1800MHz or 2100MHz and get credit for future use)

-

Forward payment credits (apply past payments toward future spectrum needs)

-

Faster release of critical bands, especially the 3.5 GHz mid-band and 6–8.4 GHz range, often called the “golden band” for its power to boost capacity and speed

India’s IoT market is set to grow from $2.8 billion in 2024 to over $10 billion by 2030. And without enough spectrum to support that growth, even the most advanced 5G infrastructure won’t deliver on its promise.

Bottom line? India’s ₹36.4 trillion 5G dream can’t run full throttle on limited airwaves. For 5G to truly pick up, spectrum policy needs to shift gears, now.

Will 6G do the work?

5G adoption is lagging, but if we play this right, 6G could be India’s breakout moment. With the launch of the Bharat 6G Vision in March 2023, India wants to build and deploy 6G by 2030, delivering 1 Tbps speeds, near-zero latency, and seamless AI, IoT, and AR/VR experiences. Over 111 R&D projects approved, 100+ 5G labs set up, India’s investing heavily in a homegrown innovation ecosystem.

From global MoUs to hosting the International 6G Symposium, India is shaping global 6G conversations and pushing for “ubiquitous connectivity” at the ITU.

Spectrum plans? Already in motion. Bands like 4400–4800 MHz and 700 MHz to 26 GHz are being aligned to support future tech.

Conclusion

With 5G now available across much of India, the basics are in place. The real question is - how will businesses, communities, and everyday users make the most of it? The answer will unfold in the way 5G gets used, not just where it’s available. Its true impact will depend on how seamlessly it integrates into daily life and ongoing development.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story