Upstox Originals

How power hungry are AI data centres?

8 min read | Updated on September 29, 2025, 17:06 IST

SUMMARY

AI is changing the world in ways we couldn’t have imagined. But at a heavy price tag—a massive spike in electricity demand. If you trace the source of this spike, you’ll find data centres. From streaming your favourite Netflix show to powering your Instagram feeds, from sending emails to processing online payments, all your requests pass through data centres. And these data centres are incredibly power-hungry. Let’s find out the humongous cost we’re paying for these data centres.

A 100 MW data centre operated by a major tech company uses as much electricity as 1,00,000 households

Let’s say you run a small business and turn to an AI model like ChatGPT, Gemini or Copilot for product marketing. You ask 15 questions on Instagram campaign ideas, festival promotions and boosting engagement. Then you make 10 attempts to generate an eye-catching image for your campaign before you get the one you’re happy with, and 3 attempts at a five-second video to post on social media.

What you don't know is that, with these seemingly small requests, you’ve used about 2.9 kWh of electricity—equivalent to running a TV for 29 hours straight or operating a microwave for 3 hours nonstop. This is what energy consumption looks like for just one person with an AI habit.

Now think of massive data centres that house thousands of computers, servers and storage devices. From streaming and payments to training AI models, they keep the internet running 24x7. For instance, Amazon alone has 100+ data centers worldwide, each of which has about 50,000 servers.

How much electricity does a data centre consume?

A 100 MW data centre operated by a major tech company uses as much electricity as 1,00,000 households. Mind you, that’s just one data centre. A single next-generation hyperscale data centre capable of handling more advanced workloads can use as much power as 20,00,000 households. And, it doesn’t end there.

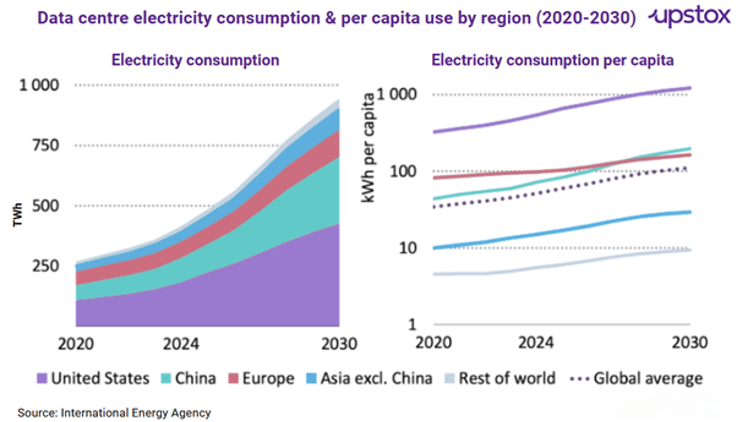

According to the International Energy Agency (IEA), by 2030, the electricity consumption from data centres is likely to grow more than 2x to about 945 TWh from the current 415 TWh. Just so you know, that’s more than Japan's total annual electricity consumption! As a matter of fact, 65% of a data centre’s operating cost is electricity, primarily for computing and cooling.

Data centres today consume about 1.5% of global electricity, which is expected to rise to 10% by 2030. In fact, it has increased by 12% annually over the last five years. And no prizes for guessing who’s to blame for — It’s the AI boom that has kicked off a race to develop the technology, demanding massive high-density data centres as well as much more electricity to power them.

The electricity demands of generative AI is 8x more than a typical computing workload. Plus, generative AI models have a really short shelf-life, driven by rising demand for new AI applications. Companies drop new AI models every few weeks, so all the energy that went into training the prior version goes to waste. And, new models with advanced capabilities usually consume more energy for training than their prior versions.

India’s Generative AI market is expected to grow at a CAGR of 28% from 2023 to 2030. Clearly, as AI evolves, its power appetite will keep increasing, and the demand for data centres and energy will explode.

Data centre-led electricity consumption by region

Regionally, US accounts for the largest share of global data centre electricity consumption (45%), followed by China (25%) and Europe (15%).

As of September 2025, there are close to 10,730 data centres across the globe.

Top 10 countries that lead by data centre count

| Country | Number of data centres |

|---|---|

| USA | 4,049 |

| UK | 485 |

| Germany | 482 |

| China | 379 |

| France | 316 |

| Canada | 284 |

| India | 271 |

| Australia | 265 |

| Japan | 205 |

| Italy | 204 |

Source: Data Centre Map

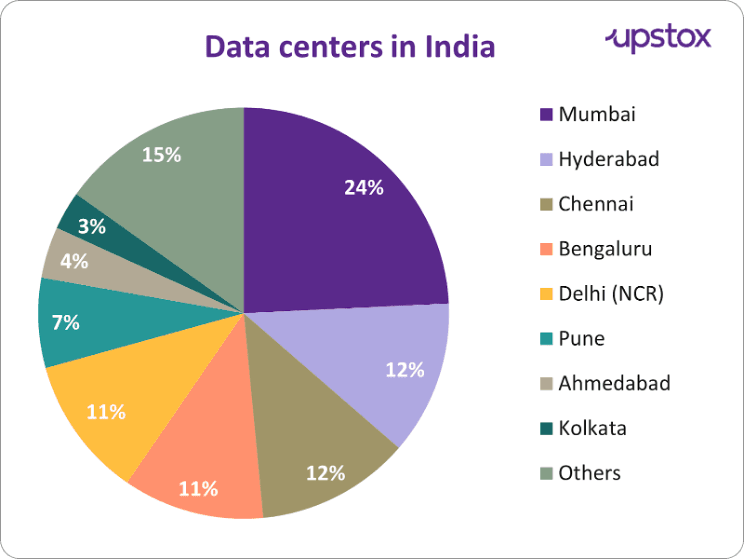

While the US leads with 4,049 data centres, India hosts just 271, a mere 2.5% of the world’s data centres. Interestingly, India presents a paradox—despite India offering one of the lowest data centre setup and electricity costs globally (about 20% to 30% lower than the US) India has a marginal share.

