Upstox Originals

Factors to consider when trying to judge the price of your next house

.png)

4 min read | Updated on June 05, 2024, 13:18 IST

SUMMARY

Are you buying a house? Make sure you are not overpaying! Here are some ways to know whether your future house is fairly priced.

Rental yields can help assess the property valuation

When it comes to life's most significant milestones, buying your own house is still one of the most significant. As per RBI data, Indian households invest about 50% of their money into real estate, including land, residential buildings and commercial buildings.

Given the importance of this milestone and the huge capital investment, it is crucial to ask this question: How do you know if your real estate is priced correctly?

Let's find out.

Rental yields: A crucial check

Rental Yields play a significant role in deciding the fair price of real estate investments. Rental yield is a measure of the annual income from an investment property as a percentage of its total value.

Rental Yield = (Annual Rental Income / Property Value) x 100

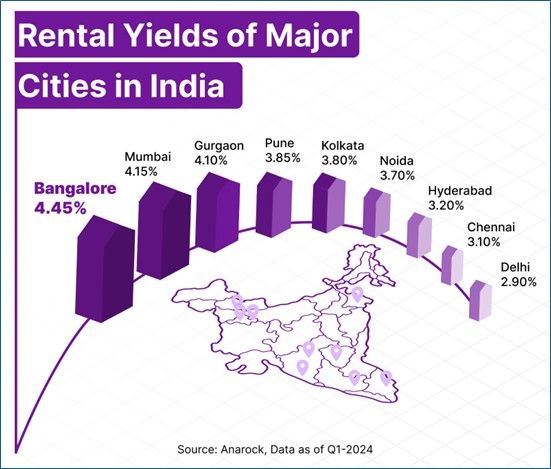

How are rental yields stacked up? Look at the chart below, which covers residential rental yields across major markets.

Now, how should you think about this?

Let’s take an example, assuming you are planning to buy an apartment in Bengaluru.

| Scenario A | Scenario B | |

|---|---|---|

| Price of property | ₹4 crore | ₹4 crore |

| Max rent that property would fetch (per annum) | ₹16 lakh | ₹24 lakh |

| Implied rental yield | 4.0% | 6.0% |

| Average yield in Bengaluru | 4.5% | 4.5% |

| How is it priced? | Undervalued | Overvalued |

Thus, rental yield acts as a mathematical / theoretical metric for you to gauge if a property is appropriately priced or not.

Besides that, it gives you a good barometer when you want to negotiate the price of the property.

Let’s take a quick look at some advantages and disadvantages of using rental yield as a valuation method.

| Advantages | Disadvantages |

|---|---|

| Easily available | Can widely vary widely from one micro market to another |

| Usually factors in the latest information | Does not take into account other tactical or emotional benefits. For example, if a certain property is located close to your place of work or your children’s school |

Is a high rental yield always good? As with all investments, one must always assess the risk around it as well. Is the yield higher because the property is in a less desirable location and someone is looking to sell it off?

Also, as mentioned above, rental yields can vary considerably depending on the area or locality. Hence, buyers and investors must always look out for yields in their area under consideration.

What are some other measures?

There are multiple other factors to keep in mind, some of which are listed below:

-

Comparative analysis: Check the prices of similar properties in similar locations either through brokers or on property websites. Comparative analysis can be done by comparing different rates: - Circle rates: This is the government-mandated minimum value, which serves as a base and affects the stamp duty calculations. - Market rate: This is the actual price at which the properties are bought or sold.

-

Historical price trends: An investor must know the historical trend of rates in a particular area.

-

Development trends: Additionally, please research the development trends of any locality. If major development is expected, it could boost prices.

-

Other factors: Property type, age, amenities, developer reputation and any other hidden costs.

Insight for investors

Real estate investments are complex with multiple financial and emotional factors at play. The steps given above should help making decisions a little easier. However, this should be carefully assessed while making a decision as a significant part of wealth will be invested into illiquid assets for a longer time frame. One shouldn’t rush and make any decision in a hurry. Take your time to analyse and make informed decisions.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story