Most of the data centres in India are located in Mumbai because of its proximity to the sea, which provides strong subsea cable connectivity.

Source: Data Centre Map

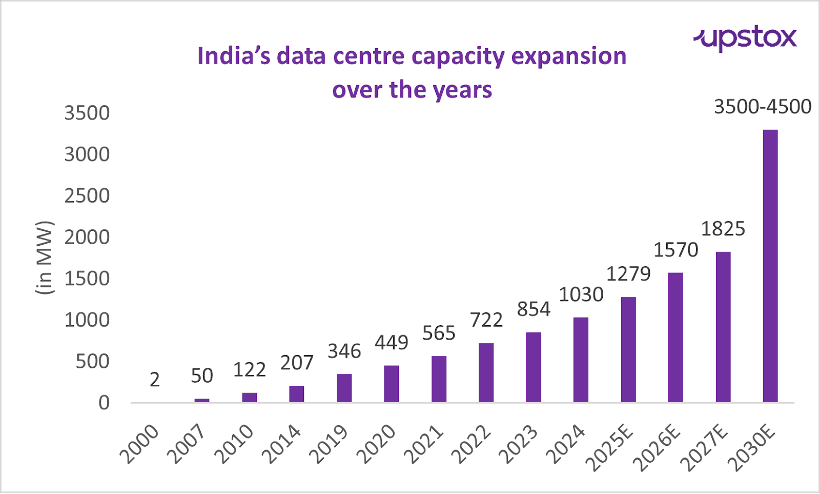

India’s current data centre capacity is 1,263 MW, compared to 15,930 MW in the US and 3,800 MW in China. While India’s data centre ambitions pale against those of the US and China, the country is in the middle of its own data centre boom. Look at the growth trajectory in the graph below. India’s data centre capacity has almost tripled from 2019 to 2024. And this is just the beginning!

If things go as planned, India’s data centre capacity will reach 4,500 MW by 2030. The expansion is likely to consume about 3% of India’s electricity in 2030, up from less than 1% at present.

Source: Kotak Mutual Fund, Economic Times

Ironically, while India has 2.5% of the world's data centre capacity, it generates nearly 20% of the world’s data, most of which ends up being processed and stored overseas. That shows just how big the gap really is and how much work still needs to be done.

But thankfully, India is working on the solution to bridge this gap.

How is India pushing data centre growth?

The Indian government has undertaken a series of initiatives, aiming to expand India’s data centre infrastructure.

The government has allowed 100% foreign direct investment (FDI) in the data centre sector, which allows global players to invest in India, making the market even more competitive. This has led to a sharp rise in investments, attracting nearly $60 billion in the last 5 years. In fact, according to a CBRE report, investments in the sector are set to exceed $100 billion by 2027.

Besides, the government’s progressive policies are laying a strong foundation for data centre growth. Initiatives like granting infrastructure status to the sector, RBI’s data localisation rules and the Digital Personal Data Protection Act 2023 are encouraging companies to store data within India.

Additionally, state-level incentives, such as tax exemptions, lower electricity costs, subsidised land and fast-track approvals are boosting growth and investment in the sector. See the case with Noida, it has become a data centre hotspot because of the UP government's generosity. Likewise, Hyderabad has received huge investments thanks to proactive government policies and reliable power.

But despite these efforts, there remain a few challenges. Let’s talk about them.

Ageing power grids

Data centres need 24x7 power, and in massive quantities. The problem is, India’s ageing power grids are unable to handle that load, especially during times of peak demand. The explosive growth of AI and the massive data centres behind it are driving demand and straining already fragile power grids. And, building new transmission lines can easily take 4 to 8 years, creating a potential bottleneck for data centre growth.

Increasing carbon emissions

At the moment, most data centres rely primarily on a coal-based grid, which intensifies carbon emissions. For context, training a single large language model produces as much CO2 as the entire lifetime of five gas-powered cars and uses as much water as a small country. IEA estimates CO2 emissions linked to electricity consumption from data centres to increase from 180 million tonnes today to 300 million tonnes by 2035. That’s massive!

So, the challenge is to meet the energy demands sustainably, and the answer lies in renewable energy sources and battery storage solutions. Falling battery costs and renewable energy tariffs can also prove to be an added benefit.

Inadequate cooling systems

High-performance AI workloads in data centres generate substantial heat. To cool it down, most data centres in India (with a total capacity of nearly 1 GW) use traditional air-cooling methods, which account for almost 40% of a data centre’s electricity usage.

Implementing advanced cooling solutions like liquid cooling can reduce energy use by up to 90% and offer superior heat management and energy efficiency. But the problem is, at present, only about 10 MW of the country’s total capacity uses liquid cooling because it’s significantly more expensive to install and maintain.

To sum up

India’s data center boom is still in its early stages. Currently, it is worth $8.01 billion market and by 2033, it is expected to touch $24.78 billion, growing at a robust CAGR of 13.37%. Even industry leaders like Adani, Amazon Web Services, Equinix and STT GDC are placing big bets on India’s potential.

But as India’s data centre sector takes the centre stage, it’s crucial to work on its energy appetite for a better and brighter future.

Disclaimer: Views and opinions expressed in the article are the author's own and do not reflect those of Upstox.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story